The world faces a glaring ambition gap for electricity supply, concerns about system flexibility, risky progress and development, and an electricity demand shakeup. Several other overarching trends are affecting the world’s power sector as the transition unfolds.

While 2021 unfolded with some relief from the chaotic global pandemic that jolted the world in 2020, the year may be remembered for its extraordinary series of energy crises. After a cold snap prompted mass generation outages across a swath of the central U.S., most prominently in Texas, volatile energy markets and power supply vulnerabilities jacked-up turmoil in California, China, India, and across Europe and Latin America.

The International Energy Agency (IEA) took stock of these events as it rolled out its World Energy Outlook (WEO2021) in October ahead of the United Nations Climate Change Conference (COP26) meeting in Glasgow, Scotland. Scenarios that could move the world toward limiting global warming to 1.5 degrees Celsius may usher in a “new energy economy” centered on electricity, but they must at the outset take into account that the system is ridden with risks to energy security, affordability, and sustainability, the agency warned.

Here are eight overarching trends gleaned from the Paris-based autonomous intergovernmental agency’s annual outlook.

A Glaring Ambition Gap for Electricity Supply

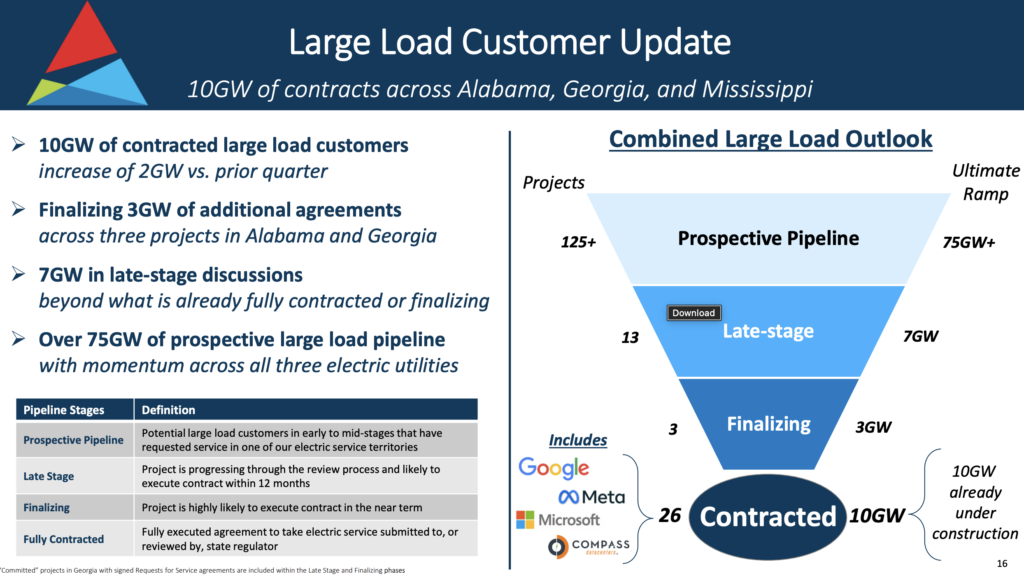

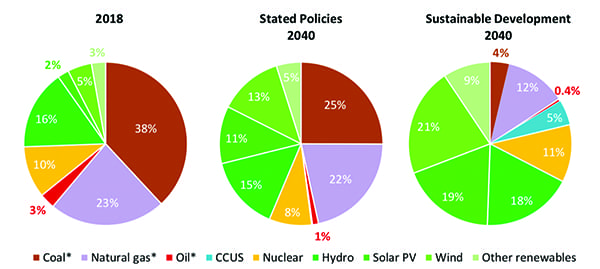

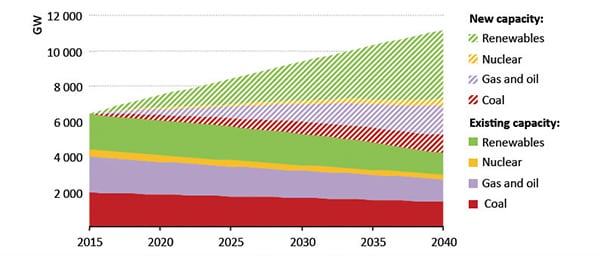

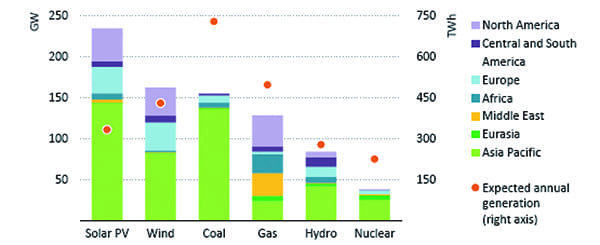

Continuing their trajectory, massive additions of solar photovoltaics (PV) and wind capacity in 2020 raised renewables’ share to 30% of total generation and squeezed fossil fuels’ share to 61%, the lowest level in the last three decades. According to Brent Wanner, head of IEA’s Power Sector Unit, policy support in more than 130 countries and “very low” technology costs have driven this growth. Decarbonization and electrification demands, including for hydrogen production from electrolysis, will continue to fuel new renewable installations, and the IEA expects that existing and already announced policies outlined in the “Stated Policies Scenario” (STEPS) may lead to an increase in combined renewable capacity additions from a record 248 GW in 2020 to 310 GW in 2030.

