Thirty-five percent of the world’s energy comes from oil, and 96% of that oil is used for transportation. The current number of vehicles globally is estimated to be 700 million; that number is expected to double overall by 2030, and to triple in developing countries. Now consider that the U.S. has 27% of the world’s supply of coal yet only 2% of the oil. Coal-to-liquids technologies could bridge the gap between U.S. fuel supply and demand.

During spring and summer 2008, gasoline prices in the U.S. increased at the fastest rate experienced over the past 50-plus years. Retail prices reached over $4.00 per gallon, driving up prices of consumer goods and causing personal financial hardships. The U.S. economy is inextricably dependent on a stable and continuous supply of liquid fuels to power its transportation sector, but the only resource for obtaining liquid fuels in sufficient quantity is crude oil. Unfortunately, crude oil production in the U.S. has declined steadily since the 1970s, while imports have increased. According to the Energy Information Administration (EIA), the U.S. produced about 58% of the petroleum products (crude oil and refined products) that it consumed in 2007. The balance was made up through imports — a disturbing trend that only seems to worsen each year.

Historically, the price of crude oil has risen somewhat predictably while exhibiting short-term capricious spikes. The most recent spike reached a record high of $147.27 a barrel in mid-July 2008. The price then dropped to below $41 on Dec. 5. Spikes are seldom captured in crude oil price forecasts. Revised EIA predictions are that oil prices will sit at $70 a barrel by 2015 and rise to $113 a barrel by 2030. Although these long-term projections may provide some comfort, the somber truth is that sharp price hikes can occur anytime and wreak havoc on America’s economy.

The U.S. has no sustained strategy for dealing with either oil price hikes or reduced oil imports. Since the 1972 oil embargo, America dabbled with the development of alternate sources for liquid fuels, but these efforts were abandoned as soon as oil prices dropped back to comfortable levels. Until electric vehicles (or some other mode of transport) replace the need for liquid fuels in the U.S., a sustained effort is needed to develop alternate resources to produce fuels fungible with the existing liquid fuel distribution and end-use infrastructure. Such resources could act like an insurance policy when crude oil price hikes are encountered.

Manage the Demand

A promising near-term way to control demand is by using hybrid vehicles. Such vehicles combine electric motors with small gasoline engines to achieve higher mileage per gallon of fuel. However, the long-term (over four years) reliability of their critical components is still unknown. Hybrid heavy-duty vehicles, such as long-haul 18-wheel trucks, have yet to be developed.

Another option is fuel cell vehicles (FCVs) that only require hydrogen for their operation. They emit only moisture and none of the greenhouse gases associated with global warming. The challenge is that the supply chain for large amounts of hydrogen is not yet ready. Around 9 million tons of hydrogen are produced today in the petrochemical industry for internal use, but 64 million tons would be needed to power 300 million FCVs — 80% of the projected number of U.S. vehicles in 2040. Technologies for large-scale hydrogen production are still under development, as are those for hydrogen transport, storage, and distribution (although a few demonstration hydrogen refueling stations have been built in California and in Germany).

FCVs face many other challenges before they can be accepted for widespread use. One is increased demand for platinum, a catalyst needed for fuel cells and hydrogen purification, which has only one-thirtieth the availability of gold. Another is unforeseen environmental effects. Although it has been well-documented that FCV use reduces CO2 emissions, no studies have been made regarding the emission of water vapor by millions of FCVs in congested, humid cities throughout the U.S. Possible effects include perpetually damp roads, increased loads on building dehumidifiers, and altered local weather conditions.

Alternative Fuel Sources

Some potential feedstocks for liquid fuel production are oil sands, oil shale, coal, and renewable resources (such as biomass). Because of their availability in the U.S., these resources are attractive for national security reasons. However, using them raises many challenges.

Biofuels. Biomass can be used to produce biodiesel and ethanol. Biodiesel is produced from vegetable oils by esterification. Ethanol is produced from starches and sugars via fermentation or from cellulosic materials by hydrolysis, which has not yet been commercialized. Corn is the currently popular feedstock for producing biofuels; however, its actual costs are blurred by government subsidies and tax breaks provided for corn growers. Thus, the consumer pays twice for biofuels: first through tax dollars and then at the pump.

