Hitachi and Mitsubishi Heavy Industries (MHI), two giant Japanese companies with substantial stakes in the world’s power sector, are separately rethinking future business directions as sizable disruptions shake up prospects for traditional market growth.

In recent months, Hitachi refined its business model to prepare it for explosive demand in digitalization solutions, focusing heavily on grid modernization, while MHI is aggressively pushing decarbonization solutions, including offshore wind, carbon capture technology, and development of hydrogen-fired gas turbines.

Hitachi Goes Heavy on Grid Technology

Days after Hitachi scrapped plans to build the Horizon Nuclear Power Ltd. project at Wylfa Newydd in Wales this January citing financial concerns with the project, the Tokyo-based conglomerate also announced it would withdraw from the business of manufacturing wind turbines in-house under its Downwind Wind Turbines brand, saying it couldn’t afford to expand the business in an increasingly competitive market. A week later, on Feb. 6, the company also announced Hitachi’s entire operation from manufacturing to sales of its industrial power receiving and transforming facilities business would be taken over by Hitachi Industrial Equipment Systems.

The measures come on the heels of Hitachi’s Dec. 17 announcement that it would acquire ABB’s power grids business in an $11 billion deal. If the deal is finalized, the Japanese giant will absorb all four of ABB’s grid businesses: Grid Automation; Grid Integration—including ABB’s high-voltage direct current systems and power semiconductors; High Voltage Products, including gas-insulated switchgear; and Transformers.

While ABB said the divestment will allow it to focus on its digital industries, Hitachi said the business will help it build an energy platform that “connects various fields such as mobility, life, and industry.” The power grids market is “rapidly expanding driven by increasing adoption of renewable energy, rising energy demand and supply in emerging countries, the expansion of distributed power sources such as electric vehicles and storage batteries, deregulation of the electric power sector in countries and regions, and advances in electric power system reform,” it noted. Hitachi’s forecasts estimate the power grids market could reach more than $100 billion by 2020, at a steady annual growth rate of 4% or above between 2017 and 2020, it added.

Hitachi’s outlook on the UK nuclear project and wind turbine business wasn’t as rosy, however. In January, the company noted continuation of the Horizon project, which it acquired from German firms E.ON and RWE in November 2012 for $1.1 billion, was contingent on securing “reasonable returns as a private enterprise.” But, after it failed to reach a deal with the UK government on financing, Hitachi said it was clear that “further time is needed to develop a financial structure” for the project. Hitachi will post a $2.7 billion impairment loss and related expenses, but it also said it will continue discussions with the UK on its nuclear program. The company’s future nuclear endeavors will likely be wrapped up in restarting of domestic nuclear plants and the decommissioning of Fukushima Daiichi, it said.

Pursuing Options Outside a Cutthroat Onshore Wind Market

Meanwhile, it said though wind power generation is regarded as having the strongest future growth potential among renewables, the market “has undergone significant changes.” Suitable land for wind turbine installations “will become limited to inland areas as flat terrain with favorable wind conditions and coastal areas become increasingly scarce, turbine blade diameters have gotten larger and the installation of wind turbines with high standalone output has advanced.”

Hitachi also pointed to turbulence in power markets. “In addition to electric power companies, there is increasing involvement in wind power generation business from various other companies and groups such as private companies other than electric companies and local governments. Meanwhile business models are also in transition, shifting away from the sellout model that focused on the sale of wind power generators in favor of service models that incorporate long-term operation and management packages.

Hitachi’s long-term growth and profitability would be better fostered by strengths in information technology and operational technology, it said. That’s why the company plans on promoting Lumada, a service platform that optimally controls and operates customer wind power generation systems. Hitachi is also conducting demonstration testing of artificial intelligence (AI) technology that will control each wind turbine individually. Finally, it will also expand its business alliance to market wind turbines manufactured by ENERCON, a German wind turbine maker that holds a 38% share of the German market (and 22% of Europe’s market share).

MHI Shifts Direction to Cater to Growing Decarbonization

Hitachi’s cautious approach in the power sector is echoed by business strategies recently announced by Mitsubishi Hitachi Power Systems (MHPS), a flagship power plant and equipment venture it jointly established with Mitsubishi Heavy Industries (MHI) in 2014. Today, MHI holds 65% of MHPS.

