Exports of natural resources have given Russia increased global political and economic clout. But domestically, the world’s fourth-largest generator of electricity has had to embark on the most ambitious reforms ever undertaken to modernize dilapidated Soviet-era power infrastructure and incentivize a massive capacity expansion to support a revived economy.

In recent years, while Europe and the U.S. grappled with the problem of securing future environmentally sound energy supplies, the booming economies of China, India, and Brazil stole the global power spotlight with frenzied activity to expand their power infrastructures to meet exploding demand. Meanwhile, the Russian Federation shares the predicaments of all these regions.

Comprising much of eastern Europe and northern Asia, its 17.1 million square kilometers (km) make the Russian Federation the world’s largest country in total area, and within that diverse enormity in the northern and middle latitudes of the Northern Hemisphere, it harbors the world’s largest natural gas reserves, the second-largest coal reserves, and the eighth-largest oil reserves.

Russia’s population of 143.2 million pales in comparison with China’s 1.3 billion. Even Indonesia, Pakistan, Bangladesh, and Nigeria have more citizens. But with the ninth-largest economy in the world by nominal value, it is home to the fourth-largest electricity market globally (after the U.S., China, and Japan), a massive network that includes 118,045 km of transmission lines, and more than 600 power plants with a capacity of over 5 MW each.

Russia’s power story, always molded by the country’s political condition, formally began just after the genesis of the Soviet socialist republic in 1918 and grew after the country’s brutal civil war that culminated in Russia’s union with five other republics to form the Union of Soviet Socialist Republics (USSR). “Communism is Soviet power plus electrification of the whole country” was iconic revolutionary Vladimir Illyich Lenin’s famous formula. It was first declared in 1920 as the newly formed State Electrification Commission (or GOELRO, as it is abbreviated in Russian) presented the first 10-year plan to electrify the country via construction of a network of regional thermal, hydropower power, and combined heat and power stations to the Eighth Congress of Soviets in Moscow (see sidebar “Illyich’s Lamp”).

Fulfilled by 1931, the GOELRO plan—which became a prototype for subsequent five-year plans—kicked off rapid progress for Russia’s electricity sector over the first half of the 20th century. Local, regional, and interregional electricity networks were unified into the Soviet energy system, and major interconnections were established with socialist Central and Eastern European countries.

In the late 1920s, the success of the central state–sponsored electrification plan reportedly prompted Joseph Stalin to abandon Lenin’s New Economic Policy, which advocated some private enterprise, in favor of a highly centralized command economy, implemented through a series of five-year plans. By 1935, dominated by a vertically integrated, state-controlled monopoly, production of electricity had increased by a factor of nearly 7, compared to the 1913 level (instead of a factor of 4.5, as planned), from 2 billion kWh to 13.5 billion kWh, and the Soviet Union had already established industries to furnish power plants with domestically engineered power equipment.

After World War II, the Soviet Union became the second-largest electricity generator in the world, behind the U.S., and in the 1950s, it pioneered the world’s very first nuclear power plant (the 5-MWe Obninsk reactor) and then two commercial-scale nuclear power plants. It also began building what was then the world’s largest hydroelectric plant, in Krasnoyasrsk.

By the 1960s, as power output soared to 290 billion kWh, national electrification had reached 80%. Yet, even as economic growth slowed and power output increased from 741 billion kWh in 1970 to 1,728 billion kWh in 1990 (or about 17% of global generation), capacity failed to keep pace with the gargantuan needs of the Soviet Union’s energy-hungry industry. The 1970s were marked by an ambitious Soviet program to expand nuclear power, and the country had already put into operation 25 reactors by 1986, the year that the Chernobyl disaster in the Ukraine punctured Russia’s—and the world’s—enthusiasm for nuclear energy expansion.

