Over nearly five decades, nuclear waste has been treated as an intractable problem, locked in dry casks, relegated to repositories that are slow to materialize, and generally viewed as a costly liability rather than a resource. But, backed by a new policy push that explicitly endorses nuclear recycling for the first time since the Carter administration, several American companies are pushing for a rethink of the nation’s stagnant backend fuel strategy. All are advancing commercial-scale recycling concepts that they say could recover valuable fissile material, cut the volume and heat load of waste, and supply next-generation reactors.

“The general definition of recycling is the action or process of converting waste into reusable material,” noted Steven Nesbit, founder of LMNT Consulting and former president of the American Nuclear Society, at the organization’s annual conference in June. “And then we’ve got the nuclear definition of recycling—separating the materials in used fuel, that is, the process of reprocessing, and making beneficial use of some of the products there, some of those materials.”

The concept is not new. In the U.S., its origins date back to the 1940s, staked in the Manhattan Project, which sought to obtain separated plutonium for nuclear weapons, Nesbit reminded attendees. “It succeeded in that goal and was deployed extensively after that by the U.S. and other nuclear weapons states, again for that purpose—accumulating weapons-grade plutonium for potential use in weapons. Fortunately, there hasn’t been any,” he noted.

|

|

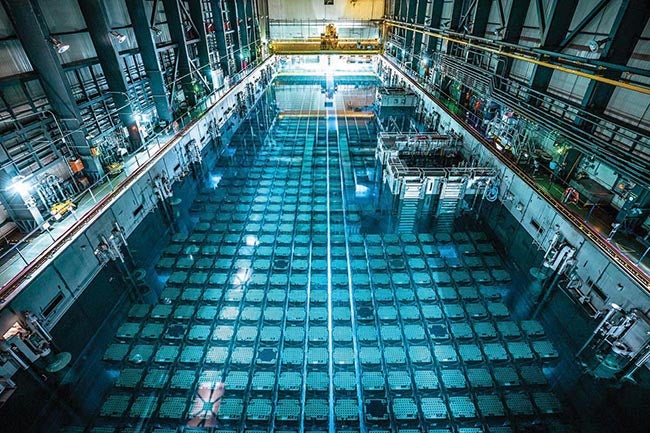

1. Orano’s La Hague plant in Normandy, France, processes 1,600 metric tons of used nuclear fuel annually, recovering uranium and plutonium for reuse—mainly in mixed oxide (MOX) fuel—while vitrifying the remaining high-level waste for long-term storage. Since opening in 1966, the 300-hectare facility has treated more than 34,000 metric tons of fuel and remains a global benchmark for recycling technology. Courtesy: Orano |

From the outset, the fundamental chemistry of nuclear separation has demonstrated its capability to recover usable materials from civilian reactor fuel. France and the UK, which pursued reprocessing as a cornerstone of fuel security and waste management, have notably advanced the plutonium–uranium redox extraction process (known as PUREX). The UK’s Sellafield facility processed more than 55,000 tons during its 58-year operation before closing in 2022. Today, France’s La Hague plant (Figure 1), owned by Orano, processes more than 1,600 metric tons of spent fuel annually, reprocessing plutonium and uranium for reuse in mixed oxide (MOX) fuel. “We’ve recycled over 40,000 metric tons overall at La Hague, which is less than half of the amount we have stored here in the U.S.,” noted Sven Bader, a technical consultant and nuclear expert from Orano.

In the U.S., efforts focused on military imperatives during the Cold War, notably to extract plutonium for weapons. The Armed Forces’ reactors at Hanford and Savannah River relied on PUREX technology. In the 1960s, the U.S. launched its only commercial reprocessing effort at West Valley, New York, which processed 640 metric tons of spent fuel between 1966 and 1972. While two other commercial facilities were built, they were never operated. General Electric’s Morris facility in Illinois was completed in the early 1970s (at a cost of $64 million) but was declared inoperable after testing revealed fundamental design flaws.

