Vineyard Wind 1, an 800-MW phase of an offshore wind project offshore Massachusetts, has achieved financial close. The milestone, a first for a U.S. commercial-scale offshore wind farm, now allows Vineyard Wind to provide its contractors with a notice to proceed with construction.

Vineyard Wind, a joint venture between AVANGRID subsidiary Avangrid Renewables and Copenhagen Infrastructure Partners (CIP), on Sept. 15 said it raised $2.3 billion of senior debt through its work with nine international and U.S.-based banks to finance the construction of the project. The company now plans to begin onshore work this fall in Barnstable. Offshore work will begin in 2022, and the company expects first power from the wind farm will be delivered to the grid in 2023.

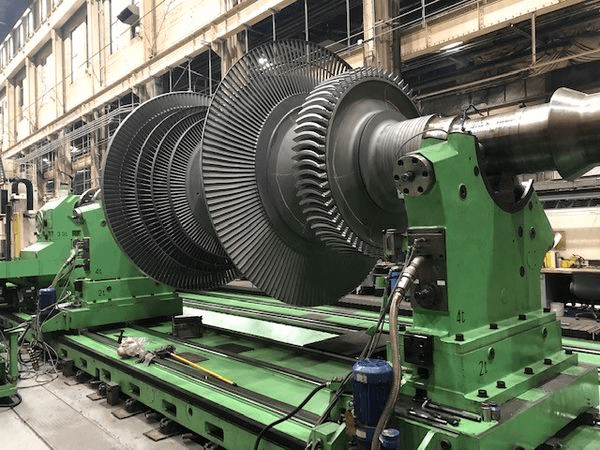

Vineyard Wind’s proposed project could include up to 100 wind turbine generators with blades extending up to 837 feet, each of between 8 MW and 14 MW, and up to two electrical service platforms (ESP). The wind turbines, mounted on either monopile or jacket foundations (for deeper waters), would be placed in a grid-like array, oriented northeast-southwest and northwest-southeast within the 75,614-acre lease area about 14 miles offshore Martha’s Vineyard. Documents suggest the company will first build an onshore export cable route, followed by an onshore substation. It will then install the wind turbines and ESPs, and finally its inter-array cable system.

Financial close of Vineyard Wind 1 follows a spate of recent milestones for the project conceived in 2009, when the Commonwealth of Massachusetts and the Department of Interior’s Bureau of Ocean Energy Management’s (BOEM) began a stakeholder process to identify offshore wind energy areas south of Martha’s Vineyard. Vineyard Wind ultimately won a federal lease area in a 2015 BOEM competitive auction. It then submitted its state and federal permit applications in 2017. In 2018, subsidiaries of some Massachusetts’ electric distribution companies—Unitil, National Grid, and Eversource—filed long-term contracts for the Vineyard Wind project at a total leveled price of 6.5 cents/kWh (in 2017 dollars) for energy and renewable energy credits from 800-MW of the wind farm’s capacity.

In October 2020, the company received final authorization from the Federal Energy Regulatory Commission (FERC) and executed an agreement with ISO-New England to connect the wind farm into the New England power grid at the NSTAR 115kV switch station in Barnstable, Massachusetts. Then in December 2020, Vineyard Wind announced it had picked GE Renewable Energy as its preferred turbine supplier, and it moved to ask the Bureau of Ocean Energy Management (BOEM) to pause review of its 2018-submitted Construction and Operation Plan (COP), so it could conduct a final technical review of GE’s 13-MW Haliade-X into the final project design. At the company’s request, BOEM resumed the federal review process on Feb. 3, and the federal agency ultimately issued a final environmental impact statement on March 8.

The company’s efforts have also been recently bolstered by Massachusetts’s overhauled climate law, which raised the state’s Renewable Portfolio Standard target to 40% by 2030 and authorized an additional 2,400 MW of offshore wind procurement, creating a new total offshore target of 5,600 MW. The Biden administration this March also laid out measures to deploy 30 GW of offshore wind in the U.S. by 2030, an ambitious target that it said could unlock “a pathway” to 110 GW by 2050, administration officials said.

“Achieving financial close is the most important of all milestones because today we finally move from talking about offshore wind to delivering offshore wind at scale in the U.S,” said Vineyard Wind CEO Lars T. Pedersen in a statement on Wednesday. “With the signing of these agreements, we now have everything in place to start construction, launching an industry that will immediately start to create jobs and make a significant contribution to meet Massachusetts’ carbon pollution reduction targets.”

Vineyard Wind said its financial close efforts were advised by financial firm Santander, which is also an investor in the project. Other investors include: Bank of America, J.P. Morgan, BBVA, NatWest, Crédit Agricole, Natixis, BNP Paribas and MUFG Bank. The project’s lead financing counsel was Norton Rose Fulbright. The effort for Vineyard Wind was led by the company’s General Counsel, Jennifer Simon Lento.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).