The sector saw an even more climactic turning point in 1992, in connection with the collapse of the Soviet Union, as some republics declared independence from the union, and eventual bankruptcy, as a weakened central government saw profits from state-owned enterprises evaporate after mass, rapid privatization. During this chapter of the industry’s history, the Ministry of Electric Power was dissolved, and the Unified Energy System (RAO-UES) —which had been established in 1956 as the Soviet Union’s single energy distributor—was reborn as a state-controlled holding company that assumed control of 72 vertically integrated local power companies ( oblenergos) accounting for 70% of Russia’s electricity generation.

The remaining share was divided between another state monopoly, Rosatom, responsible for nuclear power, and a few small, independent power companies. Blocks of UES’s shares (the entity still owns practically all of the nation’s transmission and distribution networks) were then sold to workers (numbering 600,000 at the time) and the public and, later, to domestic and foreign investors, leaving the government with a 53% controlling stake. As the country sank into a severe post-Soviet depression, while electricity prices were continually suppressed by the government to subsidize its high–energy intensity industries, economic reforms created an acute shortage of funds and stalled a number of power projects. UES was effectively crippled, running at a deficit of $1 billion on annual revenues of $7 billion, unable to invest in new capacity, grid improvements, or plant modernization efforts.

Russia’s once-bright electricity future dimmed.

A Revolutionary Reform

Then in 1998, Russia’s slumbering economy awoke and began growing at an unprecedented annual gross domestic product (GDP) rate of 6% over the next decade. Soaring electricity consumption soon highlighted the country’s dilapidated power infrastructure. Due to neglect and outright theft, transmission and distribution losses in some regions, notably in North Caucasus, were reportedly more than 30%.

Conceding that the state alone could not bear the costs required to maintain and upgrade its power infrastructure, the Russian government finally agreed to a proposal by newly installed UES head Anatoly Chubais, who had previously led privatization efforts of state properties as a minister in Boris Yeltsin’s administration in 1991, in the immediate aftermath of the Soviet collapse. Chubais argued that, if unreformed, the Russian power sector would not support future economic development, and that if the still-massive UES were reformed, it would need to be designed to attract private investment.

After much discussion and scrutiny of dozens of models presented between 1999 and 2000, the Russian Duma (consisting of its parliament and upper house) in 2001 finally approved a reform plan that called for an unbundling of the incumbent monopoly, creating an independent regulator, privatizing generation, and liberalizing electricity prices.

In March 2003, the Duma set the legal basis for the reform while approving an Energy Strategy spanning from 2003 to 2020 (though a newer, adjusted one was later adopted in 2009) that provided state consensus on the country’s energy future. And, despite a few hiccups, reform has sped ahead, fired by broad-based political support.

Russia Transformed

In 2008, UES’s holdings were unbundled: Generation, transmission, and distribution are today structurally divided and managed by companies with diversified ownership. Generation is produced by 14 territorial power and heating companies (indicated by the Russian abbreviation TGK) and seven wholesale power-generating companies (OGK). An antimonopoly service prohibits a single private owner from controlling more than 20% of generating capacity in one of eight defined regional zones. The state retains 100% interest in nuclear—through the State Atomic Energy Corp. (Rosatom)—as well as most hydropower and major transmission facilities.

Among the sector’s major players are Gazprom—which evolved from dissolution of the Soviet-era Ministry of Gas Industry and continues to be 50.1% owned by the Russian government—and a handful of foreign companies, including E.ON, Enel, RWE, and Fortum.

The Ministry of Industry and Energy has primary responsibility for the power sector, while the System Operator (or Centralized Dispatching Administration), a 100% state-owned open joint-stock company, has been set up to ensure the dispatch of electricity and stable functioning of the nation’s unified grid. The wholesale market is supervised by the Market Council, a noncommercial partnership that is governed by a supervisory board comprising representative market participants, the Russian government, and other market infrastructure bodies.

