The natural gas and electricity industries have entered into an increasingly codependent relationship as coal-fired electricity gives way to natural gas–fired generation. Both industries are firmly committed to providing reliable service, although each goes about its business in different ways. Utilities, regulators, and stakeholders are searching for ways to align interests and expectations.

Natural gas has become the primary fuel used to serve incremental growth in electricity demand, mainly because of historical low prices. The modern combustion turbine, with relatively low capital costs and desirable operating and performance characteristics (including low air emissions, small footprint, and fast start capability), particularly when used in a combined cycle configuration, has emerged as formidable competitor to King Coal. (See “O&M and Human Stresses Caused by Low Gas Prices.”) In fact, preliminary data from the U.S. Energy Information Administration shows that in April, generation using natural gas and coal each accounted for 31% of total power generation—the first time this has ever occurred.

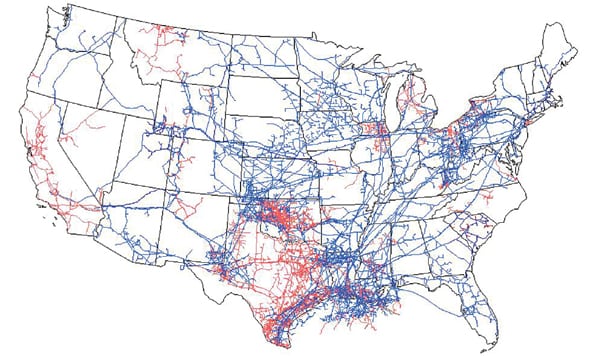

The reemergence of natural gas–fired electricity has fundamentally changed the ground rules for power market competition. The tremendous success of horizontal drilling combined with high volume, multi-stage hydraulic well completions (“fracking”) has changed the view that North America is running out of gas and that future prices of gas will make gas generation noncompetitive for all but peaking requirements. Instead, natural gas is now seen as fuel that can supply a large portion of electric load growth for several decades into the future. (For additional background on shale gas reserves, see “Global Gas Glut,” in the Sept. 2011 issue, available in the POWER archives at https://www.powermag.com.) ICF’s forecast of electric capacity additions from 2016 to 2030 illustrates this increasing reliance on natural gas for power generation (Figure 1).

|

| 1. Prediction of future capacity additions by fuel type. The columns for each year represent cumulative additions. Note that ICF projects no new (currently unplanned) nuclear or coal additions. Source: ICF Integrated Outlook, 2012 Q2 Release |

The growing reliance on natural gas for power generation has raised several concerns by independent system operators, regional transmission organizations, market participants, and national and regional regulatory bodies related to electricity system reliability. As a result, structural, physical, regulatory, and cost recovery mechanism differences in the two industries are now being considered from the perspective of service reliability.

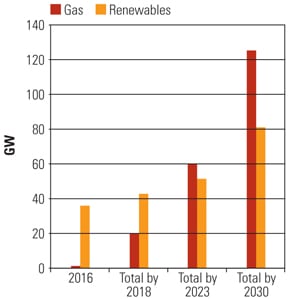

Natural gas utilities (often referred to as local gas distribution companies, or LDCs) have contracts for firm pipeline transport and storage capacity and maintain peak-shaving facilities to meet both power and non-power generation customers’ “design-day” or peak requirements by day. This is hypothetically illustrated for a period of 150 days in Figure 2.

|

| 2. A typical natural gas load duration curve. The red area at the top represents unmet demand for natural gas from power generators. Source: ICF |

At the same time as gas consumption for both power and non-power uses has grown, the availability of interruptible capacity has declined, especially during periods of peak gas demand. This leads to more days in which interruptible customers must rely on fuel switching or other measures.

Ironically, many gas-fired electric generators have relied on interruptible gas transportation services to meet their fuel needs. Many electric utilities use the presence of coal-fired plants as justification for purchasing natural gas at an interruptible rate. As more coal plants are mothballed, those utilities may not be able to continue to purchase natural gas at the lower interruptible rates, if interruptible gas is even available; instead, they will have to transition to higher-priced “firm” gas rates.

