Pairing renewable resources with energy storage systems makes a lot of sense. However, grid operators are still developing frameworks for handling these hybrid projects but they may need to be treated differently in different territories.

Renewable energy is expected to increase by a whopping 8% globally in 2021, the largest increase in nearly half a century. This tremendous shift toward renewables, driven largely by governmental climate change policy and eager global investors, is well underway. Generators and developers on the front lines of this transformation include long-time renewables producers as well as fossil fuel players looking to diversify. Still, everyone knows that renewables alone can’t address the low-carbon transformation of our electrical system, so naturally many are looking to storage and hybridization with renewables as the next step.

Over the past few years, the Federal Energy Regulatory Commission (FERC) has been active in ordering independent system operators (ISOs) and jurisdictional regional transmission organizations (RTOs) to support new technologies like storage and distributed resources, and it recently shifted toward supporting a state’s prerogative to choose their forms of generation. FERC recently opened an inquiry around hybrid storage participation, but developers are not necessarily waiting on full clarity of the rules given the proliferation of hybrid projects in interconnection queues across the U.S.

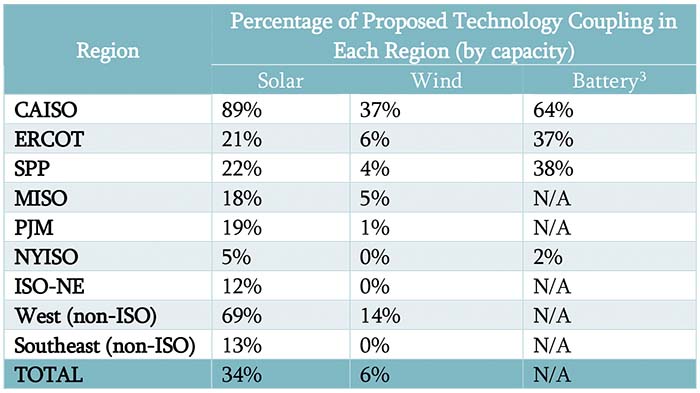

Efficiencies gained in the development process, like leveraging existing land positions or interconnection points, were early drivers for co-locating storage with other renewable assets (Figure 1). In the limited number of co-located renewable-storage project examples over the past five years, ISO/RTO markets have simply treated the components of these systems as separate resources with an interconnection sized to accommodate both, so unique rules for “hybrid” applications were not necessary.

|

|

1. At the end of 2020, 34% of solar and 6% of wind projects by capacity were being developed with a co-located battery storage unit. This table shows the coupling percentage by technology at that time, according to the largest U.S. interconnection queues. (N/A values in the “Battery” column signify that the region does not provide enough information to calculate this statistic.) Source: Lawrence Berkeley National Laboratory |

The federal investment tax credit (ITC) for renewables can be extended to the capital expenditures spent on storage if the battery primarily charges from the renewable asset. To take advantage of the ITC, many developers and storage vendors have looked to hybrids with closer integration of the parts, spurring interest in direct-current-coupled (DC-coupled) solar and storage systems. Because the storage component must charge primarily from the associated renewable facility to get the ITC, this kind of tight coupling of renewables and storage makes sense. But not all grid operators agree that hybrids are necessarily better than operating the parts independently.

Operating storage alone is still new to most grid operators, so coming up with rules for various configurations of hybrids is a new challenge, especially when the configurations are driven by IRS policy and not the needs of the grid. Many in the storage industry hope storage will one day soon have its own tax credit, which will remove the requirement that the storage charge primarily from the renewable and avoid charging from the grid. This could be a game-changer and even encourage storage hybrids with thermal plants.

If the financial influence of a tax credit does not favor either a closely coupled hybrid or a separate co-located configuration, the developer’s choice may come down to which works best in each ISO/RTO. Nonetheless, there are lessons to be learned from how some of the leading markets have tackled setting hybrid and co-located policies, and operational rules, for both renewables and storage.

Sources of Complexity for Accommodating Hybrid Configurations

Despite the motivations for renewable-storage hybrids, like development synergies, the current renewable ITC, and new elegant DC-coupled systems, U.S. organized markets are not quite prepared to handle the full complexity of these systems operating as a single resource. Some of the ISOs/RTOs are still implementing market participation structures for standalone storage, which may provide key operational elements for hybrids like the ability to accommodate state of charge and duration limitations, and market optimization given spreads between charge and discharge bids.