As biofuel production, driven by attractive subsidies, tripled to 15.9 billion gallons between 2001 and 2007, other unforeseen problems emerged. Excess nitrogen and phosphorus from increased fertilizer use started stimulating excess algae growth in water bodies. Decaying algae uses up dissolved oxygen, killing all marine life when dissolved oxygen levels fall below 2 parts per million. An area known as the "Dead Zone" in the Gulf of Mexico that cannot support marine life is now over 4,500 square miles wide.

Another concern is the inevitable diversion of land and water from food corn production to fuel corn production in response to federal drivers, such as the 2007 Energy Independence and Security Act’s call for 36 billion gallons of ethanol by 2022. The repercussion of this was expressed in March 2008 by the Earth Policy Institute and the CEOs of Cargill and Nestlé, who stated that if biofuels from corn are used to satisfy 20% of the growing demand for liquid fuels, there will be nothing left to eat.

Research is under way to produce biofuels from cellulosic materials, including corn stover and switch and mixed prairie grass, but technologies to do so are not yet ready for commercial deployment. There is also the unanswered question of whether enough land exists to grow sufficient biomass to replace oil. Even if land and water are available, the question of whether those resources should be used to grow fuel crops instead of food crops has to be addressed.

Oil Sands. Oil sands (or tar sands) contain sand, clays, water, and bitumen. Bitumen may be extracted from the sands using specialized separation systems to obtain a substance similar to crude oil. The largest oil sands deposits are in Alberta, Canada, and Venezuela, which together have about one-third of the world’s oil sands resources. In the U.S., oil sands are primarily located in eastern Utah and account for approximately 12 to 20 billion barrels of oil, not all of which is economically recoverable (Figure 1).

1. There’s oil in this chunk. This tar sands specimen was taken from Asphalt Ridge near Vernal, Utah. Courtesy: Argonne National Laboratory

Bitumen extraction may be conducted either in-situ, using underground heating or solvents, or through processing after removal of the oil sands via strip or open pit mining. Steam, produced from natural gas or oil heat, is used to separate oil from sand.

Oil sands are typically located in arid areas where water is scarce, so water procurement costs could be high. Each unit volume of bitumen recovered produces six or more units of wet sand and tailings that must be processed and reclaimed.

The synthetic crude oil derived from oil sands bitumen has a high aromatic content (in comparison to crude oil) and requires special refining techniques. Air emission control technologies are also needed to mitigate sulfur dioxide, nitrogen oxides, hydrogen sulfide, carbon monoxide, volatile organic compounds (VOCs), and particulate emissions during processing. Research is under way to improve production techniques and costs, but further research is needed to improve the commercial attractiveness of deriving fuel from tar sands (Figure 2).

2. Oil strip mining. Large-scale commercial tar sands surface mining is occurring north of Fort McMurray, Alberta, Canada. The shovel bucket holds approximately 100 tons of tar sands ore. The tar sands processing plant is visible in the background. Courtesy: Suncor Energy Inc.

Oil Shale. Oil shale (sedimentary rock that contains kerogen, also known as solid bitumen) is another potential domestic resource that could serve as an alternate source for producing liquid fuels. When these rocks are heated, the kerogen breaks down into petroleum-like liquids that can be refined to produce liquid fuels (Figure 3).

3. Oil from rocks. This fractured oil shale sample was taken in the Uinta Basin, Utah. Courtesy: Argonne National Laboratory

The largest oil shale deposits in the world are found in the U.S. The Green Formation in Colorado, Utah, and Wyoming contains an estimated 1.2 to 1.8 trillion barrels of oil equivalent. Not all resources are recoverable, but even a moderate estimate of 800 billion barrels of recoverable oil from oil shale in these areas exceeds the proven oil reserves in the Kingdom of Saudi Arabia nearly threefold.

The extraction of kerogen is far more complex than processing oil sands, as solid kerogen cannot be pumped directly out of the ground. It must first be mined out as shale rock and then heated to a high temperature (retorting) to produce liquids for refining.

