Coal-Fired Power Continues Dramatic Decline in Southeast

Once the dominant fuel in the southeastern U.S., coal has been hammered by plummeting gas prices and more efficient gas-fired plants, according to the most recent figures from the Energy Information Administration (EIA).

Though the region has seen a steady increase in gas-fired capacity over the past decade, as recently as 2008, coal still provided the majority of total generation. Most of the rest came from nuclear, with gas providing less than 20%.

But as gas prices began falling in 2008, when large supplies of shale gas began glutting the market. Coal began a dramatic retreat, to the point that gas and coal are now nearly at parity. While coal has rebounded since last year, the overall trend is still downward. According to the EIA, total generation from coal has fallen in every state in the region except Arkansas, in some states more than 50%. Generation from gas has risen in every state, with output at least doubling or nearly so in every state except Louisiana (in part because it already led the region in gas-fired generation)

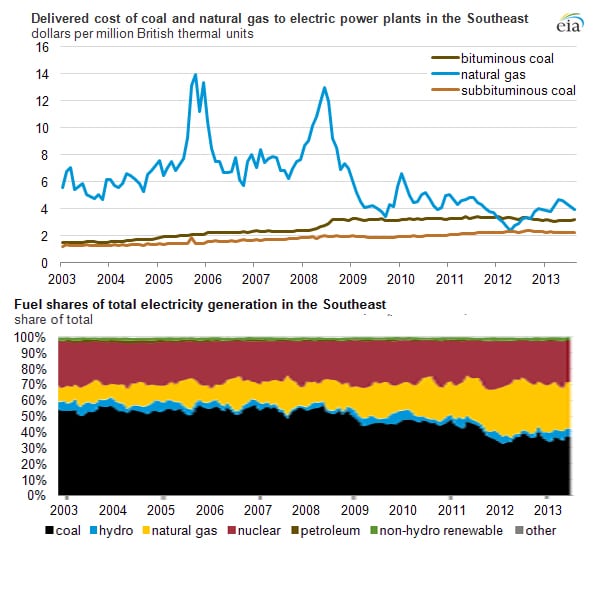

For the southeast, part of the cause is the distance from coal-producing areas. As crude oil price have risen, pulling diesel prices with them, the delivered cost of coal in the region has steadily climbed. Combined with the fall in gas prices, the cost advantage of coal has been largely erased (figure 1).

1. The fall of coal. Since 2008, coal has lost nearly all of its cost advantages over natural gas in the Southeastern U.S. Source: EIA

Though the data are not broken down by state, EIA projects a net loss of 17 GW of coal capacity nationwide between 2012 and 2016, while 31 GW of net gas-fired capacity is added. Duke Power, the region’s largest utility, has retired about 4 GW of coal capacity since 2007, while adding several large gas-fired plants.

—Thomas W. Overton, JD, gas technology editor (@thomas_overton, @POWERmagazine)