When shaping rules for storage paired with an intermittent renewable, it is important to understand how the resource will be classified and treated. Some markets have afforded certain exemptions and beneficial accommodations to intermittent renewable resources. When paired with storage though, intermittent renewables become at least partially dispatchable and perhaps need to be treated by a different set of less lenient rules used for traditional dispatchable resources.

The relative sizing of the renewable generator, storage asset, and point of interconnection, as well as daily and seasonal weather variation, and whether you can charge from the grid or not, creates a nearly endless number of combinations and scenarios. Each combination may have unique impacts on the hybrid facility’s characteristics as a grid resource. The capacity market, for example, needs to implement accreditation rules to accommodate all these variations appropriately. Additionally, if the ISOs/RTOs treat a hybrid facility as a single resource, they must account for any limitations of the facility for reliability purposes. Limitations due to weather (such as available sun if not charging from the grid) or battery state of charge may impact if and when it can be relied upon as a reserve or regulation resource.

Framework Begins to Take Shape, but One-Size Does Not Fit All

The Electric Reliability Council of Texas (ERCOT) and California ISO (CAISO) have been working on market participation structures for hybrid storage resources the longest, including those that are DC-coupled, but both have different approaches.

ERCOT’s approach treats a renewable-storage hybrid as one resource, but operates the facility at any moment as either a renewable generator or as storage and not as an entirely new and distinct resource type. The market operator considers whether the market offer from the hybrid reflects the capability of the storage component and whether the plant is awarded ancillary services. If either of these are true, the hybrid will be treated as a storage resource, but if neither parameter applies, then the hybrid will be treated as an intermittent renewable resource. PJM has also proposed a similar two-mode approach.

CAISO’s hybrid approach is a little different. There, a hybrid resource is treated as one resource that is primarily a fully dispatchable resource optimized by the market based on the resource’s bid. Being classified as a hybrid does lose some favorable treatment as opposed to being purely an intermittent renewable. Hybrids follow CAISO’s Non-Generator Resource (NGR) model, which is also used by storage. However, CAISO has proposed to allow significant flexibility for hybrid resources (Figure 2) to account for the impacts of variable or intermittent renewable production through provisions that incorporate and accommodate changes in forecasted output due to weather.

|

|

2. The 2.8-MW/5.6-MWh Connolly battery energy storage system is located on the Pronghorn Circuit near 15 solar farms in and around Lancaster, California. The Southern California Edison (SCE) pilot project pairs solar with batteries to manage the flow of power. Courtesy: SCE |

The New York ISO (NYISO) on the other hand has proposed treating a hybrid facility as an aggregation of dissimilar resources with different capacities, as opposed to switching back and forth between its existing intermittent renewable and storage participation models. However, NYISO also has a FERC-approved co-located approach that treats the renewable and storage assets as separate resources but goes the extra step to accommodate DC-coupling and the shared interconnection point that is smaller than the summed output of the two resources, both of which are characteristics people typically associate with a hybrid participation model.

Aside from tax policy, the decision to add energy storage to a renewable project will depend on the treatment and value of the asset as a standalone intermittent resource, rather than if more value can be obtained under the local rules for co-located and/or hybrid resources. Even with evolving or undefined rules for hybrids, commercial interests have been bringing huge amounts of hybrid resources to interconnection queues around the country, which itself is pushing ISOs/RTOs to develop new market participation structures.

The active FERC investigation into hybrid participation could continue this momentum, but there is some disconnect between prevailing desires for closely coupled renewable-storage hybrids to be treated like any other traditional generator and grid operators’ concerns about whether it’s possible or if it’s any better for the grid than keeping them separate. Where ISOs/RTOs fall on these questions seems to be a function of their local rules and the ability of their energy management systems (EMS) and economic dispatching technology to accommodate any new resource types and various combinations and configurations. One approach may not fit all.

—John Fernandes is a senior consultant for emerging technologies, and Tony Abate is a director for emerging technologies, both with Customized Energy Solutions (CES). CES helps clients understand changes in the wholesale and retail electricity, and renewable energy credit (REC) markets. CES also operates more than 11,000 MW of their clients’ wholesale generation, renewable, storage, and load assets on its hosted market operations platforms.