Self-contained, small islands of electric generation, storage and distribution inside the existing grid–microgrids–could be the next big thing in electricity. But some argue they may be just another over-hyped development in the line of the enthusiasm surrounding the smart grid.

A fire in a Pacific Gas & Electric distribution substation in San Francisco in April 2017 triggered a seven-hour power outage in the city’s busy downtown, knocking out traffic signals, shutting businesses, and stalling the city’s iconic cable cars.

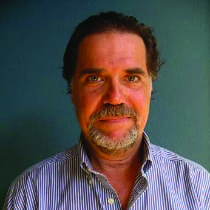

The chaos prompted Peter Asmus, a Navigant Research analyst and well-known advocate of small, self-contained electricity systems, also known as microgrids, to comment in the San Francisco Chronicle newspaper that “the incident should serve as a reminder of the effects blackouts impose.”

Asmus asked whether “there is something San Francisco can do to make it through such events?” His prescription: “New cleaner energy technologies, such as solar panels and advanced batteries, can be bundled together with other energy sources into a ‘microgrid.’ Microgrids are the answer to bolstering the resiliency of crucial public and private infrastructure.”

Among the chattering energy analysis classes, microgrids appear to be the next big thing. More than a decade ago, the next big thing was the “smart grid” (see sidebar). That enthusiasm has cooled on the experience of the limited payoff for consumers of smart, communication-enabled, electric meters, and fears of a vulnerability to cyberattacks on communications between customers and utilities. Enter microgrids, which are getting widespread industry attention and exploratory investment.

| Remember the Smart Grid? What Happened?

Ten years ago the next big thing for the electricity industry in the U.S. was the smart grid, which would turn our one-way electric power supply system into a two-way, interactive process to capture opportunities to save energy and shape loads, benefiting providers and customers. Information would flow from customers to the distribution utility and back. Living spaces would be transformed and tuned in through smart appliances that could be interconnected to the electric company, saving energy and providing convenience. Smart grids were touted by the Electric Power Research Institute (EPRI) and forward-thinking electric company executives such as Jim Rogers, then CEO of Duke Energy. A major federal law, the Energy Independence and Security Act, which President George W. Bush signed in 2007, contained a section (Title XIII) aimed at providing a legal framework for smart grid development. The smart grid seemed on its way to widespread implementation, with wild predictions about its rapid spread. The smart grid began with smart meters. And that’s about where it has stalled. A study released in June by the Smart Grid Consumer Collaborative found that 70% of U.S. electricity consumers are aware of the term “smart grid,” but only 4% participate. Utilities have installed millions of smart meters, though often facing consumer resistance. The benefits of the technology appear to flow almost entirely to the utility, while customers pay for the equipment in their bills. Security is also a concern. The British cybersecurity website SC Media, reporting on a study by the consulting firm PwC, commented, “Cyber-security and data privacy are increasingly becoming more recognized as risks to systems. Additionally, the growth of smart, connected propositions exposes new systems and controls to threats from external attackers.” “It’s rolling out much more slowly than people expected,” Harvard Business School Professor Rebecca M. Henderson has said of the smart grid in her papers on the subject. “Consumers seem less interested in its capabilities. The regulation regime is difficult. People have been talking about the market for 10 years, but it’s not yet where it’s supposed to be.” |

Are self-contained microgrids a significant part of the electricity future, as Asmus suggests? Or are they uneconomical fads, touted by advocates of a green energy revolution involving renewables and energy storage that don’t withstand economic and engineering scrutiny? Or, a third opinion: Are they reasonable approaches to particular utility needs, welcome solutions to particular problems but hardly panaceas?

What Is a Microgrid?

Navigant’s Asmus says, “It is what it sounds like: a small power grid. But when the larger utility grid goes down, a microgrid keeps running. Absent a microgrid, solar panels shut off like the rest of the grid, rendered useless when they could be providing the highest value.”

The Department of Energy’s Microgrid Exchange Group offers this more detailed definition: “A microgrid is a group of interconnected loads and distributed energy resources (DERs) within clearly defined electricity boundaries that acts as a single controllable entity with respect to the grid. A microgrid can connect and disconnect from the grid to enable it to operate in both grid-connected or island mode.”

Navigant Research’s Microgrid Deployment Tracker database identified 1,681 projects worldwide as of the fourth quarter of 2016, “representing 16,552.8 MW of operating, under development, and proposed microgrid capacity and 126 new projects.” Navigant highlights three noteworthy new projects: a 100-MW energy storage project in India’s Andhra Pradesh state; 83 MW of solar photovoltaic (PV) and storage in California’s Imperial Valley; and an 80-MW remote project in Newcastle, Australia, that includes diesel generation as well as solar PV and energy storage. The research firm notes, “Diesel capacity remains the leading generation technology in terms of total capacity, though its lead is shrinking.”

