Wind farms are not all created equal. During the previous 12 months ending February 2018, the average capacity factor for U.S. wind turbines—virtually all of which were located on land—was 36.9%. Danish offshore wind turbines averaged 45.8% over the same period. Several factors play into the difference, but location is one of the biggest influences. The wind is stronger and more consistent offshore. Floating wind turbine structures offer coastal power companies a way to tap into the vast offshore wind supply.

The dramatic technological progress, increased competitiveness, and cost reductions of renewables, particularly for wind technologies, helped convince the European Parliament and member states in June 2018 to increase European Union (EU) renewable energy targets for 2030 to 32%. A significant jump over the 27% target that was tabled in November 2016, Europe is partly pinning its hopes on the deployment of ever-larger, bottom-fixed offshore wind (BFOW) farms and breakthroughs in floating offshore wind (FOW) installations.

An example of the former is the Race Bank offshore wind farm, the fifth-largest worldwide, which officially opened off England’s North Norfolk coast around the same time as the targets were increased. Consisting of 91 turbines that produce more than 570 MW, Danish renewables company Ørsted owns 50% of the facility, the Macquarie European Infrastructure Fund 5 owns 25%, and Sumitomo Corp. and other investors own the remainder. According to the trade group Wind Europe, including Race Bank, Europe is now home to more than 4,000 offshore wind turbines stretching across 11 countries with more seemingly coming online every day.

Venturing Farther Offshore

Following a typical development pattern, the majority of these turbines were situated in the easiest-to-reach locations, at generally shallow depths, near to shore. But fully 80% of all the offshore wind energy resource is located in waters 60 meters (m) and deeper further out in European seas, where current BFOW turbines are neither economically attractive nor technologically feasible. The same is true for wind resources off the U.S. coast, Japan, and elsewhere—the strongest winds blow farther offshore.

The leap to FOW is similar to the transformation the oil and gas industry experienced as companies started building floating structures in the 1970s, opening new deepwater markets such as the Gulf of Mexico, Latin America, and West Africa. But now wind farmers and oil drillers will be working closely with each other, drawing from shared knowledge pools and relying on the same suppliers as they design, build, operate, and maintain assets in often punishing offshore environments.

Equinor, formerly known as Statoil, the Norwegian state-owned energy producer, has taken a leading role in FOW generation. The company’s Hywind floating wind farm began commercially producing off the coast of Scotland late last year (Figure 1). At 30 MW, it’s the first large-scale facility of its kind.

Several consortiums, including GE Renewable Energy, Ideol, and others, with support from the French government, have been conducting FOW trials off France’s Atlantic and Mediterranean coasts, ahead of plans for a major build-out in the near term. Recently, the Norwegian government met with Equinor and other developers to draw up a pathway toward greater adoption of FOW technology both in the North Sea and worldwide. The company said in May it expected about 13 GW of FOW to be installed globally by 2030, and it aimed to take “a fair share” of that. Equinor is also maturing a project in Norway that combines FOW generation directly with active oil drilling platforms.

According to studies by Bloomberg New Energy Finance, deals already signed by the spring of 2017 will see approximately 237 MW of capacity from FOW worldwide come online by 2020. Following the success of Hywind, those numbers will likely start to climb as estimates show that the technical potential for FOW is enormous. Wind Europe estimates France has some 2,900 GW of FOW potential alone. The UK’s Carbon Trust has identified more than 1,900 GW off the coasts as well. Additional studies estimate that Japan has a high potential, roughly 3,500 GW in the deep waters where high winds blow far offshore, away from coastal populations who, so far, have largely objected to visible turbines. Also gaining attention, the U.S. has some 2,500 GW of FOW potential.

“These markets will see huge growth in the coming years,” Alex Pucacco, operations and maintenance (O&M) consultant at engineering solutions specialist BGB Innovation, said in an email exchange with POWER. “As project risk is reduced and supply chains are developed with engineering advancements made, both conventional and floating offshore wind parks could be seen across the globe. Ørsted, EnBW, SgurrEnergy, and Equinor, amongst others, are already looking to transfer their knowledge to overseas markets, including Taiwan, Japan, China, and the United States,” he said. No longer an exercise in research and development, FOW technology has rapidly advanced to such an extent that it’s now migrating into the mainstream.

Proving Performance

It’s no surprise that the first FOW farm was built in Scotland. The water depths of the North Sea are ideal for the application, and estimates show that more than half the area is suitable for deploying floating wind power. Energy produced from turbines in deep waters could meet the EU’s electricity consumption four times over, according to estimates from the European Wind Association. A combination of high wind speeds, abundant near-shore deepwater sites, and the ability to leverage existing infrastructure and supply chain capabilities from the offshore oil and gas industry create ideal conditions to position Scotland as a world leader in floating wind technology.

Hywind’s five 6-MW turbines (Figure 2) float above waters that are 328 feet deep—and despite experiencing a hurricane and wave heights up to 8.2 m during its first three months in operation, it’s already performed better than expected, according to Beate Myking, Equinor’s senior vice president of offshore wind operations. While the typical capacity factor for a fixed offshore wind farm during winter months in the North Sea is between 45% and 60%, Hywind achieved 65.1% during November, December, and January 2018.

