Prominent private equity investment firm Blackstone has agreed to acquire the 774-MW Potomac Energy Center—a natural gas power plant located in Virginia’s “Data Center Alley”—in a deal reportedly valued at approximately $1 billion, according to sources familiar with the matter.

Previously known as the Panda Stonewall Energy Facility, the Potomac Energy Center is situated within PJM Interconnection in Loudon County, a region of Northern Virginia, which currently hosts 25% of U.S. data center capacity. “The Potomac plant is located in close proximity to over 130 data centers—with significant further growth expected,” said Blackstone Energy Transition Partners, Blackstone’s energy-focused private equity business.

Potomac Energy Center: A Strategic Power Play

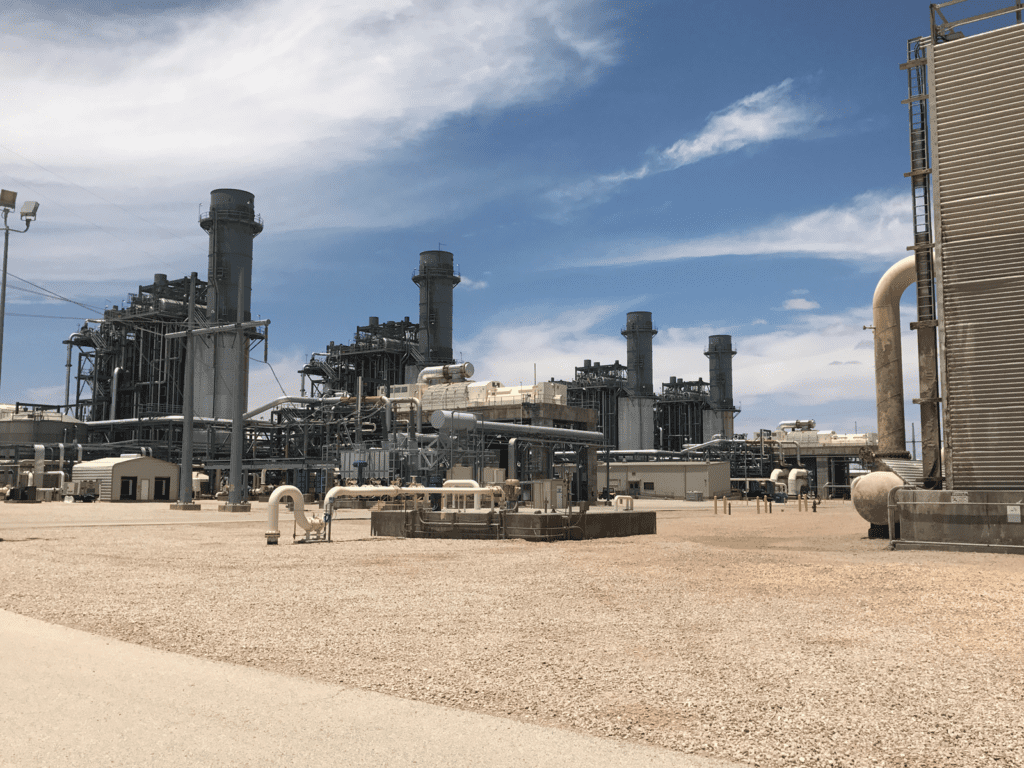

The combined cycle generating station was completed in May 2017 to meet the growing energy demands of Northern Virginia’s data center-driven market. Initially built for Panda Power and Siemens Financial Group, the project was spearheaded by Green Energy Partners and executed under a turnkey consortium comprising Bechtel Corp. and Siemens Energy. The facility incorporates advanced technology, including two SGT6-5000F gas turbines. In 2021, Ares Management Corporation acquired the plant through its subsidiary ARCC Green Energy Partners Blocker as part of a broader out-of-court restructuring. The transaction included a financial restructuring that refinanced the plant’s existing debt with a $490 million package.

Natural gas is supplied to the plant from two 30-inch gas pipelines that pass through the plant site. The power plant connects to the grid through an existing 230 kV line that traverses the site. Regulated by the Federal Energy Regulatory Commission (FERC), the plant also provides reactive power services under PJM’s Open Access Transmission Tariff.

