A project to demonstrate a novel power cycle that promises to produce low-cost, reliable, and flexible power from natural gas—while generating no atmospheric emissions, and fully capturing carbon dioxide—is inching closer to commissioning. Its developers are now actively assessing siting for the first commercial-scale 300-MW NET Power facility.

|

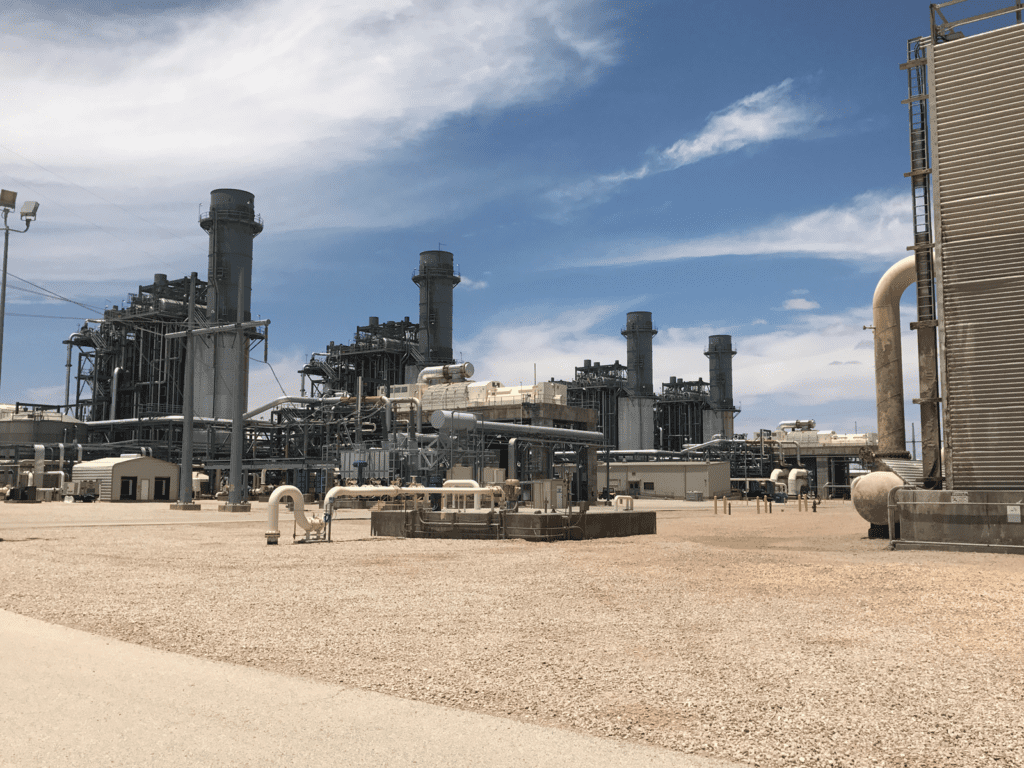

| NET Power’s 50 MWth Demonstration Plant in La Porte, Texas (PRNewsfoto/NET Power, LLC) |

A mere 10 years ago, 8 Rivers Capital, a startup founded in 2007 by Bill Brown, a former Wall Street investor and Duke University law school professor, and Dr. Miles Palmer, an engineer and entrepreneur, gave up on trying to “fix” avatars of the same costly fossil-fired power solutions to make them integral in a clean energy future. They decided, instead, to design a fossil-based system from the ground up.

“What they do in a lean innovation model is they take a bunch of people who’ve been successful before, throw them into a shoe box, throw some cash into the shoe box, punch some holes in the bottom. And those people take the cash and iterate by throwing an unformed idea out into the market,” Brown, who is now the CEO of Durham, North Carolina–based NET Power, told POWER in March. “We turned the shoe box upside down. Instead of finding a pre-existing team from another startup, we decided to do it differently.”

