Though most of the buzz about smart grid efforts in the U.S. and elsewhere involves individual utilities rolling out smart meters or governments establishing policies to promote smart grid technology deployment, a third entity has been paying attention to the benefits to be gained from smarter electricity generation, distribution, and use. Its work may be less visible to the general public, but the Department of Defense (DOD) and all branches of the U.S. military have been involved for some time in finding ways to increase energy efficiency and renewable energy use both at home and in forward operating bases (FOBs). Integrating smart grid technologies is a logical extension of those efforts.

If DOD spokespersons and the smart grid media are to be believed, we shouldn’t be surprised if some of the most significant smart grid/electricity system developments come from the military in the next few years. This article starts by looking at the factors working in favor of this vision and closes with some of the ways that military smart grid efforts could migrate to civilian power systems. In between you’ll find a rundown of what’s happening in the military smart grid arena.

Ideal Conditions

The military has an almost perfect set of conditions for developing a variety of advanced, "smart" technologies centered on electricity generation, delivery, and use.

Necessity. The DOD is one of the largest energy consumers worldwide and the single largest energy consumer in the U.S. At a White House Energy Security Forum in April 2011, Deputy Defense Secretary William J. Lynn III noted that the DOD accounts for 80% of U.S. federal energy use (and somewhere between 1% and 2% of nationwide consumption), consumes more energy than is used by two-thirds of all the nations on Earth, and has annual energy bills in the tens of billions of dollars ($15 billion in 2010). As in the civilian world, the number of electrically powered devices keeps increasing, so demand tends to rise as well. Consequently, ensuring a reliable supply of energy for both transportation and power can be challenging.

Surety of supply poses challenges for both stationary and FOB installations. According to Lynn, more than 70% of convoys in Afghanistan are used to transport fuel or water and are easy targets for insurgents’ roadside bombs. More than 3,000 U.S. troops and contractors had been killed or wounded protecting them as of April 2011.

The desire to keep its people safe—by minimizing the amount of fuel that U.S. forces need to move around in combat zones to fuel electricity generators and vehicles—is a powerful motivating factor for many of the military’s smart grid, energy efficiency, and renewable energy initiatives.

Sharon E. Burke, assistant secretary of defense for operational energy plans and programs, told the audience at the Military Smart Grids and Microgrids Conference in October 2011: "When you consider that we move about 50 million gallons of fuel every month right now in Afghanistan, much of which is for power generation, you begin to understand the huge financial cost of this fuel." Burke noted that the fuel powers more than 15,000 generators in Afghanistan alone. She added that better combat power generation has benefits that include less need for fuel, reduced noise and heat signatures, less maintenance, and a lighter force.

Protecting defense-related people, projects, and property at home is also a concern. Remember that DOD facilities are, for the most part, connected to the national grid, making them vulnerable to massive outages like those experienced in 2003 in the Northeast and in 2011 in the Southwest.

Money. Though some Americans may balk at the Department of Energy (DOE) issuing grants and loan guarantees to advance utility smart grid or renewable projects, they are much less aware of the money spent through the Pentagon on similar projects for the military.

For example, Dorothy Robyn, DOD deputy undersecretary for installations and environment, told Defense News on Oct. 31, 2011: "I’ve been delegated the authority to sign off on renewable projects that go out beyond the 10-year authority that most federal agencies have. We’re the only federal agency that has the authority to go out to 30 years. What that does is allow us to do projects that are bigger and have a longer payback period." Robyn also noted that her department can take advantage of third-party financing for renewable and energy efficiency projects.

