A much greater coal power burn is expected this summer in reaction to an anticipated rebound in natural gas prices, suggests a recent reliability assessment from staff at the Federal Energy Regulatory Commission (FERC). Among other key aspects of the new report is that while electric reliability for the rest of the nation will be adequate, Texas could see a significant chance of an energy emergency.

Current U.S. natural gas prices are 78 cents per million British thermal unit (MMBtu) higher than Central Appalachian coal prices—"the highest separation between natural gas and coal prices since July 2010," reports the Summer 2013 Energy Market and Reliability Assessment. This could mean that less coal-fired generation will be displaced by natural gas this summer compared to last summer, according to the joint assessment from FERC’s Offices of Enforcement and Electric Reliability.

Natural gas forward prices for July and August 2013 are, meanwhile, slated to show a "dramatic increase" compared to 2012, when they were below $2.50/MMBtu. For 2013, they are similar to 2011 forward prices, and key hubs around the country show similar trends: "Summer forwards at Chicago are $4.51, $4.47 at SoCal, and $4.73 in New York. The only forward price below $4.20 is at Sumas on the Canadian/Washington border, which relies primarily on hydroelectricity to meet summer power needs," FERC staff suggests.

The staff also notes that because natural gas is frequently the marginal fuel type in electricity markets, it influences electric forward prices. Electric prices into the summer could be between 25% and 58% higher than similar forward a year ago, it suggests. This summer’s forward prices may be better compared to 2011 in many regions, not to 2012 electricity forwards, which reflected low marginal fuel costs tied to "exceptionally low gas prices of last summer," it says.

Forecasts of Extreme Weather Spur Reliability Concerns for Texas

Factors that could influence power price increases are forecasts of another warmer-than-normal summer for most of the country, and particularly in the Four Corners and the Great Basin areas of the West. The National Oceanic and Atmospheric Administration (NOAA) also predicts an increased chance that an area extending from the Texas Panhandle to New Mexico through most of Oregon and northern California could see an extended drought, FERC staff notes. Additionally, it points out that 18 named storms are being watched in the Atlantic—nine that could develop into hurricanes, and four major hurricanes—though their impact may not be as great on U.S. energy markets due to the recent shift in U.S. natural gas production to onshore shale (and away from the Gulf of Mexico).

Demand response, which has become especially important in managing peak loads, will play a major role this summer, the staff forecasts. Its assessment also concludes that reserve margins will remain adequate throughout the nation—with the dire exception of Texas. A recent summer outlook from the Electric Reliability Council of Texas (ERCOT) foresees a "tight" reserve margin of 12.9% this summer, below the target of 13.75%.

ERCOT has 1.7 GW of demand response resources and 1 GW of new generation outage, but it says an extreme heat wave or an extended drought could raise a "significant chance" the grid operator will need to declare an energy emergency alert. In that event, it plans to call upon contracted consumers to reduce demand either as load resources, emergency response service providers, or participants in other demand response programs or pilots. "If a higherâ€thanâ€normal number of forced generation outages occur during a period of high demand or recordâ€breaking weather conditions similar to the summer of 2011 lead to even higherâ€than-expected peak demands, rotating outages could become necessary to maintain the integrity of the system as a whole," ERCOT warns.

In comparison, though the availability of Southern California Edison’s San Onofre Nuclear plant remains a key market and reliability factor in transmission-constrained South Orange County and San Diego, California’s reserve margin is forecast at 19%—four percentage points above the target of 15%.

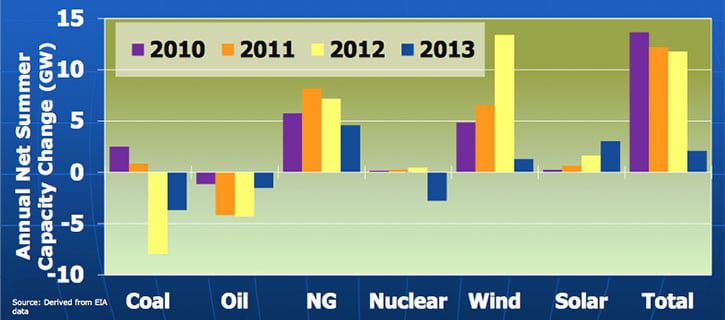

And while at least 5 GW of coal-fired capacity has retired since last summer (for a net loss of roughly 2.5 GW in PJM), reserve margins are projected to "exceed planning targets this summer," FERC’s assessment says.

One takeaway from recent back-and-forth shifts in the nation’s dependence on natural gas-fired generation compared to coal is that natural gas supply dependability becomes "more important," the staff says. It adds: "This continues to be a focus of the Commission’s gas-electric coordination initiative."

FERC: 2012 Was a Banner Year for Natural Gas Production, Generation

According to FERC’s Office of Enforcement, which also separately released its annual 2012 State of the Markets Report, U.S. natural gas production grew to a new all-time record in 2012, which contributed to the lowest nominal natural gas prices since 2002 (falling 25% to 40% across the country compared to 2011). But growing use of natural gas to produce power has increased demands placed on pipelines such as a large variability in consumption rates throughout the day. It has also increased awareness about the importance of greater coordination between the natural gas and electric industries, the Enforcement Office says.

For example, New England saw the highest spot prices in the country last year, averaging $3.91/MMBtu due to pipeline constraints and a drop in liquefied natural gas imports. In the Rockies, where prices were among the lowest in the country, however, natural gas prices last year averaged $2.59/MMBtu.

In 2012, meanwhile, natural gas demand surged to a record 70 billion cubic feet per day (bcfd), as demand for gas-fired generation grew to another high of 25 bcfd—a 21% increase compared to 2011. Power burn growth was centered in PJM and the Southeast states. According to the Enforcement Office, in 2012, "for the first time ever, natural gas used for power generation was greater than the combined residential and commercial gas demand."

The U.S. natural gas-fired combined cycle plant fleet was also more heavily used last year than at any time in the past decade as gas generation reached 1,231 TWh—30% of total net generation in 2012 (compared to 25% in 2011). Coal-fired generation in 2012 fell to 1,517 TWh, 37% of total net generation, down from 42% in 2011.

But last year, electricity demand wilted by 1.7% (65 TWh) compared to 2011, dampened by a decrease in residential demand, a lack of demand growth in the commercial and industrial sectors, and increased energy efficiency.

Sources: POWERnews, FERC

—Sonal Patel, Senior Writer (@POWERmagazine, @sonalcpatel)

NOTE: This story was originally published on June 4