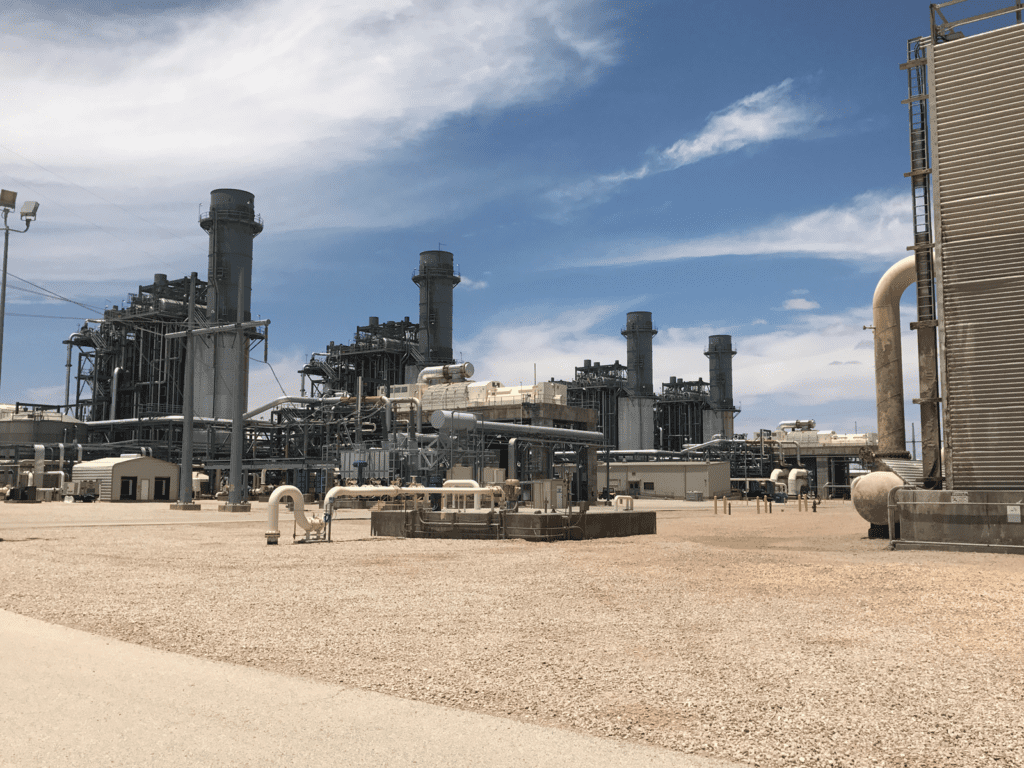

LandBridge Co., a Permian-focused land and infrastructure firm with 277,000 surface acres in the Delaware sub-region in Texas, and NRG Energy, one of the U.S.’s largest independent power producers, have inked a strategic agreement for a potential 1,100 MW natural gas–fired generation facility in Reeves County, Texas, to power a hyperscale data center.

The agreement, announced on Sept. 23, identifies a LandBridge-owned site in the Delaware Basin, adjacent to the Waha natural gas hub, where NRG could construct a large-scale, grid-connected power plant tailored to support a hyperscale data center. While no final investment decision has been made, the filing of air permit applications and interconnection requests signals an early step toward development, contingent on securing a long-term power purchase agreement (PPA).

If the project advances, commercial operation could begin by year-end 2029, aligning with the Electric Reliability Council of Texas (ERCOT)’s growing demand from data centers and other large loads. ERCOT has seen a surge in large-load interconnection requests this year, mainly driven by hyperscale data center expansions and emerging AI compute clusters.