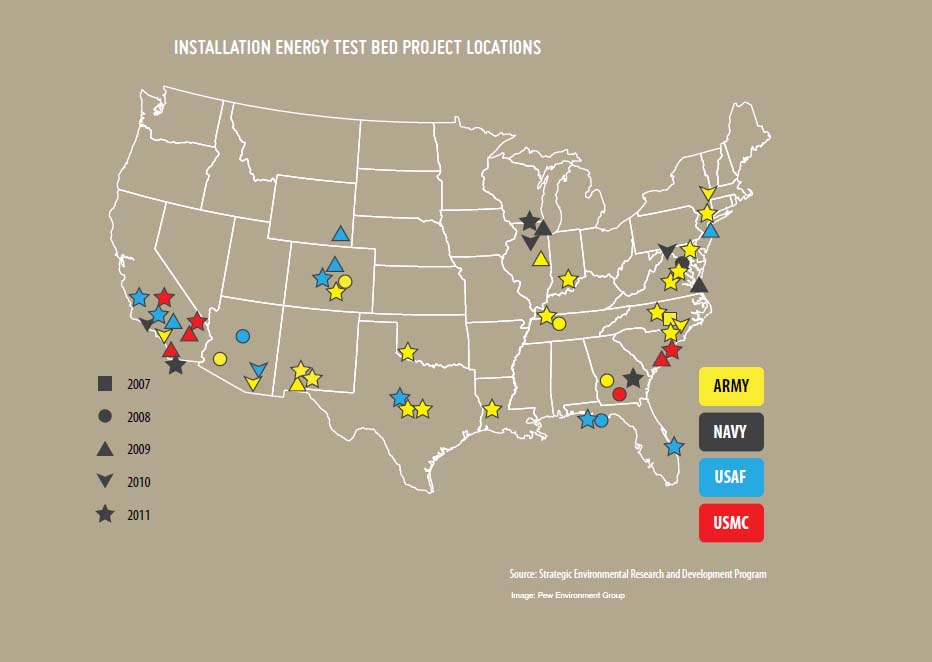

A September 2011 Pew Charitable Trusts report, From Barracks to the Battlefield: Clean Energy Innovation and America’s Armed Forces, found that "DoD clean energy investments increased 200 percent between 2006 and 2009, from $400 million to $1.2 billion, and that they are projected to eclipse $10 billion annually by 2030." Figure 1 shows the location of energy test bed project locations. Adding renewables to a stationary or mobile installation requires "smarter" energy system management than a "plug-and-play" generator; hence, the interest in various smart grid-related technologies.

1. Locations of DOD energy test beds in the U.S. Courtesy: Pew Charitable Trusts

Despite the large increases for renewables, even the Pentagon is feeling the pinch of financial constraints. As Pike Research notes in its 2011 forecast for military microgrid activity, "The greatest uncertainty impacting these forecasts is related to efforts to balance the federal budget in the coming years. In response to this funding uncertainty, a growing number of military operations are exploring demand response and ‘virtual power plant’ models that generate near-term revenue, thereby setting the stage for microgrids in the near future."

As Lynn said in July 2011, "For the past decade, we have lived in an environment in which new security challenges could be met by increased resources. Going forward, we will not have that luxury. We cannot simply spend more to cover a new mission. We are going to have to make hard choices about how to reallocate the resources we already have."

To address this situation, in 2011 the DOD released its first Operational Energy Strategy, which calls for a portfolio of energy conservation, renewable energy, and smart grid approaches to minimize costs.

Ability. The military has the capacity to innovate with fewer layers of "stakeholder involvement" than most utilities, which need to accommodate the concerns of shareholders, customers, state and federal regulators, and a variety of interest groups.

For example, Executive Order 13423 requires federal agencies to reduce energy intensity by 3% each year, leading to a 30% reduction by the end of fiscal year 2015, compared to a FY 2003 baseline, and the DOD aims to get 25% of its power from renewables by 2025 (Figure 2). Such mandates tend to accelerate the pace of change.

2. 25% by 2025. Courtesy: Pew Charitable Trusts

Track Record. The military has served as an incubator for the development of many technologies that migrated to the civilian/commercial space, including computing, the Internet, jet engines, high-performance materials, and nuclear power. It has been an early adopter—often the first adopter—of cutting-edge technologies. Of course, it has also tested technologies that either didn’t make the deployment cut or didn’t translate into commercial applications. But by virtue of its size, budget, mission, and capabilities, the Pentagon has at least the potential to accelerate development of components and practices that are essential to a smarter, more robust, and secure grid.

