Spain has served as both exemplar and scapegoat when it comes to renewable energy policy. Though power policy must necessarily accommodate specific national resources and goals, Spain’s experience as an early and eager adopter of renewable energy technologies and subsidies is a cautionary tale of how the best intentions can have unintended consequences.

Spain, the fifth-largest economy in the euro zone, has been slammed by the global economic crisis and faces a critical energy dilemma. Struggling to tamp down power prices, but unable to afford billions of euros in funding, the debt-burdened government has been forced to retroactively slash its subsidies for renewables—a measure that has frozen investment in renewables and battered the nation’s once-booming solar industry. Meanwhile, policies to phase out coal power have destroyed Spain’s domestic coal mining industry and prompted debilitating strikes by coal miners. The nation’s nuclear power sector, too, is under siege: A moratorium on building new reactors has driven the government—amid opposition that was intense even before the Fukushima Daiichi emergency this March—to extend the lives of aging reactors.

The Kingdom of Spain saw more than two decades of dizzying economic growth before the abrupt contraction in its economy in mid-2008. Its gross domestic product (GDP) growth rate reached a historic high of 1.53% in December 1997 and a record low of –1.70% in March 2009. The nation exited the recession last year, but it continues to face soaring unemployment. Nearly 20% of Spain’s 45.9 million people are jobless—the highest rate in the 27-member European Union (EU). Despite government efforts to boost the economy through stimulus spending and loan guarantees, the government budget deficit increased from 3.8% of GDP in 2008 to about 11% in 2011. To control the deficit (and reduce it to 6% by next year), as well as avoid financial contagion from other highly indebted euro zone members like Ireland and Greece, the government has implemented austerity measures, tried to privatize industries, and attempted to boost competitiveness through labor market reforms.

Most economists blame the economic woes on a burst housing bubble and the international credit crunch. Others, like Dr. Gabriel Calzada Álvarez, an economics professor at the Universidad Rey Juan Carlos in Madrid, point to the government’s substantial subsidies for the country’s inflated renewable energy sector, which Álvarez has said created large debt bubbles and artificially created a new market that would collapse without more public funding.

In a much-cited, controversial March 2009 report on the effects that renewable subsidies have on employment, Álvarez contends that between 2000 and 2008, Spain’s government spent more than $36 billion to subsidize renewable projects, while consumers paid almost $10 billion more for renewable power than set market cost. Álvarez also suggests that the resulting higher energy costs and “green” jobs may have more than doubled job losses economy-wide. Critics of the report say his analysis was “too simplistic” to be applied as a real-world model and that he deviated from peer-reviewed methodologies to estimate job impacts.

Creating a “Sustained” Renewable Policy Framework

In 1980, Spain’s social-democratic Socialist Workers Party enacted a law after the second international oil crisis to support what they called a “sustained” framework for the development of renewable energy. In 1997 another law was ratified that deregulated the power market while mandating that 12% of primary energy demand was to be met with renewable sources by 2010. By 2005, when it became apparent that objective would be difficult to achieve, the government approved a new Renewable Energies Plan calling for 29.4% of gross electricity demand to be covered by renewable sources by 2010.

To support sales of renewable power, the government put in place a feed-in tariff system, establishing fixed tariffs to be paid on top of market prices for renewable power installations. (See “The Feed-in Tariff Factor” in our Sept. 2010 issue or in the archives at https://www.powermag.com.) Later, in June 2009, a directive based on targets set by the EU called for 20% of final gross energy demand to be met with renewables (and for cutting greenhouse gas emissions by 20% compared with 1990 levels).

