The Nuclear Regulatory Commission (NRC) has accepted for review initial portions of a combined license application (COLA) from Dallas-based Fermi America to build and operate four Westinghouse AP1000 reactors in Carson County, Texas. The proposed project—which will be called the “President Donald J. Trump Advanced Energy and Intelligence Campus” (also known as Project Matador)—is slated to anchor what the developer calls a next-gen “HyperGrid,” an 11-GW hybrid energy and data infrastructure hub adjacent to the Department of Energy’s (DOE’s) Pantex Plant, the nation’s primary nuclear weapons assembly and disassembly facility.

Fermi plans to integrate four Westinghouse AP1000 reactors with what the company describes as the “nation’s biggest combined-cycle gas plant,” along with solar generation, battery storage, and utility grid ties to support up to 18 million square feet of artificial intelligence (AI) capacity. The company says it will deliver 1 GW of non-nuclear generation by the end of 2026 and has signaled its intent to begin nuclear construction next year, but NRC filings show the agency may receive site-specific environmental and safety data after late 2026. For now, Fermi has publicly targeted putting its first AP1000 online in 2032, though the timeframe will hinge on licensing, financing, and construction execution.

NRC staff on Sept. 5 formally accepted Parts 1 and 2 of Fermi COLA for review—making the submissions the first new large light-water reactor (LWR) application to clear that threshold in more than 15 years, since the wave of filings during the 2007–2009 “nuclear renaissance.” Fermi submitted Part 1 of its Part 52, Subpart C COLA for the proposed Fermi Units 1–4 on June 17, which contains general, financial, and environmental information. It submitted Part 2 on Aug. 20, comprising non-site-specific technical chapters of the Final Safety Analysis Report (FSAR), and it plans to provide site-specific portions as part of its phased submission strategy.

Project Matador: A Hybrid Nuclear-Energy and Data Ambition in the Texas Panhandle

Fermi America—a company founded by former U.S. Energy Secretary Rick Perry alongside private equity investor and Fermi America’s CEO Toby Neugebauer—first unveiled the mega-project on June 26 as it announced a partnership with Texas Tech University System.

The 5,800-acre campus in the Texas Panhandle, for which Fermi holds a 99-year lease with Texas Tech University, is “strategically situated at the confluence of several of the nation’s largest gas pipelines and located atop one of the nation’s largest known natural gas fields, the site offers a prolific, firm, clean-burning and redundant gas supply,” the company said. “Leveraging the campus’s proximity to Pantex, the nation’s primary nuclear facility that has successfully stewarded the U.S. nuclear arsenal since 1951, underscores Fermi’s strategic position to build clean, safe, new nuclear power for America’s next-generation AI. The site also boasts some of the nation’s fastest premier fiber infrastructure and prime solar resources.”

