Texas and Germany: Energy Twins?

Geographically and politically, Texas and Germany are on opposite sides of the world, but both believe strongly in competitive energy markets, and both have largely deregulated their power industries. Now both are reconsidering their market designs.

Its easy to think that Germany and Texas could not be more different. One is northern, cold, and Old World; the other hot, southern, and New World. The fact that Texas is full of the descendants of German pioneers, sent in the 1840s to colonize cities like New Braunfels and Fredericksburg, is now just a historical irony.

Certainly their politics seem to come from different planets. Conservative Texans sent both Presidents Bush to the White House. Germany, where the Greens have been part of the political mainstream since the 1990s, is one of the more liberal countries of Europe.

Their attitudes about energy and climate change are starkly different too—in most respects. Germany has set, and is achieving, some of the most aggressive carbon reduction goals in the world, while Texas Governor Rick Perry has said that the science of climate change is “all one contrived phony mess that is falling apart under its own weight.”

But in some key ways, Germany and Texas are energy twins. Both regions believe strongly in competitive markets, and both have largely deregulated their power industries. This faith in competition has led to “energy-only” wholesale markets, where generators compete in daily and hourly markets but do not get long-term capacity payments. Both have a large and growing amount of renewable energy, especially wind and solar, and are likely to see much more in the future.

Both have very low wholesale prices, for a variety of reasons. These low prices are driving incumbent utilities in both regions toward bankruptcy and are leading to plant closures. Some industry observers think prices are too low and will result in power shortages in coming years.

As a result of all of these factors, policymakers in both Germany and Texas have been considering the fundamental design of their pro-competition markets.

Texas went through an arduous debate about capacity markets, triggered by outages in 2011. The issue was put on hold with a ruling from the Texas Public Utilities Commission (PUC) in February 2014 that concluded the state had enough capacity for now, and that tweaks to the market would be adequate. This July, the German Ministry for Economic Affairs and Energy (BMWi) formally kicked off a debate on potential reforms to the market there, releasing a study of options.

Competitive Markets

Both Texas and Germany are firm believers in competition in the electricity business.

Germany moved first, enacting legislation in 1998 that opened its market to retail choice. Legislation in Texas was adopted under Gov. George W. Bush in 1999, with markets opening in 2002.

Unlike other regions of the U.S., Texas has actively pushed consumers away from having a default power supplier. According to the PUC, the default service is a “high-priced” safety net for customers whose chosen retail electric provider (REP) is unable to continue service. “This service is intended to be temporary and used only under rare circumstances when a REP is unable to provide service,” says the PUC.

As a result, Texas has by far the most active retail market for residential and small customers, according to the Compete Coalition. The 5.8 million residential customers in Texas served by 50 competitive suppliers amount to almost one-third of all such customers nationwide.

Other deregulated states, largely in the Northeast and Mid-Atlantic, still allow for a “provider of last resort” to supply customers. While commercial and industrial customers eagerly switched, residential customers have not.

In Germany, retail choice has also largely been concentrated among large customers. Residential customers can choose from 88 retailers (72 serving residential customers), but only 20% have switched away from the traditional utilities.

Both Texas and Germany have allowed municipal and cooperative utilities to remain untouched by competition. In Texas, there are 76 co-ops and 72 munis, including CPS Energy in San Antonio, Austin Energy, and the Pedernales Electric Cooperative, the largest co-op in the U.S. Moreover, Texas utilities outside of the Electric Reliability Council of Texas (ERCOT) are not part of ERCOT’s competitive market. In all, about 80% of Texas demand is covered by retail choice.

In Germany, there are about 900 municipal power agencies. Most of these serve as aggregators for their citizens and buy power from wholesale generators. Municipal and regional utilities account for 50% of retail sales in Germany, but only 10% of generation.

Energy-Only Wholesale Markets

Competitive principles have also been applied to wholesale markets in both regions. Economic theory dictates that the most efficient market is one where generators compete to provide energy in daily and hourly auctions. Such an approach limits the exercise of market power and puts constant short-term pressure on generators to lower their costs.

