As environmental regulations continue their forward march and gas prices remain low compared to historic rates due to increased domestic supply, the number of power plants changing their primary fuel source to natural gas has increased dramatically. In 2011 and 2012, just more than 5.5 GW of power plant capacity switched to burning primarily natural gas from another form of fossil fuel, according to an SNL Energy analysis of U.S. Energy Information Administration (EIA) 860 data.

By the end of 2012, 2,183 MW of capacity had shifted to primarily burning gas from another listed fossil fuel source in 2011. The units burning natural gas saw an increase in 2012 net generation to 2,321,539 MWh from 1,491,497 MWh in the previous year, representing an almost 56% rise.

Of the regional transmission organizations, PJM Interconnection recorded the highest primary fuel capacity switch to natural gas in 2012, at 1,631 MW, essentially all at PPL Corp.‘s 1,630-MW Martins Creek 3 and 4 plants in Northampton County, Pa. The decision to burn less residual fuel oil was most likely a cost-saving measure, with the delivered cost of oil to the plant in 2011 at $19.80/MMBtu, compared to $4.95/MMBtu for natural gas in the same year.

Primary fuel type conversions to natural gas were even more pronounced in 2011, with 3,350 MW of capacity shifting away from other fuels. Although more capacity was converted, the generation from the plants was actually less than when other fuels were burned. Net generation in 2011 was down over 12%, to 1,631,328 MWh, compared to 1,861,835 MWh the previous year.

The New York ISO experienced the largest capacity shift in 2011, of 1,281 MW. Three units accounted for the entirety of the capacity shift in the region, all of which were burning residual or distillate fuel oils.

While switches from fuel oil represented some of the largest changes by RTO, it also represented the largest capacity shift among fossil fuels transitioning to primarily burning natural gas in both 2011 and 2012. Plants previously burning fuel oil were some of the oldest and dirtiest, with average CO2, SO2 and NOx emissions profiles vastly higher than gas, according to the U.S. EPA.

One of the largest benefits for the 2,804 MW and 1,686 MW of fuel oil capacity that switched to primarily burn natural gas in 2011 and 2012, respectively, is the lower emission profile of gas, which may help unit operators lessen their exposure to or even avoid EPA climate regulations such as the Mercury and Air Toxics Standards or the Regional Haze Rule. While much of the discussion surrounding these EPA rules has been focused on coal-burning plants, highly utilized fuel oil–burning facilities are just as likely to exceed regulatory thresholds.

A distant second to fuel oil for primary fuel switches to natural gas in 2011 and 2012 was coal, with 347 MW and 497 MW of shifting capacity in each year, respectively. The bulk of coal capacity that is now primarily burning gas was fueled by the more expensive bituminous coal from production regions including Northern and Central Appalachia. In 2012, units shifting to natural gas from bituminous coal saw an increase in net generation, up 7% from 2011. However, this trend was not always the case; units shifting in 2011 to primarily burning natural gas from previously burning bituminous coal actually saw a substantial drop in 2011 net generation—to 526,329 MWh from 766,047 MWh in 2010, representing a 31.29% decrease.