Currently, there are no commercial oil shale extraction facilities in the U.S. But recent prices for crude oil have sparked a renewed interest in extracting oil from oil shale. Shell Oil, for example, is developing an in-situ retorting process known as Thermally Conductive In-Situ Conversion. The process involves underground heating of oil shale until it reaches 650F to 700F, at which point liquid oil is released from the shale and collected in wells positioned within the heated zone. The technical and economic viability of the process has not been proven at commercial scale.

Coal. Coal is a vast fuel resource in the U.S. that can be utilized to enhance national and economic security by decreasing the nation’s dependence on foreign oil. Coal mining in the U.S. is a mature technology, and coal transportation and storage techniques are well established. Furthermore, unlike other energy resources, the location and quantity of U.S. coal reserves are well known and mapped, making exploration unnecessary.

Coal can be converted into liquid fuels that are clean and contain zero sulfur by direct liquefaction (direct) or through conversion into a gas that is then converted to a liquid fuel (indirect). Any unconverted gas from the indirect process can be combusted in a gas turbine to generate electric power. In the event that hydrogen becomes the fuel of the future, a coal-conversion plant can be readily modified to direct the synthesis gas to a water-gas-shift reactor and a hydrogen separation device to produce pure hydrogen.

In the direct conversion process, coal is reacted under high temperature and pressure with hydrogen and a coal-derived solvent to produce a synthetic crude oil. The synthetic crude oil is then refined to produce liquid fuels. Several process concepts have been investigated in the U.S., the UK, and Japan since the 1970s, each based on a different combination of catalyst, temperature, and hydrogen pressure. Eventually, developers settled on a common approach of multistage conversion using dispersed catalysts in the first stage followed by supported catalysts in the subsequent stages. Falling oil prices in the late 1980s and early 1990s, together with stringent environmental regulations, stifled research in this area. By the 1990s, interest in direct conversion of coal to liquids had ceased in the U.S.

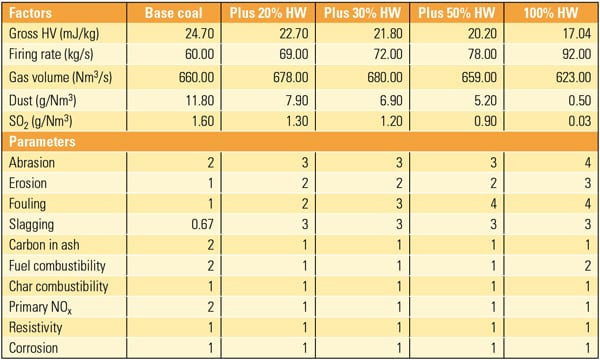

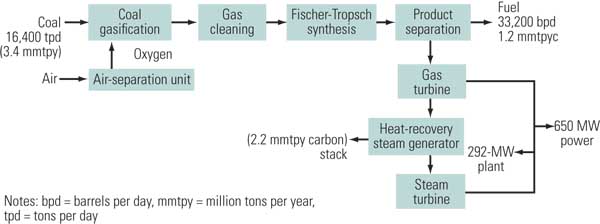

In the indirect conversion method, coal is gasified with oxygen to produce a synthesis gas, which is cleaned and subjected to a Fischer-Tropsch (FT) reaction that converts most of the synthesis gas into a liquid fuel (Figure 4). Indirect conversion technology has been practiced by Sasol in South Africa since the 1950s. In the early 1980s, Sasol built two large facilities (Sasol II and III), which currently produce about 150,000 bpd of liquid fuels. Following improvements in coal gasification technology, Sasol incorporated Lurgi fixed-bed coal gasifiers and the Sasol Advanced Synthesis high-temperature FT reactors during the 1990s. Worldwide, however, no other commercial plants have been built that integrate advanced coal gasification with FT synthesis technologies.

4. Liquid gold. A typical coal-to-liquids process without carbon capture. Source: NETL

Coal-Derived Fuel’s Advantages

Coal-derived liquid fuels are zero-sulfur paraffinic hydrocarbons that are similar to diesel. Because of its paraffinic nature, coal-derived diesel has a very high cetane number (about 75) compared to petroleum diesel (about 45). A high cetane number is necessary for efficient operation in diesel engines. The high paraffin content and low (less than 2% by volume) aromatic content also reduces particulate emissions. A test comparing coal-derived diesel with petroleum diesel on a 6.5-liter diesel engine for tactical vehicle applications showed that hydrocarbon emissions can be reduced by almost 50% compared to petroleum diesel. Carbon monoxide emissions were reduced by 50% and particulates by about 30%. There are issues of lubricity and pour and cloud points for coal-derived diesel, but these can be addressed by using appropriate additives.