According to Navigant, North America is the leading region in operating microgrid capacity, with 54% of the worldwide market share. “The United States leads all countries in terms of both capacity and total number of projects,” says Navigant.

Energy storage is a key to microgrids, providing resiliency, reliability, and if necessary independence from the conventional big grid, also known as “islanding.” Coupled with solar or wind, storage overcomes the intermittency problem of the renewable generation. Some analysts have dubbed energy storage “the great enabler.”

Costs of solar PV and battery storage are both declining. Bloomberg New Energy Finance in May issued a report—“2Q 2017 Frontier Power Market Outlook”—that predicts 2017 could be a big year for microgrids. “Storage companies and technology giants continue to lead the charge on solar and storage microgrids while island communities are test-beds for piloting new systems and ideas,” according to the report, with “energy storage companies such as Tesla, Fluidic Energy, and Electro Power Systems continuing to deploy significant capacity in the first quarter. Specifically, Tesla’s island microgrids represent 36% of the company’s total power storage capacity deployed to date.”

Successful Projects

Microgrids are beginning to solve a variety of power problems worldwide. One of the newest is a project by Italy’s giant Enel energy firm, located on the edge of Chile’s sunny and exceedingly dry Atacama Desert. Commissioned on May 31, the project merges 125 kW (peak) of solar PV with two energy storage systems, one based on hydrogen and the other lithium-ion battery storage. Enel describes this as a “plug-and-play” approach, which “can be particularly useful to ensure energy access in remote, poorly electrified areas.” The Chilean project meets part of the electric load at a camp that hosts more than 600 workers at Enel’s Cerro Pabellon 48-MW geothermal power plant, also recently commissioned.

A microgrid project in Northern Ireland, developed by AES, installed 10 MW of battery storage integrated with the existing 660-MW coal, oil, and gas-fueled Kilroot plant near Belfast. The battery array was installed in a vacant turbine hall at the plant. The project was POWER’s Smart Grid Award winner in 2016.

This year’s Smart Grid Award also goes to a microgrid project: Ameren’s Technology Application Center microgrid in Champaign, Ill., developed by Chicago-based S&C Electric Co. The project consists of two 500-kW natural gas generators, 125 kW of PV, and 50 kW of wind, combined with 250 kW of lithium-ion battery storage (see Ameren’s TAC Microgrid Seamlessly Integrates Distributed Energy Resources).

But microgrid projects don’t have to be associated with macro-sized investor-owned utilities such as Enel and Ameren or the state-owned Northern Ireland system. Asked about microgrids, Sue Kelly, CEO of the American Public Power Association (APPA), representing America’s municipal utilities, is wont to say, “Been there. Done that. Have the T-shirt.”

Mike Hyland, APPA’s senior vice president for engineering services, told POWER that municipal utilities were born as stand-alone microgrid systems. They didn’t start interconnecting into the big grid until it became clear that interconnection was less expensive and more reliable than self-generation and distribution. The municipal utility in Easton, Maryland, Hyland said, didn’t interconnect with the Delmarva Peninsula grid until 1974, and remains able to disconnect today from the grid and serve its loads alone. Easton can bid its excess power into the PJM Interconnection wholesale power market.

The small town of Minster, in west-central Ohio, with a population of 2,800 and home to the world’s largest yogurt plant (operated by Dannon), boasts the first municipally owned solar PV and storage microgrid project in the U.S. The 3-MW solar array combined with a 3-MWh lithium-ion battery storage system, financed by Half Moon Ventures and engineered by S&C, will allow the village to purchase below-market power from the solar field, defer about $350,000 of transmission and distribution costs, improve power quality, and shave peak demand.

Microgrids Are Old, and New

Microgrids could be the next big thing in electric power generation, but they are not new. The modern power business began more than a hundred years ago with a bunch of small, unconnected grids serving cities around the country. Some were investor-owned, and some were owned by local governments. These early systems expanded until the favorable economics of interconnection into a large grid became clear.

Power systems to serve remote locations unable to connect to a conventional grid, or needing continuous power for critical operations, have been around for more than 50 years and continue to prosper. Military bases and hospitals were among the earliest of microgrid projects, and the military took the lead.

