TOP PLANT: Crescent Dunes Solar Energy Project, Tonopah, Nevada

Owner/operator: SolarReserve

Three-and-a-half hours north of Las Vegas, in a rocky, desolate stretch of Nevada desert, an innovative solar-storage plant has nearly completed a year of commercial operations. It also may have delivered proof of round-the-clock dispatchable solar energy.

The Crescent Dunes Solar Energy Project, a concentrating solar power (CSP) plant built by Santa Monica, Calif.–based SolarReserve outside Tonopah, Nev., shares a lot of similarities with other solar-tower CSP plants like Ivanpah (POWER’s 2014 Plant of the Year). Just over 10,000 billboard-sized heliostats, each about 1,200 square feet, focus sunlight on a central receiver at the top of a 640-foot tower. The plant uses the heat collected to generate steam and drive a turbine generator.

CSP is a straightforward and fairly well understood technology that’s been around for more than a decade. The first utility-scale CSP plant came online in 2008, and several dozen of them are in operation around the world, mostly in Spain. Crescent Dunes isn’t the largest CSP plant by any means—at 110 MW, it’s less than a third the size of Ivanpah, the current leader.

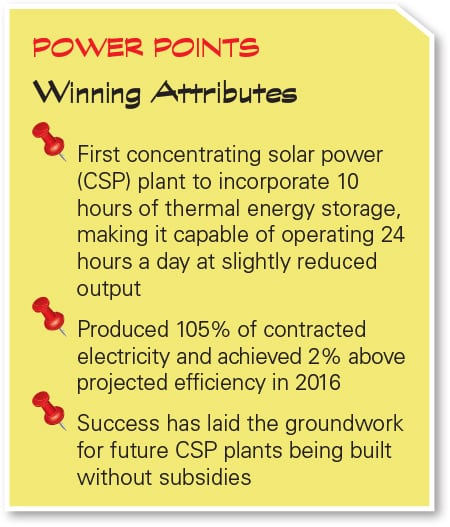

What sets Crescent Dunes apart from its predecessors is that it incorporates 10 hours of full-power thermal energy storage—a total of 1.1 GWh. In terms of duration, that’s more than earlier CSP-plus-storage plants like the Solana Generating Station in Arizona (a 2014 POWER Top Plant) that store around five to seven hours of generation, and far more than the largest battery projects currently in development, which top out at around 400 MWh. And unlike Solana, which circulates a heat-transfer fluid that is then used to heat molten salt, the receiver at Crescent Dunes heats the salt directly.

The molten salt system circulates the salt from a cold tank, through the solar tower, where it’s heated from 550F to 1,050F, and then to a hot tank (Figure 1). Molten salt from the hot tank is then sent through a Nooter/Eriksen steam generator. The steam is sent through a turbine-generator, then to an air-cooled condenser, and back to the steam generator.

|

|

1. Salt flow. The molten salt is held in a pair of large tanks, one hot, one cold—though the “cold” tank holds the salt at 550F. Source: POWER/Tom Overton |

Round the Clock

The plant sells its power to Nevada utility NV Energy under a 25-year power purchase agreement (PPA). Since reaching commercial operations in November 2015, Crescent Dunes has—unlike Ivanpah—quietly exceeded its obligations, delivering 105% of contracted output. The molten salt receiver has achieved 100% availability through 2016, and performance data show that it’s operating 2% above its expected efficiency.

On a normal day, Crescent Dunes begins generating power around 10 a.m., reaches full power around noon, and stays there until 10 p.m. to midnight per the terms of its PPA, which calls for 12 to 14 hours of generation a day. This helps NV Energy meet peak evening demand, and Crescent Dunes shuts down as that demand falls late at night.

But that’s only what it’s contracted to do for the utility. The PPA, in fact, doesn’t exploit the plant’s full capabilities. By reducing its net output slightly, Crescent Dunes can actually operate 24 hours a day, banking excess thermal energy while the sun shines and using it to generate steam all night. As a proof of concept, SolarReserve ran the plant for a continuous 120-hour period during July 2016. While doing so, it was able to maintain full power for most of the day, only ramping down to about 60% power during the early morning hours. Even better, the system’s thermal inertia means output does not fluctuate with variable insolation the way output from a photovoltaic (PV) system will. To put things in perspective, that’s an operating profile not unlike the average gas-fired combined cycle plant.