Russia has also begun the formation of a competitive wholesale market, and prices in the power market have been gradually liberalized in recent years. About 80% of electric power is traded at nonregulated market prices. While the portion of state-regulated prices is expected to diminish, as required by the reforms, some state control is expected to continue throughout Russia (with the exception of certain geographically isolated regions, including the Russian Far East, Kaliningrad, and the Arkhangelsk regions) until at least 2014.

Participants in the wholesale market also trade in capacity (on the basis of up to 10-year capacity supply contracts concluded at competitive prices), obligating generating companies to maintain a certain level of generating capacity and sometimes involving obligations to maintain or repair existing generation facilities as well as to build new ones.

The Power Sector Today

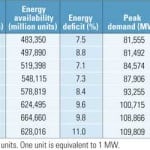

Russia is today one of the world’s top producers and consumers of electric power, with more than 220 GW of installed capacity (for comparison, U.S. installed capacity is approximately 1,000 GW). In 2009, the country consumed 849 TWh, a number that has been forecast to increase to 946 TWh by 2014 to accommodate plans for export to countries like China, Finland, Turkey, and Poland and, later, possibly to Pakistan and Afghanistan.

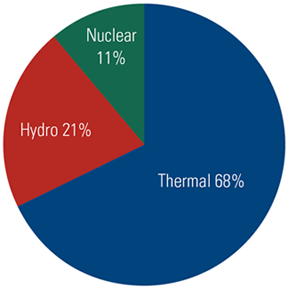

Its fleet primarily consists of about 440 thermal plants, mostly fired by natural gas; only about 77 are coal plants. Thermal generators account for roughly 68% of total capacity, followed by hydropower (at 21%), and nuclear power (11%), according to statistics from the Russian Ministry of Energy (Figure 2). For details about Russia’s current power profile and plans to expand it, see the web supplement associated with this issue on https://www.powermag.com, “Russia’s Power.”

|

| 2. Russia’s power profile. Russia’s current 220 GW of installed capacity is mostly composed of thermal plants, about 60% of which is fired by natural gas and 40% by coal. Source: Russian Ministry of Industry and Energy |

Thermal Power. In Russia, geothermal and solar are considered thermal generation, but the bulk, 154.7 GW, is fueled by gas and coal. The country has some behemoth plants like the oil- and natural gas–fired 5.6-GW Surgut GRES (Figure 3, GRES is an abbreviation from the Soviet era that denotes a state district power station), and among its larger coal-fired plants is the 3.8-GW Reft Power Plant. A common priority for wholesale generating companies and territorial generation companies is to modernize their existing power plants and build new ones using advanced technologies.

|

| 3. Behemoth gas. With a total generating capacity of 5,600 MW, Surgut-2, near Surgut in Khanty-Mansi Autonomous Okrug is one of the largest natural gas thermal power plants in Europe. It is also the largest Russian power station operated by energy supplier E.ON Russia, which is majority-owned by E.ON. Startup of Unit 3 was planned for October 2012. The Surgut-2 station continuously provides Western Siberia and Ural with power and heat. Emerson Process Management is the main automation contractor for Unit 3 of the Surgut-2 power station. Courtesy: Emerson |

Hydropower. Russia harbors 9% of the world’s freshwater resources, and as a result, an immense hydropower potential. Yet, as the government acknowledges, only 20% of this potential is currently utilized, by 102 hydropower facilities, each of more than 100 MW, and one pumped storage plant (Figure 4). The largest of the country’s 46-GW hydropower fleet was for a long time the Sayano-Shushenskaya power plant in Khakassia, but that plant suffered a devastating explosion in August 2009 that killed 75 people and put several units out of service (Figure 5). (See “Investigating the Sayano-Shushenskaya Hydro Power Plant Disaster,” in the December 2010 issue of POWER, available in the archives at https://www.powermag.com.)

