The Tennessee Valley Authority (TVA) will collaborate with ENTRA1 Energy—NuScale’s exclusive global strategic partner—to develop a 6-GW nuclear portfolio, including six ENTRA1 Energy power plants on TVA sites, the companies announced on Sept. 2.

Under the agreement, ENTRA1 Energy will develop and own nuclear assets across TVA’s seven-state service region, selling electricity to the nation’s largest public power supplier through future power purchase agreements (PPAs). The companies described the collaboration as an “important first step” in advancing next-generation nuclear, noting that ENTRA1’s “immediate strategy” is to deploy NuScale’s small modular reactor (SMR) equipment within its ENTRA1 Energy Plants.

“This collaboration could provide enough energy to power the equivalent of approximately 4.5 million homes or 60 new data centers—at a time when hyperscale data centers, artificial intelligence (AI), semiconductor manufacturing, and other energy-intensive technologies are driving unprecedented growth in electricity demand,” the companies said in a joint statement on Tuesday.

The effort marks the latest bold initiatives spearheaded by TVA, the nation’s largest public power supplier, which is making significant investments in expanding and modernizing its power system, advancing new generation and transmission infrastructure to support the region’s growing energy needs, including efforts to diversify resources and ensure reliability amid surging demand from large load sectors like digital infrastructure and advanced manufacturing.

‘Largest Deployment Program’ in U.S. History

On Tuesday, the companies said the collaborative agreement heralds the “largest deployment program” in U.S. history. A collaborative agreement in the power sector, however, is a business arrangement where two companies work together to develop energy projects by sharing resources, expertise, and responsibilities. It likely means that TVA and ENTRA1 Energy will now jointly identify sites, coordinate development activities, and share planning efforts for the nuclear projects as ENTRA1 handles the financing and construction obligations.

The structure may be designed to shield TVA ratepayers from construction risk while providing long-term price certainty through contracted power sales. It poses a contrast to NuScale’s Carbon Free Power Project in Utah, which was canceled in November 2023 after projected power prices escalated from $58 to $89/MWh, prompting municipal utilities to withdraw from the 462-MW venture. The canceled project has been much cited as an example of financing challenges facing first-of-a-kind nuclear deployment, particularly for smaller utilities without the balance sheet to absorb cost increases.

Houston-based ENTRA1, founded in 2019, serves as NuScale’s exclusive global strategic partner for the commercialization and development of power plants utilizing NuScale Power Modules (NPMs). “ENTRA1 holds the exclusive rights for the worldwide commercialization, distribution, sales, and development of our products, services, and power plants,” NuScale explains in its latest filing, noting that its commercialization strategy relies “heavily” on the partnership pursuant to the amended and restated Strategic Alliance Agreement, which became effective on May 7, 2025. The agreement, notably, also includes non-circumvention provisions that restrict NuScale from pursuing certain opportunities independently.

“The ENTRA1 team brings deep experience in investing in, developing, and executing power infrastructure. Our focus is on deploying best-in-class American technologies in the nuclear SMR and natural gas-fired power sectors—and that is what we are doing in the immediate term via our partnership with NuScale SMRs,” said Skip Alvarado, ENTRA1 Energy chief projects officer, on Tuesday. “We’re investing in the next generation of power solutions to meet the country’s growing energy demands.”

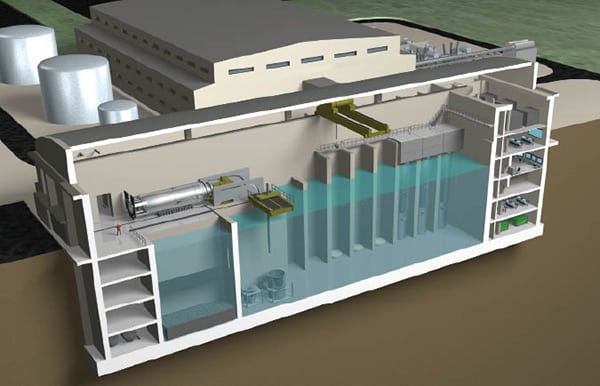

A major step in the TVA–ENTRA1 Energy effort will be to secure relevant U.S. Nuclear Regulatory Commission (NRC) approvals. While NuScale remains the first and only SMR technology with a certified design (its 50-MWe US600 model approved in 2022), the NRC in May 2025 also granted a Standard Design Approval for NuScale’s uprated 77-MWe US460 module, which can be configured in six-packs for 462 MWe per plant. However, that approval does not eliminate the need for site-specific licensing, construction, and operating permits. TVA, which already holds an early site permit at its Clinch River site in Tennessee, will likely leverage that regulatory groundwork as it evaluates potential sites across its seven-state region.

The TVA and ENTRA1 Energy on Tuesday said they will now begin “identifying opportunities to work with other federal agencies and explore potential sites with new nuclear generation and joint gas-fired capabilities.”

