Economic and population booms forecast for several countries in the oil- and gas-rich Middle East are forcing a reassessment of those countries’ historic reliance on fossil fuels and a new focus on securing sustainable electricity and water supplies.

The Middle East is a region of extremes. While some countries enjoy opulent wealth, others are some of the poorest in the world. While it is the center of global oil and gas production, it is also a primary center of oil demand, driven ever higher by soaring peak power demand. And, already one of the driest and most water-scarce areas of the world, the region is expected to double its population in the next 40 years.

In response to expected soaring growth in power demand, and with some countries already afflicted by crippling power shortages, governments in the 14 countries across the region (Bahrain, Iraq, Iran, Israel, Jordan, Kuwait, Lebanon, Oman, Palestine, Qatar, Saudi Arabia, Syria, United Arab Emirates [UAE], and Yemen), and specifically the Islamic monarchies that make up the Gulf Cooperation Council (GCC)—Qatar, the UAE, Kuwait, Bahrain, Saudi Arabia, and Oman—are embarking on ambitious plans to expand power capacity.

But compared to countries with soaring needs like China, Brazil, and India, this region’s efforts are distinguished by a shift toward diversification and away from dependence on indigenously sourced fossil fuels. Conservation of fossil fuels is being pursued not only because the hydrocarbon resources are finite but also because it makes sound financial sense.

The Middle East, for example, uses oil for 33% of power generation—compared to the world average of just 4%—especially during the sultry summer months. But at international prices of $100 per barrel, burning oil (at highly subsidized prices) in low-efficiency thermal power stations that characterize the region poses a financial drain and diminishes prospects for oil exports.

Natural gas has been the replacement of choice, given the region’s large gas resource base—though, as experts point out, the region suffers a moderately underdeveloped transmission and distribution network that puts countries at risk of shortages. In Iraq, for instance, gas shortages have currently stalled operations at four power plants that were completed in the country last year, and in Saudi Arabia, gas shortages have forced generators to turn to burning heavy fuel oil or crude oil directly. (For more on the use of heavy fuel oil, see “Blurring the Line Between Temporary and Permanent Power” in this issue.) The uncertain supply of natural gas has in some cases even impelled countries like the UAE, Saudi Arabia, Oman, and Bahrain to consider building coal-fired capacity.

And beyond volatile prices and tightening supplies, Middle Eastern oil-producing nations are also wary of the diminishing competitive advantage for hydrocarbons posed by global climate change policies, prompting them to look to renewables, which provide obvious sustainability advantages. Others, still, are considering nuclear.

The Challenges

According to experts, long-term sustainable growth in the Gulf Arab states particularly will depend on how well they introduce energy efficiency measures, invest in low-carbon energy supplies, improve water efficiency, and expand water desalination capacity.

The Renewable Energy Policy Network for the 21st Century (REN21), a global policy research network, and the International Renewable Energy Agency concur that progress is happening rapidly. One factor spurring a dynamic shift in the policy landscape across the region is the establishment or expansion of regional cooperation and institutional activities related to enhancing energy and water supply sustainability.

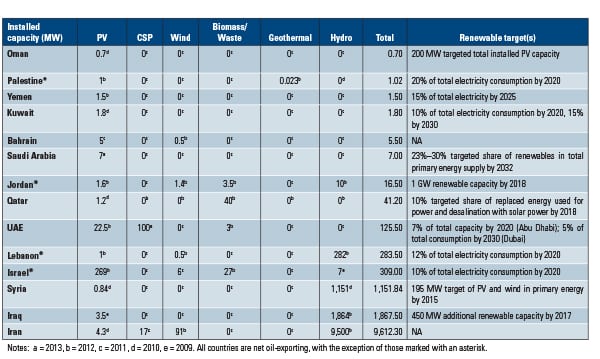

Recent years, for example, have seen the founding of the Masdar renewable energy development and investment cluster in Abu Dhabi and the King Abdullah City for Atomic and Renewable Energy in Saudi Arabia. Meanwhile, at least 12 of the 14 Middle Eastern countries, both net oil-exporting and net oil-importing, have renewable energy targets (Table 1).

