As its profile and impact on the energy market grows, the use of hydraulic fracturing, or "fracking," for recovery of shale gas is changing from a promising innovation to a standard procedure with well-defined best practices. But technological changes on the horizon ensure that the industry hasn’t yet reached equilibrium.

EPA Acts

On April 17, the U.S. Environmental Protection Agency (EPA) issued the final version of a new set of rules governing emissions from hydraulically fractured natural gas wells. Promulgated under the EPA’s authority under the Clean Air Act, the regulations are fairly narrow. Their main goal is to minimize the release of volatile organic compounds (VOCs) during the phase of hydraulic fracturing known as the "flowback period."

Typically, after initial fracturing of the shale rock, the fracking fluid that flows back up the borehole contains a mixture of water and gas. Currently, many drillers simply flare this backflow gas or allow it to escape into the atmosphere (Figure 1). Since the gases include smog-causing agents like benzene in addition to methane (a potent greenhouse gas), this process has been targeted by those hoping to make fracking more environmentally friendly.

1. Much of the gas from the initial fracking flowback is flared or released. Courtesy: Rick Hurdle/Creative Commons.

The EPA rules require new fracking wells to employ "reduced emissions completions" (RECs), also referred to as "green completions," a term of art covering a variety of technologies that capture the initial gases flowing back up the borehole. Since most of these VOCs (particularly methane) have commercial value, they can be stored and sold along with the regular gas production, if the technology is in place to capture them. In its press release announcing the new rules, the EPA estimated that employing RECs could save the industry as much as $19 million a year. The rules do not require any specific technology; rather, they are focused on performance standards to reduce VOC emissions.

However, because of the time and expense that will be required to deploy REC technologies, the industry requested—and the EPA granted—a transition period (ending Jan. 1, 2015) before the rules take effect. Until then, drillers will be required to flare the VOCs. The rules also do not apply to exploratory or delineation wells, or to those wells, such as coal-bed methane, where the production gas pressure is insufficient to employ REC.

BLM Proposes More Rules

Then, on May 5, the Bureau of Land Management (BLM) released a proposed rule covering fracking on federal and Indian lands. The draft regulations cover three areas—chemicals used, well-bore integrity, and flowback water—and promise to add a fair amount of paperwork to the process of drilling a gas well.

If the rule goes into effect, the BLM must approve all fracking activity on federal and Indian lands. A number of reporting requirements would be put in place for both new and existing wells, among them:

- The names and details of the geologic formations to be fracked

- A detailed description of the fracking process to be used

- An estimate of the water pressures and volume used during the frac

- An estimate of the size and extent of fractures to be created

- An estimate of the volume of flowback water, and a plan for its recovery and disposal

- The actual numbers for the above characteristics after the well is fracked

- The chemicals that were used in the fracking fluids

Drillers are also required to conduct a variety of engineering tests on the well and report those results to the BLM. Fracking wastewater must be stored in lined pits or tanks, but no guidelines are given for disposal beyond compliance with existing local, state, tribal, and federal regulations.

Though the reporting requirement will add a fair amount of red tape to fracking a well on federal or Indian land, the rules are generally consistent with those that have been enacted at the state level. The proposals are currently open for comment, and revision before final rules are released seems likely.

Mixed Responses

The new and proposed rules have naturally not come without controversy. The approach was slammed by state officials and congressional representatives during a May 2 hearing of the House Subcommittee on Energy and Mineral Resources in Denver. Regulators from Colorado, Wyoming, and Utah insisted they were up to the job of overseeing fracking without federal involvement.

The American Petroleum Institute (API), meanwhile, claims the REC requirements will add $180,000 to the cost of drilling a natural gas well, and that the cumulative impact will cause a 52% drop in the number of new wells and a 9% to11% decline in the nation’s gas production. The EPA, in contrast, predicts costs of around $33,000 per well, and that the technology will pay for itself quickly through increased gas recovery.

On June 4, the API released a study co-sponsored with America’s Natural Gas Alliance (ANGA) showing that total methane emissions from gas production were about half of EPA estimates, and that emissions from the fracking process itself are as much as 86% lower. Much of the reason for the different estimates appears to be that many drillers are already employing equipment to capture gas during flowback. The API/ANGA study was based on a review of data from 91,000 wells, a much larger data set than the EPA’s review used.

The experiences of natural gas producers who have already rolled out RECs in the field suggest that the EPA’s cost numbers, at least, are closer to reality and may even overstate the impact.