Looking Forward

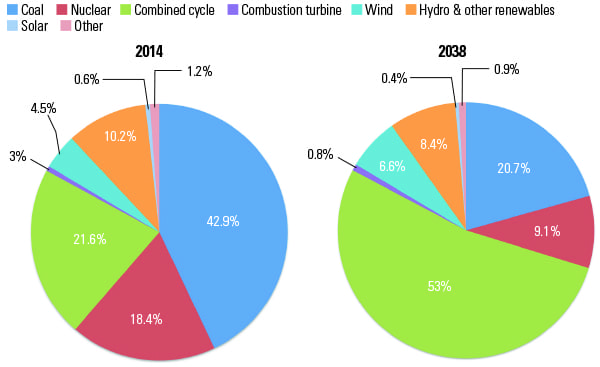

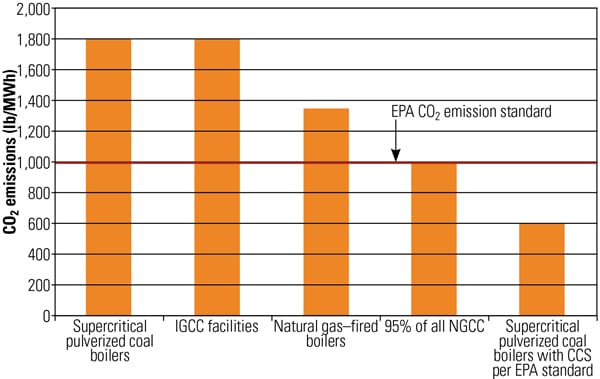

The possibility of more generators relying on natural gas at the expense of other fossil fuels seems likely given the regulatory environment being promulgated by the White House and the EPA. The lower emission profile of natural gas allows plants to meet regulations without installing costly emission controls. In President Barack Obama’s Climate Action Plan released in June, natural gas was described as a “bridge fuel” toward cleaner power plants, and the intent to promote fuel-switching to gas was stated.

The climate plan also called for regulating existing CO2 emitting sources, which will surely provide even more incentive for generators to move from the higher emitting oil and coal sources to gas.

While the plan called for new regulation of existing sources, regulations for new CO2-emitting sources have missed a deadline for completion. Passing the deadline potentially gives generators more time without regulation, but although the current iteration is overdue, the rule for new sources is slated to be repurposed in September.

Government regulation is not solely directed toward CO2 emissions. Generators will have to meet standards implemented by MATS in 2015, although options exist to prolong compliance. MATS’ stringent standards represent one of the most costly regulations due to the multitude of controls that will need to be installed at high-emitting plants, all or most of which can be avoided when burning natural gas.

Also, the U.S. Supreme Court has decided to review the Cross State Air Pollution Rule, or CSAPR, which was struck down by a federal appeals court in 2012. Although the appeals court’s decision may be upheld, the uncertainty of additional regulation is concerning to coal-fired generators.

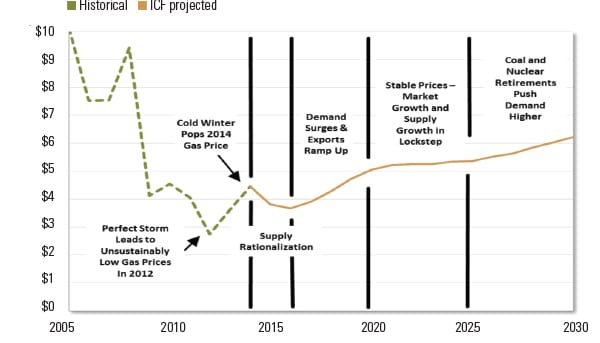

As regulation continues to favor natural gas, natural gas futures also paint a favorable picture. With gas prices at the Henry Hub below $5/MMBtu as far out as December 2018, coal will continually be pressured by a low-cost substitute. The outlook will vary by producing region, however. As gas prices continue a slow rise, less expensive high-sulfur coal from the Powder River Basin and Illinois Basin is becoming more attractive, allowing units capable of using this kind of coal to compete with gas.

Although the competitive and regulatory environments are quite supportive of gas-fired generation, there is not unconditional support. The proposed U.S. Bureau of Land Management hydraulic fracturing rule has the potential to increase costs for new wells by an average of $96,913, according to a study conducted by John Dunham & Associates. The rule will focus on a combination of chemical disclosures, well-bore integrity and water management plans.

The fracking rule is not the only thing threatening natural gas supply. The recent derailment of a train carrying crude oil—which led to a deadly explosion in a small Quebec town—has the potential to ignite a broader discussion of safety issues when transporting fossil fuels. Rail has been used to ship natural gas, and if this mode of transportation is hindered, the costly and slow development of pipelines could prevent some switching to occur at a timely pace.

Although individuals have been quick to tout the safety of gas transportation by pipeline, fossil fuel–fired explosions are not exclusive to rail cars. A compressor station near Sissonville, W. Va., was the site of a Dec. 11, 2012, explosion that flattened nearby homes and left two people with minor injuries. San Bruno, Calif., experienced a much more deadly explosion in 2010—killing seven people, injuring countless others, and destroying 37 homes. Pacific Gas and Electric Co., the owner of the pipeline, was levied with a $2.25 billion penalty.

—Neil Powell is an analyst with SNL. This article was previously published on the SNL web site and is republished with permission here, with minor style edits for this publication.