In the 1950s and 1960s, the Atomic Energy Commission (AEC, predecessor to the U.S. Department of Energy) and the Department of Defense (DOD) put significant resources into finding ways to provide remote military bases with reliable electric power when those bases were unable to connect to a grid. The AEC developed a prototype small nuclear generating plant at the Idaho National Reactor Testing Station (NRTS) in Idaho’s remote eastern desert. That was the site of what nuclear engineer and historian James Mahaffey describes in his 2014 book Atomic Accidents as “the strangest and most tragic reactor accident in American history.”

The AEC and DOD developed a reactor design, called SL-1 (“stationary low-power reactor, version one”) aimed at powering distant early warning system (or “DEW Line”) radar stations inside the Arctic Circle aimed at detecting incoming Soviet missiles during the Cold War. A demonstration plant went up at NRTS. As Mahaffey details, the plant was a 3-MW (thermal) boiling water reactor, with 200 kW converted into electricity, 400 kW used to heat living and working quarters, and the balance released to the atmosphere.

The plant had been operating for more than two years when on the night of January 3, 1961, a crew of two operators and a trainee were killed. One of the operators—against all instructions—physically lifted the main control rod on top of the reactor far more than was safe. The machine went prompt critical in 2 milliseconds, a steam explosion resulted, and all three men in the plant perished, one of them pinned to the ceiling by the control rod.

The military’s attitude toward small reactors dimmed, although the Army did deploy small units in Greenland, Antarctica, Alaska, Wyoming, and Panama. The military and other users of self-generation then turned to diesel engines for generation at internal microgrids. While reliable, diesels use expensive fuel and create polluting exhaust gases. The Pentagon is now looking at microgrid systems for its bases that couple natural gas generation, along with solar and wind, with battery storage.

The converging technologies of solar PV and battery storage are driving the current enthusiasm for microgrids. PV arrays have become much cheaper and operate well (when the sun is shining), with no fuel or emissions control costs. Battery technology developments, particularly the increased power density of lithium-ion technology, may provide the answer to the variability of sun power. Lithium-ion batteries, however, have inherent limitations, including catching on fire under some circumstances. They also have limited lifetime, meaning they have to be replaced.

Microgrid Challenges

Regulatory challenges to microgrid projects could slow development. In 2016 the Maryland Public Service Commission (PSC) denied Baltimore Gas and Electric cost recovery for two microgrid projects, one in the city of Baltimore and the other in suburban Howard County. The utility—an Exelon subsidiary—wanted to impose a surcharge on all customers to pay for a $7 million, 2-MW microgrid, and a $9.2 million, 3-MW microgrid. The PSC said the microgrid projects conflicted with the state’s 1999 electricity restructuring law, which removed generation from the control of the utility. Exelon has faced similar concerns in Illinois.

An Oncor project in Texas also has experienced regulatory obstacles. Texas classifies energy storage as generation. The state’s deregulated market means that distribution companies such as Oncor can’t sell excess power from storage into the Electric Reliability Council of Texas (ERCOT) wholesale power market.

Some conventional utilities are also skeptical of the impact of microgrids. An official from Pittsburgh’s Duquesne Light Co. told a recent conference organized by the Harvard Business Review that microgrids could lead to a “death spiral” for conventional utilities, with fewer people relying on the macrogrid left to pay for conventional grid upgrades. “Those customers who are able to afford distributed generation are now paying for a smaller portion of the electric grid,” said a senior manager, “which means the customers who cannot afford to install their own distributed generation are paying for a larger share of the electrical grid.”

APPA’s Hyland, while positive about microgrids, stresses caution and careful analysis about projects, particularly because the economics of batteries are dicey. Often, he said, the “numbers don’t add up” when it comes to battery storage cost projections.

“Microgrids are not for everybody,” he said. “They make sense in certain conditions.” Utilities pondering microgrids, he said, “need to look at empirical data, need to look at all the facts, and need to ensure that customers know what the costs will be. There’s lots of hype, and I like the hype, but at the end of the day, it’s got to be driven by facts and hard data.”

Nevertheless, optimism about microgrids is high and growing. At the Harvard Business Review meeting, Gregory Unruh from George Mason University in Virginia, as reported by the Thomson Reuters Foundation, said, “We are witnessing perhaps the twilight of the macrogrid and…the dawn of the microgrid.”

Or maybe not. ■

—Kennedy Maize is a long-time energy journalist and frequent contributor to POWER.

![Microgrid_Infographic[3]](https://www.powermag.com/wp-content/uploads/2017/08/fig-2_how-microgrids-work.jpg)