These concerns about natural gas supply and infrastructure adequacy to satisfy future power generation needs have focused the attention of regulators on gas-electric system reliability. In the Northeast, for example, and particularly in New England, the market has tightened to the degree that shippers should expect interruptible service to be unavailable for a significant number of days in the year. For New England, a recent study conducted by ICF found that there will be “a deficit” in pipeline capacity to meet peak LDC load or “design day” requirements and peak winter requirements for gas-fired generation as early as the winter of 2012–13.

Gas-Electric Interdependency: Round One

Coordination of gas and electric service was discussed more than a decade ago within the North American Energy Standards Board, the Natural Gas Council, and in pipeline service discussions with existing and prospective shippers. Recognizing the intra-day variability of many generators’ requirements for gas, many pipelines worked to develop non-uniform flow services. These were firm services that allowed the pipeline shipper to take the maximum daily quantity of gas from the pipeline over a reduced number of hours within the day.

These services were designed specifically to meet the service requirements of gas-fired generators, although the market’s response was underwhelming. Few, if any, generators were willing to sign contracts, principally for three reasons:

- High cost of service.

- Electric market designs lacked provision for cost recovery of gas transportation contracts that ensured superior reliability to the electric generator (compared to generators with interruptible service).

- Interruptible service that was practically firm because pipelines rarely were forced to interrupt the flow to the interruptible customer.

Other changes in natural gas markets occurred at that time that allowed generators to utilize available pipeline capacity, largely through interruptible service, and released capacity with little fear of interruption. The events that allow these market conditions to occur included:

- Development of the first wave of pipeline capacity turn-back by shippers as alternative transportation paths for gas supply.

- A period of high gas prices that moderated gas demand in the industrial sector, thereby freeing up existing pipeline capacity available to power generators, often on an interruptible basis.

- The economic recession of 2001, which created further “slack” capacity in many interstate pipelines.

With the availability of long-haul interruptible transportation, new generators only required that facilities be constructed from the existing pipeline “mainline” to the plant. The distance of these pipeline “laterals” could be dozens of miles or just a few hundred yards, depending upon where the generation plant could be located.

The conditions that allow for the use of interruptible service still exist in a number of U.S. gas markets. Over time, the market for pipeline capacity will continue to tighten, changing the nature of the ability to reliably obtain interruptible pipeline capacity. As gas consumption for both power and non-power uses has grown, the availability of interruptible capacity has declined, especially during periods of peak gas demand.

Gas-Electric Interdependency: Round Two

Discussions about the interdependency of gas and electric service reliability have intensified over the past 18 months. As the number and dispatch of gas-fired generators increases, the interaction between the electric grid and the gas network have stressed both systems. This situation has highlighted both the similarities and differences in the structure, operation, business practices, and communications of the two industries.

The extreme cold weather events in the Southwest during the first week of February 2011 highlighted the ways in which gas and gas-fired generators can interact in ways that affect electrical system reliability. During the period Feb. 1–4, a total of 210 generating units in ERCOT experienced an outage, derating, or failure to start. Although a detailed discussion of the events cannot be included here, those events illustrate the interdependencies of gas commodity supply, intra- and interstate gas pipelines and storage, electric generation and the transmission grid, and gas LDC load.

Three overarching issues are extremely important to understanding the interactions between the gas and electric businesses. A discussion of each follows.

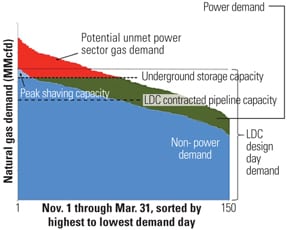

Industry Structure and Coordination Issues. There are certain differences in the structure and regulation of the two industries that need to be recognized and understood. These differences exist in both the sectors’ planning and operating areas. Under the North American Electric Reliability Corp. (NERC) reliability assessment process, the ability to serve load is analyzed under specific normal operating and contingency conditions (Figure 3).

|

| 3. NERC reliability analysis. These four primary categories are used to describe the status of electrical system reliability in the U.S. Source: NERC |

In contrast, the planning process for new natural gas pipeline and storage infrastructure has developed based on an underpinning of contracts for firm service entitlements for the contracting party. Pipelines do not construct new or expanded capacity without long-term (at least 10-year) contractual commitments from gas shippers. Indeed, the Federal Energy Regulatory Commission (FERC) will not grant the required certificate for new capacity without these contracts. Within this model, no capacity is constructed specifically to serve interruptible service requirements.