Meanwhile, Allied-General Nuclear Services began construction of the massive Barnwell facility in South Carolina in 1970, designed to process 1,500 metric tons annually, potentially making it one of the world’s largest reprocessing plants. By 1976, the plant was essentially complete and awaiting regulatory approval to begin operation.

In 1977, however, the Carter administration moved to “defer indefinitely the commercial reprocessing and recycling of plutonium produced in the U.S. nuclear power programs,” citing proliferation concerns in the wake of India’s 1974 test using plutonium from civilian reactors. While President Ronald Reagan lifted the ban in 1981, the 1982 Nuclear Waste Policy Act “kind of made it foolish from an economic perspective, for a reactor operator who was already paying the U.S. government for disposal of fuel to pay for recycling as well,” Nesbit noted.

In the following decades, spent nuclear fuel management has remained a largely unresolved challenge. Today, about 90,000 metric tons are safely stored in dry casks at more than 70 reactor sites nationwide, and while this reflects significant advances in safe interim storage practices, it also underscores decades of regulatory, political, and economic gridlock.

That might be slated to change. The Trump administration’s May 2025 executive orders direct the Department of Energy to establish government-owned, contractor-operated recycling facilities in a bid to jumpstart domestic capabilities and establish a secure supply chain for high-assay low-enriched uranium (HALEU). At the same time, the Nuclear Regulatory Commission (NRC) is engaging directly with industry on licensing pathways. And, technically, the demand for recycled materials has begun to more solidly align with the growing need from advanced reactors for fuels containing 20% U-235—HALEU—and that can utilize transuranics, including plutonium and minor actinides.

“Some advanced reactors are more amenable to using recycled material,” Nesbitt explained. Fast-spectrum designs, for example, can burn actinides to reduce long-lived waste and extend resource utilization. However, existing stockpiles, which contain only about 1% residual U-235, are insufficient for such applications, Nesbitt noted.

Strategically, the bid for reprocessing is bolstered by growing supply chain vulnerabilities, which underscore Russia’s role as the world’s sole commercial producer of HALEU. Meanwhile, repository capacity remains an open question. As Dr. Kenneth Marsden, technical director for the Material Recovery and Waste Form Development Campaign at Idaho National Laboratory (INL) stressed, reprocessing “reduces the volume of material, reduces the heat load of the material going to the repository, which extends the life of the repository.” Financially, the stakes are clear. As he noted, the Nuclear Waste Fund “is sitting at around $850 to $1,100 a kilogram,” yet under a once-through fuel cycle, “we’re paying for disposal of all of that material, and we’re not getting any value back from the fissile content that’s in there.”

Still, for now, spent nuclear fuel recycling faces significant technological and economic hurdles. Marsden said recycling may only become cost-effective when spent fuel contains roughly 7%–8% residual U-235 enrichment. “You could debate whether it’s five, maybe it’s 10, but it’s certainly not 0.7 or 1—it’s probably an order of magnitude higher,” he noted, adding that at that level, recovering and reusing the enrichment can pay for the process on its own. While INL is advancing both pyroprocessing for metallic fuels and advanced aqueous methods, Marsden stressed the need for infrastructure to “preserve and expand on capabilities through the recovery of high-value materials that do exist today.” The efforts, he said, could provide test beds for new technologies and prepare mid-career personnel for industry deployment, using government-owned materials like discharged research reactor fuel that are “economically viable to do and are probably a government liability as they stand.”

That groundwork is being matched by a new wave of companies, each taking a distinct approach to fuel recovery but all positioning themselves for market entry in the early 2030s.