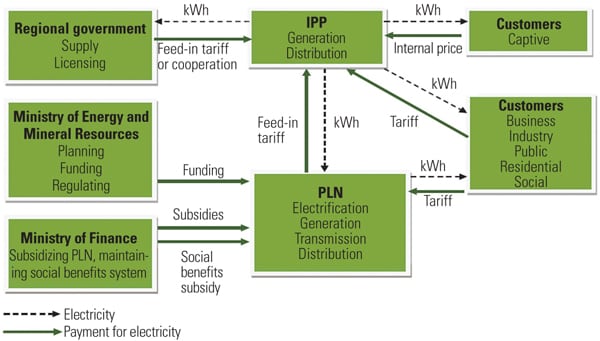

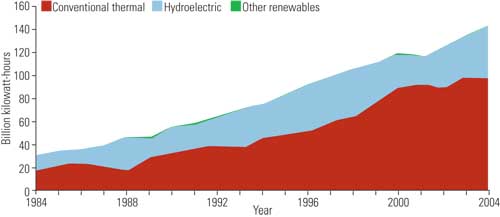

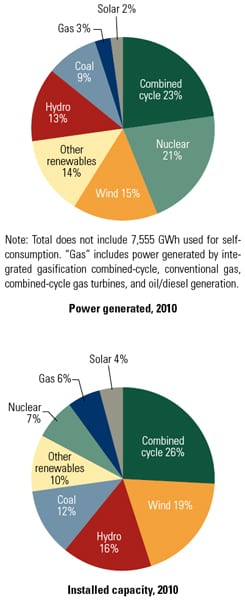

The mandates have transformed Spain’s generation mix. Compared with the 1990s, when coal, hydro, oil, and nuclear facilities generated nearly 99% of the nation’s electricity, in 2010, those four sources accounted for 69%. Gas-fired generation has grown exponentially in response to increasing amounts of variable wind power that require back-up generation and to meet swelling demand (a report by Spanish law firm Gomez-Acebo & Pombo notes that “Spain has one of the highest rates of energy consumption per unit of [gross national product] in the EU”). Wind power, meanwhile, surged from 5 TWh in 2000 to 42 TWh in 2010 (Figure 1).

|

| 1. Spain’s electricity profile. Installed power capacity in Spain’s electricity system in 2010 amounted to 103,086 MW. Power actually generated totaled 275,252 GWh, including reductions for self-consumption, pumped storage consumption, and international exchanges. “Factoring in the effects of seasonal and working patterns, the annual [demand] growth was 2.9%, compared to a fall of 4.8% registered in 2009,” grid operator Red Electrica de Espana (REE) said in its annual report. Source: REE |

“Without doubt, the main factor underpinning our success in integrating [renewable] sources into the electricity generation system has been the economic and legal framework comprising a system of regulated premiums and feed-in tariffs, which has been in force for the last 30 years and has been subject to ongoing improvements and modifications,” says Miguel Sebastián Gascón, minister for Industry, Tourism and Trade in a government renewables-specific website. The minister also says the country’s solar thermal, wind, and other sectors are among the largest in the world, and that it is on course to exceed the EU’s 20% renewable target. He adds: “This framework is stable but adaptable to the current status of each technology as it matures.”

Industry Structure

Spain today splits its generating units into two groups—ordinary and special regimes—based on how they interact with the competitive electricity market. Five companies generate the bulk of conventional power, which includes large hydro, nuclear, coal, and gas: Iberdrola, Endesa, Gas Natural Fenosa, E.ON, and HidroCantábrico. All generators under the ordinary regime sell power to suppliers through the wholesale market pool or bilateral contracting and receive remuneration for power sold on the market, plus capacity payments (including 10-year investment payments that vary according to the net power of the plant).

Special regime generators—those that produce power from renewables with installed capacities of up to 50 MW and cogeneration facilities—are not required to bid in the power pool and are permitted to sell power at government-ordained tariffs or at the Spanish pool price, plus premiums and incentives. In 2010, according to grid operator Red Eléctrica de España (REE), special regime generators produced 33% of the country’s peninsular power.

Growing Demand and Capacity

Peninsular Spain’s electricity demand (excluding its islands) currently exceeds 259,940 GWh, having risen 30% since 2000. The increase would have been more dramatic were it not for the economic slowdown, when demand plunged 5%, from 265,281 GWh in 2008. In 2007, industry consumed 38% of Spain’s generated power, followed by the services and agricultural sectors. Households consumed 33% of all power generated.

