Responding to a request from a Democrat-led U.S. House committee, the federal International Trade Commission (ITC) is investigating how New England’s increasing renewable targets are economically affecting the region, and what role renewable imports play in meeting those commitments.

The ITC, an independent, nonpartisan and quasi-judicial federal agency that also provides fact-finding as it relates to international trade, on Feb. 12 announced it was seeking input for the investigation, which was requested by the House Committee on Ways and Means on Jan. 23.

The ITC’s probe will focus on Massachusetts, and it will involve a review of Massachusetts’ electricity market, and residential and commercial rates, to understand how domestic and imported power sources affect the commonwealth. However, it will also look into renewable energy goals and commitments made by other New England states—and, significantly, it will assess how the state is faring in its transition from nuclear and fossil fuels to renewables.

A report that the ITC expects to deliver to Congress by Jan. 25, 2021, will contain a quantitative analysis of “of the potential economic effects on Massachusetts and the broader New England region of Massachusetts reaching its goals and commitments for renewable electricity sourcing (including the potential economic effects on residential and commercial electricity consumers),” as well as the “likely effects on the greenhouse gas emissions” of meeting these goals, the agency said. Finally, it will also offer “relevant case studies” involving other states, regions, or countries that “provide insights into the potential economic effects of imports of hydroelectricity, including on efforts to meet renewable energy targets.”

‘A Growing Strain’ on New England’s Grid

In his letter to the ITC, Richard Neal (D-Mass.), chair of the House Ways and Means Committee, noted that over the past three decades, Massachusetts “has seen the retirement of both nuclear and coal-generated power plants across the Commonwealth.” He added: “With these facilities offline, there has been a growing strain on the ability of New England’s bulk power generation and transmission system to meet the demands of consumers. High electricity rates undermine the competitiveness of Massachusetts businesses and make it difficult for residents, particularly low-income households to afford their utility bills.”

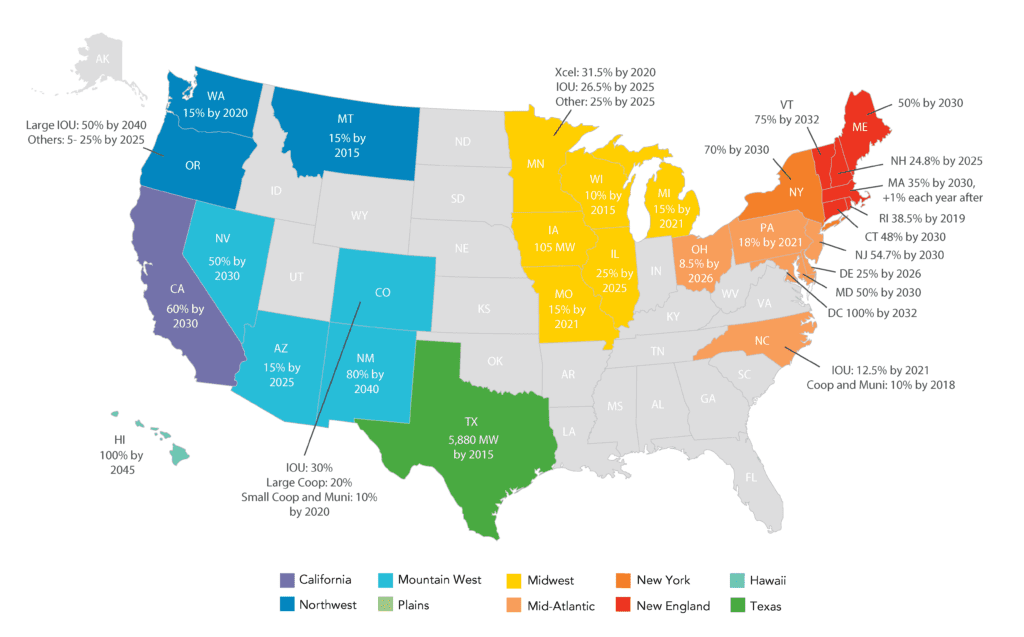

Neal noted that many states in New England have set ambitious goals to boost renewables and slash greenhouse gas emissions. Massachusetts current renewable portfolio standard (RPS) is set to 35% by 2030. However, it also has an Alternative Energy Portfolio Standard, requiring that 5% of electric load be met with high-efficiency customer-sited systems such as industrial cogeneration by 2020. And in 2017, the commonwealth established a Clean Energy Standard (CES), which sets a minimum percentage of electricity sales that suppliers must obtain from clean energy sources that have net lifecycle greenhouse gas emissions of at least 50% below those from the most efficient natural gas generator. Eligible technologies include hydroelectric and nuclear power. The CES requirement began at 16% of sales from clean energy by 2018, and after that it requires increases of 2% annually to reach a goal of 80% in 2050.