|

| Table 1. Installed renewable capacity in the Middle East. Source: REN21 |

Some are staggering: Saudi Arabia alone is looking to add 54 GW of renewables by 2032 to replace an estimated 23% to 30% share in total primary energy supply (see sidebar “Saudi Arabia’s Planned Transformation”). Several countries also have net metering in place or capital subsidies and tax or production credits or reductions, and most rely on either direct or indirect public funding or public competitive bidding processes for fixed quantities of renewable energy.

| Saudi Arabia’s Planned TransformationThe region’s energy supply woes and future trends are perhaps best characterized by Saudi Arabia, the world’s 13th-largest country that is mostly a harsh, dry desert with great temperature extremes. It is the world’s largest country without a river. The kingdom also takes the distinction of being the world’s largest oil producer, exporter, and holder of proved oil reserves.

But during the summer, when temperatures can soar to 128F, the country sees sharp upward swings in oil demand, primarily driven by power sector consumption—and specifically, from its largest utility, Saudi Electric Co. (SEC). In 2012, the kingdom’s power fuel mix was 39% natural gas (down from 52% in 2007), 35% crude oil, 20% diesel, and 6% fuel oil. Despite calls for more gas-fired generation to free up more crude oil for exports, an increasing preference for oil-fired generation over gas generation is being bolstered by highly subsidized prices for oil paid by power producers. In 2012, for example, generators paid $0.73/MMBtu for crude oil (the corresponding international price was $19.26/MMBtu) and $0.75/MMBtu for natural gas (compared to an international price of $9.04/MMBtu). However, observers also note that Saudi Arabia lacks adequate infrastructure to pipe natural gas from the production and processing centers in the eastern region to the oil-rich western and southern regions. One of the kingdom’s newest gas plants, shown at the top of this story, is Dhuruma Electricity Co.’s (DEC) Riyadh PP11 plant, a 1.7-GW independent power project situated about 125 kilometers west of Riyadh, which was completed in March 2013 after three years of construction. Hyundai Heavy Industries was the project’s engineering, procurement, and construction contractor. GE supplied the seven high-efficiency gas turbines and two steam turbines. Experts posit that Saudi Arabia’s key challenge lies in a low energy pricing policy. Despite gradual reform recently embarked on by the government, and a revision of tariffs in 2010, the policy caps power prices in the kingdom at 1.3 cents to 6.9 cents/kWh and encourages “wasteful” consumption, notes Bassam Fattouh, director of Oxford’s Institute of Energy Studies and head of the research center’s Oil and the Middle East Programme. “Between 2003 and 2012, electricity sold (a proxy for electricity demand) increased from 128,629 million kWh to 240,288 million kWh, an increase of 78%. During the same period, the peak load increased from 23,938 MW to 51,939 MW, an increase of 117%,” he says. Fattouh also points out that 50% of the kingdom’s total generated power is consumed by the residential sector—and nearly three-quarters of that is used for air conditioning. Industry uses 17%, commercial entities 16%, and governmental agencies 13%. Because Saudi Arabia has a regionally unique 60-Hz grid frequency that severely limits the potential for grid interconnections, the country has embarked on plans to increase its generating capacity from 55 GW in 2013 to 120 GW by 2020 to meet soaring future demand and support expanded water desalination efforts. But beyond its short-term options to use fuel oil and diesel instead of crude oil—which often has to be imported during summer demand swings—and reluctant to undertake the political wrangling required to raise prices of fossil fuels to reflect true costs, Saudi Arabia plans to press ahead with improving power sector efficiency by phasing out old power plants and introducing more efficient ones (thus gaining 37 GW of capacity), reducing consumer demand, and changing its power mix. Among its diversification ambitions is building up to 18 GW of nuclear capacity over the next two decades, at a cost of nearly $7 billion for each of the 16 planned reactors. The country has signed key nuclear cooperation agreements with Japan, France, and Jordan, and hopes to call in preliminary bids for its first reactor this year. Construction could then commence in 2017, with completion slated for 2022. Meanwhile, the kingdom has also unveiled formidable renewable energy capacity targets: 25 GW of concentrated solar power, 16 GW of solar photovoltaic, 9 GW of wind, 3 GW of waste-to-energy, and 1 GW of geothermal by 2032. Combined, Saudi Arabia’s plans effectively call for nuclear and renewables to make up 50% of produced electricity by 2032—though, as experts point out, the kingdom has not matched its targets with a dedicated national policy framework or energy strategy. |

REN21 reports that investment trends in the region are healthy, despite a global downturn. New investment in renewables in the Middle East and North Africa combined totaled $2.9 billion in 2012, an increase of almost 40% over 2011, and a 6.5-fold increase from 2004. Yet, that progress could be hindered by a number of challenges, it warns, including the region’s susceptibility to political unrest, financial uncertainty, and policy risk.