National energy plans drawn up before the recession call for substantial increases in total generation (72 TWh between 2008 and 2016) to fuel future growth, including further ramping up of gas power by 42 TWh and wind power by 33 TWh, but cutting coal-fired generation by 23 TWh and oil by 10 TWh. An increase of nuclear power is also foreseen—but only through uprates.

Spain has already made great strides in adding new capacity. The International Energy Agency (IEA) reported that from 2001 to 2008, total capacity increased by 87%—one of the largest hikes for a member country. As of 2010, about 95% (97,447 MW) of capacity was installed in the peninsular system and the rest, 5,639 MW, was installed in other territories, including the Canary Islands and Balearic Islands.

The Renewable Future

Because of its size and geography, Spain’s climate varies substantially by region (see a map of all of Spain’s power plants at http://bit.ly/hiFN3h). And climate has influenced its choice of renewables.

Hydro. About 1,200 hydro plants with a total installed capacity of 18.97 GW have been built in Spain, 20 of which are 200 MW or larger, and at least 2,400 MW of which is pumped storage (Figure 2). Though these represent about 50% of the hydro total, they have been underperforming since 2004, mostly because of increased droughts (blamed by the government on climate change). In 2010, however, the nation saw abundant rainfall that allowed hydroelectric facilities to generate 36.6 GWh—30% higher than the historical average and 65% above the 2009 figure.

|

| 2. Pumping up wind. Spanish renewables giant Iberdrola’s 1989-built 635-MW La Muela pumped storage facility will be followed by the 852-MW La Muela 2, slated to be operational in 2012. The ability to dispatch pumped storage power helps to mitigate the variability of wind power. Courtesy: Iberdrola |

But droughts and fierce opposition by environmental groups aren’t the only reasons large hydropower plants will not be counted on as significant future energy sources. In addition, “there are [no more] available spaces in our rivers for the installation of a big hydro plant,” explained David Gomez, the director of energy for Spain’s Trade Commission, based in Los Angeles. The country intends to exploit all its hydro potential, he told POWER, through so-called “mini-hydro plants” of less than 10 MW, which are subsidized through feed-in tariffs.

Wind. Wind is faring better. Spain boasts that wind power produced 42,976 GWh in 2010—15% of total generation. The sector’s rapid growth, reportedly boosted by premiums and feed-in tariffs, has been aided by a burgeoning wind manufacturing industry. Several wind turbine makers have set up shop in Spain, including Gamesa, Eólica, Acciona Windpower, and Alstom-Ecotècnia, and Spanish wind farm developers like Iberdrola and Acciona Energía have projects all over the world. The component supply chain, too, is thriving: 75 industrial centers related to wind exist in Spain, 18 of which are wind turbine assembly plants.

Solar. In contrast, the solar photovoltaic (PV) sector, which over the past five years saw a similar—maybe even more pronounced—boom driven by high subsidies, has been frozen by uncertainty following the government’s December 2010 decision to retroactively slash previously agreed-upon subsidies to solar energy producers.

Meanwhile, the country maintains its dominance in the solar thermoelectric sector (see the sidebar). More than a third of worldwide solar thermal electric capacity is installed in Spain. The country that commissioned the world’s first commercial central tower plant (the PS10 plant in Seville, Figure 3) in 2006 after establishing a feed-in tariff, is actively developing projects to increase solar thermal capacity to 2,400 MW by 2013—and it is building and managing several projects around the world. Of new capacity planned, 93% will likely be parabolic trough receiver technology, central towers will make up 3%, and the remainder will be Stirling dish and Fresnel receivers.

|

| 3. A solar beacon. The €35 million ($49 million) 11-MW PS10 concentrating solar power tower, a facility featuring 624 heliostats, went into operation in 2007. In 2009, owner Abengoa Solar completed PS20, a 20-MW solar tower facility at the same platform in Sanlúcar la Mayor. It later began operating Solnova 1, 3, and 4, three of five planned 50-MW parabolic trough plants. Along with two other 50-MW projects (Solnova 2 and 5), another 20-MW tower plant (AZ20) and an 80-kW concentrating solar plant based on Stirling dish technology are under construction there. Courtesy: Abengoa Solar |

Biomass. Feed-in tariffs for biomass were also implemented in 2007, but growth for that sector has been slow because the remunerative framework that could spark significant growth was “enacted practically as the recession hit,” the Ministry of Industry said. Today, Spain has some 400 MW of installed biomass capacity, fueled by products from the pulp and paper, timber, and olive oil industries.