Neighboring New Hampshire, meanwhile, has an RPS of 24.8% by 2025; Rhode Island, of 28.5% by 2019; and Connecticut, of 48% by 2030. Canadian-bordering New England states Vermont and Maine have RPSs of 75% by 2032 and 50% by 2030, respectively (Figure 1). All six New England states are also part the the northeastern Regional Greenhouse Gas Initiative (RGGI), a nine-state cooperative effort to limit and reduce carbon emissions from power plants.

The states are served by ISO-NE, a regional transmission organization that is responsible for reliable day-to-day operation of its bulk power generation and transmission system. On Jan. 27, the entity updated its Resource Mix page to reflect that 48% of the region’s power generation in 2019 came from natural gas power; about 30.5% came from nuclear; while less than 1% came from coal. Renewables generated 11.4%; wind generated 3.6%; refuse, 3.1%, solar, 1.7%. About 19% of the region’s net energy and peak load was met with net flow over external ties with Quebec, New Brunswick, and New York.

Growing Reliance on Gas, Renewables, Imports in New England

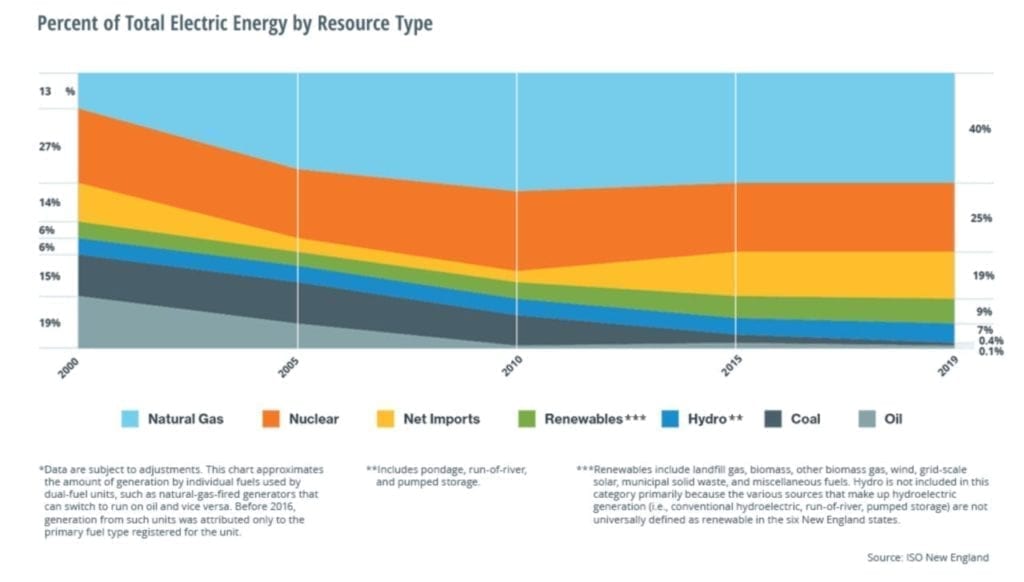

The share of natural gas power, renewables, and net imports have grown markedly in the region since 2010 (Figure 2). Their combined impact on wholesale power prices in the region prompted the closure of the 679-MW Pilgrim station, Massachusetts’s only nuclear plant, in 2019, five years after the 612-MW Vermont Yankee plant in Vermont closed for many of the same economic reasons. The region’s nuclear power now comes from the 2-GW Millstone plant in Connecticut, and the 1.2-GW Seabrook nuclear plant in New Hampshire. Connecticut recently selected supply from both plants as part of its “zero-carbon resource” selections to shield them from market impacts.

According to ISO-NE, the wholesale market has effectively attracted investment to transform the region’s power mix and boost its low-carbon attributes. “Because private firms make this investment and not public utilities, consumers are shielded from the investment risks they had been exposed to before the introduction of competitive markets,” it noted.

Because so much natural gas power has been added to the region to offset coal and nuclear closures, however, some stakeholders have voiced concerns about reliability, especially as it relates to the constrained natural gas supply during the winter, and indeterminate liquefied natural gas (LNG) and fuel oil deliveries. In its latest long-term reliability report, the North American Electric Reliability Corp. (NERC) said the region’s reliability risks are compounded by infrastructure and operational pressure from a surge in intermittent wind, solar, and hydro resources, as well as environmental permitting difficulties for new dual-fuel capability gas units. To address regional energy security issues, ISO-NE and its stakeholders are working to develop a a new, three-part market based approach: a multi-day ahead market, new ancillary services, and seasonal forward procurement. All are scheduled for implementation in the 2024–2025 timeframe, NERC noted.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine)