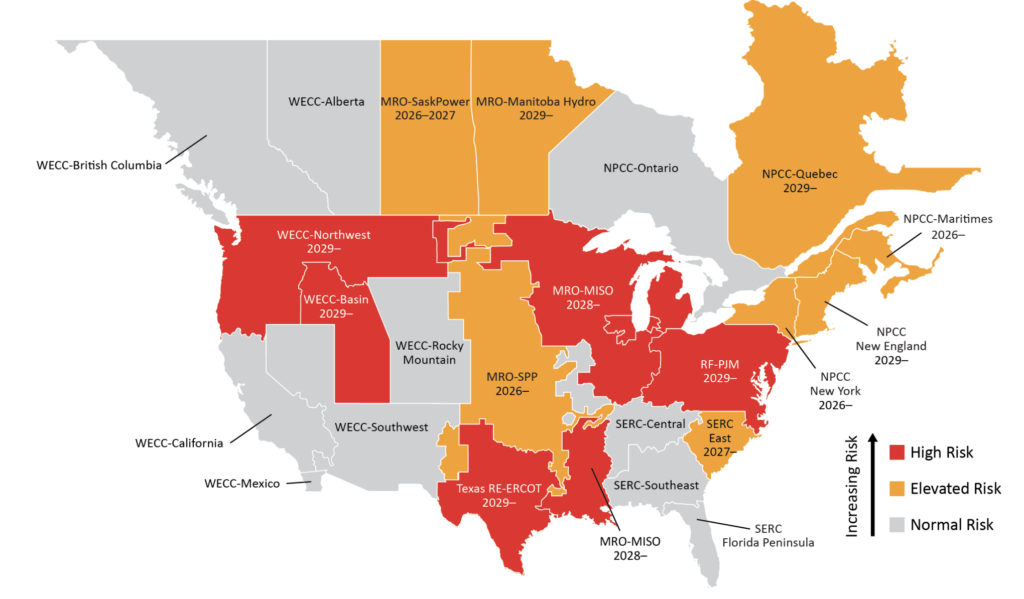

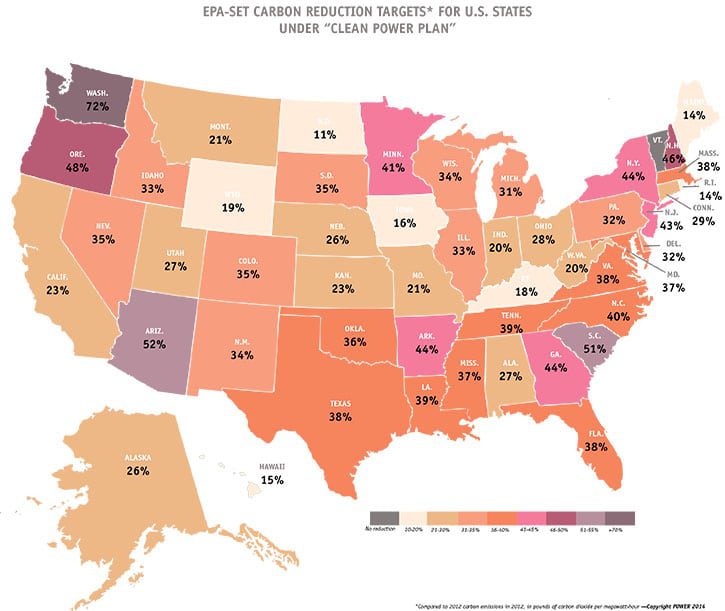

Voters in Colorado and stakeholders in Minnesota forced through unique managed generation transformation plans that paved the way for aggressive state renewable and clean energy standards—inadvertently pushing their utilities out in front of proposed and now actual federal policies.

As the power industry struggles with rising costs of adaptation, many beleaguered executives are anxiously focusing their long-term generation strategies around provisions of the proposed Clean Power Plan (CPP)—even as technocrats and lobbyists wrangle again over the language for what could be biting 2020 interim carbon dioxide reduction goals as well as stiff final regulations in 2030.

Preparedness for both the Mercury and Air Toxics Standards (MATS) and the anticipated CPP varies widely by state. It’s clear that despite its ingenuity, California stands as both an example of how to successfully and unsuccessfully transition into an ever-greener system. On the other coast, the Regional Greenhouse Gas Initiative (RGGI), a cooperative effort among the states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont to cap and reduce power sector CO2 emissions, has evolved into the poster child for the highly flexible emissions approach that the Environmental Protection Agency (EPA) is currently pushing. With its cap-and-trade regional market already up and running, RGGI may become a preferred outcome. Also leaning greener are Oregon and Washington, which are discussing joining forces with California (and British Columbia) into a West Coast RGGI-like regional alliance.

