Despite frail demand for natural gas in Europe and difficulties in upstream production growth in the Middle East and Africa, the “Golden Age” of natural gas will remain in full swing until at least 2018, recent projections from the International Energy Agency (IEA) show.

A medium-term outlook released by the Paris-based autonomous intergovernmental organization in late June (click here for the executive summary) reveals a number of possible developments that could boggle the world gas market’s blistering growth over the next five-year-period.

An “Anemic” European Gas Outlook

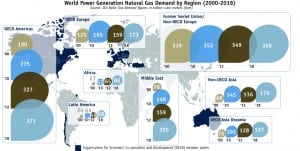

One emerging trend noted by the agency is that gas demand is surging mostly outside the 34-member Organisation for Economic Co-operation and Development (OECD)—driven mostly by China, where gas consumption grew by 13% in 2012 (Figure 1). Europe, on the other hand, saw a 1.6% drop in demand last year from a “structural weakness” in the power generation and industry sectors.

Meanwhile, more than half of the world’s gas supply last year was contributed by the U.S., though significant supply increases were also recorded from Norway, Turkmenistan, Saudi Arabia, Qatar, and China. At the same time, Russian gas production fell substantially, “driven by a combination of lower domestic demand and a reduced call for expensive Russian gas from importing countries,” the IEA said. On the interregional trade front, liquefied natural gas (LNG) trade fell 2% due to an unexpected fall in supply, while pipeline imports to Europe from the Middle East also receded as a result of pipeline bombings in Yemen. In 2012, a stunning 46% of global interregional gas trade was geared to Asian markets—a 40% increase when compared to 2011.

Looking forward over the 2012 to 2018 period, the report suggests China will remain the fastest-growing gas consumer. But European demand will only see “anemic growth” due almost entirely to “low economic growth and more conservative expectations in the power generation sector.” One reason for this, the IEA suggests, is that power generation from renewables will outpace total additional generation needs by 13% over 2012 to 2018, leaving combustible fuels with a decreasing residual load—even though several nuclear facilities are scheduled to be shut down over that period. “Over the next two years, an unfavorable gas, coal and carbon price relationship will contribute to a further drop in European gas demand to 500 [billion cubic meters (bcm)] in 2013 (from 513 bcm in 2012),” the IEA says. Forward prices indicate a price relationship improving in favor of gas in the second half of the decade, which will lead to a recovery. “Nevertheless, gas-fired power generation remains at around 100 TWh below its peak of 2008,” the agency projects.

A Healthy Diagnosis for North American, Australian Gas

The gas picture in the U.S. over the next five years is expected to be rosier—even though gas prices are projected to slightly increase—with the power generation sector alone accounting for half of overall growth. Significantly, the IEA forecasts that generation from gas-fired power plants will nevertheless fall in 2013 (compared to the spike in 2012, which was brought about by an “exceptional drop” in gas prices), allowing coal-fired generation to recover in the short term.

Shale gas development will also continue to be centered in North America until 2018, though China could enter the drive to develop unconventional gas. Several countries are now assessing the potential for unconventional gas and debating whether specific environmental regulations are required—and that could mean unconventional gas production could take off outside North America after 2020.

In Australia, gas consumption is slated to rise sharply following the introduction of a carbon price and deployment of new LNG liquefaction plants beginning in 2015. But in Japan, where uncertainty looms over the future of its nuclear power sector, a partial return of nuclear generation could mean only modest gains for gas-fired generation in the medium term.

Gas Trends: Oil Indexation, Transportation Fuel

Another gas trend identified by the IEA is that while regional market prices diverge at “unprecedented levels” (it notes specifically that the spread between Henry Hub gas prices and Japanese imports reached a record $16/MMBtu in mid-2012) oil indexation is increasingly being challenged in Asia as it has been in Europe. “However, the fact that most LNG coming on line by 2015 is linked to oil prices implies that oil indexation is likely to continue to dominate,” the agency projects.

According to the IEA, meanwhile, another surprising driver for a boom in world natural gas consumption will be the fuel’s emergence as a transportation fuel, according to the report. “Gas use in road transport represented 1.4% of global gas demand in 2012, but this share should rise to 2.5% by 2018 as consumption grows to around 50 bcm in the same period (9.4% of additional gas demand). This covers around 10% of the incremental energy needs of the transport sector, more than electric cars,” the IEA says. Gas use by bunkers and in the rail sector could also take off in the medium term. The agency cautions, however, that these possibilities are mired in each region’s development of parts of the gas value chain to “solve the chicken-and-egg problem of having a sufficient number of filling stations and natural gas vehicles (NGVs).”

—Sonal Patel is POWER’s senior writer (@POWERmagazine, @sonalcpatel).