|

| 4. Water storage. RusHydro’s 1,200-MW Zagorsk Pumped Storage Station—Russia’s only pumped storage plant—near Sergiev Posad, was approved in 1974 and became operational in 2000. Zagorsk-2, with a future installed capacity of 840 MW, is currently being constructed next to it. Courtesy: RusHydro |

|

| 5. In the aftermath. The catastrophe at the 6,400-MW Sayano-Shushenskaya hydroelectric plant that killed 75 workers in southern Siberia on Aug. 17, 2009, had a number of contributing causes, including design, operational, and repair weaknesses. Reconstruction of the plant is under way and is expected to be completed in full by 2014. Courtesy: Ministry of the Russian Federation for Civil Defense, Emergencies, and Elimination of Consequences of Natural Disasters |

The federation continues to hold a 60% stake in RusHydro, owner of 35.3 GW of generation capacity and the country’s largest hydropower firm, which evolved as a generating company after dissolution of the UES in 2008. With strong government backing, several initiatives are under way to develop the potential of rivers of the North Caucasus, in the Volga regions, and in Siberia.

Nuclear Power. The country’s nuclear sector is wholly controlled by Rosenergoatom, a subsidiary of state corporation Rosatom. That firm operates 32 reactors in 10 nuclear power plants with a total capacity of 23.2 GW. These comprise six early VVER design pressurized water reactors, 11 current-generation VVERs, and 13 light water graphite reactors. Between the 1986 Chernobyl accident and the mid-1990s, only one nuclear power station was commissioned in Russia (the four-unit Balakovo plant). Further development was restrained by an acute shortage of funds after the collapse of the Soviet bloc. Work is currently under way on 10 other reactors as well as on projects to increase the load factors at existing plants by 4.5 GW. Rosatom’s international arm, Atomstroyexport, meanwhile, has three reactor construction projects abroad, all involving VVER-1000 units.

Recognizing the strategic and economic significance of nuclear power, Russia last November reaffirmed priorities to modernize and expand its nuclear fleet and announced plans to invest $1.3 billion annually in nuclear research and development by 2020 (a 10-fold increase from figures proposed in 2007). Specific goals include demonstration of a “full range” of fast-reactor technology by 2020, first by installing the pilot BREST-300 lead-cooled fast reactor at the Siberian Chemical Combine at Seversk in the Tomsk region as a forerunner to a series of 1,200-MW versions planned nationally.

Rosatom’s long-term strategy envisions nuclear power making up a 45% to 50% share of the nation’s total power profile by 2050, and up to 80% by the end of the century. The plan, which calls for 43.4 GW of new nuclear capacity, involves moving to advanced fast reactors with a closed nuclear cycle and mixed-oxide fuel (see “Russia’s Nuclear Mission,” August 2010).

Alternative Energy. Renewables make up a minuscule portion of Russia’s power profile, their development hindered by a lack of renewable energy subsidies, concerns over the transparency of the tendering process, and the level of market liberalization. Yet, the country’s energy strategy calls for a program from 2022 to 2030 that will be marked by an expansion of nuclear, hydropower, wind, and other renewables. The plan declares that by the end of the forecast period, renewables should account for 14% of the country’s demand.

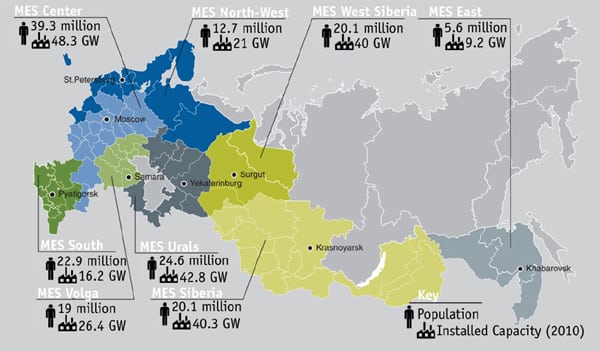

The Grid. Russia’s national grid is referred to as the “Unified National Electric Grid in Russia” because it consists of seven regional power systems: North West, Central, Middle Volga, North Caucasus, Urals, Siberian, and Far Eastern—which is not linked to an integrated grid (Figure 6). The bulk is owned by the state-controlled Federal Grid Co. (RAO FGC), which oversees Russia’s 118,000-km high-voltage transmission grid and plans to invest $14.5 billion between 2010 and 2013 to modernize it. Projects under way include a unification of the Russian and the West European transmission networks.