Other Renewables. Spain has yet to fully develop its marine and geothermal power sectors. Valencia-based Iberdrola Renovables is spearheading a project to install 10 Ocean Power Technology buoys for a total rated capacity of 1.35 MW at a pilot marine energy plant in Santoña. Meanwhile, though studies have shown Spain has substantial geothermal resources, no power plants exist. Geothermal energy is being developed for heating, however.

Subsidies: The Shadow on Solar and Wind

Spain began subsidizing renewable and combined heat and power sources after the adoption of its Electric Power Act in 1997. In 2004, a new law allowed renewable power generators to choose between a regulated tariff or a market price plus premium. And in 2007—after the EU established a target for member countries to source 20% of their power from renewables by 2020—another law set high and low electricity purchase price levels for some technologies.

The level of public financial support and total revenues per kilowatt-hour varied significantly. In 2008, for example, wind generators received €0.069 to €0.086/kWh ($0.10 to $0.12/kWh), while solar PV producers got almost quadruple that: €0.32/kWh. This subsidy mechanism, the so-called “feed-in tariff,” was guaranteed for 25 years, or for the lifetimes of the systems, to increase investor confidence.

And it worked. Generous subsidies rapidly boosted PV development in Spain. By the end of 2008—just as the economic crisis hit the country—solar PV capacity had exceeded the initial capacity target for 2010 more than eightfold.

After the onset of the financial crisis, the price of electricity from new PV projects was lowered to €0.259/kWh from €0.440/kWh, reports The Global Subsidies Initiative (GSI), an international watchdog that monitors “the transfer of public money to private interests.” By comparison, the market price for electricity from natural gas, for example, has been under €0.045/kWh. According to the GSI, in 2009, solar PV tariffs alone amounted to €2.7 billion, though the sector supplied only 2% of Spain’s electricity. GSI points out that wind producers received €600 million for supplying 12% of the country’s power.

Another critical problem with Spain’s feed-in tariff system is that instead of allowing utilities to charge more for renewable power bought at above-market prices (and letting consumers bear the brunt of the hikes), the nation has preferred to keep the price of power artificially low. That means that utilities have shouldered the burden, operating at a loss and trusting in a government guarantee to eventually pay them back. Sources say the sum of this “tariff deficit” has ballooned to more than €16.5 billion since 2000.

Then, last year, faced with an economic crisis and buckling under an overall burden of debt, Madrid drastically cut spending and implemented austerity measures that included slashing renewable subsidies. On Christmas Eve, the Industry Ministry announced it would slash PV solar subsidies between 10% and 30% for existing projects until 2014—or €3 billion over the next three years.

PV backers, including foreign private equity groups and specialist funds, are outraged by the possibility that cuts will be imposed retroactively (on plants built before 2008). Filing lawsuits, they say government’s “sudden reversal in policy” breaches long-term contracts, and it could drive many of them out of business. Legal challenges have already been filed by the regional authorities of Extremadura, Murcia, Navarra, and Valencia; at least 15 international investors, who have pumped more than €4 billion into Spanish solar PV projects, are also seeking reparations.

European Commissioners Guenther Oettinger (for energy) and Connie Hedegaard (for climate) have also chimed in about the cuts ordained by Royal Decree 14/2010 and approved by the lower parliament earlier this year. They warned that “forward-looking changes [to tariffs] may be understandable and necessary,” but that the European Commission “will not accept retroactive amendments.” Further, they argue, the nation’s cap on the number of production hours when solar generators can earn above-market rates adds to a perceived risk of investing in renewables. “Without stability and predictability, there will be more risk of delays,” the commissioners wrote to Industry Minister Miguel Sebastian on Feb. 22. “You must not forget that the negative consequences for investors’ confidence from retroactive changes in the economic conditions of one type of renewable facility may spread and produce similar effects for other types of facility in other countries.”

