To propel interest and bolster development of advanced nuclear reactor designs, the Department of Energy (DOE) will demonstrate—by October 2020—the production of high assay low enriched uranium (HALEU) fuel in a first-of-its-kind $115 million project at the agency’s uranium enrichment facility in Piketon, Ohio.

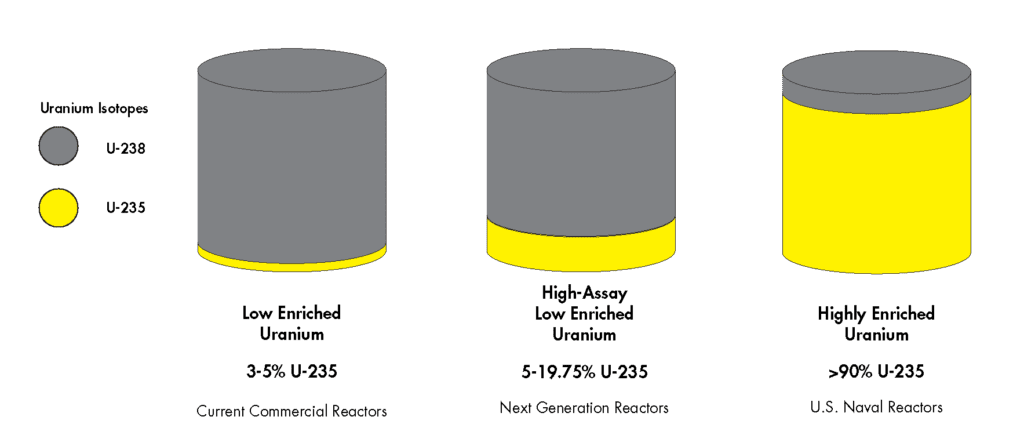

HALEU is nuclear fuel that is enriched to a higher degree (of between 5% and 20%) in the fissile isotope U-235. In comparison, the world’s current fleet of light water reactors (LWRs) currently uses fuel enriched to less than 5% U-235. “Many of our advanced reactor concepts, including some microreactors, require this type of fuel, and they require it because it provides more power per volume than conventional reactors. Its efficiency allows for smaller plant sizes, it allows for longer core life, and it allows for a higher burn up rate of nuclear waste,” Deputy Secretary of Energy Dan Brouillette told reporters on Jan. 7, as he announced the project.

“The goal of this particular project is to demonstrate the capability to produce HALEU with existing U.S. enrichment technology in support of the advanced reactor community. It will also benefit research and development programs here at the department itself,” he added.

A New Centrifuge Project

Under the three-year project, the DOE plans to contract with Centrus Energy subsidiary American Centrifuge Operating (ACO) to demonstrate HALEU production through a 16-machine AC-100M HALEAU cascade at the Portsmouth Gaseous Diffusion Plant in Pikeston.

Centrus, which was formerly known as the U.S. Enrichment Corp. (a government corporation designed to restructure the government’s uranium enrichment operations that was privatized in 1998), has already successfully demonstrated its advanced U.S. gas centrifuge uranium enrichment technology at the Piketon facility. That project, called the “lead cascade,” involved demonstrating the effectiveness of a DOE-developed, classified centrifuge design and equipment by processing uranium in a closed loop. However, though the demonstration was successfully completed, Centrus struggled to remain financial viable amid snowballing cost pressures due to delays, and it made a financial decision to cease uranium enrichment operations in February 2016. The Nuclear Regulatory Commission (NRC) later downgraded licensed activities at the lead cascade project to “limited operations,” and removed its regulatory permission to enrich uranium. Centrus submitted a revised decommissioning plan in January 2018, and requested to terminate the facility in August 2018.

The DOE’s newly announced contract with Centrus for the HALEU production demonstration appears to revive Centrus’ activity at the facility.

Brouillette said the demonstration project is expected to produce 19.75% U-235 enriched product by October 2020. The timeline, however, is complex. “For fiscal year 2019, we have $35 million set aside to support the program. Some of that work is going to be done down at Oak Ridge [Tennessee]. The centrifuges have to be moved from Tennessee to Piketon, Ohio, over the course of the following two years,” he said. “We have $40 million set aside for each one of the two years for some construction work that needs to be completed in Piketon as well as demonstration and the operation of the machines themselves.”

