War rages in Europe. Natural gas prices are through the roof. Drought threatens hydro production. Weather extremes are becoming commonplace. Supply chains are strained. Demand for electricity is headed skyward. Yet, power companies are meeting the challenges. What an exciting time to be alive!

When 2022 began, there weren’t a lot of people contemplating the effect a military conflict in Ukraine might have on the world’s energy landscape. But when Russia invaded the second-largest country in eastern Europe on February 24, the wheels were set in motion for a wide-range of consequences.

“The war in Ukraine, which was unpredictable on most economic forecasts, has had both macro and micro impacts on the power generation industry,” John Stilwell, U.S. Partner-in-Charge, Energy Advisory—Power and Utilities with Grant Thornton LLP, told POWER. “The macro effect outside of the Eastern European region mirrors the current global economic outlook and concerns around geopolitical security. Concerns over energy security and supply across the region continue to grow, and the ensuing crisis shows no sign of dissipating. The conflict has driven oil and gas prices to their highest levels in nearly a decade and forced many countries to reconsider their energy supply strategy. This is not a simple task, considering that Russia is the world’s second-biggest supplier of natural gas.”

Stilwell noted that long-term impacts will be based on near-term policy shifts centered on how Europe will replace 40% of its gas imports. “Germany has canceled approval of a newly built gas pipeline from Russia, and is now planning to import liquefied natural gas [LNG] from countries such as Qatar and the U.S.,” he said. “Belgium, Italy, and the UK have all announced accelerations in renewable energy investments. President Biden has pledged to send more LNG to Europe, showing that LNG may prove to be the bridge to Western Europe’s long-term desire for energy independence.”

Natural Gas Prices Spike, Drought Threatens Hydro

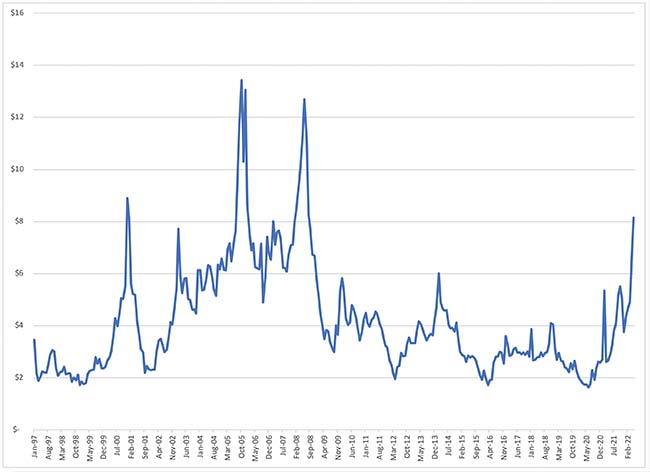

What this all means to U.S. power producers is not completely clear. Natural gas prices were already relatively high in 2021, averaging about $3.91/MMBtu based on monthly Henry Hub spot prices reported by the U.S. Energy Information Administration (EIA), which was a 92% increase compared to 2020. The rise in natural gas prices led to a decrease in gas-fired generation in the U.S. and an increase in coal-fired generation, which jumped more than 16% year-over-year—the first increase in coal-fired production since 2014. Yet, gas prices in 2022 could be even higher.

Through May, Henry Hub natural gas spot prices were averaging more than $5.74/MMBtu, according to the EIA, and had increased in every month during 2022. In fact, the average price in May was $8.14/MMBtu, the highest monthly average since August 2008 (Figure 1). Furthermore, the price of natural gas actually delivered to power plants is generally higher than Henry Hub spot prices. For example, the EIA reported that gas delivered to U.S. power plants in 2021 averaged $4.98/MMBtu, more than double the $2.32/MMBtu average recorded in 2020.

|

|

1. Henry Hub natural gas spot prices have spiked to levels not seen since 2008. Monthly average prices are shown here in dollars per MMBtu. Source: U.S. Energy Information Administration |

The high gas prices could provide coal-fired generation with a competitive advantage in the power markets again this year. Also adding proverbial fuel to the coal fire is an ongoing drought in the Western U.S. The California Department of Water Resources reported in early June that every reservoir in the state was suffering with below-average conditions. The EIA predicted the drought in California could nearly halve the state’s hydroelectric generation this summer.

The two largest reservoirs in the U.S.—Lake Mead, formed by the world-famous Hoover Dam, and Lake Powell, created by the Glen Canyon Dam—are also at historic lows (Figure 2). At the end of May, they were 29% full and 26% full, respectively. Patti Aaron, the Bureau of Reclamation’s Public Affairs Officer for the Lower Colorado Basin Region, told Reuters, “We’re in our 23rd year of drought in the Colorado River Basin. Both Lake Powell and Lake Mead have been declining rapidly during the course of this drought, and Lake Mead is now at its lowest level since it filled.” For perspective, Lake Mead was at 97% capacity in 1999.

|

|

2. Hydropower production from the Glen Canyon Dam is being threatened by historically low water levels in Lake Powell, an artificial reservoir on the Colorado River in Utah and Arizona. At the end of May, the reservoir was 26% full—its lowest level since it was filled. Source: Bureau of Reclamation |

On May 3, the Bureau of Reclamation announced urgent drought response actions to help prop up Lake Powell over the next 12 months. At the time, Lake Powell’s water surface elevation was at 3,522 feet, its lowest level since originally being filled in the 1960s. The lowest point at which Glen Canyon Dam can generate hydropower is 3,490 feet.