In March, Industry Minister Miguel Sebastian promised PV investors his department would “find solutions to prevent irreparable damages” to the sector. Key participants are hopeful: In July last year, the government managed to reach an agreement with the wind power sector under which it would cut top-up rates to wind producers by 35% until 2013—a measure that could save it €1.3 billion.

In the last week of March, Reuters reported that Spanish energy regulator Comision Nacional de Energia (CNE) had suspended subsidies for 350 PV systems alleged to have been providing fraudulent power production figures. PV Tech quoted the Spanish Renewable Producers Association as saying that owners of as many as 9,000 of Spain’s 55,000 registered PV systems could be questioned (most, for technical issues dealing with registration, it claimed). CNE had drafted a bill to prevent solar fraud in January 2009 after some plants were exposed for receiving subsidies without actually generating power.

Coal Use Contracts, Natural Gas Use Expands

The rise of renewables in Spain has increased natural gas use and, as expected, constricted coal use. Spain—a once-thriving coal exporter—in recent decades has turned to importing nearly 73% of its supplies, mostly from South Africa, but also from Indonesia and Russia. About 90% of all coal is used to generate electricity, producing 25,851 GWh—or about 9% of total generation. This compares with 74 TWh of coal-fired power produced in 2007, which made up almost 24.8% of total generation.

Coal use, as frequently explained by industry analysts, has been affected by pollution requirements and competition with natural gas. Electricity industry association UNESA claims that coal-fired power plants in Spain have an average efficiency of 37% and emit 930 kg of carbon dioxide/MWh, whereas combined-cycle gas turbines are 52% efficient and emit 365 kg of the greenhouse gas per MWh. That makes coal generation expensive to operate under the EU’s cap-and-trade program. Other reasons for the drop are that coal plant operators have had to take plants offline to abide by increasingly rigid EU directives, and the operation of coal plants that are used to supplement hydro is dependent on hydrological conditions.

This is not to say that the sector will disappear altogether. Spain’s Prime Minister José Luis Rodríguez Zapatero, who comes from the coal heartland of León, in October 2010 won the European Commission’s approval to subsidize—but only until 2015—utilities that are operating coal-fired power plants in return for their use of Spanish coal rather than imported coal, which is more affordable and of higher quality. Zapatero was looking to cushion conditions for tens of thousands of workers in coal mines, who have been protesting nonpayment, but as he told the commission, coal is also necessary to protect the country from power supply shocks caused by intermittent generation.

Spain’s government is also pouring public funding into several cleaner coal technologies. In October 2010, energy firm ELCOGAS started capturing carbon dioxide from a 14-MW pilot plant built at its 335-MW integrated gasification combined-cycle (IGCC) facility at Puertollano. The Puertollano IGCC plant some 200 km south of Madrid—which began commercial operation in 1996 with natural gas and in 1998 with syngas from gasification of an equal mixture of local coal (with an ash content of more than 40%) and high-sulfur petcoke—is one of only five utility-scale IGCC facilities in the world.

Also under way is the much-watched Integrated Carbon Capture and Sequestration Technology Development Plant under construction at Endesa’s Compostilla power plant in Ponferrada. The Spanish utility is collaborating with research institution CIUDEN to set up a 30-MWth Foster Wheeler–built circulating fluidized bed unit and test Foster Wheeler’s Flexi-Burn carbon capture technology. The unit, which will test burn a wide range of domestic (mostly anthracite) and imported coals—as well as biomass—is expected to start operations by the second half of 2011. Testing programs are expected to follow thereafter.