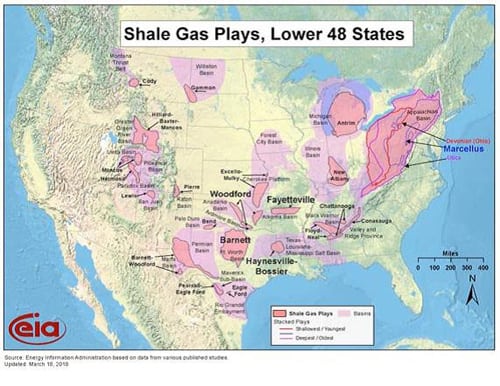

Southwestern Energy, one of the major players in the Marcellus and Fayetteville shale fields, has been using REC technology for several years and currently employs it at almost all its gas wells. Once it fully integrated REC into its drilling process, Southwestern found that its effective cost for employing the technology was zero. Other drillers, such as Chesapeake Energy, the largest driller in the Marcellus field, have reported similar experiences.

The EPA rules are not the first regulatory foray into this area—several states have enacted or considered REC in the last few years. Colorado and Wyoming (Figure 2) have required the technology since 2009 and 2010, respectively, and neither has seen any meaningful impact on gas exploration. Both states report healthy growth in permitting and gas production over the past two years.

2. "Green completion" equipment at a gas well in Colorado. Courtesy: Colorado Oil and Gas

Environmental groups hailed the EPA regulations, as expected, though some complained that they did not go far enough. The rules, for example, do not address fracking fluids. Water, not air pollution, has been the prime target of fracking opponents, who allege the process contaminates groundwater, among other complaints. However, the EPA is barred from regulating fracking under the Clean Water Act after a 2005 exemption was passed by Congress.

The BLM, for its part, drew fire from both directions. Industry groups complained about the overlap with state rules and reporting requirements, while environmental groups criticized the provision that allowed drillers to disclose fracking chemicals only after the well is fracked. And, as with the EPA regulations, some groups felt the proposed rules did not go far enough to control water usage.

"Best Practices" Emerge

The International Energy Agency (IEA) weighed in on the issue with a special report released on May 29. The IEA conducted a detailed economic analysis and concluded that applying what it called "Golden Rules" for shale gas development (an array of controls intended to minimize environmental impacts) would add only about 7% to the cost of a typical shale gas well (which still comes out to over half a million dollars over the life of the well). It also asserted that not implementing controls would lead to a public backlash that would effectively end unconventional gas production.

Meanwhile, the gas industry has not been idle. On April 30, the Appalachian Shale Recommended Practices Group (ASRPG) issued a set of guidelines for oil and gas production from Appalachian shale. The ASRPG is a consortium of 11 of the Appalachian Basin’s largest natural gas and oil producers, including Chesapeake, Southwestern, Chevron, and Shell. The guidelines actually go well beyond the EPA and BLM rules, indeed beyond anything the EPA is currently considering, covering site assessment and construction; drill planning and execution; completions; water usage and disposal; and operations monitoring, assessment, and reporting. Though the guidelines as written are voluntary, the ASRPG announced plans to submit them to state regulators and legislators in the Appalachian region as a model for future regulation.

On May 16, another group representing a coalition of sustainable and institutional investment groups announced that it would support best practice guidelines in the fracking industry. The group, led by Boston Common Asset Management and the Investor Environmental Health Network released its own best practice guide in December.

Waste Not, Want Not

Disposal of fracking wastewater is proving to be the biggest bone of contention between the industry and environmentalists. When conducted properly, the fracking process itself has been shown by an increasing body of research to be fairly benign (though some studies disagree). The biggest problem, according to a recent report from the Energy Institute at the University of Texas at Austin, is what to do with the flowback water, which can contain heavy metals, dissolved salts, toxic chemicals, and mildly radioactive minerals (Figure 3).

3. A fracking wastewater pond in the Marcellus shale field. Courtesy: Energy Corporation of America

Two primary methods of disposal have been used, neither of which is ideal. The wastewater can be delivered to municipal treatment facilities, but many of these—especially those in rural areas—are simply not equipped to hand this sort of wastewater. The water can also be injected deep underground, but this, too, has come under fire, as a number of mild earthquakes have been blamed on the practice. This allegation has found some support from the USGS, though a DOE-sponsored study released last week concluded that it was a relatively minor concern.

Both methods require that the wastewater—as much as 2 to 3 million gallons per well—be transported from the drilling site to the disposal facility, something that can require dozens of trips by heavy water trucks. This extensive vehicle traffic around drilling sites has been another complaint about the fracking process.

On-site recycling of wastewater offers one solution, and several start-up companies have begun offering potential services. Florida-based Ecosphere Technologies has rolled out a purification method involving a combination of ozone, cavitation, and electro-oxidation. The technology can purify the wastewater as it flows out of the borehole, allowing for its immediate reuse. The process is currently being tested by Newfield and Southwestern.