To flesh out the firm’s ideas, he said, the company would ask a firm with necessary expertise for feedback. In that way, “Before we got any money, we had gone through many major corporations,” looking for that ideal opportunity. “We threw an idea to them, and they’d throw it back, saying, ‘Don’t do that—don’t do coal—do gas,’ ” he said. Then, in 2009, at the urging of an old college friend from the Massachusetts Institute of Technology, Brown got on the phone with Rodney Allam. “After an hour or two, I thought, no one knows this much,” he said.

Allam, who was a former head of technology development at Air Products, described a new thermodynamic cycle, which he claimed, controlled all emissions from the outset (see sidebar, “How the Allam Cycle Works.”). After meeting Allam, and doing his own due diligence, Brown separately approached both Babcock and Wilcox and the Shaw Group for a quote on a pre-FEED (front-end engineering and design) for a test facility. “But when Shaw came back, they said, ‘Well, actually, we’d like to invest,’ ” as Brown recalls.

By June 2012, 8 Rivers had gained several interested backers. Along with Shaw—which in 2013 became part of CB&I, a company that last year merged with McDermott International—Exelon Generation signed on. Shaw would acquire a “substantial ownership position” in NET Power, and engineer, procure, and build the demonstration plant. Exelon, meanwhile, would spearhead permitting for a small-scale testing site, as well as test and commission the facility, supply its fuel, and market its output. As well as providing operations and maintenance support, Exelon held options for the first full-scale commercial plants. That month, NET Power also secured a key partnership with Toshiba Corp., which announced it would develop NET Power’s novel gas-fired generation technology.

As Mike Pacilio, executive vice president and chief operating officer with Exelon Generation, described it, the opportunity was too good to skip for the company that operates the largest fleet of low-carbon generators in the U.S., and has a long history as an innovation backer. “When we first assessed NET Power in 2012, we saw an opportunity to leverage Exelon Generation’s expertise in clean energy innovation and operational excellence to help develop and commercialize this novel, zero-emission, natural gas-fueled electric generation technology,” he told POWER in March. Exelon, specifically, was looking at the future. “Exelon Generation operates America’s lowest carbon fleet, by far. NET Power would make it possible to develop natural gas-fueled electric generation facilities with zero-carbon emissions, which could make our fleet even cleaner over time,” he said.

McDermott, which is a licensor of proprietary petrochemicals, refining, gasification and gas processing technologies, agreed, saying it also recognizes the potential and value of what it said was a “next-generation technology. As it told POWER in April, “In addition, as the EPC contractor for NET Power, this gives us tremendous potential to provide sustainable energy infrastructure solutions and be at the forefront of a new era of energy.”