Natural gas, on the other hand, has become the most significant component of Spain’s power profile. The amount of gas consumed for power generation depends on the availability of wind and hydropower. In 2010, 68,828 GWh were generated by combined-cycle gas turbines (CCGT)—23% of total generation (Figure 4). CCGT installed capacity surged nearly 10% from 2009 to 2010. However, Spain imports more than 99% of its gas, mostly from Algeria, Nigeria, and Qatar.

|

| 4. Gas-guzzling. Since 2000, gas-fired generation has grown by 101 TWh, driven by requirements for fast capacity increases, wind power backup, and Europe’s cap-and-trade program. Today, combined-cycle gas turbines (CCGT) have an installed capacity of 26.8 GW—more than any other fuel source in Spain. This image shows HC Energía’s Castejón CCGT Plant in Navarre. The 2002-built Unit 1 has a capacity of 424.9 MW; the 418.5-MW Unit 3 started commercial activity in January 2008. Should the supply of natural gas be interrupted, Castejón 3 can also use diesel. Courtesy: Iberdrola |

Phasing Out Nuclear

Spain’s eight nuclear reactors—accounting for a total installed capacity of 7.7 GW—produce a fifth of the nation’s power. The sector got its start in June 1965, when construction began on the country’s first nuclear plant, the Jose Cabrera Zorita, a pressurized water reactor. In 1971, the 460-MW Santa Maria de Garoña, a boiling water reactor (BWR), began commercial operation, followed two years later by the 500-MW Vandellos-1, a gas-cooled reactor. All three plants were turnkey projects.

In the 1970s, construction began on seven reactors, but just five were completed. Construction of five other plants began in the 1980s, but only two were completed (Trillo-1 and Vandellos-2) after the socialist government imposed a moratorium on new nuclear in 1983, citing economic reasons. In 1994, after the Minister of Industry and Energy proposed a plan in which alternative energy would phase out nuclear—and vowed to shut down older plants when they reached the end of their 40-year lifetimes—five other units under construction were abandoned.

Spain is planning to add 810 MW of nuclear capacity through uprates. The Iberdrola-owned Confrenetes BWR that came online in 1985 has been uprated four times, taking it to 1,063 MW or 112% of its original capacity. Plans to be implemented later this decade will increase the plant’s power to 120% of original capacity. In March—just a day before workers began their long struggle to cool the quake-stricken Fukushima Daiichi reactors in Japan—the Spanish government recommended a 10-year extension for the operating license of the Confrenetes plant. In February, Spain’s parliament removed a legal provision limiting nuclear plant lives to 40 years. It remains opposed to new construction, however.

Since Fukushima, the government is reviewing key renewal decisions, such as the highly controversial 2009 decision by the Nuclear Safety Council (CSN) to renew an operating license for the country’s oldest plant, the Santa Maria de Garoña. The government had already shut down Vandellos-1, the gas-graphite reactor, in the mid-1990s, after a turbine fire made the plant uneconomic to repair, and Jose Cabrera in 2006, after it reached its 40-year limit. Although CSN said plant owner and operator Nuclenor had implemented a €155 million work program to keep the 40-year Santa Maria de Garoña serviceable, the current socialist government—which campaigned on an anti-nuclear platform—forced the regulatory body to grant it only a four-year, rather than a 10-year, license, taking it to 2013.

Several reactors’ licenses have been approved since then, including Almaraz 1 and 2, and the 1,045-MW Vandellos 2, the newest and largest plant of Spain’s fleet (Figure 5). In response to recent pressures to shut down Garoña, CNE’s Antonio Cornado told Agence France Presse that the question was “not if Fukushima is similar to Garona” but whether Japan had the same seismic or tsunami risks as Spain. “The answer is ‘no,’” he said.

|

| 5. No new nuclear. Spain has no plans to build new nuclear plants. Since the Fukushima Daiichi emergency, license renewals for plants like Santa Maria de Garoña, the oldest in Spain’s fleet, have been criticized. Spain’s newest reactor is the 1,045-MW Vandellos 2 (shown here), built in 1988 near Tarragona in northeastern Spain. Courtesy: Foro Nuclear |

Spain’s uranium resources are limited to Salamanca, where the metal was mined from 1974 to 2000, when activities trickled to a close due to low uranium prices. According to the World Nuclear Association, most of the 1,600 metric tons of uranium used in Spain each year are imported from Niger.

Currently, the country stores some 6,000 metric tons of spent fuel at reactor sites. Though it has no reprocessing plans, the government has called for construction of temporary dry storage facilities at the Trillo nuclear plant and at the now-closed Jose Cabrera plant, until a longer-term storage facility can be established. Two options are being considered for longer-term storage: the preferred, centralized nuclear spent fuel and high-level waste storage facility (whose site selection began in December 2009) and a deep geological facility. Nuclear waste management strategies, funded by a 1% tax on nuclear power revenues, also include research on extended onsite storage conditions and advanced recycling options.

Balancing Renewables on the Grid

Spain’s management of its transmission system has blazed a trail for countries looking for examples of how to balance a national grid that is fed by a large amount of renewable generation. The variability of wind generation in particular—which made up 15% of the nation’s power profile in 2010—keeps grid operator REE precariously balancing load. The challenge has recently become riskier: REE in 2004 warned that trying to integrate more than 14% of wind power could significantly increase the possibilities of a major power cut.

One way REE says it manages large amounts of renewable power is through its Renewable Energies Control Centre (CECRE). Opened in 2007, that pioneering operational unit within the REE Power Control Centre is used to supervise and control sources of intermittent generation. Every 12 seconds, CECRE analyzes connectivity and wind speed from all wind farms rated at 10 MW or more and uses that data to calculate wind-powered generation levels. It also assesses the real-time risk of a sudden loss of or surge in wind power.

Still, every day brings new challenges. On Nov. 9, 2009, for example, Spain’s wind farms generated record power—315,258 MWh—enough to meet 43% of demand (at around 2 a.m.). Earlier, on June 26, at 10:32 a.m., wind farms barely covered 1%. Intense fluctuations are dealt with by using pumped storage plants as much as possible while switching off CCGT plants on a daily basis.

“Spanish legislation gives priority to renewable energies when it is possible and secure,” María Pachón, REE spokesperson, told POWER in March. “Red Eléctricas’ role consists just of putting into practice [the Industry Ministry’s political] decisions under secure conditions.” Solutions being considered in the near term include international interconnections, using surplus wind for pumped storage, and, in the long term, charging electric vehicle batteries.

Meanwhile, Spain is pressing on with plans to build new transmission links. Currently, the grid is divided into primary (at least 380 kV) and secondary (220 kV to 380 kV) transmission networks composed of over 35,797 kilometers of transmission lines and more than 3,000 substations. It also has, through the 2007-created integrated Iberian electricity market (MIBEL), interconnections with France, Portugal, Morocco, and Andorra, equal to some 5% of generating capacity. The Energy Infrastructure Investment Plan (2008–2016) calls for projects developing the 220-kV and 400-kV networks, including a high-voltage power link between the mainland and the Balearic Islands and reinforcing international links with France and Portugal (with whom Spain plans to exchange, at minimum, 3,000 MW).

Key Challenges Remain

Spain must monitor and resolve the key challenges posed by the large, rapid development of renewables—striving, above all, to “balance objectives of environment, competitiveness, security of supply and efficiency in its policy formulation,” says the IEA in a 2009 country analysis.

It should also end a mechanism that uses capacity payments as a substitute for market-based incentives to build new generation capacity because it tends to lead to inefficient investment decisions, the agency says. These payments provide participants with the “perverse incentive of withholding their plans for new capacity in order to receive the payment,” and are “complex” to administer. Another critical needed improvement is to increase retail prices and resolve government-incurred tariff deficits of up to €16 billion.

The country’s emphasis on the long-term integration of renewable power is commendable, the IEA said, but it is crucial that the nation establish clearer policies regarding other sources, such as nuclear. It also must ensure a streamlined and transparent siting and permitting process that includes interconnection to the grid for renewable developers.

Another concern is that the nation has not adequately assessed the need to build and operate backup capacity to compensate for the unavailability of intermittent renewable sources. CCGTs were and will continue to be the best option for peak-load supply and backup capacity, but they increase greenhouse gas emissions and raise security-of-supply issues owing to the volatility of international gas markets.

“Uncertain policies are bound to affect the investment climate,” the IEA concluded.

— Sonal Patel is POWER’s senior writer.