However, “unabated” coal-fired generation is still slated to remain the largest source of electricity through 2030 under STEPS, Wanner said. While financing new coal power plants has become increasingly difficult, 140 GW of new coal capacity was under construction and more than 430 GW were in planning stages when the report was released before COP26. During the historic climate conference, 47 countries supported a statement to cease new construction of and stall permitting of new unabated coal generation. These include several coal heavyweights like Indonesia, which suggested it may target a 2040 phaseout with international financial and technical assistance. Ukraine, Vietnam, Poland, and South Korea also committed to phaseouts, while India announced it would target a 2070 net-zero goal.

These announced pledges could halt investment decisions and facilitate retirements of nearly 150 GW of coal-fired capacity by 2030. Even so, the world still faces a substantial “ambition gap” of the carbon emissions reductions needed to put the world on a solid pathway to achieve net-zero emissions by 2050 (Figure 1), the IEA said.

|

|

1. The International Energy Agency (IEA) reported that fossil fuels accounted for 61% of global electricity generation in 2020—the lowest level in 30 years—while renewables accounted for nearly 30%. By 2030, wind and solar photovoltaic growth will lead renewables to a share of nearly 50% under announced pledges and potentially much higher, it said. Courtesy: IEA |

“We estimate additional wind and solar PV, and hydropower expansion in developing economies, as well as some nuclear power expansion and lifetime extensions are cost-effective measures that could cut the gap by 60% going forward,” said Wanner. How much new hydro and nuclear capacity could come online is still in flux, however, given shifting policy and investment decisions.

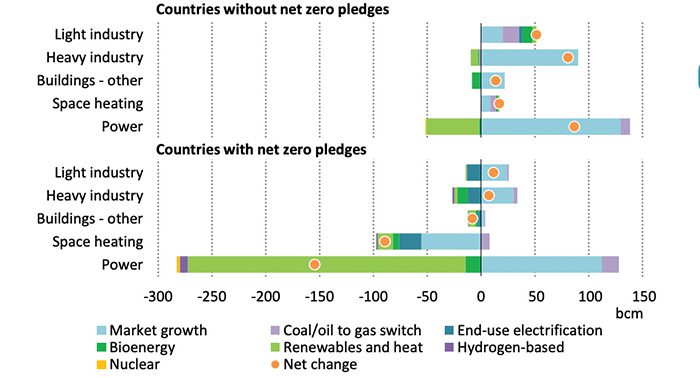

The IEA is more resolute about its outlook for natural gas generation, which it projects will increase between 5% and 15% to 2030. Natural gas, already the largest source of power in advanced economies, “remains broadly stable in those economies over the next decade, while it increases by about one-third in the emerging market and developing economies, helping to moderate coal,” the agency said. If a broader push for net-zero emissions is implemented, however, “unabated” natural gas will likely begin a “long-term decline” before 2030, it said (Figure 2).