Systems Thinking. Another reason the U.S. military is, at least potentially, an ideal fast-track test bed for smart grid development is that it is used to systems thinking—considering all of the interconnected components of an infrastructure so that it can be made secure in either a stationary or mobile operation. A true full-blown smart grid would calculate, calibrate, and control all the inputs and outputs of a complete energy system, from energy sources to end uses. Although the DOD doesn’t yet have anything resembling a comprehensive smart grid, it may get there faster than individual utilities or regional grids.

Partners and Pilots

As on the civilian side, military smart grid efforts are mostly at the pilot stage, with some projects more fleshed-out than others and the majority of facilities not yet involved. Though it will take some time for the vision of an agency-wide energy management system to become reality, as with all smart grid efforts, one has to start somewhere. The difference on the military side is a greater sense of urgency and ability to get started.

As with so many other operations outside of its core competency, the Pentagon is outsourcing or partnering with others to get the job done. Among its partnerships with other government agencies is SPIDERS (Smart Power Infrastructure Demonstration for Energy Reliability and Security), which involves the Departments of Energy and Homeland Security. Its goal is to "demonstrate that microgrids developed using Sandia’s Energy Surety Microgrid (ESM) methodology have the ability to maintain operational surety through secure, reliable, and resilient electric power generation and distribution to mission critical loads" and entails three microgrid projects of different scales:

- Hickam Air Force Base in Hawaii: a circuit-level microgrid (crawl stage).

- Fort Carson in Colorado: a larger microgrid that will incorporate a large photovoltaic system and vehicle-to-grid (V2G) storage (walk stage).

- Camp Smith in Hawaii: the entire base will be incorporated into the microgrid, which will include significant renewable energy and storage (run stage).

The DOD is also partnering with a number of energy and engineering firms, including Boeing, GE, Lockheed Martin, Siemens, Honeywell, BAE Systems, SAIC, and Raytheon. As with SPIDERS, projects that go beyond installing generation sources entail some form of a microgrid.

Military Microgrids

As a September 2011 Pike Research report on military microgrids observes, "Many Army, Navy, Air Force, and other related bases and offices already have vintage microgrids in place. What is new is that these facilities are looking to envelop entire bases with microgrids and integrate renewable distributed energy generation (RDEG) on-site." Pike Research identified "roughly two dozen military facilities" in the U.S. that are involved in smart microgrid implementations.

One sign of this sector’s growth: Last year saw a conference dedicated to "Military Smart Grids & Microgrids." Pike Research‘s "average scenario for U.S. military stationary base microgrids estimates that 457 MW of cumulative capacity will be in operation by 2017." Almost 780 MW is forecast by the same date in the "aggressive scenario." The company predicts that "the capacity of military microgrids will grow at a rate of 739% between 2011 and 2017, increasing from 38 megawatts (MW) to 316 MW during that period, under a baseline forecast scenario."

The military is exploring both stationary microgrids (on bases, for example) and mobile grids, for field deployment. Though the lessons learned from stationary projects have more obvious transferability to civilian applications, lessons learned from mobile microgrids could also be valuable—for providing power to locales devastated by natural disasters, for example.

Pike Research forecasts for estimated revenue from stationary base microgrids: $430 million in annual revenue by 2017 in the average scenario and $767 million in the aggressive scenario. Estimates for mobile microgrids: over $30 million in 2017 for the average scenario and close to $45 million for the aggressive scenario. Real money, but not a lot of money in the context of overall military budgets.

According to an August 2011 DOE Microgrid Workshop Report, the long-term goal for the DOE Office of Electricity Delivery and Energy Reliability microgrid initiative is "To develop commercial scale microgrid systems (capacity 10 MW) capable of reducing outage time of required loads by 98% at a cost comparable to non-integrated baseline solutions (uninterrupted power supply [UPS] plus diesel genset), while reducing emissions by 20% and improving system energy efficiencies by 20%, by 2020."

Following are brief profiles of some current military microgrid projects and their status. As the DOD’s Robyn has said, the department wants "to test pretty systematically a range of technologies. We want to have a range of vendors so that we can have competition, and we want to test them in a number of different configurations."