Coal is the most abundant fossil fuel resource in the U.S. Recoverable resources — those that can be economically extracted from a coal bed by current mining methods — are 275 billion tons. The demonstrated reserve base, which includes those parts of coal resources that have a reasonable potential for becoming economically recoverable, is much larger and is estimated to contain 491 billion short tons, as of January 2007.

Annual U.S. coal production is nearly 1.15 billion short tons. The EIA projects a steady rise in coal consumption to 1.56 billion short tons by 2030, including 29 million short tons for coal-derived liquid fuels production. Based on these projected rates of consumption, the U.S. has a coal supply that would last a few hundred years. Following the general rule of thumb that 1 ton of coal produces 2 to 2.5 barrels of coal-derived liquid fuels, coal resources in the U.S. are fully able to support several coal-derived liquid fuel plants to help offset the 10 million barrels per day of crude oil imported in 2007.

Synergy with Biomass

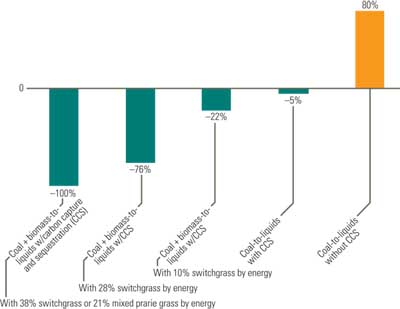

CO2 emissions, on a well-to-wheels basis, during the production of coal-derived liquids without CO2 capture and sequestration (CCS) are about 152% greater than for petroleum-derived fuels. If CCS is included in coal-derived liquids production, the associated CO2 emissions are 2% less than for petroleum-derived fuels.

A potential approach to reducing CO2 emissions is to blend biomass with the coal feedstock. By doing so, the CO2 produced by the biomass fraction during production of the coal-derived fuel offsets the CO2 that was used up by the biomass during its growth phase by photosynthesis. Unfortunately, the logic cannot be extrapolated to a 100% biomass feed because of its low energy density and high moisture content (in comparison with coal) that leads to excessively high production and processing costs.

A recent study showed that by blending 15% to 30% biomass (by weight) with coal, the associated emissions can be 10% to 20% lower than the petroleum-derived fuel baseline. However, if coal and biomass were processed separately to produce a liquid fuel, their combined CO2 emissions are larger, indicating the synergy derived from blending coal with biomass. Three biomass types were selected for study: woody biomass, switchgrass, and corn stover, all of which are relatively abundant and do not directly affect food supplies.

Ready Market

The largest market that is ready to bear the risks of purchasing and using coal-derived liquid fuels is the U.S. Department of Defense (DOD), which currently uses more than 300,000 barrels (on average) of petroleum-derived liquid fuels each day, 74% of which is for jet fuel. The DOD’s reliance on foreign fuel represents a vulnerability that could adversely affect national security should a disruption occur in the crude oil supply chain.

The Air Force has set a goal of supplying 50% of its fuel requirements in the lower 48 states from domestic sources by 2016 (Figure 5). The DOD, through the Defense Advanced Research Projects Agency (DARPA), has been promoting the production and utilization of high-value fuels from domestic coal and oil shale resources. DARPA’s studies have shown that coal-derived liquid fuels can reduce particulate emissions by as much as 78% and 96% for cruising and idling jet operating modes, respectively.

5. Synfuel earns its wings. A C-17 Globemaster III taxis after landing on October 31 at Joint Base Balad, Iraq. In FY-06, the U.S. Air Force (USAF) consumed 2.6 billion gallons of aviation fuel. The USAF Synthetic Fuel Initiative requires the entire fleet to use a 50/50 synthetic fuel blend by early 2011. The C-17 was certified in December 2007. Courtesy: U.S. Air Force

In addition to environmental benefits, coal-derived liquid fuels have a high degree of thermal stability, which provides enhanced system performance for military aircraft. The DOD’s use of coal-derived liquid fuels could build public confidence and facilitate the introduction of such fuels into the private sector vehicle fleet.