Natural gas pipeline facilities have been designed and constructed based on peak day contracted firm capacity. Firm pipeline customers usually contract nearly 100% of the capacity in a pipeline because pipelines do not build capacity to serve interruptible customers. This practice presents obvious problems for gas-fired generators, who often prefer interruptible transmission service due to variability in volume requirements.

Under “average annual operating” conditions, most pipelines have some level of capacity that is not used by firm customers and, therefore, is available for nonfirm (interruptible) loads. If the requirements for nonfirm deliveries are communicated to the pipeline within the nomination cycle timeline, the pipeline can utilize facilities to allow for delivery of gas requested up to the physical capabilities of the system. This is the normal procedure for interruptible transportation service or capacity release from the firm shippers.

The electric industry is fundamentally different. Generation capacity expansions are driven by a combination of “resource adequacy” requirements and market design, while planning for transmission infrastructure is triggered by reliability criteria under stressed system conditions. Hence, there is an implicit level of reserve capacity available in the transmission and generation systems to accommodate contingencies or above-normal weather conditions.

Furthermore, from an operating perspective, power plant generation follows load to serve the hourly needs of the system. The generation units that are primarily required for reliability in peak conditions tend to run a very limited number of hours. As such, firm gas transportation service, which is purchased with fixed reservation fees that do not vary based upon the volume of gas delivered or provide daily or time-of-day usage rates, is expensive and unnecessary when considering the annual amount of gas required for these facilities.

In regions where excess gas pipeline capacity is available, these low capacity factor units can rely upon interruptible service with a reasonable degree of certainty that service will be available. As growth in gas system requirements in a region reach the point where new pipeline capacity is required or when market conditions result in simultaneous peak electricity and gas demand, the differences in the structures of the two industries can result in a mismatch between the requirements for gas delivery service requirements for gas-fired electric generation. This can be particularly challenging in areas where a significant amount of the generation capacity or reserve capacity is gas-fired.

Information and Service Requirements. Even on nonpeak flow days, gas-fired generation requires high-volume, high-pressure loads with large load swings that pipelines have not been designed to accommodate (that is, pipelines aligning a slow-moving product, gas, with a fast-moving product, electricity, that is subject to large demand changes on short notice and plant cycling). A sudden increase in gas demand (plant startup) may cause pipeline pressure drops that could reduce the quality of service to all pipeline customers.

The two main issues are whether the requirements for the gas are knowable within the gas pipeline nomination cycle and whether volumes are taken in excess of confirmed nominations, including specified allowances for hourly swings.

If the requirements for the gas are not known within the gas pipeline nomination cycle and the available capacity for interruptible loads is factored into the pipeline operating plans, or if hourly swings are excessive, a pipeline would need to allocate, reserve, or build facilities on the pipeline to provide service for these “intra-cycle” requirements. This may involve the creation of pipeline services that do not currently exist. Although pipelines are capable of adding capacity (in the form of more pipe, compression, or market-area storage) within a period of time, they are unlikely to do so without a cost-recovery mechanism, traditionally through a contract for that service.

In a number of market locations, some gas-fired generation units rely upon pipeline transportation above the level that has been nominated, scheduled, and confirmed with the pipeline. (Note that the gas nomination cycle is not synchronized to day-ahead or real-time operations of generation facilities, resulting in a potential disconnect in usage versus nomination.) Though these gas volumes are ultimately replaced through balancing provisions, the timing of the replacement does not prevent pressure transients that threaten delivery pressures along the pipeline.

A delivery of these unauthorized volumes lowers pressure on the pipeline in proximity to the delivery point and at locations upstream and downstream of that point. This is a particularly critical problem if these occur at periods of peak utilization of the pipeline in the winter. Given the coincidental winter peak for gas LDC and gas generation load, these unauthorized volumes can be a significant risk in regions that do not have excess aggregate pipeline capacity.

Different Contingency Events. Natural gas and electric infrastructure are fundamentally different in the manner in which the integrated systems operate, particularly in the context of unanticipated loss of a facility. At its most severe, a mechanical or other physical failure in electric infrastructure can result in the immediate loss of service from an entire generating unit or transmission line that can, under some conditions, produce cascading loss of service to millions of customers. The nature of these events and the required instantaneous response of system operators has generally served as impetus for electric system planners to employ both resource adequacy review and reliability (system security contingency) review to assess infrastructure requirements.

