The rise of artificial intelligence (AI) isn’t just transforming industries; it is also transforming the energy grid. Behind every AI breakthrough lies a massive surge in computing power, and with it, an unprecedented demand for reliable and affordable electricity. As the U.S. positions itself for continued technological leadership, meeting the energy needs of AI data centers has become a central challenge for utilities, regulators, and policymakers.

The Scale of the Challenge

Just a decade ago, a typical large data center drew around 30 MW. Today, new hyperscale facilities regularly require 100 to 200 MW, and leading operators are designing facilities capable of consuming 500 MW to several gigawatts (GW). The scale and speed of this growth are staggering. The impact on our energy system is difficult to predict.

According to the Electric Power Research Institute (EPRI), U.S. data center electricity demand is projected to grow between 3.7% and 15% annually between now and 2030, a fourfold range that underscores the uncertainty of the landscape. Complicating matters further, it’s unclear whether the next generation of AI chips will ultimately dampen or accelerate overall energy demand.

The Role of Energy Markets

While the demand curve remains uncertain, evolving energy markets are already adopting mechanisms to balance load and supply. Organized wholesale markets optimize resource dispatch across large footprints, generally keeping costs lower than isolated bilateral arrangements.

These markets are eager to tap any and all potential sources of energy, regardless of where it is generated. Expanding the size of the market typically results in more flexibility when it comes to balancing load and supply.

Upgrading the Grid

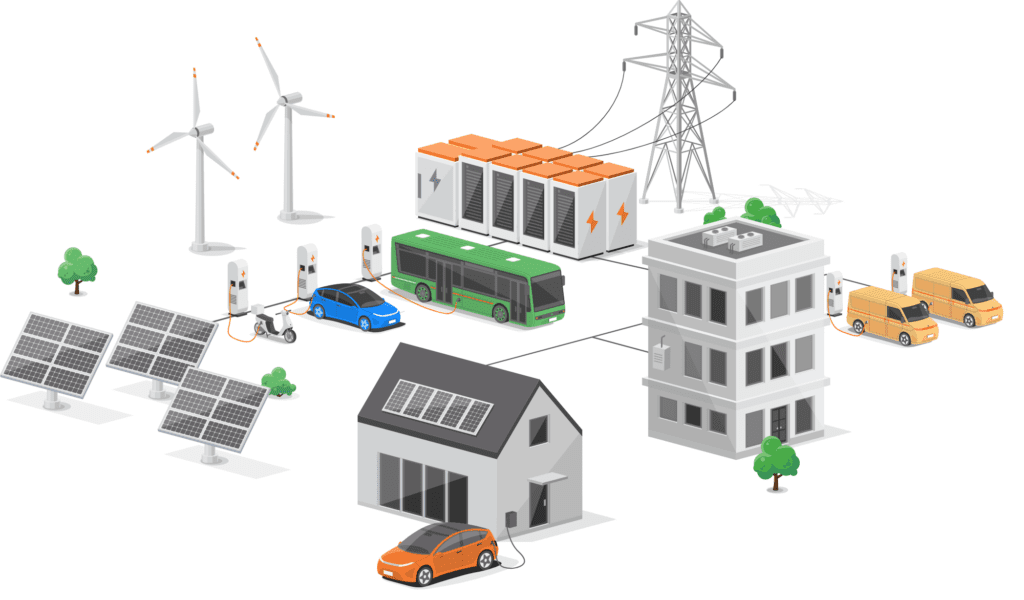

But markets alone aren’t enough. The grid itself must evolve to meet AI-driven load growth. That means major investment in:

- Advanced transmission conductors capable of moving more power through existing corridors.

- Grid-enhancing technologies (GETs) such as dynamic line rating, and voltage management tools to optimize existing conductors.

- Modern switchgear and power electronics, to rapidly switch between power sources and grid connections.

- AI-driven grid applications for predictive planning, faster decision support, and efficiency gains.