While Blackstone did not reveal the terms of its transaction in its announcement on Friday, Reuters reported that “Blackstone is paying around $1 billion for the facility.” The valuation may reflect Potomac’s strategic location and efficiency. POWER has verified this reporting with sources familiar with the matter.

“This investment underscores Blackstone’s commitment to investing in the electric infrastructure required to power AI innovation,” said Bilal Khan, senior managing director at Blackstone Energy Transition Partners, in a statement on Friday. “We believe Potomac is well-positioned to help meet data center-driven power demand growth in Northern Virginia.”

Blackstone officials highlighted the plant’s opportunity to supply baseload power to the energy-hungry region and its “potential to integrate a hydrogen fuel blend in the future, which could provide future environmental benefits.”

“I am tremendously excited about this investment. Potomac has a reputation and history for providing reliable and high-quality generation capacity, which are critical to helping support the region’s growing power needs,” said Lee Davis, CEO of Creto Energy, Blackstone Energy Transition Partners’ North America power platform.

Investing in Megatrends: AI, Power, and the Digital Economy

The deal is notable for Blackstone, the world’s largest alternative asset manager. In a recent blog, Ken Caplan, global co-head of Real Estate at Blackstone, outlined a number of “megatrends” that are “redefining” industries and consumer behaviors. “We see a significant opportunity to invest in the companies and assets driving the next phase of economic growth. We view this as building the infrastructure of the future, focusing particularly on four megatrends: [artificial intelligence (AI)], power, life sciences, and the digital economy,” he wrote.

“AI is powered by data, and in recent years, total data generation has been doubling every three years. Between 2010 and 2025, data created, consumed and stored will have increased over 100x,” he noted. Blackstone has acquired a substantial share in the space, including through a $10 billion acquisition of QTS, a publicly traded data center company, in 2021 and a $16 billion acquisition of AirTrunk, Asia’s largest data center operator, in 2024. Also in 2024, the firm spearheaded a $7.5 billion debt financing facility for CoreWeave, a specialized provider of cloud infrastructure tailored for AI workloads. It also injected $300 million into DDN, a global leader in AI and data intelligence solutions, to fuel the company’s rapid growth. The moves have positioned Blackstone as a global leader in digital infrastructure, with a portfolio valued at $70 billion in operating or under-construction properties and a land bank that can support an additional $100 billion in development, Caplan said.

In tandem, “Power is facing a dramatic supply and demand imbalance. U.S. energy demand has stayed relatively steady since 2005, but power demand is projected to grow by a robust 40% over the next decade,” Caplan added. “An increase of this magnitude transforms a historically stable market into one with ample opportunities for those with capital and expertise to act as solution providers.”

A primary reason is that “existing infrastructure is already strained, requiring massive investments in power generation, transmission, and distribution. The U.S. power grid, with an average age of over 40 years, lacks the capacity to meet rising demand,” he wrote. “To keep pace, the country needs to double the grid’s capacity over the next 12 to 13 years, which requires massive capital investment. Just connecting current energy projects in the U.S. transmission queue to the grid requires an estimated $3.9 trillion.”

Blackstone noted that while it is investing in “opportunities across the entire power infrastructure spectrum,” energy infrastructure “represents ~30% of our $50 billion+ infrastructure business, and we have a dedicated energy transition fund.”

The firm, notably, is an investor in Invenergy, the largest independent renewables developer in North America. “Our commitment to power infrastructure extends beyond equity investments,” Caplan noted. “Blackstone is one of the most active lenders in the space, providing capital solutions to companies powering the economy. Through our investments across energy generation, transmission, distribution, critical equipment, and services—spanning both debt and equity—we are helping address the intermittency of renewable energy sources.” The company, for example, is a strategic investor in natural gas companies, like its midstream joint venture with EQT and our investment in Tallgrass Energy Partners, he said.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).

Correction (Jan. 27): A previous version of this story incorrectly said Blackstone owns Invenergy. Blackstone does not own Invenergy and is more accurately described as an investor.