|

|

2. Natural gas demand drivers vary by market, but coal-to-gas switching is slated to increase gas demand across the board. Low-carbon fuels like hydrogen and ammonia may also moderately affect future natural gas demand. Courtesy: IEA |

Concerns About System Flexibility

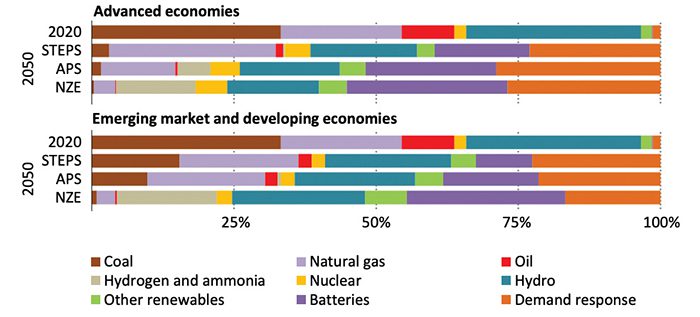

The massive influx of non-dispatchable variable generation from renewables is driving more emphasis on greater flexibility, from minute-to-minute, hour-to-hour, and season-to-season. The WEO2021 suggests that in the U.S., the European Union (EU), and China, average flexibility needs will rise by more than 40% from 2020 to 2030. If net-zero ambitions are achieved by 2050, global average flexibility will need to quadruple, it suggests. So far, system planners have relied on thermal generators for flexibility, but over the longer term, the IEA projects hydropower, bioenergy, and even nuclear power plants may become more central to system flexibility (Figure 3).

|

|

3. Coal and natural gas generation will remain “cornerstones” of electricity flexibility, but flexibility profiles are slated to change as power generation mixes across the world transform, the IEA suggested. This graphic shows three IEA scenarios: the Stated Policies Scenario (STEPS), which explores where energy systems might go without further policy intervention; the Announced Pledges Scenario (APS), which assumes announced policies (as of October 2021) will be implemented; and the Net-Zero Emissions by 2050 Scenario (NZE). Courtesy: IEA |

Storage technologies, including batteries, pumped hydro, compressed air energy storage, gravity storage, and hydrogen and ammonia energy storage, will likely play a “much larger role” in all scenarios. But the WEO2021 also notably highlights demand-side response’s potential—which will depend heavily on the implementation of necessary regulations and digital infrastructure. Efforts could include demand time-shifting from air conditioners, heat pumps, and electric vehicles. Transmission lines could also assist in balancing demand and supply within and between regions, for example, by linking hydro-rich systems to centers of high demand.

Progress and Development Has Been Limited, Risky

Time to act on transition measures will be essential. Pramudya, sub-coordinator of Power System Planning at Indonesia’s Ministry of Energy and Mineral Resources, noted his country’s utilities are balancing new resource additions, policy shifts, and implementation of new grid codes at existing plants. “We’re facing an over-supply inventory if we need to add more renewable plants in order to increase the share of renewables.” The issue will affect all aspects of the power business, including generator compensation, Pramudya noted. “When variable renewable energy resources come onto the grid, that will [affect] the capacity factor of baseload power plants, which will decrease the availability factors agreed to in power purchase agreements.” Policy shifts could also affect utility bottom lines, particularly as they affect power plant lifetimes, he said.

Infrastructure is also limiting. Offering a developer’s perspective, Enrique De Las Morenas, head of Competitor Intelligence, Market Studies, and Strategic Analysis at Enel’s Global Power Generation division, noted “two very different realities” exist depending on market dynamics. “In developing countries, we are reaching a point where saturation of renewables is creating a lot of difficulties in regards to the permitting process, and we need to make sure that governments put in place measures to bring renewables closer to the population.” Permitting issues must go hand-in-hand with grid planning, he suggested. “In the developing world, we are reaching many bottlenecks in terms of distribution and networks that are no longer capable of providing access to all the renewables we want to deploy,” he said.