Ecologix Environmental Systems, based in Alpharetta, Ga., offers a somewhat different solution based on dissolved air flotation (DAF). DAF works by saturating the water with dissolved air under pressure. The microscopic air particles capture dissolved solids and other contaminants, forming a sludge blanket that can be mechanically removed. Combined with additional chemical treatment and polishing, the system can also purify wastewater for immediate reuse.

Another company, Washington-based WaterTectonics, employs a method known as electrocoagulation to purify flowback water. Since heavy metals and colloids are primarily held in solution by their electrical charge and particle size, applying an electrical current causes them to coagulate by destabilizing the charges on the dissolved contaminants. WaveTectonics has successfully tested the technology at drilling sites in Texas, Pennsylvania, Colorado, and Wyoming (Figure 4). It is currently working with Halliburton to roll out the technology on a larger scale.

4. WaterTectonics’ electrocoagulation technology has been tested at fracking sites in several states. Courtesy WaterTectonics.

One drawback of electrocoagulation is that it cannot remove dissolved salts, so it is best suited for shale fields where salt levels are low to moderate, or where other methods (such as reverse osmosis) can be used to purify or recycle the brine.

Out With the Water, In With the LPG?

An ideal solution, though, would be to eliminate water from the fracking process altogether if another medium could be found that would not draw unwanted waste up from the drill hole, and would not require such intensive efforts at treatment, or even treatment at all.

A Canadian company named GasFrac believes it has the answer.

The Calgary, Alberta-based firm has developed a method to frac gas wells using liquefied petroleum gas (LPG). Though still experimental, GasFrac has used the technology to frac more than 1,000 wells, mostly in Canada (Figure 5).

5. GasFrac has used gelled propane to frack more than 1,000 wells in Canada and the U.S. Courtesy GasFrac.

A paper presented at the 2011 SPE North American Unconventional Gas Conference reviewed the results of several LPG-fracked wells in the McCully field in New Brunswick. The authors concluded that the technique showed considerable promise, particularly in clean-up and initial well performance.

According to the authors, the basic process—which involves forcing a liquid down the drill hole to fracture the shale rock so that the natural gas can flow back—is essentially the same as with conventional fracking. The fluids used are a gelled mixture of HD-5 propane and commercial butane. However, LPG has a number of chemical and physical properties that may make it a superior fracking medium.

Unlike water, LPG is a hydrocarbon and thus miscible with methane, so no chemical additives are necessary to increase solubility. LPG has far lower viscosity and surface tension than water, even with the usual fracking chemicals added to the fluid. This allows the LPG to flow deeper into the fractures, freeing more gas, and also eliminates phase blocking caused by fluid trapped in the rock pores. LPG also has about half the density of water, allowing greater drawdown pressures during flowback.

In addition, LPG vaporizes as it mixes with methane, so the flowback fluid is entirely hydrocarbon gas. This has several advantages, one of which should be obvious: the entire flowback can be captured as gas production. With water-based fracking, a considerable amount of water must flow out of the borehole before any gas emerges.

In fact, GasFrac claims that almost all of the LPG used can be recaptured. This is in contrast to water-based fracking, where most of the water remains in the ground (along with its chemical additives).

Another advantage is that no clean-up is necessary between fracking stages. When using water, the fracking fluid must be flushed out and replaced before another fracture can be conducted. This because shale is porous and many of the compounds in shale are water-soluble; thus the fractures and matrix can begin to degrade and reduce efficiency of the well without careful management. With LPG, this step is unnecessary, again because LPG is chemically similar to methane and thus chemically and mechanically compatible with the shale formation.

One result is that less LPG is necessary to frac a well than when using water, meaning an LPG fracking operation requires only about a quarter of the truck trips, reducing the impact on the local roads and infrastructure.

Still, there are obstacles to overcome before LPG fracking moves beyond the experimental stage. LPG is more expensive and more complicated to handle than water, and not all drilling sites have the infrastructure to supply large amounts of LPG. While areas like the Marcellus and Utica fields in the northeastern U.S. may be well suited, the same cannot be said of remote areas like Wyoming. Finally, the technology is proprietary (patents on it are pending), and GasFrac concedes it does not yet have the capacity to roll its technology out on a large scale (the company reports a substantial backlog of orders and requests for proposals). Finally, as with any technology that represents a substantial change in how things are done, it will take time before the industry embraces it even if other challenges can be met.

Uncertain Future

The EPA rules are not set to take full effect until Jan. 1, 2015, and the BLM rules are still in the comment stage (and may ultimately include a grace period as well). Thus, it is very difficult to be sure what their ultimate impact will be, especially as states such as Ohio are developing their own regulatory regimes. The explosive growth of fracking has drawn a wide variety of entrepreneurial energies, and further advances in technology promise to make the process cleaner, greener, and cheaper regardless of what regulatory equilibrium finally settles in.

—Thomas W. Overton, JD is POWER’s gas technology editor. Follow Tom on Twitter.