But some policymakers have been concerned that constant short-term competition will hinder long-term investments, leading eventually to shortages. A number of U.S. power markets combine short-term energy markets with long-term capacity markets. The PJM Interconnection, for example, holds auctions to supply capacity three years in advance. This is intended to support existing resources and pay for new entrants.

Germany and Texas offer no payments for capacity.

Germany and Texas are polar opposites in another market aspect. ERCOT has divided Texas into 4,000 “nodes,” or spots on the grid where prices vary according to supply, demand, and congestion. This system of “locational marginal prices” or LMPs is common in U.S. markets. Germany has offered a single price for the whole country. On the other hand, ERCOT has consolidated operations into a single balancing authority, while Germany continues to be divided into four areas, each owned by a different company.

Large and Growing Wind and Solar

Germany has become a world leader in renewable energy, with 28% of its electricity coming from wind, solar, biomass, and hydropower in the first half of 2014. The official goals of the Energiewende are for renewables to have a 50% share of electricity by 2030 and 80% by 2050. Solar is now the largest single source of capacity, with over 36 GW, more than coal. Over 21 GW of this were added between 2010 and 2012, in a country with a summer peak power demand of 65 GW.

In fact, recent reforms of the renewable energy law in Germany were intended to address this solar explosion by making development more predictable and steady. The reforms established “corridors” of development of between 2.5 and 3.5 GW per year for solar, with prices adjusted to fit that range.

Texas is the number one state in the U.S. for wind power, with 12,354 MW, amounting to more than 20% of the U.S. total at the end of 2013. This produced 8.3% of total generation in the state. This lead is growing even wider, as another 7 GW are under construction and 24.3 GW of capacity have filed requests for interconnection to the grid, an early step in the development process. New transmission lines are opening up regions of West Texas and the Panhandle region to new wind development, reducing the congestion that held it back. If all currently proposed projects are built, Texas could get a quarter of its electricity from wind, on average. Given the variable nature of wind, this means there could be periods when wind power would supply most of demand. It has already hit 38% of state demand over an hour, during a period of low demand and high output.

Thanks to excellent wind resources, low land costs, and business-friendly development policies, Texas wind power prices are among the lowest in the world. A recent report by Lawrence Berkeley National Laboratory found that U.S. wind farms built in 2013 averaged a cost of $25/MWh, dominated by projects in the Great American Wind Belt, from North Dakota to Texas. Recent wind farms in the Texas Panhandle are reporting capacity factors of greater than 50%, and although their contract prices are proprietary, they are estimated to be around $22/MWh.

And while Germany also has a lot of wind power, it is miles ahead when it comes to solar. The Texas solar market is small, lagging behind a dozen other U.S. states in cumulative installed capacity. The state legislature has repeatedly rejected bills to promote solar, such as rebate programs and tax incentives. Rules for the competitive marketplace make it difficult for customers to generate their own power through “net metering,” an arrangement where customer meters roll backwards as customer-sited solar panels generate electricity. Net metering is standard in more than 40 states, but in Texas power suppliers choose whether to allow it or not.

Municipal utilities and cooperatives in Texas are encouraging solar through feed-in tariffs (popularized in Germany), net metering, and by buying power from solar wholesale generators. Austin Energy is a pioneer in the “value of solar” tariff (VOST), where the payment is determined by calculating the value of avoided utility and social costs, such as fuel use, power plant investment, air pollution, and other factors. Austin recently adjusted its VOST price from 12.8¢/kWh to 10.7¢/kWh. CPS Energy, serving the much larger city of San Antonio, had considered a low VOST but backed off after customer opposition; it is maintaining a net metering policy.

Still, Texas had only 213 MW of solar in operation at the end of 2013, according to the Solar Energy Industries Association; Germany had 169 times as much. This is despite the far superior solar resource in Texas (Figure 1). Texas has an estimated “gross technical potential”—the maximum amount technically possible—of almost 21,000 GW from photovoltaics (PV), enough to power the state 10,000 times over. Germany’s solar resource has been compared to that of Alaska. El Paso gets about twice as much solar influx as Berlin.