Rocket Science

Crescent Dunes cost around $1 billion, about $260 million of which was private equity. The $737 million in debt financing was supported by a loan guarantee from the Department of Energy (DOE), something the company concedes was essential to project development—it’s unlikely the plant could have been built without it. So far, that’s been the case with all CSP projects in the U.S.

But, as CEO Kevin Smith told POWER in an interview during a visit to the site, SolarReserve took a different tack than other CSP developers. “The key for us is that, from the beginning, we focused on energy storage. It was all about storage.” Some other developers, he said, were drawn to the price disparity between PV and CSP in the mid-2000s, believing that would be enough to make projects economic. “The problem was that when PV prices dropped, all of a sudden CSP was more expensive.”

That’s more or less stopped future CSP projects without storage in their tracks. “We’re unlikely to ever see another direct-steam CSP project ever built,” he said.

The molten salt receiver technology behind Crescent Dunes is, in a real sense, rocket science. It was originally developed in the late 1990s by then-United Technologies Corp. (UTC) subsidiary Pratt & Whitney Rocketdyne for use in space exploration. Though that idea never took flight, the company began looking at commercializing it for power generation in the 2000s.

That was the genesis of SolarReserve, which was formed in 2008 using seed capital from U.S. Renewables Group in partnership with UTC. For three years, SolarReserve worked with Rocketdyne to design a commercial-scale system that could be used as the core of a large CSP plant. It was, Smith said, “a significant challenge.” SolarReserve ultimately acquired all the intellectual property for the design from Rocketdyne in 2014.

Construction on Crescent Dunes began a few miles north of Tonopah in 2011, with on-site employment peaking at just over 1,000 workers. Emerson, Nabtesco, and Delta Products Corp. supplied the array of plant control systems.

Full-power operation was first achieved in the fall of 2015. SolarReserve says the plant is on track to deliver a consistent 500 GWh annually to NV Energy beginning in 2017. Most of the electricity serves demand in the Las Vegas area, by far the state’s largest load center.

Rising Sun

The sight of an operating solar-tower CSP plant is something that is not easily forgotten. At full power, the receiver glows like a miniature sun, so bright with concentrated sunlight that the eye cannot remain on it more than a moment or two (see this issue’s cover photo). Whether Crescent Dunes’ future—and that of CSP-plus-storage generation—is quite so bright remains to be seen. Initial signs, however, are positive.

SolarReserve has an array of new plants in various stages of development that will be less expensive and even more efficient than Crescent Dunes, Smith said. Two near-term examples will move substantially past what the company has achieved in Nevada.

The 100-MW Redstone project in South Africa, which breaks ground this fall and will incorporate 12 hours of storage, should see about a 30% decrease in construction costs from Crescent Dunes, as well as reduced construction times. The 260-MW Copiapó project in Chile, with 14 hours of storage, plans to bid its power at under $70/MWh, without subsidies. That plant, using two solar towers and an additional 150 MW of PV generation, is being designed from the ground up to operate as a 24-hours-a-day baseload facility.

Other projects are in the works in China and Australia, Smith said. “We have an agreement with Shenhua Group, China’s largest coal generator, to build a 10-tower facility, and another agreement with State Grid Corp. to build another 10 towers, though they may not be all on the same site.”

Another 10-tower, approximately 2-GW project in Nye County, Nev., is also on the drawing board, with construction tentatively slated to begin in four or five years. Two sites in Nevada have been identified. The choice of Nevada was no accident. In addition to the abundance of undeveloped land with excellent insolation, the state’s business and political communities have thrown out the welcome mat for future solar plants.

The success of Crescent Dunes has changed the financial posture of these projects, however. While Crescent Dunes needed DOE support, Redstone and Copiapó are 100% commercially financed. Said Smith, “We’ve convinced the financial markets.” ■

—Thomas W. Overton, JD is a POWER associate editor.