|

| 6. Russia’s energy regions. The Federal Grid Co., an entity 80% owned by the Russian Federation, maintains more than 1.22 million kilometers of transmission lines and 854 substations (with a total installed capacity exceeding 322,500 MVA) in the Unified Energy Grid (UNEG). The national grid comprises 73 Russian regions that are divided into zones, each falling under the control of one of the company’s “backbone” electric grid branches (designated as MES). The sparsely populated Chukotka, Kamchatka, Taimyr, Yakutia, Magadan, and Sakhalin regions in the Far Eastern zone are not yet covered by the UNEG for “lack of economic conditions.” The national grid also includes about 137 inter-state electricity transmission lines with contiguous countries for import and export. Source: Federal Grid Co. |

The grid company’s profits have been squeezed in recent years due to what it says are rising costs and the government’s reluctance to raise regulated tariffs for myriad state-regulated monopolies such as the railway.

A Further Overhaul Planned

Mired so deeply and for so long within the government, Russia’s power sector has been vulnerable to the political and economic volatility affecting the country. Stricken first by dissolution of the Soviet bloc, which emptied state coffers, and then severely by the global economic downturn, Russia’s existing power fleet is in bad shape.

Most power stations, built between 1960 and 1970, are said to have low efficiency, in the range of 33% to 35%, compared with 50% to 60% at modern gas-fired combined cycle power stations. More than 50 GW of generating capacity in the European part of Russia has reached the end of its design life. And, by some estimates, nearly 60% of all electric infrastructure is plain worn out. The grid, too, is aged: Of the 2.5 million km of power lines in Russia, 1.5 million km have reached the end of their economic life, according to research by Renaissance Capital.

Recognizing the problem, the Duma in 2009 approved an updated “Energy Strategy 2030” that calls for modernization measures valued at $615 billion. Among its main features is the replacement of old gas turbine units with combined cycle gas turbines, increasing efficiencies of coal and nuclear plants, and replacing obsolete analog technology with digital systems for reactor modernization.

In a measure backed strongly by then-Prime Minister Vladimir Putin (now president of the Russian Federation), the energy strategy also calls for an expansion of power capacity so that by 2030, Russia will have a 17% reserve margin, the difference between available capacity and peak demand (the typical U.S. minimum reserve margin is 15%). With demand projected at 1,533 billion kWh by 2020, that feat will require the addition of at least 78 GW by 2020 and 173 GW by 2030 at a cost of $360 billion.

Gazprom, the Siberian Coal Energy Co., and several other generating firms have signed capacity supply agreements with the industry’s autonomous Market Council that involve a 10-year guaranteed rate of return on power produced at new plants. In return, the firms are obligated to build a range of gas, oil, and coal-fired power plants with fixed deadlines to boost the nation’s generating capacity by 30 GW (Gazprom alone will take on 9 GW) by 2017. A total of 140 new power plant blocks are already in the pipeline to be built between now and 2017, many of which will be gas-fired combined cycle power plants.

At the same time, the Federal Grid Co., owner of most of the country’s high-voltage transmission grid, plans to invest $25 billion between 2013 and 2017 to modernize its infrastructure, a program that includes renovation of the unified all-Russia energy grid and putting 16,965 km of new lines into operation.

Yet, any progress on this front will depend crucially on how Russia overcomes the challenging hurdle to attract investment. Some industry observers are optimistic that it will succeed. Several foreign investors—such as Finnish energy company Fortum, Italy’s Enel, and Germany’s E.ON—have already entered the sector, enticed by liquidation of the former power monopoly UES in 2008, and many have reported profits from Russian ventures. According to Prof. Rolf Langhammer of the Kiel Institute for the World Economy, to attract an influx of foreign investment, “Russia’s entry into the World Trade Organization (WTO) in the fall of 2011 sent a signal that foreign investors can count on legal guarantees and the protection of their intellectual property rights in the country.”