Smack in the middle of what to those two groups would be fly-over country sit Colorado and Minnesota, two central states that, driven in large part by citizen activists, are smoothly making the sweeping transition from a largely coal-dependent economy to a lower-carbon, renewable base ahead of MATS and are well positioned for even the strictest final CPP regulations.

Beginning over a decade ago, in November 2004, voters in Colorado approved ballot initiative “Amendment 37” requiring the state’s largest utilities to obtain 3% of their electricity from renewable energy resources by 2007 and 10% by 2015 (since increased to 20% and expanded three times). Though Colorado’s voters may be a little more famous for legalizing marijuana, their more sober actions a few years earlier marked the first time in U.S. history that a renewable portfolio standard (RPS) was put directly before voters and passed rather than forced into law by a state legislature. Since then, voters in Colorado and stakeholders in Minnesota forced through unique managed generation transformation plans that paved the way for aggressive state renewable and clean energy standards—inadvertently pushing their utilities out in front of proposed and now actual federal policies.

Not only have these states’ voters transformed their energy sectors, they’ve also literally transformed Xcel Energy. Headquartered in Minnesota, Xcel is both the largest power provider there and in Colorado while serving 5.5 million customers spread across six other Midwestern and Western states. As a result of Minnesota’s and Colorado’s activist-driven laws, today Xcel is the number one wind energy provider in the U.S. in terms of originating, obtaining, and delivery (Figure 1). Beginning with Colorado’s voter-passed RPS, the energy transformation process in both states has proven to be a simultaneously contentious and profitable collaboration between political and economic stakeholders. Either way, “a thank you is warranted to the voters,” said Jack Ihle, Xcel Energy’s director of environmental policy in a late March interview with POWER. “They continue to be a huge driver in this process. Coloradans and Minnesotans have driven a lot of renewable development through state portfolio standards and two different orchestrated fleet modernization efforts,” said Ihle. The proactive end-result has also shown that “we can save money with flexibility in wind energy,” said Ihle.

|

1. Wind farm in Colorado, near Pawnee Buttes. Courtesy: Lee Buchsbaum |

By being forced into becoming one of the first movers off of coal-fired power, Xcel locked in lower construction and retrofitting costs. With MATS driving a massive wave of changes in the U.S. energy fleet, as other utilities go into the market for plant conversions, slower movers inevitably will face greater labor and component costs. These in turn will ultimately be borne by ratepayers and shareholders.

Colorado’s Clean Air Clean Jobs Act

In Colorado, the Clean Air–Clean Jobs (CACJ) project is helping Xcel comply with MATS, although the project is part of a much larger emission reduction strategy. Under CACJ, Xcel has retired the two coal units at Arapahoe Generating Plant and Units 1 and 2 at Cherokee Generating Plant. Unit 3 will retire soon as well. Also at Cherokee, Xcel will switch Unit 4 from coal to natural gas. The coal unit at the Valmont Generating Plant will also be retired. The entire project will be complete by 2018. To meet state mercury requirements and MATS, Xcel has installed activated carbon injection systems at Comanche and Pawnee generating plants. Both plants also have other controls, such as baghouses and scrubbers. Pawnee’s CACJ mandated scrubber went online last year.

Xcel created compliance plans at the direction of the legislature for Colorado’s Public Utility Commission. The remaining coal units to retire are Cherokee 3, which will retire in 2015, and Cherokee 4 and Valmont 5—the last two coal units on the project. Valmont will retire at the end of 2017. Xcel will begin operation of a new combined gas cycle plant there in the third quarter of 2015. All the mandated retrofits at the Pawnee and Hayden stations (Figure 2) are largely under way or completed. “These retrofits keep the remainder of the system in compliance,” said Ihle. “The Clean Air Clean Jobs Act helped us modernize the rest of our Colorado fleet, putting us in good shape with MATS. We really didn’t have additional requirements work to do there at all.”

|

2. Undergoing retrofits. Xcel Energy’s 446-MW Hayden Generating Station in northern Colorado is getting $160 million in environmental retrofits. Courtesy: Lee Buchsbaum |

“Clean Air Clean Jobs took down a gigawatt of coal and replaced it with natural gas and wind,” said former Colorado Governor Bill Ritter (D), one of the chief architects of the legislation. At an April forum hosted by the Center for the New Energy Economy at Colorado State University, where he now has a leadership role, Ritter discussed that it is largely at the state level where the real movement towards green energy is occurring—not in Washington.