- On-site or nearby generation, including hybrid renewable plants, geothermal, natural gas, and small modular nuclear reactors.

- Load flexibility so non-critical AI tasks can be shifted to off-peak hours or across regions with available capacity.

Paying a Fair Share

Large AI data centers cannot absorb resources at the expense of local communities. Regulators and operators are working to ensure that costs are distributed fairly while enabling necessary infrastructure investment.

A landmark settlement in Indiana earlier this year illustrates the emerging framework. It requires new large loads exceeding 70 MW to sign long-term contracts (up to 12 years, with a ramp-in period), pay significant minimum charges, provide upfront collateral, and adhere to transparent modification terms. The approach ensures utilities can recover investments without burdening existing customers, while providing data center operators with the reliability they need.

Locating Where Power Is

Historically, data centers were built near urban hubs or telecom exchanges, with power extended to them. Today, advances in fiber and satellite bandwidth mean that facilities can instead be built where robust power infrastructure already exists, often (but not always) in less populated areas with easier access to land and water. This siting strategy reduces the burden on constrained urban grids while helping balance regional supply.

Interconnection: The Bottleneck

Even with good siting, the interconnection process remains a choke point. Bringing new loads onto the grid requires extensive studies as well as upgrades to transmission and substation assets, efforts that can take years. Reforms are underway:

- FERC Order 2023 has prompted transmission providers, such as SPP, MISO, and CAISO, to streamline processes through initiatives such as the Consolidated Planning Process and Expedited Resource Addition Studies.

- AI-driven simulation tools are being piloted to accelerate study timelines and improve accuracy in load forecasting, cost estimation, and readiness assessments.

Still, lead times for critical equipment remain daunting, with distribution transformers now taking about 30 to 50 weeks to arrive. Large power transformers can take up to 150 weeks. Switchgear often takes a year or more to deliver. Building a more resilient domestic supply chain, with long-term incentives, standardized protocols, and stable demand signals, is crucial.

Securing the Grid

AI data centers add not just load, but critical applications. Many are landing in territories served by many utilities that have expertise constraints. Expanding federal cyber programs, such as DOE’s Rural and Municipal Utility Cybersecurity grants, will be essential to closing these gaps.

In parallel, utilities must scrutinize procurement of grid equipment from foreign suppliers to guard against espionage and sabotage risks. As AI becomes integral to defense, finance, and healthcare, securing both physical and digital infrastructure is a matter of national security.

Beyond Diesel Backups

Most mission-critical data centers today rely on diesel generators for backup; however, cleaner and more resilient options are emerging, including natural gas plants, hybrid solar-wind-battery systems, geothermal facilities, and eventually small modular reactors. These options—in combination with flexibility resources and energy storage—can enhance reliability, although they are most effective when deployed in combination with larger, interconnected grids to ensure resilience during failures or maintenance outages.

Innovation and Workforce Needs

Keeping the grid prepared for AI-driven energy growth requires not just steel and silicon, but people. The U.S. faces shortages of electrical engineers, lineworkers, and skilled trades, made worse by an aging workforce. Expanded education and training pipelines are as important as grid hardware upgrades in ensuring future readiness.

Innovation in business models also plays a role. Performance-based regulation, subscription-style tariffs, and bilateral supply contracts could provide utilities with more flexible tools to serve GW-scale data centers without compromising affordability for households and small businesses.

Staying Ahead of Global Competition

Finally, the race to meet AI’s energy demand is a race against time and against global rivals. China is aggressively scaling its own AI and grid infrastructure. To stay ahead, the U.S. must continue to invest in R&D through national labs, strengthen domestic supply chains, and foster public-private partnerships that share risk and accelerate deployment.

AI may be the defining technology of the century, but its full potential cannot be realized without a secure, resilient, and modernized energy grid. Meeting this challenge will require cooperation among utilities, regulators, policymakers, and industry leaders, as well as action at a pace that matches AI’s own exponential growth.

—Bryce Yonker is executive director and CEO of Grid Forward.