Fort Bragg Army Base, N.C. Fort Bragg covers over 100 square miles and has been a leader in the areas of sustainable resource use, including microgrid development. Its microgrid, one of the largest in the world, can (like many) island itself from the main grid and includes several distributed generation sources (15 diesel generators, one 5-kW fuel cell, and a 5-MW gas turbine); SCADA communications, monitoring, and control capability; its own distribution network; and thermal energy storage (chillers produce chilled water at night, when energy is cheaper, for cooling use during the day). Honeywell has been a major industry partner. The base’s microgrid has enhanced electricity reliability and reduced overall energy costs.

Fort Bliss Army Base, Texas. In December 2010, the DOD selected Lockheed Martin to demonstrate an "intelligent microgrid" at a U.S. Army Brigade Combat Team complex at Fort Bliss. The two-year program is to test the ability of the company’s microgrid technology to supply peak power, support critical operations in the event of a major power source loss, and reduce greenhouse gas emissions and energy consumption by more than 20%.

Twentynine Palms Marine Air Ground Task Force Training Command, Calif. "29 Palms" is the largest U.S. base in the world. In 2009, General Electric (GE) was awarded $2 million for a technology demonstration contract to test and validate a microgrid system controller at the Mojave Desert facility. The DOD’s Robyn describes it as "the first major large-scale test of that technology." The microgrid, scheduled to be fully operational in early 2012, will be capable of islanding roughly a third of the marine base’s total load while meeting the DOD’s criteria for cybersecurity.

The facility has more than 1 MW of PV generation as well as a 7-MW gas-fired cogeneration plant. More PV, fuel cells, and energy storage may be added in the future. GE says it has "helped design a microgrid control strategy—for the largest microgrid in the U.S. among DOD sites—managed by a platform based on existing GE controls already utilized for smart substations." On-site and utility grid power and the base’s load demands will be "monitored and coordinated using the configurable logic of GE’s Multilin Universal-Plus relay."

Wheeler Army Airfield, Hawaii. This island base is home to the DOD’s first Smart-Charging Micro Grid (SCMG) system, which consists of a 25-kW solar array on a carport, 200 kWh of battery storage capacity, and four plug-in all-electric vehicles. The pilot program is a prototype designed to help make the installation energy independent. The Army says that "The system powers four electric vehicles and has the ability to provide instant backup power to support three buildings for 72 hours, including the garrison headquarters." Honeywell Aerospace won a cost-plus fixed fee $4.6 million contract for delivery, testing, and demonstration of the Wheeler microgrid.

Canada’s Rapid Electric Vehicles (REV) delivered the first APV (ancillary power vehicle) to Wheeler in December 2010. The APVs, based on Ford’s Escape SUV and its F150 pick-up, include REV’s proprietary energy storage and power train system, which enables stored energy to be used to power equipment or buildings, effectively making it a mobile energy transport system, the company says (Figure 3). By October 2011, REV had won three contracts to supply REV 300ACX V2G-capable electric vehicles to the Army’s Tank and Automobile Research, Development and Engineering Center. In a press release, REV said, "Together with SAIC we can meet the requirements that the Department of Defense has to increase national security by creating a virtual power plant from as many as 200,000 non-tactical electric vehicles by 2015."

3. Smart charging. One of the vehicle-to-grid SUVs that is part of the Wheeler Army Airfield "Smart-Charging Micro Grid." Source: U.S. Army

Bagram Air Base, Afghanistan. A 1-MW microgrid project went into operation in July 2011 at Camp Sabalu-Harrison on Bagram Air Base (Figures 4 and 5) and powers more than 60 structures. As Deputy Secretary of Defense William J. Lynn, III explained, "A major source of inefficiency in theater are daisy-chains of fuel-hogging generators at forward operating bases. Rather than efficiently distributing right-sized generators across a FOB, everyone often brings their own, resulting in tremendous overcapacity and waste. The microgrid project at Bagram will replace 22 existing generators with four energy efficient ones, yielded a 30% savings in fuel."