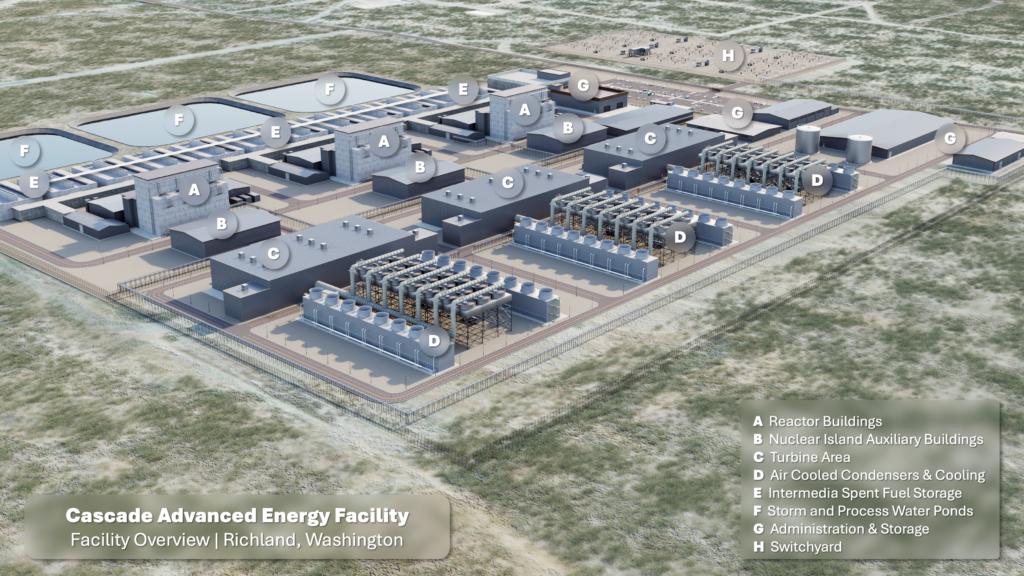

Filings show that the company plans to operate as a vertically-integrated developer overseeing licensing, construction, and full lifecycle management of nuclear, gas, and renewable assets, with additional digital and cooling infrastructure designed for hyperscale AI tenants and confidential government workloads. The model will rely on behind-the-meter (BTM) energy provisions to its hyperscale tenants, it said. The campus will also deploy “advanced cooling technology,” including air-cooled condensers, a “turnkey” digital and energy platform development for “defense-aligned and AI-intensive data center operations,” and full lifecycle nuclear facility management, from licensing to decommissioning. For now, the company says it plans to finance Project Matador through a mix of institutional equity, project-level special purpose entities for each energy asset, asset-backed debt, long-term take-or-pay leases with hyperscaler tenants, a real estate investment trust (REIT) structure for the real estate component, and federal/state incentives, including DOE loan guarantees and clean energy tax credits.

Fermi envisions that its core revenue model, notably, will be “underpinned by long-term hyperscaler lease commitments with AI data center tenants. These leases include take-or-pay provisions tied to service-level guarantees for power, cooling, security, and uptime,” it notes. In addition, each “energy-generating component”—nuclear, natural gas, solar, and battery—will be “structured within project-level [special purpose entities] to allow for discrete financing, ring-fenced risk, and optimized accounting,” it adds. “These entities may be consolidated or unconsolidated depending on Fermi America’s controlling interest and contractual arrangements.”

Perry, who served as the head of the DOE during the first Trump administration, has suggested the campus is necessary to compete with international efforts as the race for AI and digital infrastructure gains a whirlwind pace. “The Chinese are building 22 nuclear reactors today to power the future of AI,” he noted. “America has none. We’re behind, and it’s all hands on deck. President Trump’s first Executive Order addressed the energy issue and emphasized the need to continue making America energy dominant. His recent decisive action to sign four additional Executive Orders that pave the way for a nuclear power energy renaissance demands that American innovators rise to the occasion.”

1 GW Expected Online by the End of 2026. 11 GW in Total—Including 4.4 GW of new Nuclear

Project Matador’ nuclear portion will ultimately comprise four Westinghouse AP1000 pressurized water reactors (PWRs), each rated at about 1.1 GWe for a combined 4.4 GWe, though Fermi America indicates it may stage the build, beginning with two units before expanding to four. Fermi’s application references Revision 19 of the AP1000 Design Control Document (DCD), which will allow it to leverage an already certified Gen III+ design rather than introducing a new concept.

According to NRC-accepted schedules, construction of the first AP1000 (Unit 1) could begin in the second quarter of 2027, with fuel loading anticipated in the latter half of 2032 and commercial operations before the end of 2032. Additional units will be staged thereafter, with site-specific schedules for Units 2, 3, and 4 marked “to be provided later.”

Fermi’s NRC filings suggest its approach is informed by the challenges that plagued Vogtle 3 and 4 in Georgia—the only AP1000s built in the U.S—which were completed in 2023 and 2024 after years of delay and billions in overruns tied to design changes, nuclear-grade documentation burdens, and supply chain bottlenecks. Significantly, to avoid similar setbacks, the company plans to implement an “innovative, forward-thinking, deployment model that leverages the existing AP1000 design and NRC regulatory structure, while avoiding unnecessary overconservatisms that have caused the nuclear industry to be unsuccessful.” Fermi says it began engaging early with NRC staff to identify potential hurdles upfront and set more realistic review schedules.

As an important part of the strategy, Fermi has also proposed a “graded separation” of nuclear and non-nuclear systems within the AP1000 plant that will keep all certified nuclear safety systems under full NRC-grade controls while allowing non-safety systems—like those that will serve the data centers and behind-the-meter distribution—to be designed, procured, and operated to commercial-grade standards. The company argues the approach will cut costs, simplify procurement, trim documentation, and streamline operations and maintenance. NRC workshops are planned to define system boundaries and oversight responsibilities, it says.

In parallel, the NRC on Sept. 8 signaled it is willing to test new regulatory processes with the project. As part of a pilot program under the National Environmental Policy Act (NEPA), the agency will work with Fermi on an applicant-prepared environmental review document—an approach designed to to streamline analysis and avoid delays. Site-specific information to support that review is slated for submission throughout 2026.