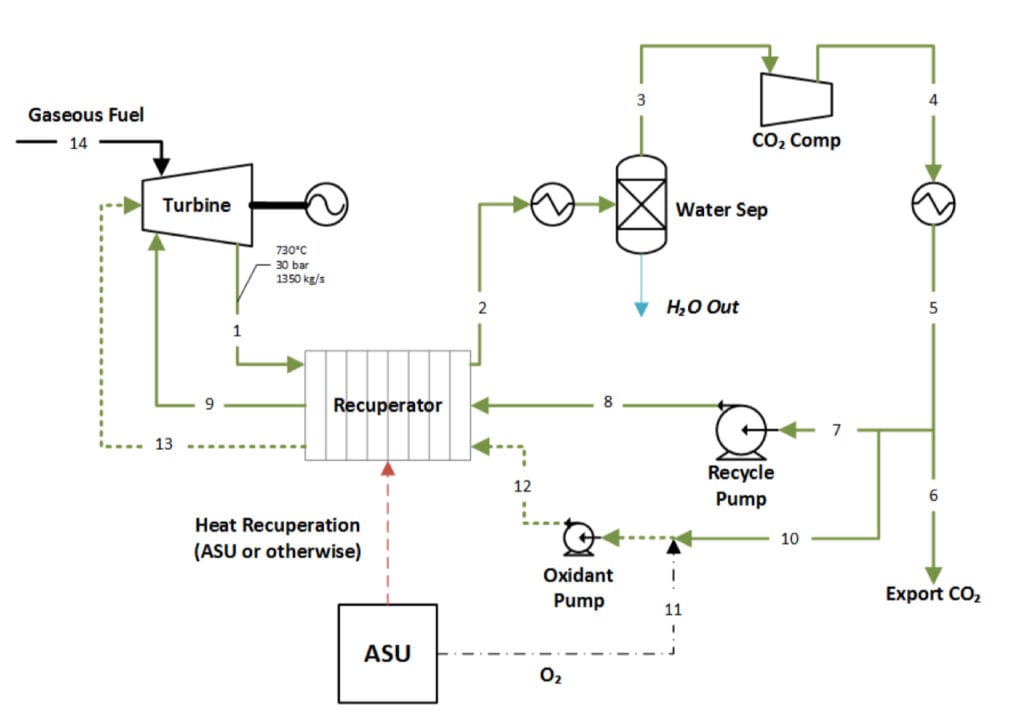

How the Allam Cycle WorksWhile research and development is underway on several supercritical carbon dioxide (sCO2) cycles, the Allam Cycle, which was designed within the last decade, has emerged as a key forerunner. NET Power’s first plant in La Porte, Texas, is a 50-MWth (25-MWe) plant that will demonstrate the cycle with natural gas. The $150 million project, which was scaled down from a 500-MWth pre-FEED design (to ensure scalability) includes all Allam Cycle components, and it will demonstrate full operation tests, including startup, shutdown, ramping, and hot, warm, and cold starts. It will also demonstrate first-of-a-kind engineering, and first-of-a-kind construction, as well as ensure the CO2 quality can be confirmed for offtake viability. According to the company, the full-scale unit will run at a potential net efficiency of 55.1%. “By slightly increasing the capital spent on heat exchangers and other plant components, we can boost the efficiency of the plant to 58.9% efficiency, which allows for the same amount of power to be made with less fuel. This will be attractive in countries with higher gas prices,” an 8 Rivers spokesperson told POWER. If the demonstration phase is successful, NET Power says it could begin global deployment of 300-MWe commercial plants as early as 2021. The Allam Cycle is a specialized sCO2 system that is directly fired with oxy-fuel, and which recycles its exhaust heat. Another way to think about it is that it is essentially “any supercritical CO2 Brayton cycle that is oxy-fueled and direct-fired; it recuperates turbine exhaust heat via a recycle stream; it is able to use a heat source in addition to the turbine exhaust; and it uses a turbine inlet temperature above 800C (1,000C to 1,200C optimal) and inlet pressure above 80 bar (200 bar to 400 bar optimal),” a spokesman said. (For more about the varied array of sCO2 cycles under development, see “What Are SCO2 Cycles?“.)

At the La Porte demonstration, the natural gas is combusted with a mixture of hot, recuperated CO2 and oxygen (which is piped in from an adjacent Air Liquide facility). “Burning oxygen instead—known as oxy-combustion—is usually challenging economically because oxygen is expensive to produce,” the company says. “NET Power overcomes this problem by recuperating the majority of the produced CO2 into the combustor, dramatically lowering oxygen requirements.” The resulting working fluid—which is now a mix of high-pressure CO2 and water—is then expanded through a turbine and then cooled in a heat exchanger (a recuperator). This process condenses the water and allows it to be separated out, leaving a nearly pure vapor-phase CO2 stream. That CO2 stream is compressed and pumped back up to high pressure, and the excess CO2 is sent to a pipeline, ready for export. The remaining stream is reheated in a recuperator and makes its way back to the combustor, where the hot, high-pressure CO2 helps the combustor achieve a final inlet temperature of about 1,150C as it combusts with a fresh stream of natural gas and oxygen. |

A Long List of Benefits

According to NET Power, the two most significant ways the Allam cycle makes oxy-combustion economic are by “relying on a more efficient core power cycle,” and by recycling heat within the system to reduce the oxygen and natural gas consumption, and associated costs of the air separation unit. The process is also environmentally friendly, it notes, because it produces no emissions—a major consideration as the decarbonization movement increasingly grips the power sector. Water, which is used at the demonstration, is also negotiable. “By switching to air cooling, NET Power plants actually become net producers of water while only seeing a minor efficiency reduction,” the company says.