Nuclear Possibilities

Considering those risks, it is significant that several countries in the Middle East—among them, the UAE, Jordan, Saudi Arabia, and to a lesser extent, Qatar, Oman, Kuwait, and Bahrain—are actively considering starting nuclear programs for power and water supply.

In a 2008 independently published comprehensive policy on nuclear energy, the gas-rich UAE dismissed coal as an option to meet projected escalating power demand because of its environmental and energy security implications. In an explanation that has since been echoed by the region’s other countries, the UAE said nuclear emerged as a “proven, environmentally promising and commercially competitive option.”

Today, after accepting a $20 billion bid from a South Korean consortium to build four nuclear reactors—a total of 5.6 GW—two are already under construction at UAE’s Barakah site in Abu Dhabi (Figure 1). The UAE hopes to have all four 1.4-GW APR-1400 units producing power by 2020 and plans to export power to Gulf neighbors via the regional power grid. Uniquely, the UAE offset delays to a construction start by offering joint-venture agreements to foreign investors for the construction and operation of future nuclear plants, and it plans to manage its nuclear power program based on contractor services, rather than indigenous expertise. It also concluded long-term agreements for the supply of nuclear fuel. The plants will, for the most part, be financed by the state and Korean equity partners.

The Barakah reactors won’t be the first in the region. That honor goes to Iran’s controversial Bushehr reactor. Construction was suspended in 1979, resumed in 1994, and the plant began commercial operation in late 2013, reconfigured as a VVER-1000 by Russia’s Atomstroyexport.

And beyond Saudi Arabia’s lofty call for 18 GW of new nuclear capacity, Qatar is also looking into the viability of nuclear power to support soaring electricity demand and expanded desalination capacity. The country signed a nuclear cooperation agreement in 2010 with Russia’s Rosatom. Oman, meanwhile, has expressed interest in investing in a neighboring country’s nuclear plant. In 2010, Kuwait announced an intention to build four 1-GW nuclear reactors by 2022, but in mid-2011 said it would not proceed with those plans.

Finally, Jordan, which must import more than 95% of its energy needs at a cost of nearly one-fourth its GDP and which also has a substantial “water deficit,” in October 2013 selected Atomstroyexport as the supplier of two AES-92 nuclear units. The country will make its final decision on the new builds in late 2015. Russia is expected to contribute about half of the project’s total $10 billion cost for the build-own-operate project.

Power Trading

Emerging solutions to address potential energy shortfalls in the region include the establishment of cross-border interconnections and power trading. While most countries have had long-existing interconnections with neighboring countries, some are considering transcontinental imports, including hydro from the Nile Basin, the Congo, and Central Asia and Pakistan. The most prominent interconnection program is the Gulf Cooperation Council Interconnection Authority’s (GCCIA’s) partly commissioned 400-kV “supergrid,” which links GCC countries: Bahrain, Kuwait, Qatar, Oman, UAE, and Saudi Arabia.

That $1.2 billion project entails three phases (the first two were completed by 2011), including a high-voltage direct current back-to-back 1,200-MW installation between a 50-Hz, 400-kV system and a 60-Hz, 380-kV system. Developers highlight the line’s success, saying it has provided instantaneous transfer of power to state networks to avoid full or partial interruptions during major incidents—thus avoiding significant economic losses caused by outages. A 2013-released GCCIA report claims it has saved GCC countries $3 billion in investments as well as $330 million in operating costs and fuel.

The interconnection authority is now reportedly eyeing the introduction of an energy market management system, a bidding platform that would replace time-consuming bilateral negotiations and contracts and allow countries to request bulk electricity and advertise spare capacity at the same time. The GCCIA ultimately wants to establish a wholesale and spot-priced market in the GCC and beyond, though GCCIA Chief Operating Officer Ahmed Ali Al-Ebrahim acknowledges several hurdles must first be overcome.