“We have 220 million Americans who live in a state with a renewable energy standard; about 240 million Americans who live in a state with an energy efficiency resource standard,” Ritter said at the April event. This didn’t happen because of federal legislation. The Center for the New Energy Economy tracks how many energy-related bills are being introduced on the state level. In 2013, 4,500 bills were debated and 600 became law. “Republican and Democratic governors alike” are trying to understand this not from an environmental agenda, but as an economic opportunity, Ritter said.

Minnesota’s Metro Emissions Reduction Projects

The conversion of Minnesota’s large coal plants to natural gas began in 2007 and 2008 as part of an agreement (known as the Metro State Emissions Reduction Project) between environmentalists, the state chambers of commerce, and Xcel. Residents in the cities of Minneapolis and St. Paul were looking ahead to the mercury rules and knew they needed “to get rid of much of our coal power to stay compliant,” said J. Drake Hamilton, science policy director at Fresh Energy, a St. Paul–based nonprofit that helps draft Minnesota energy policy in an April phone interview with POWER.

As a result, Xcel retired and replaced two coal-fueled plants (High Bridge and Riverside, a POWER Top Plant winner) with combined cycle natural gas—again, this project was part of a much larger emission reduction strategy than just MATS. For multiple reasons, Xcel recently retired the remaining coal units (Units 3 and 4) at Black Dog Generating Plant. They too will be replaced by natural gas. Many of the now-retired coal plants were the oldest in the state. Units owned by Minnesota Power, Otter Tail Power, and the Municipal Utility of Rochester were retired and their power replaced largely by gas and wind. When the conversion process started, coal-fired electricity constituted almost 70% of Minnesota’s power. Now it’s just below 50% and falling.

The single unit at Allen S. King Generating Plant and the three units at the Sherco Generating Plant—the state’s largest coal-fired power plant—were equipped with mercury controls. However, the older two units at Sherco are at the cusp of their economic viability (the newest unit was recently rebuilt after an explosion and fire). Those units are the target of much debate as stakeholders craft Xcel’s new 15-year integrated resource plan to be filed with the Public Utility Commission (PUC). “Xcel has been ordered to conduct expedited modeling for renewable alternatives. Fresh Air will be conducting our own modeling as well. Both models will become part of PUC records. We expect a comprehensive decision by late 2015,” said Hamilton.

In concert with environmental groups, the State Chamber of Commerce, Minnesota Power, Xcel, and other stakeholders also held a multiyear discussion resulting in the Minnesota Mercury Reduction Act. All parties agreed to a 90% reduction in mercury from their largest units by 2016 using activated carbon and filtering. “In Minnesota, we have a constitutional right to hunt and fish. But around 2000, our state and water agencies noticed there were fish advisories due to mercury pollution. All of us agreed that we didn’t think it was right to take our kids to fish and hunt and not be able to eat the fish,” said Hamilton.

Pushing the envelope further, since 2011, Minnesota’s PUC has required investor-owned utilities to conduct side-by-side economic analysis comparing upgrading older coal-burning utilities to current environmental standards, building new plants, or retiring existing facilities and replacing their power with a suite of cleaner alternatives. The resulting power transformation has come about because of a convergence of environmental and economic factors—pushing ahead of federal regulations.

As a result of the conversions, just as in Colorado, Xcel—by far the largest power provider in the state—was ahead of MATS before it was phased in.

State Leadership Pushing Harder Than the Feds

The other states where Xcel operates also face renewable energy standards, goals, or targets. But only Minnesota has a specific carbon reduction mandate target, “and we’re on track for that,” said Ihle. Though of course most of the renewable programs do reduce CO2, “our wind footprint is responsible for much less of a CO2 reduction than converting from coal to natural gas. But at the end of the day, state-sponsored energy efficiency and demand side management programs are also having a large impact. Those three pillars are really the drivers of our carbon reduction: renewables, power plants retirements and efficiencies,” continued Ihle.