Financial Problems for Incumbent Utilities

Another issue common to both regions, and a key driver of the debate about capacity markets, is the financial difficulties of some of the largest incumbent utilities.

European utilities E.ON, RWE, GDF Suez, and Vattenfall all saw major losses in 2013. RWE has called it “a crisis in conventional power generation” and has closed 12,600 MW of capacity since the start of 2013. German utilities have requested permission to shut down almost 15 GW more of conventional power.

In Texas, utility giant Energy Future filed for bankruptcy in April 2014. Formerly the TXU utility, it was bought in a leveraged buyout by Energy Future Holdings in 2007. The company is deeply invested in coal plants, which were increasingly uncompetitive as gas prices plunged. According to the Wall Street Journal, the company “succumbed to a lousy bet on natural gas prices and more than $40 billion in debt.” Its retail arm, TXU Energy, lost a quarter of its customers between 2008 and 2013.

The drivers of financial problems are the same in both Germany and Texas: low wholesale energy prices.

In Germany, observers credit a large overcapacity of supply for driving prices down. The oversupply has come from a mix of declining demand due to the European economic recession, overly optimistic investments in new coal and gas power plants, and the rapid growth of wind and solar.

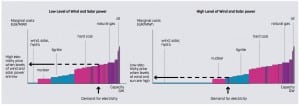

Because wind and solar power have very low operating costs and will produce power regardless of the market clearing price, they bid into the market at a very low price to make sure their power is sold. They take whatever the market-clearing price is. Nuclear plants are usually next in the merit order, because they are difficult to switch off if their bid is not accepted. Coal, biomass, and gas plants follow. Typically, the most expensive plants are “peakers,” like gas combustion turbines, which run only a few hours per year to meet peak demand but that need to recover all their costs in those few hours.

The market operator buys as much power as needed to meet demand in each hour. As shown in Figure 2, the market on the left has low levels of wind and solar power, which has little effect on market prices. But as renewables grow, as shown on the right, they push other plants further down the merit order, driving down prices and excluding higher-priced fossil plants (Figure 2).

The first victim of solar power has been the daily midday peak in demand. Unlike U.S. power systems, that tend to peak in late afternoon, because to air conditioning loads, Germany has a pronounced mid-day peak. Thanks to large amounts of solar power, this peak has been flattened out.

The implication for other generators is that the daily peak is the period when prices rose, and their revenues increased. With no daily peak, there are few opportunities for generators to make money.

Compared to solar’s daily rise and fall, wind has a different effect, coming in large bursts of weather-driven energy. During the week of Feb. 13, 2014, for example, strong winds from the North Atlantic drove massive wind generation in Germany, as shown in Figure 3. These power surges reduce prices across the wholesale market as well, but in greater amounts and at different times of the year and day.

When demand is low and wind output is high, such as on spring weekends, there can be enough wind power to conflict with the minimum operating levels (“turndown”) of thermal power plants. With too much supply on the market, prices can go to zero or even negative.

Texas has also experienced zero and negative pricing episodes, but they have largely been restricted to certain nodes where insufficient transmission was available to let the power escape to other parts of the state. With the new expansion of transmission, less congestion and fewer low-price episodes are expected.

But experience with wind and solar has already made it clear that period surges of power are a feature, not a defect. As they grow, there will be more episodes of low prices, and conventional generators will be increasingly pushed aside.

Yet, barring some new technological breakthroughs, these power plants will be needed to provide power when the wind doesn’t blow and the sun doesn’t shine, and to compensate for their ups and downs.

This is the crux of the problem in Germany. In Texas, the earlier debate was driven by concerns about sufficient capacity in the short run. But given the tremendous wind and solar resources in Texas, and their increasing competitiveness, it will be an issue there too.

This new operating scenario raises the question, Should power plants be paid just to be available?

The Debates About Capacity Markets

In Texas, the debate about capacity markets kicked off thanks to outages in the winter of 2011. Cold temperatures, combined with a number of power plants not operating, led to controlled outages, as ERCOT cut power to prevent wider blackouts.