Perhaps its greatest challenge, though: The GCC must orchestrate a policy shift away from electricity subsidies in the region. Subsidies on power and natural gas produced obstruct a proper electricity market from forming in the GCC, because true prices of both are unknown. Until GCC countries can address the political and economic issues that inhibit price-reflective electricity markets, the full potential of the GCC interconnection grid will be left untapped, he said.

Water Woes

For the drought-prone Middle East, where average rainfall ranges between 20 and 40 cm per year (compared to 72 cm globally), water scarcity is a paramount concern. The region hosts about 5% of the world’s population but only 1% of its renewable water resources, most of which is in transboundary basins such as the Euphrates and Tigris River Basins (shared by Syria, Iraq, and Iran) and the Jordan River Basin System (Jordan, Palestine, and Israel). As a result, almost all of the region’s water resources are overexploited and severely polluted, leading to saltwater intrusion in the aquifers and subsequent lowering of water tables. Meanwhile, population and economic growth are expected to further catapult water demand—which, compounded by adverse climate change effects, could set the stage for conflict.

Some initiatives entail regional collaboration on water and electricity. The oil-rich countries on the Arabian Peninsula, specifically, are tackling the problem with large desalination schemes to help alleviate water stress. Desalination is costly and energy intensive, with energy costs accounting for up to 50% of operation costs. According to the Pacific Institute, desalination plants generally require 15 MWh for every million gallons of freshwater produced. Still, the process has been practiced for more than 50 years in the region (Figure 2) and emerged as the most feasible solution for some countries.

The International Desalination Association (IDA) reports that more than half of the world’s capacity growth between 2001 and 2011—276%, rising to 6.7 billion cubic meters a day (m3/d)—took place in the Middle East. The region’s desalination efforts are characterized by three main methods differing in terms of energy consumption and cost, and whether they can be used for seawater or brackish water treatment. Multistage flash and multi-effect distillation are distillation-based methods that are generally preferred because they support cogeneration of water and power. The third, more energy-efficient method—reverse osmosis (RO)—uses membranes to separate salts from water. But though membrane technology and energy recovery have improved markedly since the 1960s, and RO today makes up the bulk of worldwide desalination capacity, energy consumption still accounts for about 40% of operation costs.

The region’s recent shift to promote sustainability encapsulates the water and energy nexus (see also “The Water-Energy Nexus Takes Center Stage” in this issue). Experts posit that Saudi Arabia’s water use is seven times its sustainable level, while the UAE uses 15 times its sustainable level, and Kuwait more than 20. Meanwhile, several leaders are actively backing projects that shift from fueling desalination efforts with oil (and, less frequently, natural gas) and toward concentrated solar power and other renewables—even though some experts are unconvinced renewables can match the high-energy footprint needed for desalination.

As the largest desalination producer in the world, Saudi Arabia’s efforts to produce more than 4 million m3/d (representing 18% of global production), for example, require roughly 300,000 barrels of oil per day. The kingdom in December announced it would build the world’s largest solar-powered desalination plant in Al-Khafji Governorate on the Arabian Gulf Coast that will have the capacity to produce 30,000 m3/d and 2.5 GW of power via ultra-high concentrator photovoltaic cells when completed. That RO project is only the first phase of the King Abdullah Initiative for Solar Water Desalination that requires all seawater desalination in the kingdom to be powered completely by solar by 2020. The second phase entails a 300,000 m3/d solar-powered desalination plant; a third phase implements the initiative throughout the kingdom.

Finally, with 120 desalination plants operating in the region and more water required to fuel the energy boom and vice versa, some experts express trepidation about the possible environmental consequences from release of so much brine back into the oceans. Then there are concerns about greenhouse gas emissions from the intense amount of energy required for the process.

But the solutions here too are standard. Two levels of actions require urgent attention to achieve a lower energy footprint, says Middle East expert and former IDA President Dr. Corrado Sommariva. “The first one is the creation of policies that encourage energy efficiency, providing a realistic price for energy even in oil-rich countries and rewarding energy efficiency. On the technical level, it is necessary to educate managers and plant operators on how to operate plants in a much more energy efficient manner with relatively few changes.” ■

— Sonal Patel is a POWER associate editor (@POWERmagazine, @sonalcpatel).