But others see continued problems with reform efforts, specifically that the sector still bears the legacy of the state-governed Soviet era. Alexander Kornilov, a senior analyst covering the electric power sector at Alfa-Bank, told business journal Russian American Business in 2012 that foreign investors were concerned about constant rule changes, pointing to one incident during early 2011 as an example, when senior government officials ordered caps on power tariffs that were deemed to be rising too rapidly.

Investment will likely also hinge on the development of enough skilled labor. Qualified staff left the sector during the slump in the 1990s, and the next-generation workforce is critically lacking, with control unit engineers and maintenance specialists particularly in demand, industry experts report. Russia will also need to float its once-buoyant domestic power technology sector, which shrank during the transition period after the fall of the Soviet bloc and has been insufficient to meet surging demand for equipment. Major energy equipment firms like Siemens, GE, Alstom, ABB, Skoda Power, Schneider Electric, Westinghouse, and Mitsubishi Heavy Industries have already entered the fray and established a firm footing.

By some reports, Russian technology for heavy duty gas turbines, ultrasupercritical steam turbines, gasification, and process control systems, as well as electro-technical equipment, lags far behind global standards, afflicted by limited funding for research and outdated production facilities. The government has reportedly bought controlling stakes in enterprises to optimize equipment production for generation companies. In the 2011-issued “Strategy for the Development of the Electro Machine Building Sector till 2030,” the Ministry of Industry and Trade calls for high import taxes on equipment manufactured abroad to reduce imported products in new projects to 10% by 2025.

Fuel Woes

Russia may have some of the world’s largest coal and gas reserves, but domestic generators using these fuels are reportedly subjected to higher prices and less flexibility in obtaining them than might be expected. Russia’s recoverable reserves of coal have been estimated at 173 billion short tons—smaller only than those of the U.S., which holds roughly 263 billion short tons—but the country produced just 372 million short tons in 2011 (76% of which is hard coal), less than a third of U.S. coal production.

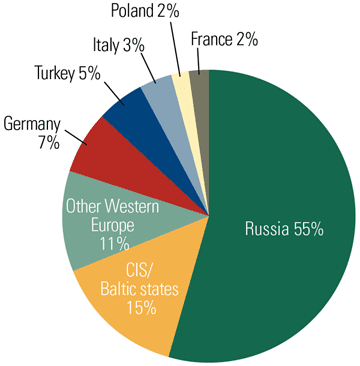

In 2011, Russia produced about 510 billion cubic meters of natural gas—the largest by volume in the world—about 60% of which was sold on the domestic market. But the country’s gas generators, which represent 60% of thermal generation capacity and around 40% of domestic electricity production, suffer a different ordeal: Stakeholders routinely raise concerns about the competitiveness of upstream fuel supply markets. One issue is that Gazprom (whose controlling stake is held by the Russian government) dominates the domestic gas market with a 75% market share. According to some, Gazprom has cut back on the very high level of natural gas supplies for electricity generation because it can glean five times more money by exporting the gas to the west (27% of European Union gas comes from Russia).

But Gazprom is also the country’s largest owner of power generating assets (Figure 7). Its generating fleet totals 38 GW, or 17% of Russia’s installed capacity, which raises concerns about the potential for the company to discriminate against competing thermal generators. It should be noted, however, that independent producers, such as Novatek and some Russian oil companies, are beginning to build a notable presence in the generation fuel supply market.

