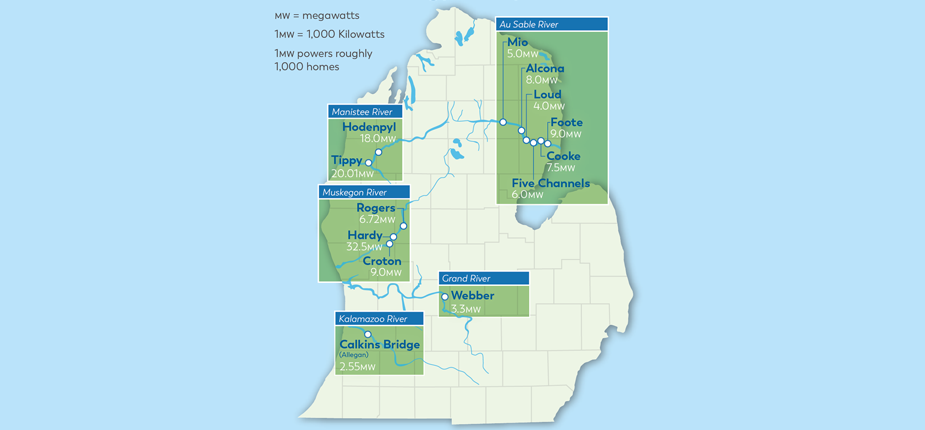

Consumers Energy will sell its 13 hydroelectric dams along five Michigan rivers to Confluence Hydro, an affiliate of Hull Street Energy—for a price of $1 a piece.

A Consumers Energy spokesperson confirmed the symbolic “technical sale” price of $1 for each dam, adding that the company has also entered into a 30-year agreement to purchase energy, capacity, and renewable energy credits from the dams. The financial terms of that contract will be disclosed in filings with the Michigan Public Service Commission. The arrangement shifts cost responsibility for future investments, operations, and relicensing to Confluence Hydro, the company said.

The move, expected to close in 12 to 18 months pending state and federal approval, is designed to lower long-term costs for Consumers Energy customers while ensuring the continued operation of the century-old facilities and preserving the reservoirs on which nearby communities depend, the company added.

“We believe a sale of the dams is the best path forward for our customers,” Sri Maddipati, president of Electric Supply at Consumers Energy, said on Sept. 9. “This sale balances two important needs: to lower costs for our customers while continuing to care for communities that depend on the dams,” Maddipati noted that three years of community meetings and economic studies informed the decision and gave residents confidence that the reservoirs’ economic, recreational, and ecological benefits would endure.

Confluence to Seek Renewal of Federal Licenses

Under the agreement, Confluence Hydro will contract with Consumers Energy to supply power from the dams for 30 years. Confluence plans to seek renewal of the dams’ federal licenses, which begin expiring in 2034. Confluence Hydro is a wholly owned subsidiary of Hull Street Energy, an investment firm that owns and operates 47 hydroelectric facilities across North America.

As a Consumers Energy spokesperson told POWER, the amount paid under the agreement “recognizes the value of energy, capacity and renewable energy credits, and transfers cost responsibility for the dams’ investments and operations to the buyer.” Confluence will also take “responsibility for the dams going forward, and Consumers Energy will not be responsible for relicensing or decommissioning projects or operational costs in the future,” she said.

Ed Quinn, Confluence Hydro CEO, praised Consumers Energy’s safety record and operational culture and pledged to modernize the dams. “With decades of experience operating hydro facilities, we are committed to preserving and modernizing these important resources to maximize their contribution to the grid,” Quinn said. “We see extraordinary opportunity to leverage our combined strengths to build a best-in-class hydro company —one that protects communities, supports employees, mitigates risk and delivers reliable, clean energy for the future.”

The sale marks the culmination of a process launched in 2022, when Consumers Energy began exploring options for its dams, including potential decommissioning or continued ownership. In August 2022, the utility announced plans and held initial community meetings, followed by an economic impact study completed in December of that year. A formal request for proposals was issued in February 2024, and stakeholder groups convened to develop priorities under scenarios for relicensing or divestiture.

Consumers Energy also noted it has already notified its hydro operations employees of the sale. All affected staff will be offered positions with Confluence Hydro, and Consumers Energy will continue to operate the dams until ownership transfers. The utility has also informed local communities and plans to schedule further meetings this fall to discuss the sale’s implications and reservoir management.

Federal and state regulators, including the Federal Energy Regulatory Commission (FERC) and the Michigan Economic Development Corporation, must approve the transaction and oversee relicensing. Confluence Hydro will need to meet stringent safety and financial assurance standards set by FERC before assuming control. Consumers Energy emphasized that safety remains paramount throughout the transition.

Hydro Is a Small Fraction of Consumers’ Generated Capacity

Consumers Energy, Michigan’s largest utility serving 6.8 million customers across the Lower Peninsula, generates roughly 1% of its total capacity from its 13 river-based hydroelectric facilities. While the utility operated more than 90 hydro plants at its peak, the divestiture points to a strategic emphasis on electric and natural gas reliability investments elsewhere in its generation portfolio. “By comparison, approximately 16 wind turbines or up to 500 acres of solar can generate the same amount of energy as the 13 river hydro facilities,” the company notes.

The company said the sale reflects its shifting power portfolio. “The energy solutions that worked for the last 100 years are different from Michigan’s current and future needs. Consistent with our Clean Energy Plan—our road map to ending coal use by 2025 and achieving net zero carbon emissions by 2040—we are adding more investments in renewable energy sources like solar and wind.”

CMS Energy, Consumers Energy’s parent company, is meanwhile riding a wave of robust demand growth across its Michigan service territory, driven in part by a burgeoning data-center pipeline. “We have reached an agreement with a new data center, which is expected to add up to 1 GW of load,” CEO Garrick Rochow told investors during its latest earnings call at the end of July, noting that early ramp-up is targeted for 2029 and 2030 and will complement a 9-GW growth pipeline that includes both tech and manufacturing customers. That incremental load underpins the utility’s strategy to spread fixed costs over a larger base, helping to offset upward pressure on customer bills.

On the generation side, CMS Energy is balancing an aggressive build-out of renewables and storage with targeted investments in natural gas capacity. “Our integrated resource plan (IRP) will primarily address capacity,” Rochow said, adding that modeling for 2% to 3% annual sales growth points to additional storage beyond mandated levels, as well as new gas peaking resources. The company’s mid-2026 IRP filing is expected to outline roughly $5 billion in incremental capital needs, driven by coal retirements, expiring power‐purchase agreements and the need to meet Michigan’s clean-energy mandates.

A cornerstone of CMS Energy’s long-term strategy is its Clean Energy Transformation, which the company says is built on measurable targets and supported by a disciplined capital plan. According to a September 2025 investor presentation, Consumers Energy will seek to exit coal by the end of 2025, achieve 60% renewable energy by 2035, become 100% clean by 2040, and achieve net-zero greenhouse-gas emissions by 2050. The commitments leverage Michigan’s 2023 energy law and federal incentives, including safe-harbor provisions through 2029, transferable tax credits, and utility PPAs with added capacity value, it says.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).