How the TVA-ENTRA1 Deal Compares to Recent AnnouncementsWhile POWER has reached out about the scope and timeline related to the new TVA-Entra1 collaborative agreement, the collaboration clearly leads a pack of recent unprecedented ambitions to scale up nuclear deployment in the U.S. Many have been led by tech giants. Amazon’s Current Leader at 5+ GW. As perhaps the largest commitment to date, Amazon last year set out to build more than 5 GW of new nuclear capacity by 2040. In October 2024, it said it would back the deployment of 5 GW of new X-energy SMR projects by 2039, starting with an initial four-unit 320-MWe Xe-100 plant with regional utility Energy Northwest in central Washington. Amazon has also partnered with Dominion Energy to explore SMR development near Virginia’s North Anna nuclear station, targeting at least 300 MW of additional capacity. But the company’s strategy spans multiple avenues. This June, it finalized an $18 billion 17-year PPA with Talen Energy to buy up to 1,920 MW of carbon-free electricity from the 2.5-GW Susquehanna nuclear plant. Microsoft’s Three Mile Island Revival. Microsoft, prominently, in September 2024 secured an agreement to restart Constellation’s Three Mile Island Unit 1 reactor (Crane Energy Center) in Pennsylvania. Under a 20-year power purchase agreement beginning in 2028, Microsoft will take 100% of the plant’s 837 MW output exclusively for its data centers, representing a $1.6 billion investment. Google Pursuing Multi-Faceted Nuclear Strategy. Outside of a 500-MW PPA agreement with Kairos Power for multiple advanced reactors, potentially by 2035, Google has committed early-stage development capital for three nuclear projects (a combined 1.8 GW) with Elementl Power. Google is also partnering with Commonwealth Fusion Systems for 200 MW of fusion power from a plant in Virginia. Meta’s Investment in Existing Nuclear. Meta secured a 20-year agreement with Constellation Energy to extend the life of the 1,121 MW Clinton Clean Energy Center in Illinois, beginning in 2027. The deal includes a 30 MW plant uprate and potential development of advanced reactors or SMRs at the site. Meta has also launched a request for proposals targeting 1-4 GW of new nuclear generation for delivery in the early 2030s. Oracle’s 1-GW Project. In September 2024, Oracle founder Larry Ellison announced plans for a gigawatt-scale data center powered by three SMRs, suggesting building permits were already secured. However, specific timelines and partnerships remain undisclosed, and progress for that project has been murky. |

TVA’s Nuclear Ambitions: From SMRs to Fusion

TVA operates three existing nuclear sites—Browns Ferry (three units, 3.8 GW), Sequoyah (two units, 2.3 GW), and Watts Bar (two units, 2.3 GW). The utility also maintains 29 hydroelectric dams and multiple thermal generation sites, including 17 natural gas-fired power plants. These sites include Allen (Tennessee), Ackerman and Caledonia (Mississippi), Brownsville, Colbert, Gallatin, Gleason, John Sevier, Johnsonville, and Lagoon Creek (Tennessee), Kingston (Tennessee), Kemper and Magnolia (Mississippi), Marshall County (Alabama), Paradise (Kentucky), and Southaven (Mississippi). TVA is also building new combustion turbine and combined cycle facilities are under construction at Cumberland (Tennessee) and Kingston (Tennessee).

The utility launched its New Nuclear Program in February 2022 and has since boosted that funding to a combined $350 million to explore advanced reactor deployment through fiscal year 2026. “We have been working harder than anyone else in the utility industry to support nuclear development in America,” a TVA spokesperson told POWER on Tuesday. “TVA stands at the forefront of America’s advancements in nuclear energy—and its bold partnerships and national leadership continue to power the nation’s nuclear renaissance. As the enterprise builds the next generation of nuclear power to ensure energy reliability and security, it also celebrates the groundbreaking collaborations and federal recognition of FY 2025.”

This summer, the utility submitted a historic construction permit application to the NRC for a GE Vernova Hitachi BWRX-300 small modular reactor at its Clinch River Nuclear Site. If built, the Clinch River unit—dubbed CRN-1—will serve as a flagship for U.S. commercial deployment of the BWRX-300. Work could begin on non-nuclear site preparation as early as 2026 and achieve commercial operation by 2032. A TVA spokesperson told POWER it expects an NRC review decision by year-end 2026.

TVA is notably leading a coalition of industry partners in pursuing $800 million from the Department of Energy’s Gen III+ grant program to develop the BWRX-300 design SMR at Clinch River. The utility has also trailblazed—in the U.S. at least—an innovative integrated project delivery approach for its Clinch River SMR project alongside strategic partners, which include Bechtel, Sargent & Lundy, and GE Hitachi.

Meanwhile, as POWER reported in detail in August, TVA became the first U.S. utility to sign a PPA for Generation IV nuclear power through a three-way deal with Google and Kairos Power for a 50-MWe molten salt reactor scheduled to begin operations in 2030 at Hermes 2 in Oak Ridge, Tennessee. The project will directly support Google’s rapidly growing data centers in Montgomery County, Tennessee, and Jackson County, Alabama.

TVA is also expanding into fusion technology. In July, it signed its first set of commercial contracts with fusion company Type One Energy for “Project Infinity,” an ambitious effort to develop and deploy a 350-MW fusion power plant in the Tennessee Valley by the mid-2030s.

“TVA is leading the nation in pursuing new nuclear technologies, and no utility in the U.S. is working harder or faster than TVA,” said Don Moul, TVA president and CEO, on Tuesday. “This agreement with ENTRA1 Energy highlights the vital role public-private partnerships play in advancing next-generation nuclear technologies that are essential to providing energy security—reliable, abundant American energy—and creating jobs and investment across the nation.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).