Rapid Partnership Development and Financial Backing

Alongside licensing efforts, Fermi has also begun executing major equipment procurements and securing crucial partnerships. On July 2, the company announced two strategic agreements to secure more than 600 MW of gas-fired generation equipment to support the first phase of the HyperGrid campus, a move that it said was essential to delivering its goal of 1 GW of power by 2026. The package includes six Siemens SGT800 gas turbines, six heat recovery steam generators (HRSGs), and one SST600 steam turbine (an ISO-rated 478-MW combined cycle set, estimated at 400-plus MW at site elevation), which it bought from from Firebird LNG in conjunction with Siemens Energy.

In tandem, Fermi acquired three secondary-market GE Frame 6B gas turbines and a paired GE steam turbine formerly used at a New Jersey industrial site. After refurbishment, the company plans to run the 6Bs gas turbines initially in simple cycle for ~135 MW (ISO), and then add new HRSGs to convert to combined cycle at >200 MW (ISO)—about 180 MW at Amarillo’s elevation—with a full-load HHV heat rate in the low-8,000 BTU/kWh range. Fermi says the behind-the-meter units—which will be equipped with selective catalytic reduction and carbon monoxide catalysts—will provide highly reliable tenant power while sharply cutting criteria pollutants. Notably, it suggests, the gas fleet’s CO₂ intensity will be more than 30% lower than typical marginal grid supply.

Just four weeks later, the company cemented a formal partnership with South Korea’s Hyundai Engineering & Construction to plan and deliver the nuclear segment of Project Matador. Fermi cited the company’s track record, which has delivered 18 reactors in South Korea—all Korean-standard APR reactors—as well as four APR1400 reactors at Barakah Nuclear Power Plant in the UAE. Signed in Seoul, the non-binding memorandum of understanding (MOU) sets terms for feasibility studies, basic design, and eventual engineering, procurement, and construction (EPC) execution. “With Hyundai E&C on board, Fermi America plans to begin construction on the nuclear power complex next year and aims to have the first reactor operational by 2032,” Fermi said.

Other major vendor and other EPC relationships have also been since formalized. On Aug. 21, it agreed with Westinghouse Electric Co. to finalize the COLA for the four AP1000 units and execute a joint deployment strategy for the nuclear portion of Project Matador, whereby Westinghouse will provide technical support on licensing and design integration. On Aug. 26, it contracted engineering and architecture firm Parkhill, and Lee Lewis Construction, a construction manager/contractor. And on Aug. 26, it signed an MOU with Doosan Enerbility—a global supplier of major reactor components—to guarantee long-lead nuclear equipment delivery. The agreement covers cooperation on large-scale reactor components and potential future work in small modular reactors (SMRs).

Fermi has also made public that it recruited Mesut Uzman (as chief nuclear officer) and Sezin Uzman (as vice president for Supply Chain and Compliance)—a husband-and-wife leadership team with direct, end-to-end delivery experience on 16 new-build AP1000 and other advanced reactors in the UAE and China, including the Barakah project.

On the fuel front, Fermi on Aug. 15 signed an MOU with ASP Isotopes and its subsidiary Quantum Leap Energy to explore developing a high-assay low-enriched uranium (HALEU) enrichment facility at its Carson County campus. While the four planned AP1000 units will run on conventional fuel, Fermi said adding HALEU capability could position the site as both a clean energy generator and a strategic nuclear fuel hub, aligning with DOE projections that U.S. HALEU demand could exceed 50 metric tons annually by 2035. The proposed plant would use laser-based isotope separation to produce HALEU, a fuel needed for many Gen IV and SMR designs, with the goal of reducing reliance on Russian enrichment and securing Western supply chains.

And, on the financing front, Fermi America on Aug. 29 closed a $100 million Series C preferred equity round led by Macquarie Group and set up a $250 million senior loan facility (with $100 million drawn at close) to fund long-lead supply chain purchases, team build-out, and phase-one construction of the Amarillo HyperGrid campus. The deal is advised by Cantor, Newmark, and Donovan & Co. with legal counsel from Haynes Boone, Latham & Watkins, and Vinson & Elkins. On Monday, Sept. 8, the company filed a Form S-11 registration statement with the U.S. Securities and Exchange Commission (SEC) for a proposed IPO of its common stock, seeking to list on the Nasdaq Global Select Market under the ticker FRMI; UBS, Cantor, and Mizuho were named joint lead book-runners, with Macquarie Capital, Stifel, and Truist Securities also on the syndicate.