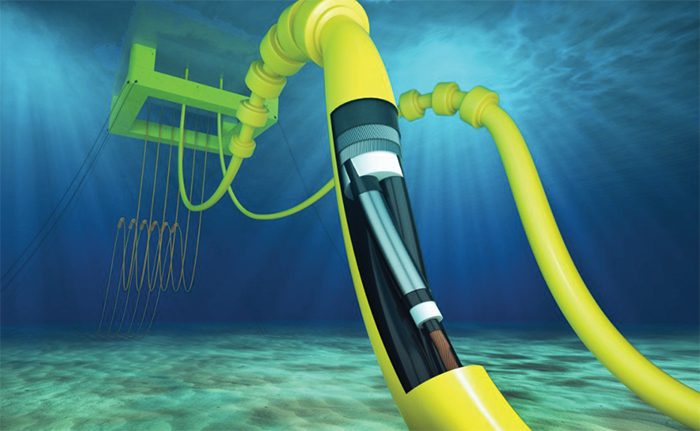

“Hywind is an engineering masterpiece but it faces many challenges, both in O&M, serial production, and deployment, in order to overturn the success of monopile and jacket foundations in Europe,” said Pucacco. “Maintenance of these offshore wind farms are not without their challenges. If you consider towing the structure to port for major component replacement, you need to disconnect the cables both for power and tether. This is costly, time consuming, and vessel intensive, and you can often lose out on the economics of multiple changeouts that conventional offshore jackets allow,” said Pucacco.

Far-shore sites also pose additional challenges for installation, O&M, and higher foundation costs as they move into deeper water. This is already particularly evident in Scotland, where existing projects are being developed in water depths greater than 40 m and in complex seabed conditions. Floating offshore wind could circumvent a number of these challenges, unlocking deepwater sites close to shore that would support conventional high-voltage alternating current transmission, port-based O&M strategies, and lower installation and major repair costs by removing the need for expensive heavy-lift installation vessels. Floating substations are also being developed to further support this nascent sector.

Test Trials in France and Japan

As Hywind proves out its technology, French developers, in partnership with GE Renewable Energy, and with the backing and support of the government, are rapidly taking the next steps toward commercializing other FOW technologies. Following decades of dependence on nuclear power, France now aims to generate 33% of its energy from renewables, with a heavy reliance on both BFOW and FOW. One of the initial test sites is in the Bay of Biscay, an area known for its omnipresent high winds and stormy seas. To help power this transition, in conjunction with the French naval shipbuilding and energy company DCNS, GE Renewable Energy is developing a floating wind turbine system to be topped by its massive Haliade-X turbines.

As announced earlier this year, GE will be investing $400 million to develop gargantuan 12-MW turbines with a rotor diameter of 722 feet, roughly double the average, featuring blades more than 351 feet long. GE says each Haliade-X will produce about 67 GWh annually, “enough clean power for up to 16,000 households per turbine, and up to 1 million European households in a 750 MW windfarm configuration.” The first units are expected to ship in 2021.

Financing a wide variety of FOW projects is the Australian-based Macquarie Capital that long ago decided to get in on the ground floor of cutting-edge renewable energy technology. It has forged a strong relationship with the French-based Ideol to develop the first utility-scale commercial floating offshore wind farm in Japan.

Founded in 2010 with the goal of developing, testing, and proving out economically feasible floating solutions for the offshore wind industry, Ideol has been conducting advanced trials of its 2-MW Floatgen floating project in France, which produced its first electricity in December 2017. At the end of April, the Vestas turbine mounted on Ideol’s Damping Pool base was towed to the Centrale Nantes SEM-REV offshore site and connected to the national electricity grid. It arrived just in time to experience an episode of severe weather (5 m waves and 15 m/second winds) that proved its seakeeping performance and confirmed some of Ideol’s simulation models.

Ideol is also about to commission a 3-MW FOW pilot project off Japan using the Damping Pool floating foundation technology, which could open the door to full-scale commercial construction as early as 2023. “Our technology is particularly compatible with tomorrow’s very large wind turbines,” said Paul de la Guérivière, CEO of Ideol. With Macquarie’s backing, “we are now ready for the next stage: commercial-scale deployment.”

Floating Ideas in California

Other near-term projects include the ReaLCoE endeavour. Part of a consortium led by German turbine manufacturer Senvion, the group is working to develop what it calls next-generation 10+ MW-rated, robust, reliable, and large offshore wind energy converters for clean, low-cost, and competitive electricity. Over the next three-and-a-half years, the consortium expects to develop, install, demonstrate, operate, and test a technology platform for the first prototype of a double-digit rated capacity turbine in a realistic offshore environment, hoping to trigger hundreds of millions in investments into the European clean-tech sector.

One of the partners in ReaLCoE, EnBW, which has been developing wind farms since 2011, recently took several additional steps to develop FOW arrays, including engaging in a joint venture (JV) with Seattle’s Trident Winds to build what could become the first U.S. floating offshore wind farm. Located off the coast of central California, the group plans a 650–1,000 MW FOW project with a grid connection in Morro Bay. The initial focus of the JV is to obtain a site lease from the Bureau of Ocean Energy Management and secure the grid connection, which became available following the shutdown of the Morro Bay power plant. ■

—Lee Buchsbaum (www.lmbphotography.com), a former editor and contributor to Coal Age, Mining, and EnergyBiz, has covered coal and other industrial subjects for nearly 20 years and is a seasoned industrial photographer.