competitive markets

-

History

NRG Energy’s Pivot Amid Power Sector Change

Once a giant pure-play independent power producer, NRG Energy has cultivated a legacy of pioneering business models to withstand waves of change in the power sector. Its latest strategic shift pivots from

-

Trends

ERCOT, MISO Warn of Potential Power Supply Shortfalls

(Updated—May 6, 2022) The Electric Reliability Council of Texas (ERCOT) and the Midcontinent Independent System Operator (MISO) over the past week separately expressed concerns about power supply uncertainties in the face of upcoming warmer-than-normal temperatures. MISO raised an alarm on April 28 when it said that it projects “insufficient firm resources” to cover the summer […]

-

Renewables

Competition Is More Important Than Ever to Tackle Today’s Energy Challenges

As we commemorate another Earth Day this April, the challenges facing our energy systems and the environment seem more pressing than ever. Americans face continued economic uncertainty following the COVID-19

-

Markets

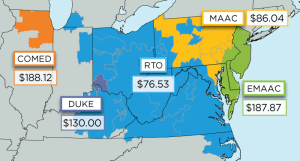

Market Transitions: The MOPR Merry-Go-Round

The PJM Interconnection’s Minimum Offer Price Rule (MOPR) was introduced in 2006 as a floor to bar new generators from artificially depressing capacity auction clearing prices through below-cost bids.

-

Markets

Competition, Not Outdated Monopoly Models, Key to Meeting Tomorrow’s Challenges

The past year and a half has been, to put it mildly, a weird time. Americans have grappled with the COVID-19 crisis, as well as with the associated economic fallout that revealed cracks in a number of our nation’s workforce and social systems. But recent years have also exposed the significant flaws in parts of […]

-

Commentary

Competitive Markets and Environmental Goals—Yes, They Can Coexist

While the nation is rightfully consumed with responding to the COVID-19 crisis, other battles are being fought that also will have decades-long consequences. One of those involves states seeking to override

-

Markets

Gas-Heavy ISO-New England Braces for Steep Influx of Wind, Solar, Storage

While it is currently highly dependent on natural gas generation today, about 95% of ISO-New England’s (ISO-NE’s) interconnection request queue—a proposed total capacity of 20.9 GW—comprises wind, solar, and battery projects. That clearly indicates that developers in New England’s wholesale market “are looking to take advantage of state incentives, declining technology costs, and revenues from […]

-

Markets

The Significance of FERC’s Recent PJM MOPR Order Explained

A divided Federal Energy Regulatory Commission (FERC) issued a long-awaited order on Dec. 19 in which it directed PJM Interconnection to dramatically expand its Minimum Offer Price Rule (MOPR) to nearly all state-subsidized capacity resources. The order will have a significant impact on PJM’s capacity market. While it was no surprise that the decision immediately […]

-

Coal

More Losses for FirstEnergy; FES Seeks Policy Support Amid Bankruptcy

Despite significant milestones to become a fully regulated utility, FirstEnergy Corp. on October 25 reported third-quarter losses of $512 million on revenue of $3.1 billion. The results largely reflect charges related to the court-approved settlement in the bankruptcy cases of its competitive subsidiaries FirstEnergy Solutions (FES) and FirstEnergy Nuclear Operating Co. (FENOC), the company said. […]

-

Renewables

NRG Renews Emphasis on Retail with PPA-Free Renewables Service

NRG Energy, which recently shed a substantial portion of its competitive generation portfolio and has shifted efforts to stimulate growth of its retail business, unveiled a simplified renewables procurement process that does not require a power purchase agreement (PPA). The company on October 18 launched “Renewable Select,” a plan that it says transforms the “lengthy […]

-

Legal & Regulatory

Can Coal and Nuclear Power Plants Be Saved?