A Rare NRC Filing, and a Long Road Ahead

The NRC’s acceptance of Fermi’s COLA marks a significant evolution for the U.S. nuclear industry, which today relies on a fleet of 93 LWRs largely built between the 1960s and 1990s. So far, only two GenIII+ reactors have been built over the past decade—Vogtle Units 3 and 4—and construction of those reactors began in the mid-2000s, following the NRC design certification rule (DCR) for the AP1000 design in January 2006.

Notably, however, the NRC has not received a COLA for a large LWR in more than 15 years. The last COLA, came from Florida Light and Power for two AP1000 units for Turkey Point 7 and 8, submitted in June 2009. The COLA capped a surge of more than a dozen applications between 2007 and 2009, though most of those filings—covering AP1000, ESBWR, ABWR, and U.S. EPR designs—have been either withdrawn, suspended, or terminated. Only Vogtle Units 3 and 4 AP1000 units in Georgia, which submitted a COLA in March 2008, ultimately entered service in 2023 and 2024. Today, four licensees still hold six unbuilt COLs: DTE’s Fermi 3, Duke Energy’s William States Lee 1 and 2, Dominion’s North Anna 3, and FPL’s Turkey Point 6 and 7.

In April and May 2025, the Tennessee Valley Authority (TVA) submitted a two-part construction permit application to the NRC for a GE Hitachi BWRX-300 small modular reactor (SMR) at its federally owned Clinch River site in Oak Ridge, Tennessee. In contrast to Fermi America’s Part 52 combined license application for large LWRs, TVA is pursuing approval under 10 CFR Part 50, the traditional two-step licensing framework, which will incorporate its 2019 early site permit (ESP). The NRC docketed both parts of the application in July 2025 and has set a target to issue an FSER by Dec. 14, 2026, contingent on TVA’s provision of additional technical information later in 2025. If built, the 300-MWe “CRN-1” unit will be the first new U.S. boiling water reactor since Watts Bar Unit 2 entered service in 2016.

So far, the NRC has also issued ESPs—which lock in approval of a site for up to 20 years independent of a reactor design—for six sites: Clinton, Grand Gulf, North Anna, Vogtle, PSEG, and TVA’s Clinch River. ESPs address site safety, environmental protection, and emergency planning issues ahead of construction decisions, providing developers with more regulatory certainty in siting before committing to a full license application.

Between December 2023 and November 2024, the NRC also issued three notable construction permits for advanced test reactors: Kairos Power’s Hermes 1 non-power fluoride-salt–cooled high-temperature reactor (KP-FHR) in Oak Ridge on Dec. 14, 2023; Abilene Christian University’s Molten Salt Research Reactor (MSRR) in Abilene on Sept. 16, 2024—the first NRC-approved research reactor project in decades and the first U.S. construction permit for a molten-salt–fueled reactor; and Kairos Power’s Hermes 2 test facility on Nov. 21, 2024, which authorized two 35-MWt non-power units to support KP-FHR commercialization. Earlier this summer, TVA, Google, and Kairos announced the first-of-its-kind PPA for Hermes 2’s redesigned, 50-MWe KP-X commercial demo targeted for 2030. Kairos noted the construction permit covers the original low-power configuration but does not require a substantive amendment for the planned changes.

And beyond TVA, the NRC is concurrently reviewing multiple advanced-reactor construction permit applications. It docketed TerraPower’s Natrium project at Kemmerer, Wyoming—a sodium fast reactor with molten-salt energy storage— in 2024 under Part 50. NRC’s public schedule targets completion of the environmental and safety reviews by December 2025. In Texas, the NRC accepted Long Mott Energy’s four-module X-energy Xe-100 (HTGR, 320 MWe total) on May 12, and the federal regulator has issued a review schedule targeting an Environmental Assessment/FONSI by mid-2026 and an FSER by November 2026.

For now, Fermi’s Amarillo project faces a long regulatory path. NRC staff isn’t expected to issue a hearing notice until Fermi files Part 3 of its COLA, which includes site-specific environmental and safety data. The schedule calls for an applicant-prepared draft environmental impact statement in February 2026, followed by site characterization data in October and December 2026. Beyond licensing, experts note, the project—like all mega-projects serving high-demand digital infrastructure—will need to navigate financing, construction execution, and supply chain challenges, as well as demonstrate sustained demand from hyperscale tenants.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).