By contrast, most mechanical or physical failures of gas pipeline or storage facilities result in reductions in the amount of capacity of the pipeline rather than a complete loss of service. The exception to this is a complete failure of a pipe segment or incident of third-party damage to a pipe segment through improper excavation in the pipeline right of way. Even in instances where a pipe segment is completely disrupted, some level of service in the downstream markets is usually maintained through the diversion of gas through other routes.

As a result, outages in the gas industry are addressed through a process of allocating reductions in capacity that result from a contingency event consistent with the priority of customers based on contracts. Interruptible service is curtailed first, followed by firm service to secondary delivery points, and finally firm service to primary points. If the event is sufficient to require reductions in firm service rights, best efforts are made to retain service to “human needs” customers such as homes, hospitals, and schools.

Because of these differences and the differences in probabilities of contingency events, the two industries’ planning and construction of facilities to address unanticipated outages and contingencies differ markedly. Moreover, these differences have been codified into the regulatory framework that governs each industry.

More Questions for the Electricity Industry

How these reliability issues will be addressed ultimately is difficult to predict at this time. But it is clear that there are a number of fundamental aspects of gas and electric markets that must be taken into account, and soon. In the “competitive” electric markets, where economic dispatch of generation is achieved through a bidding process based upon the variable generation costs, the incursion of fixed pipeline demand charges creates capital recovery risks and risks involving the return on that capital. Moreover, capacity payments to generators have yet to reflect any commitments or investments to secure reliable fuel supplies outside of the plant. As an aside, some formulations of capacity payments are based upon calculations that include dual-fuel capacity, which can improve fuel supply reliability, provided the fuel is available, oil storage can be sited at the plant, and combustion of oil is allowed under air emissions regulations.

Electric markets that are vertically integrated may not face the same challenges. In those markets, the ability to evaluate the need for firm gas pipeline capacity is internalized into the planning process. For example, in Florida, pipeline expansion on Florida Gas Transmission and the construction of a competing “green field” pipeline (Gulf Stream) was accomplished through long-term contracts with power generators to meet FERC traditional certificate requirements. This indicates that planning for some firm gas transportation services is often included in the planning for reliable electricity supply under vertically integrated electric systems. Inclusion of gas supply infrastructure is only one of many other aspects of evaluating the appropriate electric market structure.

Implications for the Gas Industry

The structure of the North American gas market has created numerous market centers, where gas transactions provide liquid and transparent market signals. At periods when pipeline capacity is not constrained, the basis differential (the difference in the short-term prices at two locations) is generally well below the regulated firm transportation rate designed to recover the pipeline’s cost and provides a reasonable return. When the average annual basis differential is well below the cost of firm transportation, pipelines face difficultly in contracting capacity and face cost-recovery challenges. This situation exists for a number of pipelines, where the changing location of new shale gas supplies has left segments of the pipeline underutilized.

If the manner in which ensuring gas supply reliability to power generators creates additional pipeline capacity in all markets, the average basis differentials in the markets would be expected to decrease. This could exacerbate the changes to pipeline cost recovery in the regions where pipeline capacity and demand are in reasonable balance.

The electric industry has approached this situation through the Transmission Planning Standards and Contingency Considerations developed by NERC, which requires regional markets to maintain plans consistent with NERC standards. The natural gas market transportation services market has been designed with reliance on contracts that are signed in response to market conditions, without regional reliability requirements. Reconciling these two approaches will likely take years.

Two Hard Questions

Finding workable solutions to these challenges will require regulators, stakeholders, and possibly legislators who thoroughly understand the structure, complexity, and differences between the gas and power generation businesses. Two contentious questions must be asked and answered before better integration of the natural gas and power generation industries can occur.

What is the optimal level of reliability that should be developed? Reliability can always be improved through the construction of redundant facilities. But redundancy, by definition, reduces system utilization. When systems and equipment are operating “as designed,” the redundant facility is idle, yet its costs must still be recovered.

How much redundancy should customers be required to pay for?

That is a public policy question. Perhaps the electricity and gas markets will be given time to answer this question, or maybe regulations will be quickly enacted as a proxy for market response and consumer preference.

— Bruce Henning (bhenning@icfi.com) is vice president and Judah Rose (jrose@icifi.com) is senior vice president for ICF International.