The most significant week in transatlantic nuclear cooperation since the 1950s atomic partnership unfolded Sept. 14–24, 2025, as a coordinated surge of commercial agreements—totaling over $100 billion—spanned advanced reactor deployments, advanced nuclear fuel supply chains, nuclear waste management, maritime nuclear applications, engineering services, and regulatory harmonization.

Formalized under the Atlantic Partnership for Advanced Nuclear Energy signed Sept. 15, the announcements seek to align U.S. energy-dominance priorities with the UK’s nuclear ambitions as both countries seek to end reliance on Russian nuclear material and cut reactor licensing timelines from three to four years to roughly two.

The orchestrated wave around U.S. President Donald Trump’s Sept. 16–18 state visit to the UK demonstrates how rapidly the nuclear industry can pivot when regulatory barriers fall and government policies align with private capital. While Trump claimed $350 billion in bilateral deals across all sectors during the visit, the nuclear tranche alone opens the path for both countries to capture surging demand from AI-driven data centers and industrial decarbonization while cementing Western-controlled supply chains for next-generation reactors.

In London, UK Energy Secretary Ed Miliband called it the coordinated wave, the start of “a golden age of nuclear,” saying: “We’re kickstarting a golden age of nuclear in this country, joining forces with the U.S. to turbocharge new nuclear developments and secure the technologies of the future.” U.S. Energy Secretary Chris Wright matched that tone, noting that “today’s commercial deals set up a framework to unleash commercial access in both the U.S. and UK, enhancing global energy security, strengthening U.S. energy dominance, and securing nuclear supply chains across the Atlantic.”

Before the Surge: Life Extensions, Supply Chain Strengthening, and First U.S. Fuel Contract