But politician Ritter knows that renewables far too often are evaluated through the lens of partisan divide—with deleterious results. “Nebraska, which has the fourth best wind resource in the county, has only 700 MW of wind installed. We’re powering nearly 25% of Colorado with less-good wind. But inside of Nebraska’s Republican-led unicameral house, legislators are deciding how to make something of that. They are looking at their windy neighbors, seeing how that energy is being harnessed and exported, and realizing they are losing out of this economic opportunity.”

The bottom line, says Ritter, is that the “naysayers were wrong when we did some bold things in Colorado. Today wind generation rates are cheaper in some ways by half than coal in many states.” For states like Minnesota and dozens of others that do not mine any coal or produce any natural gas, harnessing the wind becomes a much larger economic driver than importing fossil fuels from elsewhere. “We’re working with 13 western governors on the president’s Clean Power Plan. There is very much a conversation happening. Folks might say publicly that they won’t work with the EPA, but when we convene with the environmental leads from those states, they often say ‘we think there’s a way we can comply if we’re forced to and here’s some stuff we want you to consider going forward,” said Ritter.

Some of their considerations are based on the low-growth trajectory of coal—and some on future economic opportunities. “Republican Governor Rick Snyder of Michigan is looking at his state’s energy portfolio and realizing ‘we’re importing 100% of our coal from other states. We produce none of this energy here.’ Coal comprises about 70% of Michigan’s portfolio. He’s now drafting a clean energy plan that looks at renewable energy as well as natural gas. Economically and environmentally, the state is now spending more money on coal-fired generation than if they were importing wind energy directly from Iowa.”

In turn, the Republican leadership of Iowa now sees wind energy as an exportable economic opportunity. Kansas, too, is starting to export wind energy into the Southeast, where power producers are shifting from coal to natural gas. “The Republican governor there has refused to take apart or roll back Kansas’ RES because he understands the economic impacts wind is having on rural economies. This is no longer a conversation about public health and environmental issues. Its about jobs. Here in Colorado we eventually put in place a 30% renewable energy standard because we knew it would create jobs in-state. And that’s the bottom line,” said Ritter.

Nationwide, as other generators rush to comply, ratepayers might be paying more money to convert. “It was strategic for us to engage early on with the Colorado legislature,” reflects Ihle. “Around 2011 there was a lot of angst about MATS. We looked at it and realized we could comply with it. We determined that as a proactive clean energy strategy, given that we could plan on a little more lead time, we could enter the markets early for wind turbines or retrofits. To be fair, a lot of customers have concerns about paying for something before they are needed. CACJ was well placed and well timed, and we and our customers are better off for doing it,” said Ihle. Conversely, if you’re dealing with a lot in a hurry, that’s bigger burden for rate payers and stakeholders.

Currently, 18% of Minnesota’s electricity comes from wind, using only 1% of the entire resource. “We’d like to increase to double that to 40% by 2030 but the utilities are opposing,” Hamilton said. “They are already concerned about CPP and opposing higher RESs. In Minnesota, wind has become our lowest cost energy resource, and our farmers see this as a cash crop. Minnesota is proof that aggressive carbon emissions reductions can be achieved and we can still grow the economy.” Largely because of Minnesota’s rich wind resource, all of its utilities are meeting their renewable standards ahead of schedule.

An Unclear Path to Clean Power

The big question mark here is the CPP: Without knowing the final rule, the industry will be groping ahead more than clearly moving forward. “We expect targets to change,” Ihle said. “And then there comes the process for developing a state plan for compliance. We think we’re fairly well positioned until the Clean Power Plan rule would be phased in, though the early 2020 targets are very stringent. We’re trying to get credit for our early action issues,” he added, referring to Xcel’s compliance with Colorado and Minnesota regulations.

Going forward, the legislature funded the Minnesota Renewable Energy and Transportation study to look at what it would take to ramp up the state’s RPS from 25% by 2025 to 40%. “They are now are looking at adopting a 40% level by 2030 to help us meet our CPP obligations,” said Hamilton.

Ihle does worry about complying with a reduction level that’s 80% as stringent in five years as it is in 15. He also worries about the costs to the national energy generation fleet. “CPP could force the retirement of over 50 GW of coal production, as much as MATS is driving out now. Either way, you’re going to see another large round coal plant closures if the plan is finalized at close to these early proposals. As far ahead as Xcel is, if we had to meet these proposed interim targets, there would be some real concerns that we could get there,” he said.

—Lee Buchsbaum is a freelance writer and photographer with extensive experience covering mining, the coal industry, electrical generation, and transportation.