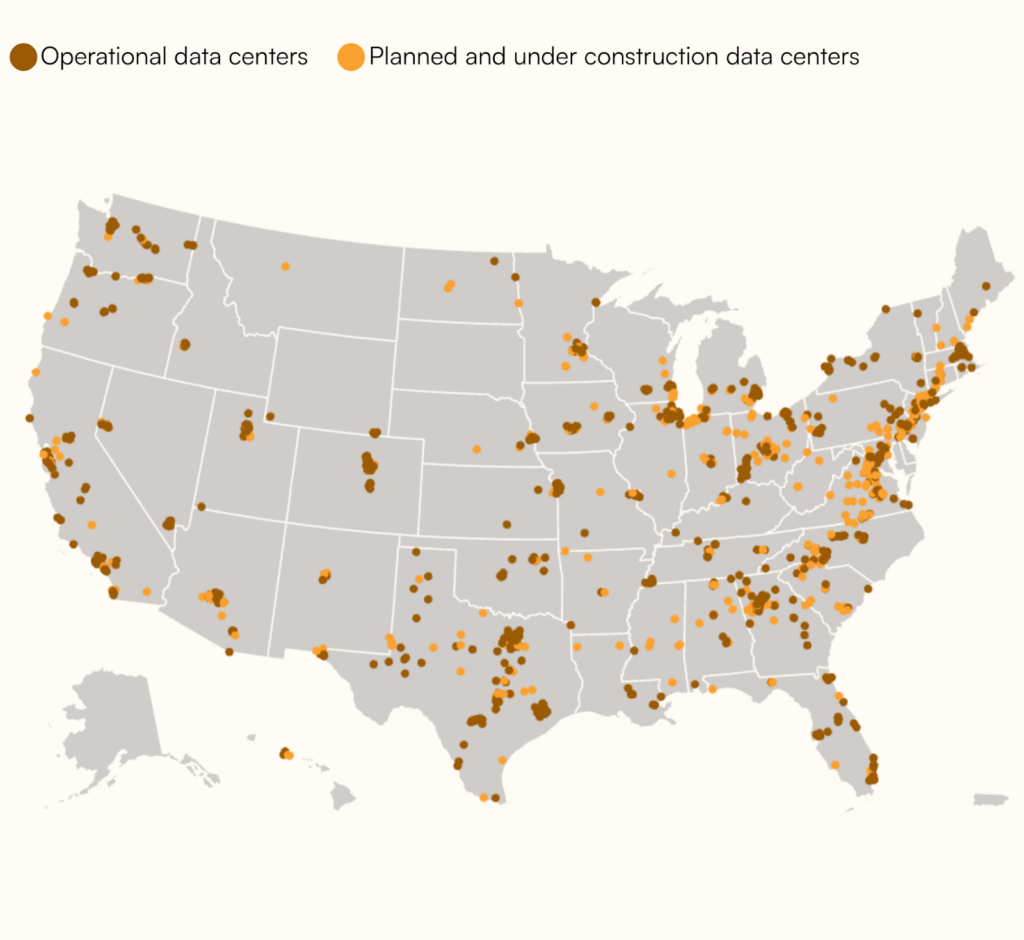

According to Enerdatics’ August 2025 U.S. Data Center Overview, data center demand in the Electric Reliability Council of Texas has surpassed 20 GW of potential load, representing roughly one-third of the interconnection queue’s 60 GW backlog. The analysis notes that concentration around Dallas, Houston, and San Antonio is straining system planning and transmission timelines. Wholesale prices in ERCOT’s West and South zones have averaged $45–$65/MWh year-to-date, with peak spikes topping $200/MWh during summer heat waves, underscoring the value of dispatchable gas generation to firm intermittent renewables.

While Texas’s Public Utility Commission has streamlined generator interconnection under its “connect-and-manage” framework, ERCOT’s queue backlog remains high, with more than 60 GW of projects—including over 20 GW of data center load—awaiting study and upgrade commitments. To address financing hurdles for new dispatchable capacity, the Texas Energy Fund has approved low-interest loans for multiple gas-fired projects since mid-2025, including a $216 million, 20-year loan at 3% for NRG’s 456-MW project at the T.H. Wharton gas plant site in Houston in August. Meanwhile, retail electric providers are innovating offerings for large-load customers—data centers among them—by crafting bespoke rate structures, fixed-price hedges, and bundled services that lock in energy costs, hedge against market volatility, and support credit requirements for lengthy PPAs.

If LandBridge and NRG advance their 1,100-MW project on schedule, commercial operation by 2029 would coincide with projected ERCOT peak demand growth—about 10 GW from data centers and another 5 GW from transport and industrial electrification—helping to alleviate capacity shortages and reduce volatility.

The Delaware Basin spans West Texas and southeastern New Mexico, forming the western sub-region of the prolific Permian Basin and encompassing Reeves, Loving and Pecos counties in Texas alongside Eddy and Lea counties in New Mexico. Its extensive oil-and-gas pipelines, abundant low-cost natural gas at the Waha market hub, and existing high-voltage transmission corridors have attracted hyperscale data center developers seeking sites with ready fuel supply, grid interconnection, and space for large-footprint campuses.

LandBridge, formed by private equity firm Five Point Infrastructure LLC, actively manages its 277,000 acres to support energy and infrastructure development, drawing on its owner’s track record in energy, water management, and sustainable infrastructure in the Permian Basin.

“NRG’s selection of this site for potential development of critical power generation supported by a data center project marks an exciting step forward for both LandBridge and the entire Delaware Basin,” said Jason Long, Chief Executive Officer of LandBridge. He notably added the collaboration further advances LandBridge’s powered land strategy and bolsters the value the company offers to “blue-chip” power generators and digital infrastructure developers.

For NRG, one of the largest competitive power generators and retail suppliers in the U.S., the prospective 1.1-GW plant underscores a broader push to align dispatchable gas capacity with the explosive growth of digital infrastructure in ERCOT. The company brings deep experience balancing merchant generation and long-term contracts, a skillset increasingly vital as hyperscale demand reshapes load patterns and fuels volatility across West Texas.

NRG pivoted sharply over the past year to package its generation development and merchant expertise around ERCOT’s fast-growing data center load. In its Q2 2025 earnings call, management announced long-term retail power agreements totaling 295 MW—expandable to 1 GW over a 10-year initial term, with options to extend to 20 years. Pricing is above the company’s midpoint target and structured with protected margins and hedges designed to secure returns. Beyond that, NRG reports more than 4 GW of joint development agreements and letters of intent with data center customers, supported by 2.4 GW of natural gas turbine capacity reserved for activation once contracts are finalized.

The strategy is reinforced by NRG’s partnership with GE Vernova and Kiewit to deliver 5.4 GW of combined-cycle gas generation across U.S. data center sites—what executives describe as a turnkey proposition that couples advanced turbine technology, balance-sheet strength, and fuel logistics to serve hyperscale and AI compute demand.

NRG has also bolstered its portfolio through acquisitions and state-backed financing designed to expand dispatchable capacity in ERCOT and beyond. In August 2025, the company closed on LS Power’s 13-GW natural gas portfolio and 6-GW Commercial & Industrial Virtual Power Plant platform, extending its reach across both ERCOT and PJM.

“We are pleased to explore bringing reliable energy solutions to West Texas,” said Robert J. Gaudette, executive vice president and president of NRG Business and Wholesale Operations, on Tuesday.“Once anchored by a long-term customer, the site has the potential to foster innovation and support data center growth, economic resilience, and grid stability in the region.”

LandBridge stressed in its release that the agreement remains preliminary. Development is subject to execution of a power purchase agreement, regulatory approvals, financing, and other customary conditions, and the project may not proceed as described.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).