Beyond that, the company also touts the technology’s operational flexibility, claiming turndown capabilities are beyond combined cycle and comparable ramping ability. “The ramp-rate could be 2% to 5% per minute from warm to hot start,” a spokesperson said. And, because the technology’s performance is resistant to ambient condition changes—such as altitude—a plant can be designed to use no water, and the technology could create new siting opportunities, for example, in non-attainment zones.

A Pioneering Business Model

But another aspect about the novel project that is frequently cited by interested parties is its potential to draw revenue streams from byproducts along with sales of the electricity it produces.

As NET Power notes, the plant is inherently designed to capture CO2 and generate it as a “low-cost, pipeline-ready byproduct.” And, as a spokesperson told POWER, “a single plant is capable of producing enough CO2 to justify a 57-mile pipeline.” For now, the company anticipates that recent passage of 45Q carbon capture tax credits and growing needs for low-cost CO2 for industrial processes—such as for enhanced oil recovery (EOR), where injected CO2 can increase oil recovery by 10% to 25%—are poised to boost global demand of its technology.

The company says it is already “working with” an array of potential customers, including with oil and gas industries, on development opportunities. Last November, for example, it struck an investment deal (that is still awaiting regulatory approval) with Oxy Low Carbon Ventures, a subsidiary of international oil and gas exploration and production company Occidental Petroleum Corp, which uses CO2 for EOR. Though details are sparse, Occidental Petroleum’s Senior Vice President of Operations Support Richard Jackson noted in a press release, the “innovative low-carbon technology solutions will grow Occidental’s business while reducing emissions.”

The Environmental Protection Agency (EPA), too, seemingly recognizes this game-changing quality. In its December 2018–released proposed revisions of the greenhouse gas emissions rule for new or modified units, the agency declined to determine that carbon capture and storage (CCS) or partial CCS was a best system of emission reduction (BSER) for new natural gas–feed stationary combustion turbines because it “is exorbitantly expensive, has not been adequately demonstrated, and would not be available for a large number of existing sources.” It noted, however, “similar technologies—such as use of the novel Allam Cycle—are, while seemingly promising, still in the early demonstration phase.” The note suggests that if the Allam Cycle is commercialized, it is likely the agency could reconsider part of its finding—which would amount to a boon for NET Power’s proprietary technology.

As significantly, project partners are now also exploring ways to allow NET Power plants to also “co-generate nitrogen, argon, and process heat,” which would “drive lower-cost, lower-carbon industrial processes, such as cheap, zero-carbon hydrogen production,” Brown said.

At the same time, the company is looking at the technology’s potential to use flare and waste gases (including associated, acid, and sour gases) in the combustion process. That aspect “integrates directly with operations of oil producers,” Brown noted. Yet another avenue for growth involves integration with liquefied natural gas regasification terminals, where it could provide high-efficiency power generation and eliminate the need for gas-fired regasification.

Demonstration of a Coal-Fired Allam Cycle Project

Meanwhile, 8 Rivers Energy is also separately pushing development of a 5-MW project to demonstrate a coal-fired Allam Cycle. The DOE has furnished the Energy and Environmental Research Center (EERC) at the University of North Dakota and 8 Rivers Capital with $700,000 (of a total project cost of $875,000) for the first phase of the project, which will end on July 31, 2019, and entail evaluation of the appropriate scale and candidate host sites for a large coal-based Allam Cycle pilot plant. “There is potential for greater funding in the future, but that has not yet been granted,” an 8 Rivers spokesman said. Sites under consideration include the La Porte site, EERC’s facility, and Basin Electric’s Great Plains Synfuels Plant. The Lignite Energy Council also says the Allam cycle is part of its quest to find carbon dioxide solutions.

The EERC in November 2018 suggested it could receive DOE funding for two other phases. In Phase II, expected to run a year, developers would conduct the FEED, and in Phase III, which would span five years, developers would build and operate the pilot. DOE funding for all three phases could amount to $44 million. The development team has submitted an application for Phase II, which was due on March 31.

