investment

-

Renewables

Energea Launches Latin America Solar Portfolio With $100-Million Investment

Global renewable energy developer and operator Energea said it has launched its LATAM Energy Portfolio, the company’s fourth and latest active investment strategy. The group on February 25 said it will invest in distributed solar power projects across South America, Central America, and the Caribbean.

-

Trends

How Utilities Can Prepare for the AI-Driven Energy Surge

After more than two decades of relative stasis, electricity demand in the U.S. is expected to increase by 25% by 2030 and by more than 75% by 2050, compared to 2023—a transformation largely driven by the surge in new data centers needed to power the artificial intelligence (AI) boom.

-

Data Centers

Data Center Developer, Major Investment Group Plan Gigawatts of New Capacity

A data center development company led by former executives with Amazon Web Services (AWS) has joined with a leading investment group to launch a platform for hyperscale data centers in North America.

-

Gas

Entergy Arkansas Adding New Gas-Fired Power, Extending Nuclear as Part of Investment Plan

Entergy Arkansas, the utility that provides electricity to about 735,000 customers in 63 counties in that state, announced a plan to add about 2.6 GW of new power generation capacity, in part by converting old coal-fired units to burn natural gas. It also is renewing the operating license for the 1.8-GW Arkansas Nuclear One power plant, the state’s only nuclear power station, with plans to invest in new equipment that would increase the facility’s output.

-

Trends

Advanced Nuclear Developers Raise New Capital as 2025 Investment Hits Record Levels and Demonstrations Near

Three advanced nuclear developers—Radiant, Last Energy, and ARC Clean Technology—announced the closing of major private funding rounds in mid-December 2025, signaling renewed investor momentum behind microreactors and small modular reactors (SMRs) as the companies move from design and licensing into pilot deployment and early commercialization. The announcements—which span a new $300-million-plus round at Radiant, an […]

-

Hydrogen

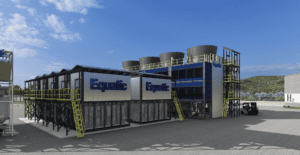

Carbon Removal Company Closes on Major Investment

A California-based carbon removal company said it has completed a funding round in support of the company’s first 100-kilotonne carbon dioxide removal (CDR) commercial facility. Equatic, which is considered a pioneering company in combined carbon dioxide removal and green hydrogen production, on August 11 announced the successful closure of its Series A round, with Catalytic […]

-

Commentary

Buyer Beware: Deeper Pockets Funding Deeply Speculative Power Sector Expansion

As billions of dollars flood into the historically niche electricity sector, U.S. power generation is having a moment and entering what may be its most consequential investment cycle in decades. The U.S. power space saw record levels of capital investments in 2024. These billions in new investments are coming not just from legacy participants, but […]

-

Commentary

Private Equity Reprioritizes for a New Energy Landscape

The advent of President Trump’s second term has heralded significant changes for the U.S. energy industry, and savvy private equity investors are adapting. Six months down the road, the reprioritization of investment opportunities by such savvy private equity investors has delineated some clear—and familiar—near-term winners. Two of the top five private equity investment trends in […]

-

Commentary

Funding the Power Surge: Navigating the Trillion-Dollar Investment in the U.S. Power Sector

The U.S. power sector stands at a juncture, facing a confluence of factors that are poised to trigger an era of unprecedented growth and necessitate a large influx of capital. Driven by the increasing demand from data centers, the reshoring of manufacturing, and electrification across transportation, heating, and industry, the demand for electricity is rising at a pace unseen in recent decades.

-

Legal & Regulatory

Private Equity Weighs Focus as Government Policies Shift

As the new administration begins implementing its energy policy agenda, the market is keenly anticipating the impact on private equity sponsors’ energy transition investments. President Trump has signaled

-

T&D

PG&E, Citizens Energy Program Will Fund Grid Investments, Benefit Ratepayers

California-based Pacific Gas and Electric Company (PG&E) and nonprofit charitable organization Citizens Energy Corp. are partnering on a proposed investment program that expects to provide more than $450 million to help PG&E customers in low- and moderate-income households pay their energy bills. Submitted to the California Public Utilities Commission (CPUC) late last month, the updated […]

-

T&D

$2.2B for 13 GW of New Transmission Capacity: DOE Unveils Latest Boost for U.S. Grid Modernization

The Biden administration will invest $2.2 billion in eight projects under its Grid Resilience and Innovation Partnership (GRIP) program to bolster the nation’s power grid with nearly 13 GW of new transmission capacity across 18 states. The funding, announced on Aug. 6, marks the second round under the Department of Energy’s (DOE’s) GRIP program, a […]

-

Trends

2024 Shaping Up to Be Dramatic for Transmission and Distribution

In a significant push toward modernizing America’s aging grid infrastructure, the Biden administration, in partnership with 21 states, has launched the Federal-State Modern Grid Deployment Initiative. The measure marks the latest triumph for transmission and distribution (T&D), which has seen “lumpy” progress in recent decades. The initiative unveiled on May 28 essentially seeks to establish […]

-

Renewables

Global Utility Alliance Calls for Tripling Renewable Energy Capacity

A group that represents utility companies worldwide said its members want to nearly triple their renewable energy generation capacity by 2030. The Utilities for Net Zero Alliance (UNEZA), which was formed at last year’s COP28 climate summit in Dubai in the United Arab Emirates (UAE), said the group collectively wants to increase its green energy […]

-

Commentary

What Does the Nuclear Industry Need to Do to Scale Production Toward Net-Zero Goals?

The United Nations Climate Change Conference (COP28) proved to be a historic moment for nuclear energy, with more than 20 countries including the U.S., France, Japan, and the UK pledging to triple global

-

News and Notes

UK Nuclear Recap: Major Funding for GEH’s SMR and Sizewell C as Hinkley Point C Suffers New Hefty Delays

Over the past week, the UK government stepped up its nuclear agenda, doling out a £33.6 million grant under its Future Nuclear Enabling Fund to support GE Hitachi Nuclear Energy (GEH)’s BWRX-300 while also announcing a substantial £1.3 billion investment in the proposed 3.2-GW Sizewell C nuclear project. The developments, aimed at potentially tripling the […]

-

Nuclear

Bipartisan Support Makes Backing Nuclear Power an Administration-Proof Investment

Maria Korsnick, president and CEO of the Nuclear Energy Institute (NEI), the policy organization of the nuclear technologies industry, suggested a bipartisan majority in Congress recognizes the importance of nuclear energy and has supported the industry with unprecedented levels of funding. As an example, Korsnick pointed to the Bipartisan Infrastructure Law, which provided a $6 […]

-

Fiction

Marnie Surfaceblow: Bowing Under Pressure

Just because something hasn’t failed doesn’t mean it won’t—especially when an “old dog” of a plant is taught new tricks. Two women wearing personal protective equipment waited impatiently in the

-

Legal & Regulatory

Empty Space—Navigating the Void of Pore Space Regulation in Texas

The Inflation Reduction Act (IRA) has spurred investment in carbon capture and sequestration (CCS), a key tool for decarbonization, by significantly increasing the tax credit for permanently sequestering carbon dioxide. However, many states lack comprehensive laws necessary for CCS projects to attract investment. That includes Texas, a global energy capital that boasts high storage potential. Regulatory […]

-

Commentary

Transmission for Transition: Solving the South African Energy Crisis Through Logistics

South Africa is in the midst of an energy crisis characterized by electricity shortages, blackouts, and lack of new infrastructure investment. Eskom, the state-owned utility supplying more than 90% of the nation’s electricity, has suffered from operational failures, maintenance issues, and breakdowns at aging, poorly maintained power stations, leading to steady declines in the energy […]

-

Business

Brownfield Sites Spur Opportunity in the Power Grid

Over the past few years, climate change coupled with the Biden administration’s push for clean energy alternatives has spurred innovation in the power grid. One growing trend among developers, planners and forward-looking utilities centers on repurposing former brownfields and superfund sites into facilities that produce renewable energy alternatives such as wind and solar energy. The […]

-

Trends

10 Near-Term Global Power Sector Trends

While 2021 provided its own share of extraordinary energy debacles, Russia’s invasion of Ukraine in early 2022 cascaded into full-blown energy turmoil. This year will begin with the world “in the midst of

-

Renewables

Investment Bank ‘Mobilizing’ up to $115 Billion for Renewables, Energy Storage and More in EU

The European Investment Bank Group (EIB Group) said it will support an initial investment of €30 billion ($30.2 billion) in loans and equity financing to move the European Union (EU) away from fossil fuels and toward cleaner forms of energy over the next five years. The EIB board of directors on Oct. 26 said a […]

-

Press Releases

Worsening energy crisis is a major opportunity for investors

The global energy crisis will continue to deepen and should act as an alarm call now about the decent long-term future rewards in sustainable investments, says the CEO of a leading global financial giant. The analysis from Nigel Green, CEO and founder of deVere Group, one of the world’s largest independent financial advisory, asset management and […]

-

Press Releases

Galway Sustainable Capital Provides Inovateus Solar a Strategic Capital Investment

SOUTH BEND, Ind. (Feb. 18, 2022) — Inovateus Solar, a privately held solar project developer and Engineering, Procurement & Construction (EPC) firm for commercial, municipal, and utility scale solar power projects, has announced a material investment by Galway Sustainable Capital (Galway). Galway’s investment will enhance Inovateus’ development resources, construction capabilities and project financing capacity. This […]

-

International

Disorderly Transitions: Eight Enduring Global Power Sector Trends

While 2021 unfolded with some relief from the chaotic global pandemic that jolted the world in 2020, the year may be remembered for its extraordinary series of energy crises. After a cold snap prompted mass

-

Press Releases

Capital Infusion Will Accelerate REsurety’s Information and Risk Management Toolkits for Clean Energy Industry

BOSTON, Mass. (Oct. 27, 2021) – A $16 million capital infusion will fuel the growing breadth of REsurety’s market intelligence, asset insight and risk management tools for clean energy sellers, buyers, investors and advisors. Climate solutions investment firm Hannon Armstrong (NYSE: HASI) provided a majority of the Series B raise, joining existing investors including Launch […]

-

International

Why UK Businesses Should Invest in New Machinery and Plant Equipment Now

After more than 12 months of unprecedented working conditions and extremely tough challenges for power companies, the most sensible route for businesses in the coming year seems, on the face of it, to be to consolidate and let things settle whilst the economy stabilises. However, economic predictions for the next year tell us that savvy […]

-

Business

Money Makes the Power and Energy Sectors Go ‘Round

If you’ve seen the musical “Cabaret,” you know that “money makes the world go ‘round” in a variety of ways. While it may not indeed make the power and energy sectors “go ‘round,” money does

-

News

Japan Pulls Back from Coal, Though New Plants Move Forward

Japanese financial institutions and energy companies continue to move away from supporting coal-fired power generation, as the country’s leadership reiterates what it says is an “unwavering resolve to