MHI, whose corporate roots began in 1884, when Yataro Iwasaki founded Mitsubishi, today operates as an independent company with a substantial stake in the power business (along with equipment and systems for industry and infrastructure and aircraft, defense, and space). The bulk of MHI’s power system revenues comes from gas and steam power generation systems, but it also relies on sales of compressors, aero-engines, nuclear power, renewables, and marine machinery equipment.

Takaoki Niwa, president and CEO of MHI America (MHIA), told POWER in February that MHI projects that power demand will expand further as electrification progresses, but it expects gradual movement toward low-carbon and carbon-free energy. North America offers ample opportunities for expansion in this realm, and the company is actively pursuing the market, recognizing a potential market slowdown in Japan, owing in part to declining population growth.

“With the mission of reducing carbon dioxide, our solutions are offshore wind turbines and carbon capture plants,” he said, noting that MHI—which sidestepped opportunities to take on the onshore turbine market—has a joint venture with Vestas to boost sales of its massive 9.5-MW V164 offshore wind turbine, and that MHI adapted and scaled the novel carbon capture process in use at Petra Nova, the world’s largest commercial post-combustion carbon capture system at a power plant.

In November, Vineyard Wind, a joint venture of Avangrid Renewables and Copenhagen Infrastructure Partners, selected MHI Vestas Offshore Wind as the “preferred supplier” for an 800-MW project proposed off the coast of Martha’s Vineyard in Massachusetts, a project under development that will be the first large-scale offshore wind project in the U.S. when it comes online, as expected, in 2021. Industry sources point out that the project’s success will depend on its ability to offer capacity into the ISO-New England market, but the Federal Energy Regulatory Commission on Feb. 4 declined to act on Vineyard’s emergency request to stay the grid operator’s capacity auction because it was not allowed to participate as a “renewable technology resource.” On Feb. 5, however, Massachusetts certified the project’s final environmental impact report. The project will now need to obtain permits from the Cape Cod and Martha’s Vineyard Commissions, and the Barnstable Conservation Commission, among others.

If the project succeeds, the turbine supply deal could prove lucrative for MHI Vestas. Vineyard Wind on Feb. 14 said it submitted a bid for a 1,200-MW offshore Long Island as part of the New York State Energy Research and Development Authority’s request for proposals for offshore wind resources as part of plans to quadruple planned offshore wind development to 9 GW by 2035.

Carbon Capture a Key Market Focus for MHI

MHI will also bank on emerging interest in carbon retrofits. Tiffany Wu, a business development manager for MHI America’s Engineered Systems Division (ESD)—a division entrenched in delivery of engineering, procurement, and construction (EPC) projects—told POWER on Feb. 6 that MHI has made notable progress in fine-tuning MHI’s proprietary KM CDR Process. The carbon-capture technology that the company developed over three decades and demonstrated at Southern Co.’s Plant Barry in Alabama between 2011 and 2014 was scaled up by a factor of 10 and adapted for Petra Nova, which has remained the world’s largest commercial post-combustion carbon capture system at a power plant since it began operations in January 2017 (Petra Nova was POWER’s Plant of the Year in 2017).

Wu said the carbon capture system—MHI’s first commercial power project—which is owned by NRG Energy and JX Oil & Gas, is “operating as designed,” capturing 4,776 metric tons/day, or about 90% of the carbon dioxide form a 37% flue gas slip stream from Unit 8 at NRG’s WA Parish Plant near Houston, Texas, a feat achieved by “meticulous planning.” Since Petra Nova, a project that demonstrated the KM CDR process’s technical feasibility, the ESD team has increased its capture capability process to 95%.

More significantly, total project costs for the next large-scale carbon capture and compression plant—none yet under construction but in which interest in widespread, Wu said—will be nearly 30% less. The cost reduction was mainly achieved by reducing the height of the flue gas quencher by 39% without losing capture efficiency. The height of the carbon dioxide absorber tower’s absorption section has also been slashed 29% and the water wash section by 39%.