To support the DOD’s efforts, Congress approved the Consolidated Security, Disaster Assistance and Continuing Appropriations Act (H.R. 2638) in October 2008. Included in the bill is $60 million to support continued coal-derived liquid fuels testing and certification by the Air Force in fiscal year 2009 and $20 million to support research into CCS for the future production of coal-derived liquid fuels. The bill also supports the Air Force’s commitment to purchase 50% of its aviation fuel in the form of synthetic fuel blends beginning in 2016.

Challenges Remain

The advantages of coal-derived liquids are manifold, but many technical and public perception challenges remain. Here are the myths about coal-derived fuels that must be busted.

Costs Are High. No commercial coal-derived liquid fuels plants have been built in the U.S. Consequently, it is difficult to accurately estimate the costs of producing liquid fuels from coal. The Sasol plants were built at a capital cost of about $6 billion, equating to approximately $40,000 per daily barrel at a production rate of 150,000 bpd, although these costs cannot be directly translated to a comparable plant in the U.S.

The Sasol plants produce a substantial amount of chemical by-products, and in many years, revenue from these by-products has exceeded the revenue from fuel. Inflation and fluctuating currency exchange rates also complicate comparison; the Sasol plants were built in the early 1980s, so the capital cost of $40,000 per daily barrel would be approximately double in 2006 dollars.

In 1993, Bechtel undertook a conceptual baseline design study of a nominal 50,000-bpd bituminous coal-derived liquid fuels plant for the U.S. DOE. In 1993 dollars, Bechtel estimated the capital cost to be $59,500 per daily barrel. Adjusting for inflation to 2004 dollars, this capital cost estimate became about $80,000 per daily barrel. The report was revised in 2007 for a similar-capacity plant in the Illinois coal basin producing commercial-grade diesel and naphtha liquids from medium-sulfur bituminous coal. With the revised design, the total plant cost estimate increased to $4,528 million, or $90,574 per barrel of product per day. This high estimate is due to the significant risks related to building a first-of-a-kind plant, including uncertainties about technical performance, capital and production costs, and environmental performance. As multiple plants are built, it is likely that this capital cost will decrease through design advancements and process improvements.

Pollution Is Increased. Pollutant emissions from coal-to-liquid facilities are expected to be minimal because coal-derived sulfur compounds will be removed and converted into elemental sulfur in the gasification/gas clean-up stage. Because of the sensitivity of the FT catalyst to poisons, all contaminants must be removed to near-zero levels (ppb levels), and this ensures that overall plant emissions would be close to zero. Consequently, coal-derived diesel fuel is virtually sulfur free and exceeds requirements for ultra-low-sulfur diesel and meets or exceeds the most stringent air quality standards in the U.S.: California’s standards.

Waste solids emissions consist of a nonleachable slag from the gasification process. If power generation is included in the plant for improved economics, nitrogen oxide emissions will be minimized using low-NOx burners in the turbines. Selective catalytic reduction and activated carbon injection can be employed in the flue gas stream to remove mercury, additional NOx, and other contaminants. These technologies are commercially available today.

CO2 Emissions Increase. Most of those who argue that CO2 emissions will increase with the use of coal-derived fuels compare the well-to-wheels emission rates: 27 pounds of CO2 emitted per gallon for conventional petroleum-derived fuel versus 50 pounds of CO2 emitted per gallon of a coal-derived liquid fuel. The drawback with the well-to-wheels comparison is that it mixes apples and oranges: CO2 emissions during the production of the liquid fuel (whether from coal or oil) with the CO2 emission figures of the end user, because different people drive different vehicles — and drive them differently. Also, the end user’s CO2 production is a function of vehicle performance chosen for the calculation of the total emissions.