Summer Heat Presents Additional Risks

In addition to the drought, heat presents risks for power generators. Last summer, temperature records were shattered across many parts of the Pacific Northwest in late June. Portland, Oregon, and Seattle, Washington, broke all-time highs by significant margins, with temperatures in the two cities hitting 116F and 108F, respectively. In Lytton, British Columbia, the temperature hit 121F, setting a new national record in Canada.

“The biggest risks are typically those where common drivers both increase electric demand and decrease available supply. That’s what happens when you have extreme heat or cold that increases customer electricity usage for cooling or heating, while at the same time potentially impacting a generator’s ability to produce at expected levels,” Daniel Brooks, vice president of Integrated Grid and Energy Systems with the Electric Power Research Institute (EPRI), told POWER.

“The recent NERC [North American Electric Reliability Corp.] Summer Reliability Assessment highlights a few regions where widespread, prolonged extreme heat could result in insufficient supply to meet demand and the need for rolling load shed,” Brooks said. “The NERC assessment identifies MISO [Midcontinent Independent System Operator] as the largest risk this summer. This is where hotter than average summer highs, over a wide region, could result in higher demand for electricity with potential lower output from the growing wind generation in the region, compounded by a slightly lower supply available due to recent retirements.”

Brooks also noted that risks were elevated in both the Western U.S. and in Texas. “While not as severe as the risk faced in the Midwest, the risk is driven by similar patterns of higher than typical temperatures, driving increased demand, coinciding with the potential for reduced wind and/or solar, with drought-related wildfires and hydro availability also contributing,” he said.

Supply Chain Woes Continue

POWER has covered supply chain problems in previous issues this year (see “Optimism Is Warranted in the Power Industry in 2022 and Beyond” in the January issue and see “Supply Chain Issues Mean Planning Is More Important Than Ever” in the May issue). Still, troubles persist and warrant further attention.

“Current supply chain issues continue to impact the global solar industry driving up costs,” Grant Thornton’s Stilwell said. “Solar module suppliers, manufacturers, renewable energy developers, and utilities all face great uncertainty surrounding the immediate future of the solar module supply market. While in the macro context, supply chain pressures are increasing shipping and equipment costs for cells and panels, several immediate micro factors exist that will continue to drive up pricing and market uncertainty.”

Stilwell also suggested the conflict in Ukraine was impacting supply chains. “Supply chain disruption is a major factor on both focused and broader levels of the current conflict. Imports of components for batteries, microchips, auto parts, and petrochemical production are at risk. Russia is the world’s third-largest producer of aluminum and nickel, which are key elements in the production of lithium-ion batteries. Ukraine is a major producer of rare gasses essential in microchip production. Disruptions in these markets could further exacerbate the global microchip crisis, already exacerbated by the pandemic,” he said.

“In concert with other global pressures, it seems possible that the Ukraine Crisis may develop into the biggest test of the global supply chains yet,” Stilwell said. “European leaders are already looking to diversify sources and supply routes where possible and preparing risk response plans for the most vulnerable supply chains.”

Demand for Power Is Growing Quickly

Despite these challenges, electrification will continue to grow. “EPRI’s models show that the electric sector’s share of end-use energy will increase two to three times in the most affordable pathways to reaching economy-wide net-zero by mid-century. That means much more of society will depend on the electric sector as we go forward,” said Brooks. “Electric grid reliability and resilience is not a barrier to achieving decarbonization. It’s a prerequisite.”

Among the areas of highest growth in the U.S. is Texas. Oncor, the largest energy delivery company in Texas with more than 140,000 miles of transmission and distribution lines serving more than 400 communities and 98 counties, offers a case in point. Speaking at the co-located POWERGEN and DISTRIBUTECH events in Dallas, Texas, on May 23, Jim Greer, executive vice president and COO of Oncor, said, “Here in the Oncor area we are experiencing customer and load growth at unprecedented levels.”

Greer noted that the population of Texas is expected to double by 2050. He also suggested the state’s industrial sector is expanding equally fast, mentioning a $30 billion facility Texas Instruments is constructing and a $15 billion plant that Samsung is currently building in Oncor’s territory as examples of the growth. “ERCOT [the Electric Reliability Council of Texas, the independent system operator that manages about 90% of the state’s electric load] currently estimates that approximately 17 GW of crypto-mining load is looking to interconnect to the grid,” Greer said. He further explained that ERCOT’s current peak load is 74 GW, meaning the crypto mining additions would increase load by more than 20%.

The adoption of electric vehicles (EVs) will add even more demand to the grid. A common thumb rule suggests one EV draws about the same load as adding one new single-family home to the system. That’s significant. Furthermore, fleets offer perhaps even greater potential for growth. “Oncor has identified more than 24,000 fleets in our service area,” Greer said. “It’s an interesting time to be in our industry.”

Of course, planning is crucial to accommodate for these and other power grid changes. “System operators need to ensure their resource adequacy planning processes reflect future risks with a changing resource mix and changing extreme weather patterns,” said Brooks. “EPRI’s Climate READi [Resilience and Adaptation] and Resource Adequacy initiatives are engaging system operators and other stakeholders to develop the processes and tools to provide forward-looking risk assessment and investment planning.”

—Aaron Larson is POWER’s executive editor.