Expanding infrastructure is costly and may take decades: the WEO2021 suggests grid investments alone may require $370 billion on average over the next decade, with most of the increase going to distribution. To achieve net-zero by 2050, grid investment will need to soar to $630 billion a year. As the transition unfolds and energy systems become more coupled, markets must also recognize flexibility’s broader value, Morenas suggested.

The Electricity Demand Shakeup

Complicating the supply picture is how electricity demand is shaping up. “We observe that key parts of energy demand are increasingly becoming electrified, as we see with the rapid growth of sales for electric vehicles as well as electric electrification of buildings heating and some industrial processes in an increasingly complex energy system,” said Michael Waldron, head of IEA’s Energy Investment Unit.

The WEO2021 suggests that under STEPS, demand could soar 80% by 2050, above today’s level of 23,300 TWh to 42,000 TWh. The electrification of transport under announced policies alone could drive demand by 900 TWh in 2030. Improved energy efficiency will be critical to “tempering” demand growth, but at an economy-level, “increased electrification may offset almost 50% of the demand savings from energy efficiency improvements in the STEPS to 2030,” the WEO2021 notes.

Energy Security Already Highly Vulnerable

Meanwhile, the already precarious supply-demand balance is also vulnerable to a long list of factors, several which prompted the energy crises that characterized 2021. The WEO2021 suggests challenges afflicting reliability are rooted in the “increasingly complex set of interactions between electricity, fuels, and storage.” The IEA’s modeling of a net-zero scenario suggests that 40% of energy consumed worldwide by 2050 will undergo “at least two conversion steps on the way to consumers. By contrast, hardly any of the energy reaching consumers today has been converted more than once,” it notes.

Electricity security is a specific focus in the report, given the world’s growing reliance on solar and wind–generated power, and their associated “ever-growing need for various forms of flexibility to maintain reliable system operation.” Addressing challenges will require recognizing these new sectoral interlinkages, the IEA said. They should also allow for appropriate investment signals, resolution of inadequate market designs, bottlenecks arising from a lack of infrastructure, and cybersecurity risks stemming from a new reliance on digitalization.

The world should also recognize that it will suffer new physical risks from changing climate, including disasters and water shortages, the IEA warned. Meanwhile, trade patterns and geopolitical considerations could pose new complexities to resource procurement, including a long list of critical minerals that will be needed for clean energy technologies and hydrogen production.

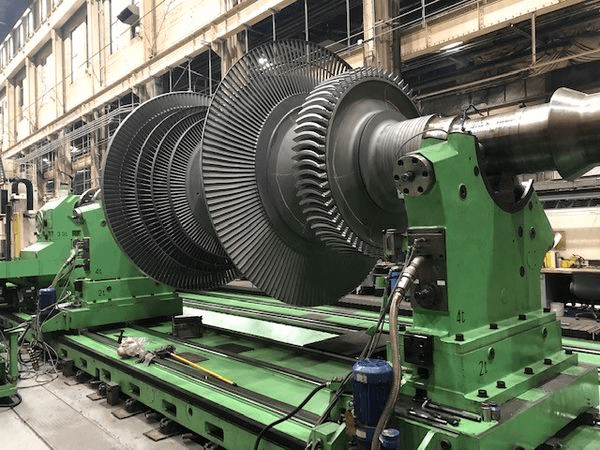

Hydrogen, Ammonia Co-Firing and CCUS Emerging as Lifelines for Thermal Power

Because energy security and affordability are at stake, and to alleviate flexibility challenges posed by variable renewable energy integration, as well as address systemic and infrastructure limitations, the IEA notably suggested dispatchable generation—which includes existing and future coal and gas plants—may have a key role to play. In a comprehensive report released alongside the WEO2021, the IEA suggested that the possibility to combust “high shares” of low-carbon hydrogen and ammonia in fossil fuel power plants could provide countries with an “additional tool for decarbonizing the power sector, while simultaneously maintaining all services of the existing fleet.”