Licensing needs could also extend the project timeframe, Brouillette noted. While Piketon is currently licensed to conduct the work, ACO would need to pursue its own licensing at the NRC. Brouillette said: “We don’t expect that that will take too long because many of these companies were already been down this path at least once before. We’re optimistic that that’s going to be a fairly short timetable, and we can meet the goal that we have of proving this concept by roughly 2020/2021, in that timeframe.”

However, in a January 2018 white paper focused on HALEU, the Nuclear Energy Institute (NEI) estimated that getting regulatory approvals to modify an existing license to enrich uranium to HALEU levels could take between 12 to 18 months—and require an environmental review. “The most significant factor affecting the licensing of a HALEU enrichment facility—regardless of the technology used—would be the criticality safety aspects of increasing enrichment to nearly 20%,” the NEI said. No revisions or changes would be required for existing regulations, the trade group noted. “However, additional criticality benchmark data may be necessary for criticality code validation in the higher LEU enrichment range to support the establishment of reasonable safety margins (i.e., not overly conservative) in the licensing process,” it said.

According to the DOE, because of the “sensitive nature” regarding access to and operation to U.S.-origin enrichment technology, “ACO is the only source capable of executing the contract activities to meet the requirements of the HALEU Demonstration Program.” The agency added that the company’s AC-100M technology is also “the only existing U.S.-origin uranium enrichment technology, and further, has the potential to be deployed at a commercial-scale serving the broadest market need.”

“What we’re doing is in order to take advantage of the most cost-effective approach and meet the timeline for expected demand, we’re going to follow with strategy of using existing equipment and an existing facility with a current NRC license,” Brouillette said. The Piketon facility already has existing centrifuge equipment, and the technology to produce HALEU fuel is already “at an advanced technical readiness stage,” he noted. “It’s ready to be fully demonstrated, which is in no small part due to significant industry and DOE investment in our in [research and development].”

HALEU Needed ‘Across the Board’

Brouillette told reporters that “Russia has the ability to produce these type of fuels,” which is why the U.S. government was “looking for U.S. origin and U.S. source fuel. We feel this is very important, again, for national security, for energy security needs here in the U.S,” he said.

But according to Dr. Everett Redmond, senior technical advisor of the NEI’s New Reactor & Advanced Technology division, the DOE’s announcement is a significant leap in the right direction because no commercial facilities to make HALEU on a commercial scale or transportation infrastructure associated with uranium hexafluoride above 5% exist worldwide. Still, several technical and regulatory issues will need to be addressed before HALEU can become a commercial offering in the U.S., he told reporters in a call on Jan. 7.

Interest in HALEU’s importance has been on the NEI’s “radar” for some time, Redmond noted, and the trade group has long urged the federal government to consider that establishing HALEU fuel production capability in the near future is critical to U.S. leadership as global competition heats up to design and build small modular reactors as well as larger non-LWR reactors.

According to Redmond, the need for HALEU “is across the board,” and interest is rife worldwide, especially in countries developing advanced reactor designs. (For an infographic showing the status of current small modular reactor designs, see POWER’s Big Picture infographic in its November 2018 issue.) The fuel is needed for a handful of microreactors under development—many smaller than 10 MW—but “also high temperature gas reactors that may be operating in the 100-MW to 200-MW range. It also includes salt reactors, which may be operating at higher power levels than that, so it actually is necessary for a lot of these advanced designs that are not water-cooled,” he said.

These include designs put forth by Silicon Valley-based Oklo, which is developing a 2-MW fast reactor, and Maryland-based X-energy, which is working to complete first demonstration of a 75-MW high-temperature gas-cooled pebble bed advanced reactor. (For more on the companies developing microreactors and the status of their development, see “Big Gains for Tiny Nuclear Reactors,” in POWER’s November 2018 issue.)