It’s no secret that U.S. nuclear and coal-fired power plants are struggling to remain viable in competitive markets. Many plants have been retired for economic reasons long before the facilities reached the

-

Commentary

Searching for Relief from the Headaches Facing the Merchant Power Sector

Unlike their regulated counterparts, merchant power generators have increasingly struggled to compete over the last few years and the outlook for many is that this won’t change any time soon. While regulated power companies often enjoy near monopolies in their respective markets, merchant power companies build out their power generating capacity on a speculative basis […]

-

Legal & Regulatory

FERC Nixes PJM’s Fixes for Capacity Market Besieged by Subsidized Resources

In a 3–2 decision, the Federal Energy Regulatory Commission (FERC) rejected approaches filed by PJM Interconnection to reform its capacity market, whose integrity and effectiveness has been increasingly and “untenably threatened” by state subsidies for preferred generation resources, the federal regulatory body acknowledged. The June 29 order sharply divided the commission, prompting Democrat Commissioners Cheryl LaFleur […]

-

Renewables

Six Glaring Interventions in Competitive Markets — Beyond the Trump Plan

The Trump administration’s attempt to prop up uneconomic “fuel secure” generators in competitive markets is just the latest in a string of recent “extra-market” interventions that experts said imperil independent organized markets for electricity. In a recent white paper, Raymond Gifford and Matthew Larson, energy partners at Wilkinson Barker Knauer LLP, said the restructured administrative […]

-

Renewables

NRG Sells Renewables Assets, 3.6 GW of Louisiana Coal and Gas Power Plants

NRG Energy, in a bid to shed $7 billion in consolidated debt, is selling the bulk of its renewable assets and development platforms along with several coal and natural gas power plants worth 3.6 GW tied to its South Central Generating business. The independent power producer, which recently relinquished bankrupt wholesale generator GenOn Energy to […]

-

Coal

Dynegy Will Merge with Vistra Energy to Beat Market Volatility

To strengthen balance sheets and thwart market woes afflicting generators in competitive markets, Dynegy Inc. and Vistra Energy will merge, creating a company that is projected to have a value greater than $20 billion. Dynegy, which operates a power plant fleet of 27 GW, will merge into Vistra Energy, the parent company of TXU Energy […]

-

Coal

Vistra Closing Two More Giant Uneconomic Coal Plants in Texas

Vistra Energy moved to halt a financial hemorrhage stemming from unprofitable conditions in the Electric Reliability Council of Texas (ERCOT), announcing plans to shutter two more coal-fired power plants—the 1.1-GW Sandow Power Plant (which includes a 2009-built unit) and the 1.2-GW Big Brown plant—in early 2018. The company’s decision made public on October 13 comes on […]

-

Renewables

Monticello Goes Under, More Coal and Nuclear Imperiled in Texas (Updated)

A week after the Department of Energy (DOE) proposed a rule to bolster uneconomic coal and nuclear generators in competitive power markets, Luminant announced that an “unprecedented low power price environment” will force it to retire a 1.9-GW coal-fired power plant operating in the Texas market. The plant’s economic woes suggest a larger swath of […]

-

Legal & Regulatory

[UPDATED] DOE to FERC: Force Competitive Markets to Value Coal and Nuclear Resiliency, Reliability Attributes

A rule proposed by the U.S. Department of Energy (DOE) on September 29 directs the Federal Energy Regulatory Commission (FERC) to mandate that competitive power markets develop and implement market rules to “accurately price” what it calls “fuel-secure” generation. The DOE’s “Grid Resiliency Pricing Rule” directs FERC—an independent regulatory government agency that is officially organized as […]

-

Renewables

PJM Auction Signals Trouble for Nuclear, Coal, and Even Renewables

Two nuclear plants owned by Exelon Corp. in Illinois and Pennsylvania failed to clear PJM Interconnection’s latest annual capacity auction, putting one of those financially crippled units at risk of early retirement. Meanwhile, procurements for solar, wind, and demand response fell dramatically compared to last year, and drastic price declines could roil the market for […]

-

Coal

AEP Sells Competitive Natural Gas, Coal Power Plants

American Electric Power (AEP) has sold four competitive natural gas and coal power plants‚ a total of 5.2 GW, and plans to invest the proceeds from the sale in its regulated business. AEP completed the sale of the plants to Lightstone Generation LLC, a joint venture of Blackstone and an affiliate of ArcLight Capital Partners […]