Parties lined up on either side of the issue, with generators calling for more payments and large consumers, including oil and gas producers, in opposition.

“A multi-billion dollar debate rages in Texas—a debate that has captured the attention of those at the highest levels of government and industry,” said a report for the Texas Coalition for Affordable Power.

Proponents held up as a model other competitive markets in the U.S., chiefly the PJM Interconnection, running from the Eastern seaboard to Chicago. PJM has run a capacity market since 2004, holding periodic auctions to solicit capacity commitments three years in advance. PJM says it has a capacity market “to encourage retention of existing resources and development of new resources.” It requires all generators to bid, and awards payments based on a market-clearing price.

In nine years of auctions, PJM has awarded $54 billion in payments for capacity, almost entirely to existing power plants. While engineers recommend a reserve margin of about 15%, PJM is well above that, operating in 2013 at 29% above summer peak demand. This translates into about 20 GW of “extra” capacity, above and beyond requirements.

This surplus capacity is reflected in the results of capacity auctions, which have seen record low prices in recent years. Combined with pending air quality rules from the Environmental Protection Agency, plant owners are deciding now whether to clean up or shut down the plants. Low prices are making that decision obvious. There have been at least a dozen plants running at capacity factors of less than 2.7%. PJM forward capacity auctions for 2016 and 2017 have resulted in almost 12 GW of net retirements.

PJM’s capacity market is criticized for paying both too much for capacity and too little.

Ohio-based American Electric Power (AEP) is the country’s largest operator of coal-fired power plants. “AEP has issues with this regulatory construct we sometimes call a capacity market in PJM,” said CEO Nick Akins in 2013. “This version of socialism that equates DSM [demand-side management] and non-firm transmission with reliable, capital-intensive steel in the ground is really just capitalism in a sandbox, where the rules seem to penalize long-term investors.”

In congressional testimony earlier this year, Akins announced that AEP would be retiring one-quarter of its coal fleet by the end of 2015. He called for PJM to offer “a reliability adder, or price floor” for coal plants, as well as long-term payments.

“We need to return the focus of the nation’s electric grid to reliability and away from a financial scheme that rewards speculative activity.”

But according to a critique by analysts Anna Somer and David Schlissel, “capacity markets have paid billions of dollars to existing generators without evidence that those payments were necessary to ensure reliability.”

“The idea that a ‘capacity market’ is the only way to address power reliability concerns is off-base and is fueled by generators who would benefit from a subsidized market,” said Tony Bennett, president of the Texas Association of Manufacturers. “A capacity market would have an unmistakable chilling effect on economic growth in the state with a tremendous, long-term negative impact on Texas energy consumers.”

As part of their investigation into the issue, the Texas PUC commissioned research by the Brattle Group on reserve margins. Brattle calculated that an “economically optimal” reserve margin would be 10.2%, while one based on standard engineering practices (a 1-in-10 years loss-of-load event) would be 14.1%. The cost difference of maintaining those margins would be about $100 million a year, a relatively small amount on a system with more than $35 billion in total sales. Brattle estimated that ERCOT’s current energy-only market would maintain an 11.5% reserve margin.

A 10-year forecast released in early 2014 showed reserves exceeding 13.75% through 2019, thanks to flat electricity demand and increasing capacity from wind and gas plants.

In response to the Brattle analysis and the lower load forecast, the PUC did not adopt a capacity market. “Our energy market seems to be healthy,” said Commissioner Brandy Marty.

Instead, the PUC raised the System Wide Offer Cap to $9,000/MWh and implemented an Operating Reserve Demand Curve (ORDC) starting in June 2014. The ORDC provides extra payments to the real-time market when reserves get tight.

In Germany, the debate about capacity markets has been similar so far, though far more blame is apportioned to the growth of wind and solar.

“We think it necessary to rethink the market design by introducing a mechanism which values the supply of capacity and not only the production of electricity,” an RWE spokesman told Platts. “This mechanism should be open for every technology from the supplier side as well as from the consumer side, be market-based and oriented towards European solutions.”

But Energy Minister Sigmar Gabriel recently compared capacity markets to an unemployment program. “When it comes to capacity markets, this cannot be a [welfare program] for power plants—where you do not work but earn money,” he told an energy industry conference in June.

Unlike Texas, European power markets are long on capacity. The lingering economic recession, especially in southern Europe, has driven down demand. A build-out of conventional plants by major utilities 10 years ago and the rapid growth of wind and solar have all added to it.

A number of design proposals have been made for market reforms, most recently in a report prepared by Connect Energy Economics for the Ministry of Economic Affairs and Energy (BMWi).

The report emphasized the importance of increased flexibility, and cautioned against a capacity market, suggesting a more limited strategic reserve might be more prudent.

“The transformation of the power supply system towards a system characterised by electricity from renewable energy sources requires an evolution of the power market design,” the report concludes. “Both the supply side and the demand side need to become more flexible in order to balance the variable feed-in of wind and solar power.”

“Capacity markets interfere strongly with the power market and entail significant regulatory risks,” the report said. They are also difficult to integrate with a common European market, and can hinder flexibility options.

Instead, “A safeguard can be established by some relatively minor changes of the regulatory design.”

“We may not need capacity markets if we fully exploit the current system’s possibilities and reduce existing barriers,” Nina Scheer, a member of the German parliament for the Social Democrats, told Bloomberg. “The deeper we venture into capacity market systems, the more it may cost.”

“A properly functioning energy and services market can deliver all the capacity you need,” said Mike Hogan of the Regulatory Assistance Project. “An energy market is perfectly capable, at least in theory, of valuing reliability and compensating investors for supplying fixed resources. Too many people are using the current shortcomings in the implementation of wholesale markets as a pretext for claiming they can’t work and to push for a return to central planning, though they rarely call it that.”

“A consensus has not yet emerged on which market designs are best suited to ensure long-term resource adequacy in restructured power markets,” according to the Brattle Group.

Texas and Germany: More Similarities Than Differences

While the motivations in the capacity market debates have been different in Texas and Germany, in the long run they may turn out to be the same.

Texas regulators have been concerned about simply having enough power, while in Germany, the concern is about the right kind of resources that can integrate renewables, and how to transition to that optimal mix.

In the long run, though, both will be seeing a great deal more wind and solar power—in Germany because of strong-willed policy, and in Texas because of a superior resource and a pro-competition attitude.

Wind power in Texas is already the least-cost option, with contracts under $25/MWh. Though it is possible that the federal tax credit for wind power will be reduced, or even not renewed, it is just as probable that natural gas prices will rise as demand increases. With coal increasingly off the table due to both cost and environmental restrictions, and nuclear and biomass uncompetitive, wind will be the resource to beat.

Solar has rapidly dropped in price, especially in Texas. Austin Energy recently signed a contract with SunEdison for 150 MW of solar at a reported price of only 5¢/kWh. The first “merchant” solar plants are being built, confident enough to brave the competitive market without a long-term contract. Experience in Germany shows that a stable and mature industry will drive down costs further.

As the industry matures in Texas, as it has in Germany, it seems inevitable that the strong fundamentals of solar will bear fruit. Texas has lots of sun, solar output coincides with valuable summer peaking periods, it uses no water (other than for cleaning), it is easy to deploy, and produces no air pollution—an important consideration in non-attainment areas like Houston and Dallas.

This is clearly a period of technological innovation, as new generation, demand-side, and distributed resources enter the fray. All competitors will try to craft market policies to their own advantage by protecting their own investment or hindering others.

What will matter most is whether policymakers are able to maintain a pro-competition attitude in the face of constant attacks from incumbent generators. Although Texas has been unwilling to promote renewables as aggressively as other U.S. states, let alone Germany, it has also been willing to remove barriers to their development.

German policymakers are facing the same pressure. As utilities suffer losses, they are trying to both preserve their existing business models while developing new ones. No issue is more important to their financial survival than the rules of the market.

—Bentham Paulos is a freelance writer and consultant specializing in energy issues.