|

|

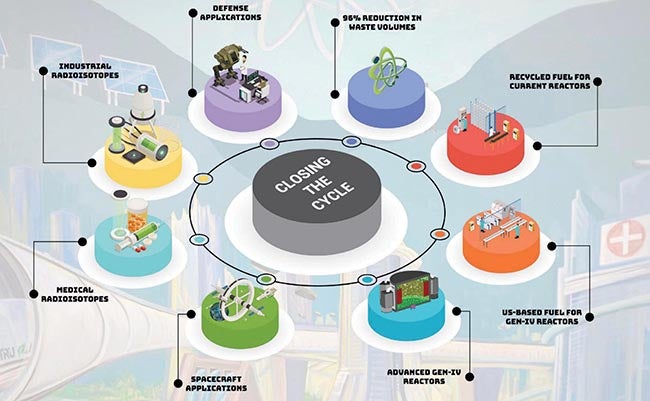

2. Curio is developing NuCycle, a used nuclear fuel recycling process designed to reduce high-level waste volumes by 96%. The system produces recycled fuel for existing and next-generation reactors, along with isotopes for medical, industrial, and other applications, as part of its approach to a closed nuclear fuel cycle. Courtesy: Curio |

Curio’s NuCycle. Perhaps the most ambitious of the new entrants is Curio, founded in 2020, whose business model is centered on building a single commercial facility by the mid-2030s, underpinned by a complete circular-economy model (Figure 2) that recasts nuclear waste as a portfolio of resources. “In the case of uranium, let’s say if we do end up doing that, 4,000 metric tons a year at a commercial scale, we’re generating 3,800 metric tons of about 0.9 weight percent uranium,” said Curio Chief Innovation Officer Vik Singh. “Compare that [to] Canada’s approximately 10 million pounds a year of U3O8. This would be roughly the same. That’s a lot of uranium.”

NuCycle integrates “oxidative declaring, selective fluoride volatility, and exhaustive electrolysis” into a single system, designed to maximize product revenue while minimizing waste, Singh noted. The recovered uranium offers “a swoop discount of approximately 25%,” and proliferation safeguards are embedded from the outset. “We’ve embedded [materials control and accounting] from the earliest stages. We’re working with Sandia National Laboratory right now to use real, real-world data from our laboratory-scale experiments to guide safeguards-by-design philosophy that works for our process and that does not compromise the economic viability,” he said.

Oklo: Recycling with Reactors. Oklo’s strategy is to vertically integrate fast reactor deployment with co-located fuel recycling, eliminating transport costs and regulatory complexity, said Dr. Christina Leggett, Oklo director of Fuel Cycle Technology. “We believe that by doing that, by this vertically integrated approach, we can have savings of up to 80% on fuel costs,” she said. Ideally, she added, “a fuel fabrication facility would be co-located, so it would definitely be recycling. And we believe that this enables an economical, vertically integrated front-end fuel source.” The company’s recycling process uses pyroprocessing adapted from INL. “It is a high-temperature process that uses electrochemical separations in molten salts to recover actinides,” she explained. The approach targets both existing light-water reactor fuel and Oklo’s advanced reactor fuel, she added.

SHINE: Isotope Recovery to Reactor Recycling. SHINE is adapting its medical isotope production expertise to nuclear fuel recycling. “Recycling is kind of our tip of the spear right now,” said Ross Radel, SHINE’s chief technology officer. “The common threads through that really revolve around neutron utilization technologies, and radiochemistry is really core to what we do.” The company says it is focusing on recovering high-value isotopes alongside traditional fuel materials. Radel pointed to strontium-90 as an example. “There has been a lot of interest in that isotope and other heat-generating isotopes in particular, which is really a win-win—they can be used to heat batteries and support missions.” SHINE plans a 100-metric-ton-per-year pilot facility by the mid-2030s, using aqueous co-extraction processes that keep uranium and plutonium mixed to address proliferation concerns.

Orano: Eyeing an Expansion to the U.S. As the world’s largest commercial reprocessing operator, Orano could bring decades of operational experience to potential U.S. projects, Bader said. However, “These are not small endeavors,” he said. For a 1,600-metric-ton facility, he said, the operation demands about 4,000 full-time employees, another 1,000 contractors, and spans 750 acres. Orano’s PUREX process, which has been proven at industrial scale for decades, could be adapted in partnership with domestic entities. “If you take what we’ve done at La Hague, you can save years of engineering and construction time,” he said, adding that siting, licensing, and public engagement in the U.S. could be “as big a challenge as the technical side.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).