The remarkable cost reductions were also achieved through reduced design redundancy, and better modular design, which now minimizes onsite fabrication, Wu said. “Reduced redundancy and modular & compact design contribute to 10% and 42%, respectively.” Meanwhile, the process, now known as the “Advanced KM CDR Process,” also features a new solvent (KS-21), which offers a “higher technical advantage compared to KS-1,” including higher stability and lower volatility, she said.

A number of MHI executives told POWER that the market for carbon capture in the U.S. is especially ripe, owing to a boost from the 45Q tax incentives Congress enacted in February 2018. The legislation amends Internal Revenue Code Section 45Q to increase the tax credit for capture and sequestration of “carbon oxide,” or for its use for enhanced oil recovery (EOR) or natural gas development. Before the enactment, Section 45Q allowed for a tax credit of $20 per ton of CO2 captured and permanently sequestered, and $10 per ton for CO2 used as a tertiary injectant, such as EOR. The credit amounts, adjusted annually for inflation, were increased to $22.48 and $11.24 for 2017, though credits are capped at 75 million tons of qualifying CO2.

As Wu noted, MHI is banking on efforts to increase oil production through EOR. “To qualify for the credits, CO2 capture facilities must commence construction by Dec. 31, 2023,” which doesn’t leave developers with much time to make final investment decisions, she noted. “The credit goes to the owner of the CO2 capture facility; that owner can transfer it to owner of the CO2 storage operation,” she said. “After operational, the CO2 capture facility can receive credits for 12 years,” she said. Inevitably, “more plants on the ground will drive down costs of the relatively new technology,” she added.

Pushing Gas Technology Into New Realms: Hydrogen

Todd Brezler, vice president of Marketing at MHPS, on Feb. 6, meanwhile outlined a number of ways the MHPS is leading a “change in power.” A key company focus is to refine technology for large gas-fired turbines and offer them as coal and nuclear plant replacements. But at the same time, the company is engineering gas turbines to co-fire with hydrogen.

“Since 1970,” he noted, “MHPS has operated 29 units with hydrogen content ranging between 30% and 90% with over 3.5 million operating hours.” With the backing of Japan’s research arm, the New Energy and Industrial Technology Development Organization (NEDO), for example, MHI said it succeeded in developing a combustor that can use 30% hydrogen mixed with liquefied natural gas fuel for large power generation gas turbines.

The company told POWER it will soon roll out a market case for increased hydrogen use in power generation to propel decarbonization efforts. MHI’s goals are to commercialize hydrogen power generation by 2030. MHI, meanwhile, wants to make hydrogen-fired gas turbines a key facet of a “global CO2-free hydrogen society using renewable energy by 2050,” and its plans suggest that it will market increased use of “fossil fuel–derived hydrogen combined with CCS in the transition period.” It said: “We will continue to lead the construction of an international hydrogen supply chain with hydrogen power generation that produces a large and stable supply of hydrogen to contribute to the realization of a CO2-free hydrogen society.”

To speed up technology development and introduce equipment to power companies, Brezler noted MHPS is currently piloting a project to convert one of three units at Vattenfall’s 1.3-GW Magnum combined cycle plant in the Netherlands to 100% renewable hydrogen by 2023. The project, in Groningen, entails modifying a M701F gas turbine, which MHPS delivered. As of December, MHPS had carried out an initial feasibility study that examined application of a diffusion combustor, an existing technology, and it has verified conversion to hydrogen-fired power generation “is possible.”

Meanwhile, MHI has also begun research on the use of ammonia, which shows promise as one of the energy carriers for hydrogen in gas turbine combined cycle applications. “New units with hydrogen capability and upgrades to existing units will be offered post demonstration,” Brezlar said.

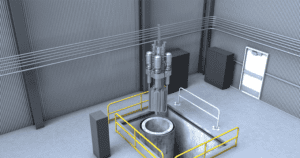

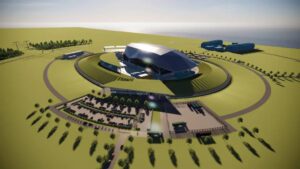

MHPS is also heavily marketing its TOMONI solution, using data visualization and analytics to optimize operations and maintenance and boost performance and flexibility, he said. At the moment, he noted, the company is building an artificially-enabled power plant at its T-Point validation facility in Japan.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)