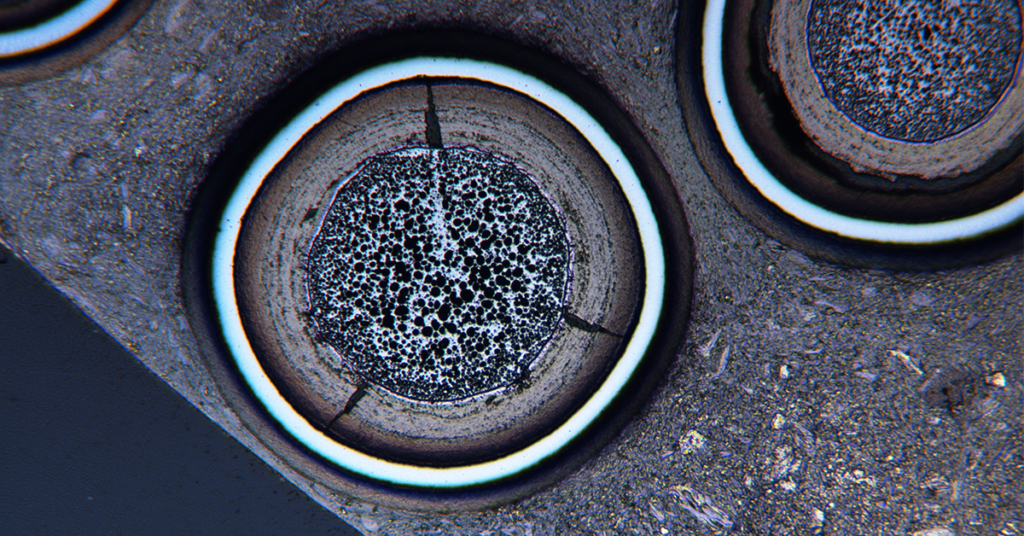

Centrus, notably, announced on Nov. 29 that it signed a new services contract with X-energy “to proceed with the preliminary design” of a facility to fabricate uranium oxycarbide tristructural isotropic (TRISO)-based fuel. The agreement stipulates that Centrus would provide facility space to X-energy at its Technology and Manufacturing Center in Oak Ridge, Tenn. As they announced the agreement, the companies said the proposed so-called TRISO-X facility would position the companies to be “first to market in the sector of [HALEU] TRISO-based fuel for advanced reactors and potentially, accident tolerant fuel for the existing light water reactor fleet.”

As significantly, HALEU could also be used in existing nuclear reactors. “There is at least one design of new fuel for LWRs—a kind of very new design—that would need enrichments up to 19%,” Redmond noted. Though he did not mention the company by name, Massachusetts-based fuel company Lightbridge is developing HALEU for use in commercial fuel. It has said it wants to demonstrate the fuel in a research reactor at a U.S. national laboratory in 2020, as well as a commercial nuclear power plant powering a U.S. city by 2021.

Another consideration is that the nuclear power industry is beginning to think about higher burnups in the existing fleet, “which would need enrichments of above 5%, but not too much above,” Redmond said.

NEI: HALEU Action Needed Now

In a July 2018 letter to Energy Secretary Rick Perry, the NEI suggested that by 2030, about 185.5 metric tons of HALEU could be needed annually—up from 1.5 metric tons in 2019, but still a small fraction of the 2,000 metric tons of uranium used annually by the existing U.S. fleet. The NEI added, emphasizing the accelerated timeframe, that development, demonstration, and deployment of many advanced nuclear technologies “is in jeopardy since there is no certainty that a HALEU fuel infrastructure will be in place when they are ready to enter the market. At the same time, investment into a HALEU fuel infrastructure is highly unlikely given the market uncertainty.”

In its January 2018 white paper outlining fuel cycle hurdles for advanced reactors, the NEI also noted that if advanced reactors were to be deployed in the U.S. by the early 2030s, the DOE should provide an interim HALEU supply—using its inventory of high-enriched uranium that could be down-blended to HALEU—to the commercial nuclear industry by the end of 2022. In that paper, the trade group urged the DOE to begin supporting the design, qualification, licensing and fabrication of larger HALEU transportation packages by the end of 2019, as well as to develop criticality benchmark data needed to license HALEU facilities and transport packages.

The NRC, meanwhile, should work to to finalize the material control and accountability regulatory guidance document of Category II special nuclear materials, as well as develop guidance for implementing a physical security plan at such a facility, the NEI said.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine).