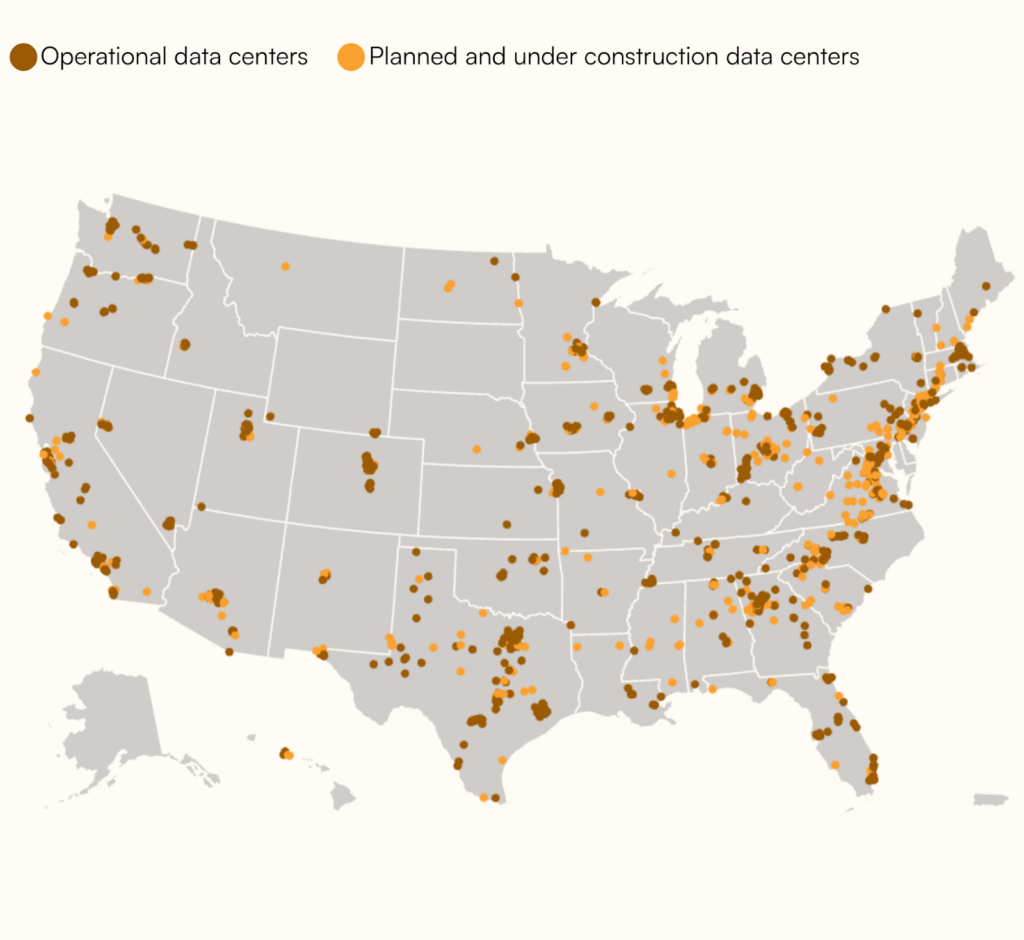

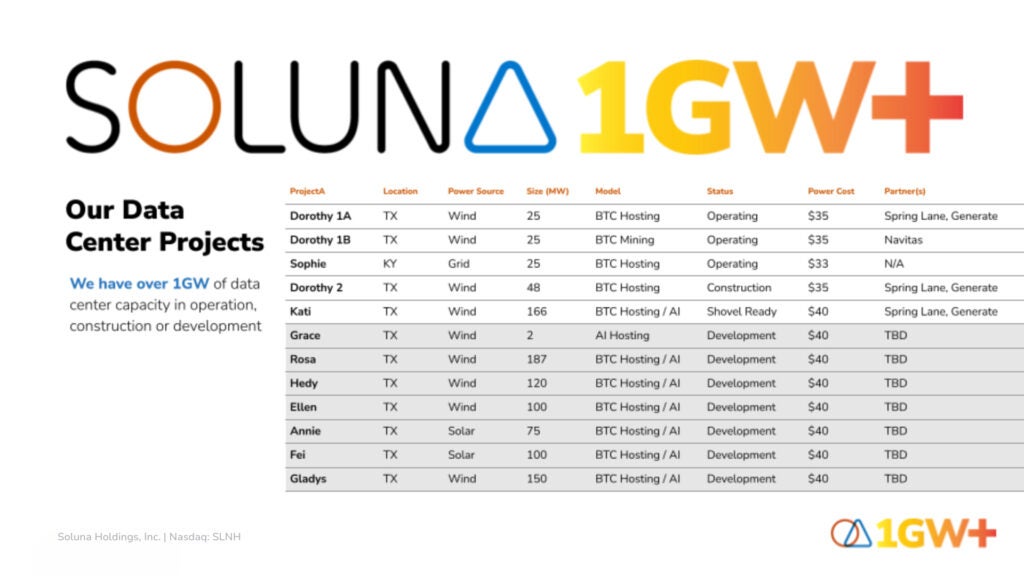

Soluna Holdings, a developer of data centers powered by renewables, is set to break ground on Project Kati, a 166-MW wind-powered data center campus poised to support Bitcoin hosting and the rapidly growing demand for artificial intelligence (AI) and high-performance computing (HPC) infrastructure.

The project, a partnership with EDF Renewables, Masdar, and Spring Lane Capital, is designed to integrate utility-scale wind generation with flexible, high-density Bitcoin and AI computing workloads to leverage novel arrangements that will boost grid resilience and optimize returns for renewable energy producers, the company told POWER. Project Kati is slated to become one of the largest dual-purpose computing facilities in Texas, it said.

Project Kati will launch in Willacy County, located in South Texas’s Rio Grande Valley, which borders the Gulf of Mexico. On Sept. 18, the project will break ground on Phase 1, an 83-MW Bitcoin hosting facility that, when online in the first quarter of 2026, will offer 48 MW to Galaxy Digital, a New York-based financial services firm focused on digital assets, cryptocurrency, and blockchain technology. The remaining 35 MW from Phase 1 is reserved for Soluna’s own customers. Kati 2, the project’s 83-MW planned second phase, will “establish Project Kati as a dual-purpose facility serving both Bitcoin hosting customers and the rapidly growing demand for AI and HPC workloads.”

Galaxy Digital announced on Aug. 12 that it would relocate 48 MW of proprietary bitcoin mining operations from its Helios campus in the Texas Panhandle to Soluna’s Project Kati 1 in Willacy County. The company will be the anchor customer for Soluna’s renewable-powered data center. Soluna, notably, secured a $5 million loan from Galaxy for the facility on March 18 and will provide turnkey infrastructure and operations once the facility becomes operational in early 2026.

“Breaking ground on our biggest project yet expands our Texas footprint, strengthens partnerships with leading renewable developers, and proves our colocation model of pairing high-performance computing with clean energy at utility scale,” said John Belizaire, CEO of Soluna. “Project Kati showcases our ability to deliver large-scale facilities with world-class investors and positions Soluna for long-term growth across Bitcoin hosting and AI infrastructure.”

Flexible Load Meets Wind Variability

Project Kati’s phased approach aligns with surging demand for data capacity and persistent grid congestion in ERCOT, Soluna said. Community leaders, institutional investors, and utility partners are expected to attend the Sept. 18 ceremony.

While Soluna declined to share details about the turbine technology that will power the facility, it noted the project is well-suited to crypto load, which typically requires massive, constant power consumption, often consuming as much electricity as entire cities and placing significant strain on local grids due to its 24/7 baseload demand that can fluctuate unpredictably with cryptocurrency market conditions.

Last year, the Public Utility Commission of Texas (PUCT) adopted a rule for reliability purposes requiring cryptocurrency mining facilities of more than 75 MW in the Electric Reliability Council of Texas (ERCOT) region to register with the state and annually report details about their location, ownership, form of business, and electricity demand. The grid operator’s Large Flexible Load category, dominated by crypto miners, is projected to consume 54 TWh in 2025, representing nearly 60% growth from 2024 and accounting for approximately 10% of total ERCOT consumption.

On June 23, ERCOT issued new requirements mandating that all large electronic loads 75 MW or greater—including data centers and crypto mining operations—complete voltage ride-through capability surveys and update their dynamic grid models by Aug. 31, 2025, after studies revealed that up to 2,600 MW of load loss during transmission faults could trigger cascading system-wide outages.

The directive followed ERCOT’s June 13 Large Load Workshop, which detailed how a severe fault in West Texas could cause voltage dips to 0.70 per unit for more than 20 milliseconds, potentially triggering the loss of 1,500 MW out of approximately 3,000 MW of large electronic loads in the region if their ride-through capabilities align with the Information Technology Industry Council (ITIC) curve standards. ERCOT’s analysis showed that under worst-case inertia and frequency response conditions, losing more than 2,600 MW of load could push system frequency above 60.4 Hz, a threshold that could cause conventional generators to trip offline and create an uncontrolled cascading blackout across the Texas grid. Such dynamic events could occur in seconds rather than the minutes or hours available for controlled load shedding, it warned.

But according to Soluna, Project Kati is exceptionally well-suited for a flexible load like cryptocurrency computing “because it creates a powerful symbiotic relationship,” Larbi Loudiyi, vice president of Power at Soluna, told POWER. “Crypto load provides the perfect blend of operational flexibility and economic agility that traditional industries cannot match,” he said.

“First, our load can ramp up or down quickly, acting as a dynamic ‘shock absorber’ for the wind farm’s variability. When the wind blows strongly but the grid is congested, we can consume that excess energy in seconds. When grid demand rises and power becomes more valuable, we can power down just as fast, allowing every megawatt to be sold at a premium. This isn’t just helpful; it’s a fundamental optimizer for the wind farm’s revenue.”

And second: “The speed at which we can deploy and scale this load is critical. Unlike building a factory or a large-scale battery facility, which can take years, our modular computing infrastructure can be built and brought online in a matter of months,” he said. “This allows us to rapidly respond to market opportunities and provide an immediate solution to the chronic curtailment issues facing renewable energy in Texas.”

Asked how Project Kati will address variability while integrating with grid needs, Loudiyi noted Project Kati “already has a sophisticated industrial automation system—known as a SCADA system—that continuously monitors and manages its output in real time to comply with grid operator (ERCOT) commands.” When the wind farm receives a “Base Point” instruction from ERCOT, “that becomes its absolute maximum output limit (MW),” he said. The wind farm system automatically adjusts the turbines to ensure they never exceed it. “The innovation with the data center is that it acts as a ‘smart load,’ consuming power on-site during periods when the grid cannot accept all the energy the wind farm is capable of producing. Instead of curtailing (wasting) that energy, we redirect it to the data center. This turns a grid constraint into an economic and environmental benefit.”

PPA-Backed Agreement Suite

Loudiyi confirmed that the project is anchored by a Power Purchase Agreement (PPA), but he noted that the project’s behind-the-meter arrangement “requires a sophisticated suite of agreements to function seamlessly within ERCOT’s market rules.”

“While the PPA governs the sale of energy from the wind farm to the load, a critical component is the Retail Electricity Provider (REP) agreement. At Project Kati, we’ve partnered with EDF Renewables to purchase up to 166 MW of energy produced by the Las Majadas Wind Project to power the data center,” he explained.

Ultimately, beyond just providing a flexible load, “we offer independent power producers (IPPs) a true turnkey solution,” he said. “We manage the entire complexity of structuring these agreements, along with development, construction, and operations, to deliver immediate and reliable curtailment mitigation.”

Backed by $100 Million from Generate Capital

Earlier this week, Soluna announced it secured a $100 million scalable credit facility from Generate Capital—a San Francisco-based sustainable infrastructure investment firm. The move intends to bolster the buildout of Project Kati and the expansion of Soluna’s pipeline of renewable-powered data centers.

The structure includes an initial $12.6 million draw to refinance Dorothy 1A and Dorothy 2 projects—Soluna’s existing wind-powered Bitcoin hosting and mining facilities in Silverton, Texas, which it brought online in April 2023 and early 2025. Additional tranches include $22.9 million in delayed draws for continued Dorothy 2 buildout and Project Kati 1 development, alongside an uncommitted $64.5 million accordion facility to support equipment procurement for AI workloads and fund Soluna’s expanding 2.8 GW development pipeline.

Soluna said its partnership with Generate Capital positions the company for rapid expansion across its 2.8 GW development pipeline, which includes recently announced Projects Gladys (150 MW wind) and Fei (100 MW solar) that pushed the company past the 1 GW milestone in August 2025.

“We’re not just growing our current projects, we’re building new ones wherever wasted renewable energy can be converted into valuable high-performance computing. This deal reflects a different kind of infrastructure financing, focused on capital efficiency, modular growth, and disciplined execution,” said Soluna CEO Belizaire. “We’ve known the Generate team for quite some time before partnering; they understand our business, our team, and our industry well, making them so much more than just investors. We see them as strategic partners going forward.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).