Nuclear costs aren’t on the rise globally as has been widely thought, says a new report from the International Energy Agency (IEA) and Nuclear Energy Agency (NEA) surveying the levelized cost of generating electricity (LCOE).

The eighth edition of the report, “Projected Costs of Generating Electricity” compiles data for 181 plants in 19 OECD and 3 non-OECD countries, calculating LCOE based on an average lifetime cost approach. The analysis is performed using three discount rates: 3%, 7%, and 10%.

Plants surveyed include 17 natural gas plants (13 combined cycle gas turbines and four simple cycle gas turbines), 14 coal plants, 11 nuclear plants, 38 solar photovoltaic plants, 12 solar thermal plants, 21 onshore wind farms, 12 offshore wind farms, 28 hydro plants, 6 geothermal plants, 11 biomass and biogas plants, and 19 combined heat and power plants.

Nuclear Is Still Cheap

Among its findings is that at a 3% discount rate, nuclear is the lowest cost option for all countries. Nuclear technologies in OECD countries spanned a low of $29/MWh in South Korea to a high of $64/MWh in the UK.

“However, consistent with the fact that nuclear technologies are capital intensive relative to natural gas or coal, the cost of nuclear rises relatively quickly as the discount rate is raised,” the report notes. At a 10% discount rate, the range, for example, is pushed up to $51/MWh in South Korea and $136/MWh in the UK.

“As a result, at a 7% discount rate the median value of nuclear is close to the median value for coal, and at a 10% discount rate the median value for nuclear is higher than that of either [combined cycle gas turbine (CCGT)] or coal. These results include a carbon cost of USD 30/tonne, as well as regional variations in assumed fuel costs.”

The report suggests that at a 7% rate, LCOEs for coal plants range from $76/MWh in Germany to $107/MWh in Japan. Comparatively, at a 7% rate, CCGT LCOEs range from $66/MWh in the U.S. to $138/MWh in Japan.

Meanwhile, LCOEs in China for nuclear plants at a 7% discount rate ranged between $37 and $48/MWh; for coal, they were $78/MWh; and for CCGT, they were $93/MWh.

Renewables Still Much More Costly Than Baseload Technologies

Compared to a 2010 study, the report includes more technologies that are low- or zero-carbon sources, suggesting a “clear shift in the interest of participating countries away from fossil-based technologies,” the agencies said.

However, they also noted that the ranges in costs are “significantly larger” than for baseload technologies.

LCOE for residential solar PV at a 7% discount rate ranges from $132/MWh in Portugal to $293/MWh in France. For commercial PV at 7%, they range from $98/MWh in Austria) to $190/MWh in Belgium.

At a 7% discount rate, meanwhile, onshore wind LCOEs range from $43/MWh in the U.S. to $182/MWh in Japan. For offshore, costs range from $136/MW in Denmark to $275/MWh in South Korea.

The report also demonstrates that the cost of renewables, especially solar photovoltaic, has fallen significantly over the last five years, and that “these technologies are no longer cost outliers.”

A Tricky Comparison

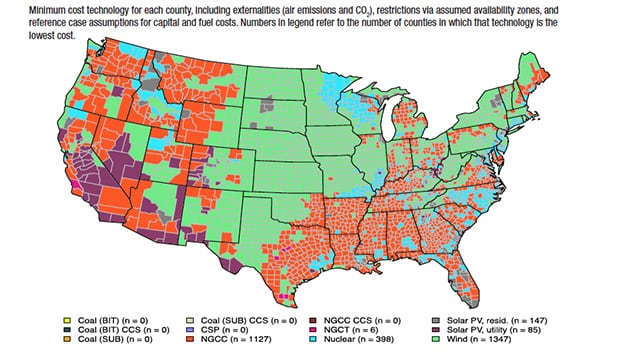

Yet, it also concludes that the cost driver of the different generating technologies remains both market- and technology-specific. “As such there is no single technology that can be said to be the cheapest under all circumstances,” it concludes. “As this edition of the study makes clear, market structure, policy environment, and resource endowment all continue to play an important role in determining the final levelized cost of any investment.”

Interpreting the results was tricky, the agencies admitted, noting that doing so required taking account of significant variations among countries in terms of technologies presented and the reported costs. It also pointed out that some assumptions have a degree of uncertainty.

Fuel costs, for example, are ever changing. The report points out that fuel prices saw big declines globally, and that values assumed for the report were fixed before those declines and “therefore may be high relative to expectations at the time of publication.”

—Sonal Patel, associate editor (@POWERmagazine, @sonalcpatel)