Yet, the Allam cycle’s coal potential may not be so straightforward, Leslie Sloss, a technical expert with the IEA Clean Coal Centre, noted in a recent paper. “For this technology to run with coal, all the clean-up steps that would generally be involved with a coal gasification project are required, and therefore it would be more complex. However, this is currently available and proven technology on existing gasification and [integrated gasification combined cycle] plants,” she said.

Among technical changes she noted are the combustor “may need to be redesigned to handle gasified coal.” Removal of impurities such as NOx and SO2 could be achieved as nitric and sulphuric acid, using well-demonstrated methods used in oxy-fuel combustion systems, she said, however.

The Road to Technical Achievement

To reap its vast potential, NET Power must first successfully complete the demonstration. That road has been ridden with technical challenges, and despite ambitions to begin operating commercial plants within the next five years, project development, which has been ongoing since 2010, has been delayed by a series of technical hurdles.

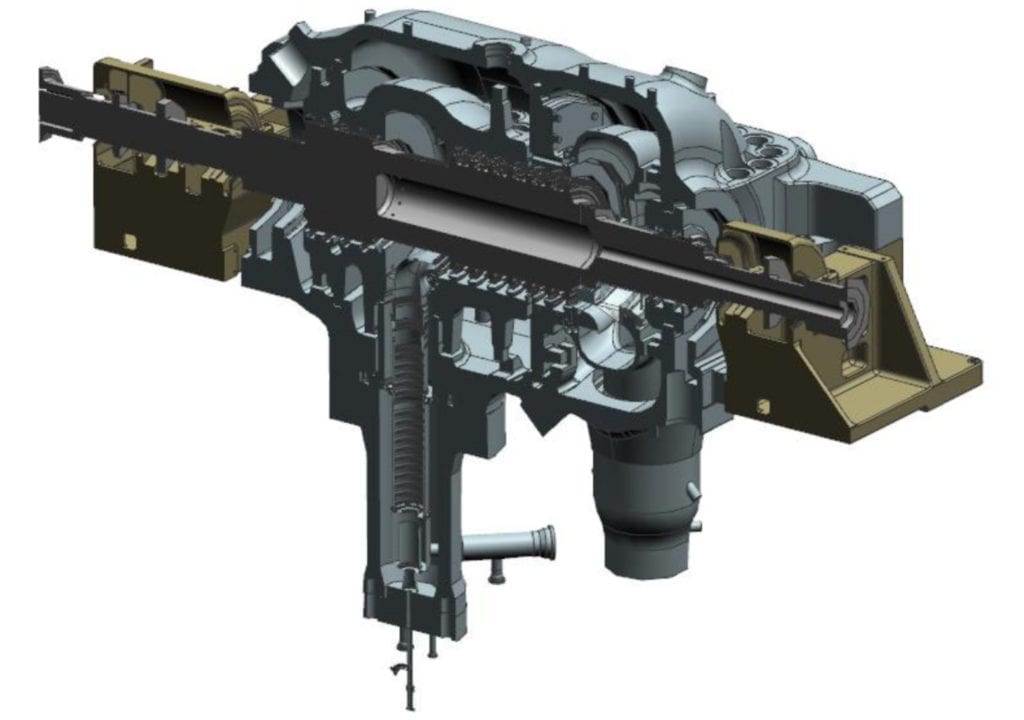

On May 30, 2018—after two years of quiet development—NET Power marked perhaps its most important milestone: It achieved first-fire of a commercial-scale 50-MWth combustor that was engineered and manufactured by Toshiba Energy Systems & Solutions in cooperation with Parametric Solutions, a U.S.-based gas turbine components engineering firm.

The achievement is especially remarkable considering that due to its nearly closed-loop process, the Allam cycle relies on a delicate balance of heating, cooling, compression, and venting. “Every aspect of the compressor-turbine train—from aerodynamics and process control to lube oil and seal support systems—have to be carefully considered to prevent damaging or hazardous conditions,” a spokesperson told POWER. Efficiency is also key. The main strengths of the direct sCO2 cycle are rooted in its inherent ability to capture carbon dioxide at high pressures—between 30 bar and 300 bar—which are not typical of a CO2 storage system. This requires compact turbomachinery and micro-channel heat exchanger designs that can perform the large thermal recuperation it needs.