|

| 7. Gas giant. Gazprom, owner of Russia’s largest power generating assets—Mosenergo, TGC-1, and WGC-2—has a total capacity of 38 GW, or about 17% of Russia’s total installed capacity. The company, like others in Russia, is building several combined cycle power plants, seeking to boost its aggregate capacity to 44.8 GW by 2020. Its newest addition is a 450-MW combined cycle gas turbine that was commissioned at the Pravoberezhnaya Combined Heat and Power Plant in St. Petersburg on Nov. 23. Courtesy: Gazprom |

An interesting perspective offered by Austin-based global intelligence company Stratfor suggests that Russia’s natural gas producers are being forced to rely on revenues from gas exports and may be suffering financially because government measures let domestic users pay a fraction of the price paid by Russia’s foreign customers. “According to current Gazprom data, it costs Gazprom approximately $132 to produce or acquire and then distribute 1 tcm of natural gas, but its revenue from the domestic market is only $80 per tcm, which means Gazprom loses more than $50 per tcm sold domestically. Considering that the domestic market makes up 60% of sales, the loss is monumental,” the group said in an analysis published in 2012.

Gazprom has asked the government for a 45% increase in domestic natural gas prices by the end of 2013 and an end to price restrictions by 2014. If granted, Stratfor speculates, the increases will undoubtedly resculpt the country’s energy future and have major repercussions for its myriad gas generators and energy-intensive metals industries. If not, Gazprom—which alone contributes around 20% of the state budget revenues—could find itself in trouble, given that the country’s domestic natural gas consumption is projected to increase, while sales to Europe are projected to decrease.

Have the Reforms Worked?

Describing Russia’s electricity sector reforms as the “most ambitious… ever undertaken,” the International Energy Agency (IEA) in an April 2012 consultation paper calls the nation’s achievements so far “impressive.” But it warns that the reforms are still in their infancy, and the “outcome remains uncertain at this stage.” The 2008 privatization introduced several new players, and it managed to diversify generation ownership, yet government-owned enterprises still own or control more than 60% of total generation assets, the agency notes.

And perhaps more alarmingly, a trend is emerging that points toward consolidation into government ownership after unbundling and privatization, which has implications for competitive neutrality in the longer term. The IEA has called for increased diversity of ownership through further divestment, or initiatives such as virtual power or other mechanisms to sell rights to the output of publicly owned generators, which could provide a practical option for assets, like hydro or nuclear facilities, that are difficult to privatize.

Pervading Politics

Russia’s power story has come a long way from the campaign to install Illych’s lamp in every household to “enlighten” the masses, and it continues to be shaped by political and economic forces. Today, despite reforms to increase investment, the energy industry’s biggest flaw continues to be that it is dominated by monopolies controlled by a government whose leadership hasn’t really changed over the last decade, some experts say. International rankings point to Russia’s propensity for deep-seated corruption, and Putin’s return to the presidency in May signaled that not much will change, some observers lament. “Foreign investors are able to operate in Russia only if they establish good working relations with members of the dominating clans. The quickest way to be awarded projects and contracts in Russia is to offer those clans stakes in respectable international companies,” as Mikhail Krutikhin, an analyst and consultant for the oil and gas industry and politics in Russia, said in a fiery opinion for Euractiv.

But this could actually work to the benefit of efforts to modernize Russia, as Vladislav Inozemtsev, a much-cited economist and founder and director of the Centre for Post-Industrial Studies in Moscow, told German publication Speigel Online in November. No political or economic upheavals are expected between now and 2018 because “the economic system is robust and flexible,” he said, “[a]nd the majority of the population will remain content because they have never lived as normally as they do now.”

At a lecture in Vienna earlier that month, Inozemtsev argued that corruption has emerged as a necessary outcome of the collective repression of Soviet times because it gives individuals a sense of control. The state, too, devalues collective action, and a system has emerged where “bribery is the most effective means to reach any goals and solve any existing problems.” Therefore, he says, “state representatives who get used to corruption are not seen as foes, but as a systemic part of the regime. Under such circumstances, public service becomes business, corruption turns into a form of rent, and the protest against the regime diminishes.”

— Sonal Patel is POWER’s senior writer.