Outfitting them with carbon capture, utilization, and storage (CCUS) technologies could also preserve these generators’ crucial attributes, which include providing system adequacy and inertia, which is a key source of grid stability. By 2030, 79% of existing coal and gas plants in advanced economies and 83% in emerging economies will still have useful technical lives, the IEA noted. “Early retirement of coal- and gas-fired generation will require additional investment in those affected regions to ensure a just transition and avoid economic and social disruption. Financial pressure will also increase on the owners of the assets that would become stranded as a result of policy decisions,” it said.

Retrofitting plants to enable the use of low-carbon fuels or with CCUS would allow thermal plants to operate into the future as low-emission sources of firm capacity, while reusing their existing assets, associated infrastructure, and supply chains, and it could also reduce costs, and economic and social dislocations associated with the large-scale transformation of the power sector. Pivotally, “Retrofits for use of low-carbon fuels and CCUS also provide a hedge against the risk that cost reductions in newer generating technologies like offshore wind, enhanced geothermal or advanced nuclear do not materialize,” the agency said.

Technologies to enable low-carbon fuel combustion already exist or are under development, the IEA noted. While hydrogen plays only a negligible role in the power sector today (accounting for less than 0.2% of electricity generation globally), several gas turbine original equipment manufacturers (OEMs) have already developed turbines that can combust 100% hydrogen by volume. Some OEMs are also developing gas turbines that can be fired with ammonia. And while several companies have announced plans to convert large-scale plants for hydrogen or ammonia co-firing, or operate dedicated hydrogen-fired power plants, some countries are pushing to make hydrogen power part of their generation profiles.

Japan, notably, wants to use 0.3 million tons (Mt)/year of hydrogen—for up to 1 GW of hydrogen-fired power capacity—and 3 Mt/year of ammonia in the power sector by 2030. South Korea, meanwhile, has a target of 1.5 GW installed fuel cell capacity in the power sector by 2022 and of 15 GW by 2040. Still, by 2030, low-carbon hydrogen and ammonia “are likely to remain expensive energy carriers for power generation,” the IEA said. However, costs will depend on the market.

“Our analysis suggests that co-firing 60% of low-carbon ammonia in a Japanese coal power plant in 2030 would lead to a generation cost that is 30% higher than energy market value in baseload, but just 15% higher in peak load conditions,” it said. “By contrast, using the same low-carbon ammonia in Indonesia would lead to a four-fold increase in generation costs compared with the variable operating costs of a coal power plant. The impact would be fully felt due to the absence of both a wholesale electricity market and a carbon price.”

Digitalization Is Playing a More Prominent Role

As the connected energy system grows more complex, digitalization has begun playing a more concerted role to provide more insight, flexibility, and potentially cut costs through increased efficiency. The WEO2021 notes spending on digital grid technologies that are accommodating more inverter-based generation enabling two-way flows reached $40 billion in 2019, making up about 15% of total network investment. Technologies include sensors, machine learning, and drones that are being leveraged to improve power plant performance, extend asset lifetimes, boost operations and maintenance, detect outages, reduce downtime, and improve transmission and distribution of power. On a broader level, they span from smart meters, connected appliances, and electric vehicles to unlock the full potential of demand-side flexibility.

Investment Is Lagging

Perhaps the factor that most concerns the IEA, as well as sustainability-committed governments and organizations across the world, is that insufficient investment is contributing to uncertainty over the future. In the WEO2021, the IEA estimated $4 trillion will be needed by 2030 to “get the world on track” to address climate change.

“The IEA has been warning for years that current investment levels in the global energy sector are inadequate—both to meet near-term energy needs and long-term transition goals,” noted Dr. Fatih Birol, IEA executive director. “It is hard to understate the dangers inherent in today’s shortfall in spending on clean energy transitions, compared with the levels required. If we do not correct it soon, the risks of destabilizing volatility will only grow as we move forward,” he said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).