If CO2 emissions from coal-derived liquid plants are captured and sequestered, the overall CO2 emissions would be equal to or less than those from petroleum (Figure 6). For an automobile getting 27 miles per gallon, CO2 emissions when burning gasoline are about 0.8 pound per mile and 2.1 pounds per mile with a coal-derived liquid fuel produced at a plant without CCS. With CCS, however, the same automobile’s emissions would drop to 0.8 pound per mile. There is, however, a legitimate concern regarding the scalability, reliability, and commercial economics of carbon capture and storage technologies as applied to coal-derived liquid fuel plants.

6. Comparing fuels. Estimated change in greenhouse gas emissions if petroleum fuels were to be replaced by one of these alternative fuels. Source: DOE

Large Volumes of Water Are Required. It is often stated that the water requirements for a coal-derived liquid fuel facility are so large that building such plants would deplete precious water supplies, particularly in areas where water is scarce. Though this may be true, most of the water used in the production of coal-derived liquid fuels can be recycled water. There are three major water needs: process water, boiler feedwater, and cooling water. Process water includes water consumed as part of the reactions occurring in the coal gasifier and the FT reactor and water used for scrubbing ammonia and hydrogen chloride from syngas. Though the former is lost, the latter two may be recycled after appropriate treatment.

The amount of water required to operate a coal-derived liquid fuels plant is a function of many variables, including the type of gasifier used to provide the syngas, the design of the FT reactor, coal properties, and the average ambient temperature and humidity. A theoretically derived rule of thumb developed by Bechtel in 1998 is that for each gallon of coal-derived liquid fuel, an eastern coal would require 7.3 gallons of water and a western coal would require 5.0 gallons. Of the total water requirements, only about 1 gallon of water per gallon of coal-derived liquid is consumed in the reaction, indicating that the remainder can be recycled. However, in the absence of real plant data, water consumption estimates could be expected to vary somewhat.

Launching a New Industry

The U.S. has pursued several efforts that were intended to develop a coal-derived liquid fuels plant, but the first plant has yet to be built (Figure 7). In 1995, the U.S. Department of Energy started and operated an Alternative Fuels Development unit in LaPorte, Texas, which has since shut down. This unit demonstrated the production of zero-sulfur coal-derived liquid fuels, dimethylether, and higher alcohols from a simulated coal-derived synthesis gas. Unfortunately, the low price of crude oil while the plant was operational discouraged any business interest in turning this effort into a commercial venture.

7. New fuel sources. U.S. coal-to-liquids projects on the drawing board as of June 2008. Source: NETL

About a dozen announcements have been made by the private sector regarding the construction of coal-derived liquid fuel plants over the past few years, including those from Headwaters and Rentech in 1995 and, most recently, Consol Energy and the Crow Indian Nation in 2008. Unfortunately, the 2005 announcements were stifled by a powerful environmental lobby and the challenge of financing the $4 billion to $5 billion investment. Some entrepreneurs took their expertise and business acumen to China, India, Dubai, and other nations where there is greater financial support for and less environmental opposition to building coal-derived liquid fuel plants. The ironic consequence of this shift is that the U.S. might be importing coal-derived liquid fuels while it sits on the largest reserves of coal. Even worse, the feared emissions of CO2 and other pollutants that prevented construction of these plants in the U.S. could very well be wafting their way to the U.S., thanks to a phenomena known as the Asian Brown Cloud.

Fortunately, growing national concern about unpredictable and rising oil prices and their associated impact on the economy, national security, and global competitiveness recently encouraged new activity in the public and private sectors: the first formal U.S. forum to address issues associated with coal-derived liquid fuels. Another promising response is the recent passage of the Emergency Economic Stabilization Act of 2008 (H.R. 1424) on October 17, 2008, which includes $250 million in tax credits to support the installation of gasification technology, including technologies for producing liquid fuels from coal. The tax package also aims to spur CCS through $1.1 billion in new tax credits.

Overall, converting coal to liquid fuels is one element of an integrated approach that is needed to address fuel security. At least in the near term, it could bring a higher level of stability to world oil prices and to the global economy. Over the long term, it could serve as insurance for the U.S. (or any other oil-importing nation) against artificial or unwarranted price hikes from oil-producing countries.

—A. Dilo Paul, PhD, MBA (anton.d.paul@benham.com) is a senior scientist for The Benham Companies LLC—a wholly owned subdidary of Science Applications International Corp.