4. Smarter generation. Joe Barniak, contractor with Project Manger-Mobile Electric Power, and Michael J. Zalewski, RFAST-C mechanical engineer, stand in front of a power panel while looking at a Tactical Quiet Generator (TQG) at Camp Sabalu-Harrison. The power panel is part of the Afghan Microgrid Project that provides power to more than 60 structures at the camp with greater efficiency than the 20-plus TQGs it replaces. Source: U.S. Army, photo by Summer Barkley

5. Intelligent control. Joe Barniak, contractor with Project Manger-Mobile Electric Power, programs the Intelligent Micro Grid control unit at Camp Sabalu-Harrison. The 1-MW power grid is operated by Project Manger-Mobile Electric Power with forward engineering support of the project provided in part by the Research, Development and Engineering Command’s Field Assistance in Science and Technology Center nested in the 401st Army Field Support Brigade. Source: U.S. Army, photo by Summer Barkley

Tech Transfer or Gridlock?

In September 2011, the DOD’s Robyn—who manages and oversees permanent military installations worldwide as well as installation programs that involve energy, the environment, safety, and occupational health—said that her agency is "uniquely positioned to help get some of those [smart and microgrid] technologies commercialized so that we can go on and buy them as another commercial customer and use them in our buildings." Technologies that are demonstrated to be effective for the DOD, she added, are "likely to work for the rest of the country."

In October, Robyn told Defense News: "The first [step] is for us to be the sophisticated early adopter, and we’re really good at doing that. Then the next step is to buy it in large numbers and thereby jumpstart the commercial market. Each of these test-bed projects has a timeline. We give them a finite amount of money. There’s typically third-party validation, and we have an estimated return on investment.

"It’s not always appropriate to look at a return of investment—for example, if what you’re mostly focused on is enhancing the security of the installation."

There should be no question about the importance of more self-reliant, sophisticated, and flexible power grids for the military. However, the trickle-down benefits of DOD smart grid technology pilots for non-military electricity customers—in terms of new technologies and lower prices—may be limited.

To take a small example, the EVs currently being developed for the military are custom builds (as so much is for the military) by a new entrant, which suggests that the likely tech transfer between REV and the dozens of mainstream "legacy" automakers with better consumer brand awareness could be minimal. What could transfer to the civilian grid from V2G pilots is a better understanding of how to handle the distribution-level technical issues involved in using EV-stored energy to provide grid-balancing ancillary services. The regulatory and economic aspects of that transaction would be another matter.

Other energy storage technologies developed for military applications may not translate quickly into civilian life because of cost constraints, whereas the military’s primary reason for deploying energy storage is security rather than least cost. Over time, however, we can hope that experience gained in military applications leads to cheaper technologies.

Another limiting factor is that even for technologies that work technically, working practically can mean different things in military and civilian contexts. Microgrids, for example, are likely to remain relegated to energy users who put a premium on reliable power supply—including various types of industrial, corporate, and educational campuses.

Though the size of military renewable generation installations is smaller than most utility-scale projects beyond base gates, military microgrid projects may provide valuable lessons about balancing renewable and fossil-fueled generation sources. They could also accelerate greater deployment of distributed renewable generation, something that at least one leading utility CEO, NRG Energy Inc.’s David Crane, already has his eye on. According to an interview with Yale Environment 360, "The electricity future, says Crane, will be transformed by the widespread adoption of three innovations: solar panels on residential and commercial roofs, electric cars in garages, and truly ‘smart meters’ that will seamlessly transfer power to and from homes, electric vehicles, and the grid."

One would hope that the civilian electricity sector could also benefit from cybersecurity insights gained through military microgrid endeavors; however, given the number and type of vulnerabilities on the civilian grid, the solutions and standards would likely be somewhat different.

The greatest potential for tech transfer lies in robust microgrids. Mobile microgrids—not unlike those being used at FOBs—could benefit civilian energy users, particularly when they are needed to respond to natural disasters such as hurricanes, floods, and tornados. As for stationary microgrids, the longer the many players pulling the strings of the continental grid delay grid modernization, the stronger the business case becomes for developing even more islanding-capable microgrids.

—Dr. Gail Reitenbach is POWER‘s managing editor.