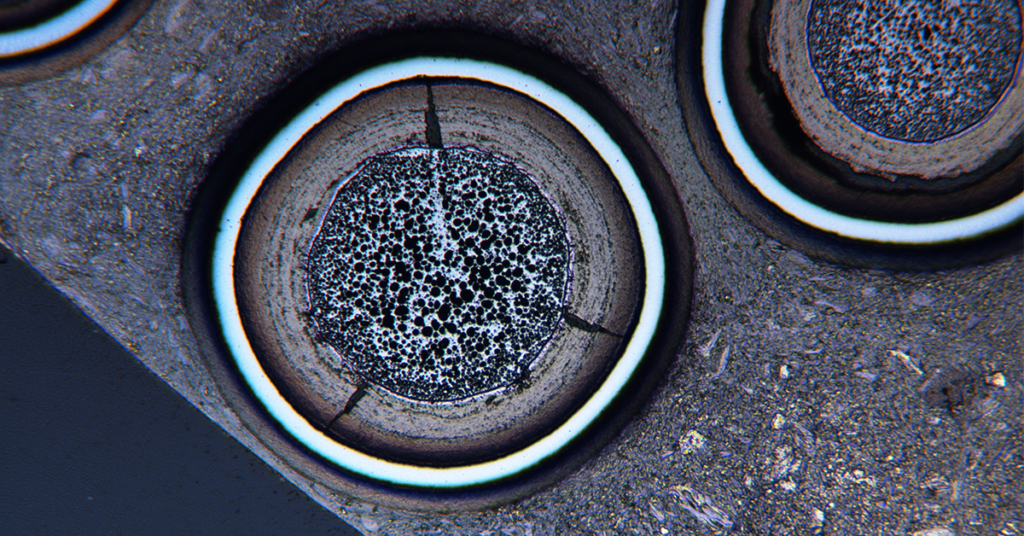

Even before the fortnight of massive nuclear deals kicked off, momentum was building across the Atlantic nuclear partnership. EDF Energy on Sept. 1 announced 12-month life extensions for Heysham 1 and Hartlepool nuclear power stations until March 2028 to add about 3 TWh of generation to reduce imported gas dependence. On Sept. 3, Westinghouse formalized memorandums of understanding with six British suppliers—William Cook Cast Products, Trillium Flow Technology, Curtiss-Wright Controls (UK), Boccard UK, Bendalls Engineering, and Sheffield Forgemasters—to supply key reactor components including valves, pumps, actuators, mechanical electrical piping and instrument modules, pressure vessels, tanks, heat exchangers, and cast and forged steel components for AP1000 and AP300 projects in the UK and internationally. As significantly, U.S. startup Aalo Atomics revealed on Sept. 9 that it had quietly signed in July 2025 the first commercial contract by any U.S. advanced reactor company for enriched uranium delivery from UK-headquartered Urenco.

Centrica/X-energy: Hartlepool AMR Deployment and 6 GW Fleet Ambition

On Sept. 15—a Sunday—UK energy giant Centrica and U.S. advanced reactor developer X-energy announced a Joint Development Agreement to deploy up to 12 Xe-100 Advanced Modular Reactors at the EDF and Centrica Hartlepool site, totaling 960 MW of new capacity. The project would replace the current nuclear station, which is scheduled to retire in 2028, and provide both clean electricity and high-temperature process heat for Teesside’s critical industries. The agreement also sets an ambition for as much as 6 GW of advanced reactors across the UK, marking the largest announced AMR fleet to date.

Beyond headline power figures, the deployment addresses grid reliability and decarbonization needs for industrial loads that cannot depend solely on electrification. The UK Department for Energy Security and Net Zero (DESNZ) previously identified high-temperature gas-cooled reactors as the top advanced nuclear technology for demonstration, and the Xe-100 is designed to serve industrial clusters and regional utilities.

Centrica is set to provide initial project funding. Full-scale activities are targeted to launch in 2026, and first power is planned for the mid-2030s. The Hartlepool site already carries a new nuclear designation under the UK government’s National Policy Statement, supporting a clear regulatory path. Centrica and X-energy are in negotiations with equity partners and top-tier engineering firms to expand deployment across England, Wales, and Scotland.

Holtec, EDF UK Mull SMR-300 at Cottam Site

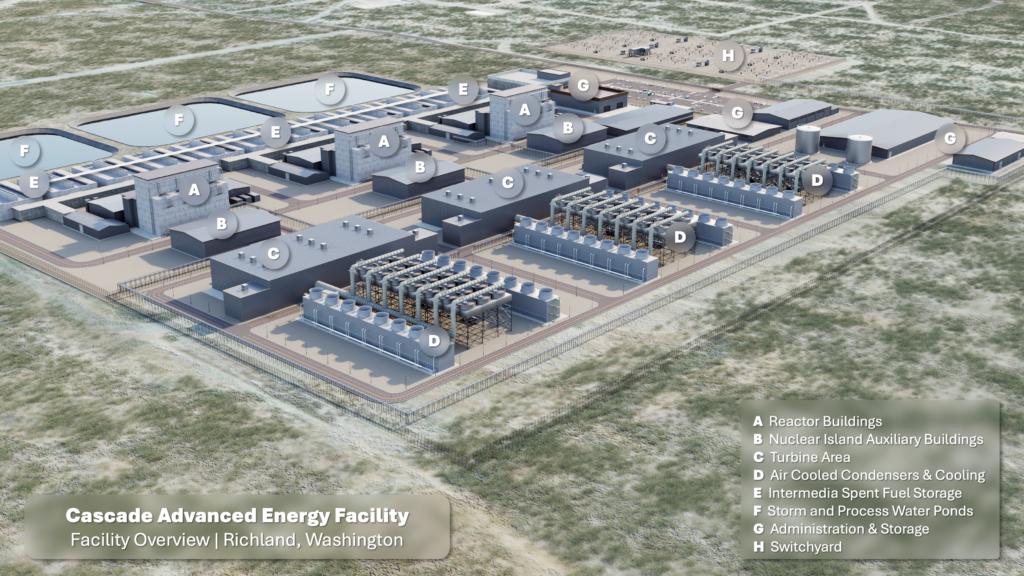

U.S. SMR developer Holtec International, EDF UK, and real estate partner Tritax on Sept. 14 announced an MOU to develop Holtec’s SMR-300 small modular reactors at the former Cottam coal-fired power station in Nottinghamshire. The project will provide clean power to new advanced data centers on the 900-acre site to leverage existing grid connections and infrastructure to reduce development costs and timelines.