Exelon Generation’s Pacilio acknowledged that the biggest technical hurdle the project has faced was the design and testing of the first-of-its-kind sCO2 combustor. The combustor, now fully demonstrated, “is the same size as the ones that will be used in commercial units,” he said.

According to Toshiba’s engineers, the solution combined the company’s gas turbine and steam turbine technology. “Regarding gas turbines, Toshiba has technologies for air-cooled nozzles and blades and, also, combustion in the air with a pressure of around 2 MPa [megapascal] and a temperature up to 1,500C. Regarding steam turbines, Toshiba has developed and commercialized USC [ultrasupercritical] steam turbines in [the 1990s], and are now developing advanced USC (A-USC ) steam turbines. Their conditions are around 24 MPa and 600C for USC and around 31 MPa and 700C for A-USC,” it said.

The engineering challenges were hefty. The system’s “inlet pressure is 30 MPa, which is much higher than those of current commercialized gas turbines. And the inlet temperature is 1,150C, which is much higher than those of commercialized [USC] steam turbines and is the same level as those of so-called E-class gas turbines,” the company said.

First, the engineers applied a double-shelled structure for the turbine and combustor—such as is common for USC steam turbines. It also leveraged its A-USC expertise to develop high-temperature materials for the casings and rotors in the sCO2 turbine. Engineering a durable thermal barrier coating (TBC), which they noted plays a crucial role in the sCO2 turbine and combustor’s cooling design (because temperature differences through the TBC in an sCO2 turbine is almost double that of conventional air-cooled gas turbines), posed as significant an engineering challenge. The company also engineered highly efficient cooling technologies, including cooling nozzles and blades, to manage the cycle’s extreme heat flux.

But finessing the technology has proven slower than expected. When Toshiba first announced it would develop the next thermal generation power system in June 2012, the company and partners Shaw Group, Exelon, and NET Power aimed to demonstrate the 25-MWe Allam cycle natural gas plant by mid-2014, planning a full-scale 250-MW commercial plant by 2017. However, while Toshiba wrapped up a six-month test to validate the combustor in August 2013 at a California facility (using a model that was a fifth of the one installed at NET Power), Toshiba first announced that it would supply the first-of-its-kind turbine in October 2014. The partners didn’t fully assemble and complete high-speed balancing tests for the rotor until August 2016. By October 2016, however, the turbine had been fully assembled and shipped to La Porte.

New Means and Future Potential

Yet, despite work to refine the project’s nits, Brown told POWER, “it is almost a mistake to call this a demo facility as it’s really a sophisticated test facility for the cycle and various components.” The company is so confident that while the full performance evaluation is underway at the 50-MWth natural gas demonstration, it has completed a pre-FEED study for a full 300-MWe commercial plant, and steps were underway to begin FEED and early development work.

Pacilio, who noted Exelon Generation has a contract with NET Power through which it provides oversight of engineering, construction, commissioning, and operations of the demonstration facility, said the company is “actively assessing siting” for the first commercial-scale 300-MW NET Power facility. “There are many factors that will go into identifying the best sites for the first commercial NET Power units. The market for NET Power projects will also include sites where geologic storage is suitable,” he said.

For Brown, NET Power’s most winning aspect is its ability to call on partners for sound advice. NET Power executives, Charlie Bowser, president, and Paul McDonough, vice president of Operations and Construction, for example, are “on loan” from Exelon to enable NET Power to leverage Exelon’s expertise in gas power operations, engineering, and maintenance. “Exelon also provides technical and commercial oversight to the NET Power leadership team through two board members, Ron DeGregorio, past president of Exelon Power, and me,” Pacilio said.

For now, NET Power is gearing up for a surge in interest in the technology and its potential. So far, NET Power has staffed a commercial team to provide front-end engineering design support and feasibility study support to potential customers. The company also has a financial plan in place to support adequate staffing as the technology further commercializes, Pacilio noted.

—Sonal Patel is a POWER associate editor.