PJM Interconnection has trimmed its near-term peak-demand projections in its updated 20-year load forecast, citing tighter vetting of large-load adjustment requests and revised electric-vehicle (EV) and economic assumptions. The grid operator, however, reaffirmed expectations for significant long-term growth driven by data centers and broader electrification.

In its 2026 Long-Term Load Forecast, issued on Jan. 14, PJM expects a lower peak demand in the near-term—at least through 2032—compared to last year’s report. Compared with the 2025 load forecast, PJM reduced its projected summer peak demand by 2,564 MW for 2026 (–1.6%), by 4,414 MW for the 2028 summer peak used in the capacity auction (–2.6%), and by 1,630 MW for the 2031 summer peak used in transmission planning (–0.8%) to reflect more stringent near-term assumptions.

The projections reflect “updates to the electric vehicle and economic forecasts as well as improved vetting of requested adjustments for data centers and large loads,” PJM noted. “For example, the updated load forecast for summer 2026 predicts a drop in peak electricity use attributed to large loads (-0.7%), economic activity (-0.5%) and EVs (-0.1%) compared to the PJM 2025 Long-Term Load Forecast Report,” the grid operator said.

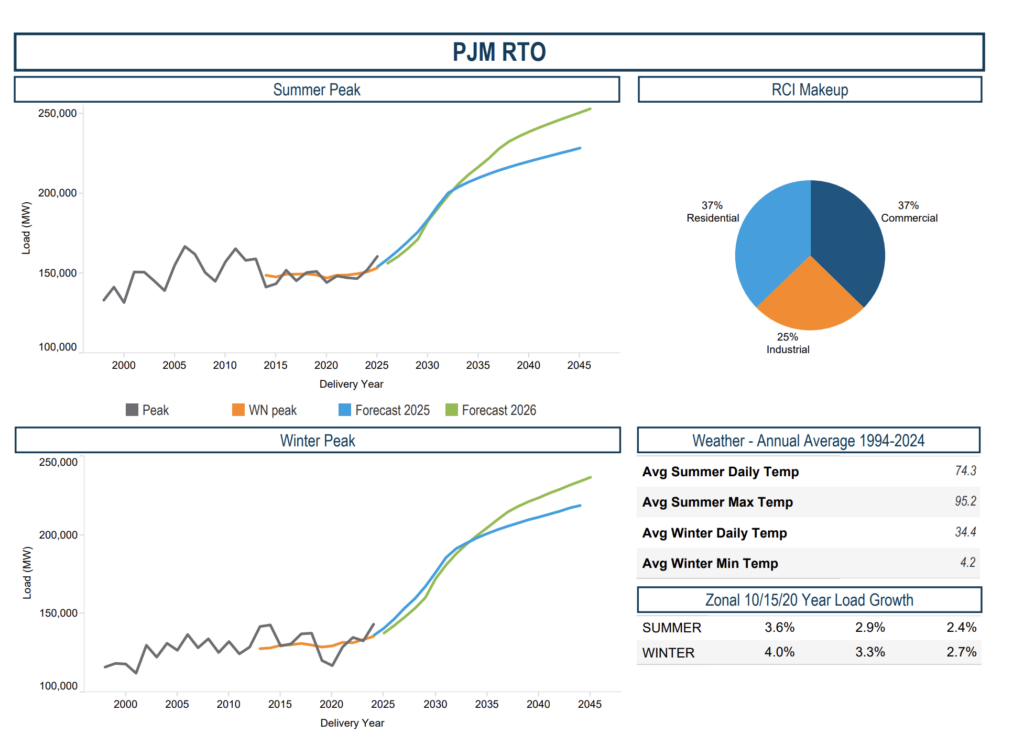

At the same time, however, its long-term growth outlook has surged, and it projects summer peak demand growth at an average annual rate of 3.6% over the next decade. Winter peak will surge even higher, at an annual rate of 4.0%, up from 3.1% and 3.8%, respectively, in the 2025 forecast. PJM also expects that net energy demand will grow 5.3% per year over 10 years, compared with 4.8% in last year’s outlook.

In the latest update, PJM expects summer peak demand could increase by roughly 85,000 MW over the next 15 years, reaching more than 241,000 MW—which is well above the system’s record summer peak of 166,929 MW set in 2006. While winter peak demand is expected to remain slightly lower than summer, the 2026 report shows winter peak is poised to close the gap—peak winter load is estimated at nearly 224,000 MW by 2041.

PJM’s record winter peak last occurred on Jan. 22, 2025, when the system served an average hourly load of about 143,336 MW. That compares with its current generating capacity of approximately 182,000 MW.

As PJM explained, the report “includes a 20-year long-term forecast of peak loads, net energy, load management, distributed solar generation, plug-in electric vehicles, and battery storage for each PJM zone, region, locational deliverability area (LDA), and the total [regional transmission organization].” The long-term forecast is “for planning purposes and is separate from the daily and weekly forecasts performed by PJM Operations to prepare for daily load changes,” it noted.

Typically, the load forecast is compiled using 24-hour econometric models (one for each transmission zone) where load is the dependent variable, alongside weather, calendar events, economic data, and end-use variables. PJM said it starts with metered historical load and reconstitutes total load with load-management addbacks, peak-shaving program adjustments, and distributed solar estimates.

The process examines residential, commercial, and industrial sectors separately, incorporating end-use saturation rates, efficiency assumptions, and economic drivers. PJM staff then adjusts for behind-the-meter solar growth, battery storage deployment, and plug-in EV adoption, while also incorporating non-modeled trends from distribution companies—particularly data center additions—that cannot be captured through econometric relationships alone.

The load forecast changes, notably, stem from a new framework that distinguishes “firm” from “non-firm” large load additions. Near-term forecast years—which it defines as loads coming online within three years—now require Electric Service Obligations or Construction Commitments before PJM will include them in capacity market and transmission planning assumptions. Longer-term projects lacking such documentation are treated as “non-firm” and probabilistically de-rated based on the likelihood of completion.

The grid operator formalized this approach through its Load Adjustment Request Implementation document published in July 2025, which it developed collaboratively with stakeholders to impose transparency on how data center and other large industrial load requests are vetted. The framework filtered out speculative or duplicative requests—primarily data centers—that lacked sufficient legal or financial commitments. PJM also updated its EV adoption assumptions and incorporated revised economic inputs (from Moody’s Analytics’ September 2025 release).

The report shows PJM adjusted load forecasts for 15 of its transmission zones in the 2026 report, with 14 zones where data center development was a contributing factor.

Twelve zones received standard data center growth adjustments: American Electric Power, American Transmission Systems, Allegheny Power Systems, Baltimore Gas & Electric, Commonwealth Edison, Dayton Power & Light, Duquesne Light, Jersey Central Power & Light, Metropolitan Edison, PECO Energy, Potomac Electric Power, and PPL Electric Utilities. Dominion Virginia Power received adjustments for data center growth plus a voltage optimization program, while Public Service Electric & Gas adjustments accounted for data center growth plus port electrification. East Kentucky Power Cooperative received an adjustment for its peak-shaving program.

—Sonal Patel is senior editor at POWER magazine (@sonalcpatel, @POWERmagazine).