The arrangement transforms a historic “Megawatt Valley” site into a clean energy and AI hub, with the 1 GW data center project targeted for this decade and SMRs operational in the early 2030s, the company said. The UK project will benefit from lessons learned to reduce risk and accelerate progress as a second-of-a-kind deployment (following Holtec’s SMR-300 at Palisades, Michigan). Holtec’s Dr. Rick Springman noted the project “represents a potential $15 billion project, creating thousands of local jobs while drawing on the lessons from our Palisades project.”

The project includes foreign direct investment in Framatome’s nuclear fuel fabrication and services and Arabelle Solutions’ turbine manufacture. Great British Energy Nuclear and the National Wealth Fund are conducting feasibility studies and early-stage investment discussions.

Last Energy/DP World: £80M Port-Centric Microreactor at London Gateway

Washington, D.C.-based Last Energy and global logistics leader DP World on Sept. 15 signed a memorandum of understanding to develop the world’s first port-centric micro-nuclear power plant at London Gateway logistics hub, backed by £80 million in subsidy-free private investment. The proposed PWR-20 microreactor will supply 20 MWe of electricity to power DP World’s ongoing £1 billion expansion of the Thames Freeport facility, with surplus exported to the grid and operations targeted for 2030.

London Gateway links cargo to over 130 ports in more than 65 countries and handles more than 50% of the UK’s deep-sea temperature-controlled imports, making it strategically critical for UK trade resilience. The facility’s expansion will add two new all-electric berths and a second rail terminal, positioning it to become the country’s busiest container port within five years.

Last Energy’s PWR-20 design successfully completed a Preliminary Design Review conducted by the UK’s Office for Nuclear Regulation, Environment Agency, and Natural Resources Wales in July 2025—the first nuclear developer to achieve this milestone in the UK. The fully modular microreactor uses proven pressurized water reactor technology designed for flexible siting, plug-and-play installation, and rapid scalability within a 24-month delivery timeline. Last Energy plans to own and operate the power plant on-site, eliminating customer capital requirements while providing long-term power purchase agreements.

TerraPower/ KBR: Natrium Reactor Studies

U.S. advanced nuclear technology company TerraPower and engineering firm KBR agreed on Sept. 14 to cooperate in seeking potential deployment of TerraPower’s Natrium reactor in the UK. The collaboration will involve joint studies and site evaluations for the 345-MW sodium fast reactor with molten salt-based energy storage system, capable of boosting capacity to 500 MW.

KBR President Jay Ibrahim noted: “Expanding our collaboration with TerraPower to the United Kingdom marks a significant milestone in advancing clean, reliable energy solutions globally.” Each Natrium reactor is projected to create 1,600 construction jobs and 250 permanent full-time positions, building on the companies’ preexisting alliance formed in March for deploying Natrium plants across North America, UK, Europe and beyond.

The agreement supports development of UK nuclear construction skills and domestic supply chain capabilities while positioning the UK to participate in future global export opportunities.

Amentum: 3,000 UK Nuclear Jobs and Waste Management

U.S. engineering company Amentum announced Sept. 18 plans to create 3,000 new jobs over four years in UK nuclear power and defense, representing a 50% increase in its UK headcount. The $203 million investment builds on Amentum’s role as lead delivery partner for Hinkley Point C and Sizewell C nuclear power stations and provider of technical solutions for small modular reactors and fusion research.

Separately, Amentum was appointed Sept. 15 as the only company to win positions in all four lots of Nuclear Waste Services’ Integrated Waste Management Specialist Nuclear Services Framework, valued at £26 million over four years. Amentum Energy & Environment President Mark Whitney emphasized the company will “provide critical specialist capabilities and solutions to enable NWS in ensuring safe and secure management of the UK’s radioactive waste.”

Amentum CEO John Heller, who met with Trump and UK Prime Minister Keir Starmer at Chequers, stated: “The energy resilience and national security of both nations depend on continued leadership and advances in energy and technology.”

Rolls-Royce SMR: U.S. Regulatory Engagement

UK SMR developer Rolls-Royce SMR confirmed Sept. 14 that it entered the U.S. regulatory process by submitting an engagement plan to the Nuclear Regulatory Commission (NRC) in April 2025. The move paves the way for potential deployment of the 470 MW SMR design in the U.S. market, leveraging regulatory harmonization provisions in the new UK-U.S. cooperation agreement.

The regulatory engagement follows Rolls-Royce SMR’s selection in June as the chosen technology in Great British Nuclear’s SMR competition, which positions it to build the UK’s next generation of nuclear power stations. The company is 18 months ahead of competitors in European regulatory processes and has progressed to Step 3 of the UK’s Generic Design Assessment. The U.S. engagement enables potential licensing pathway acceleration through shared regulatory reviews, supporting the bilateral goal of reducing licensing timeframes from 3-4 years to approximately two years.

BWXT: $1.5 Billion Defense Fuels Contract

BWX Technologies announced on Sept. 16 a $1.5 billion contract from the U.S. National Nuclear Security Administration to build the Domestic Uranium Enrichment Centrifuge Experiment (DUECE) pilot plant in Tennessee. While primarily focused on U.S. defense needs, the contract supports domestic uranium enrichment capabilities that strengthen Western fuel supply chains amid efforts to eliminate Russian nuclear dependencies by 2028.

The pilot plant will demonstrate low-enriched uranium production for NNSA defense missions before being repurposed for highly enriched uranium for naval propulsion. BWXT President Rex Geveden noted: “Once operational, both facilities will enable us to scale manufacturing, so the United States maintains sovereign capability to produce vital nuclear materials for national security.”

A Big Boost for Regulatory and Policy Collaboration

The Atlantic Partnership for Advanced Nuclear Energy, signed Sept. 15, formalizes a renewed and expanded MOU between the U.S. NRC, the U.K. Office for Nuclear Regulation, and the Environment Agency of England. It builds on a collaboration that dates to 1975.

Under the refreshed agreement made public on Sept. 18, regulators will share technical reviews and mutually recognize each other’s safety assessments, and work to target reactor design approvals within 24 months and site licensing decisions within 12 months by leveraging completed work and avoiding duplication. The regulators will also coordinate fusion energy programs—employing AI-enabled simulation tools—and co-host a Global Fusion Energy Policy Summit in the United States in 2026 to deepen transatlantic cooperation.

The cooperation extends to site licensing workload sharing and fusion energy collaboration through coordinated experimental programmes combining British and American expertise with AI technology for advanced simulation tools. A Global Fusion Energy Policy Summit will be co-hosted in the United States in 2026 to strengthen international cooperation.

Broader Technology Prosperity Deal

The nuclear agreements form part of the broader UK-U.S. Tech Prosperity Deal signed Sept. 18, encompassing $42 billion in UK investments from major U.S. technology companies. The comprehensive agreement covers artificial intelligence, quantum computing, and civil nuclear energy cooperation, with Microsoft leading a $30 billion investment commitment—its largest outside the U.S..

The framework seeks to position both countries to capture AI-driven energy demand while establishing resilient supply chains for critical technologies and advanced nuclear fuels, bypassing hostile actors and improving energy security for both nations and their allies.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).