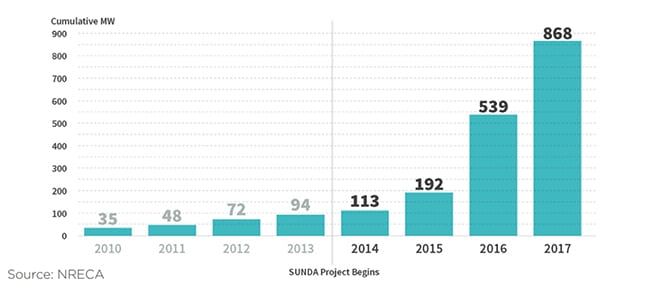

Electric cooperatives in the U.S. have vastly accelerated solar power installments. Today, they own or purchase more than nine times as much solar photovoltaic (PV) power as they did in 2013, a new report says.

The report, “A Solar Revolution in Rural America,” was prepared by the National Rural Electric Cooperative Association (NRECA), a national trade association representing more than 900 local electric cooperatives. Electric co-ops serve 42 million Americans across 56% of the nation’s landscape, it noted.

The dramatic increase in solar installations is pegged to NRECA’s launch of the Solar Utility Network Deployment Acceleration (SUNDA) project in 2014. As part of that project, which leveraged funding from the U.S. Department of Energy, several electric co-ops developed models and resources aimed to integrate solar into their respective portfolios. It began as a partnership with 17 cooperatives to build 30 MW of solar in 10 states.

“The impact of these projects expanded far beyond the footprint of those early adopters,” NRECA said. The average co-op solar project is more than 1 MW, up from 25 kW in 2014, and half of the nation’s co-ops have solar offerings for their members through projects that they own, power they buy, or joint projects with other co-ops, the reports says. By the end of 2019, the combined capacity of cooperative solar is expected to surpass 1 GW.

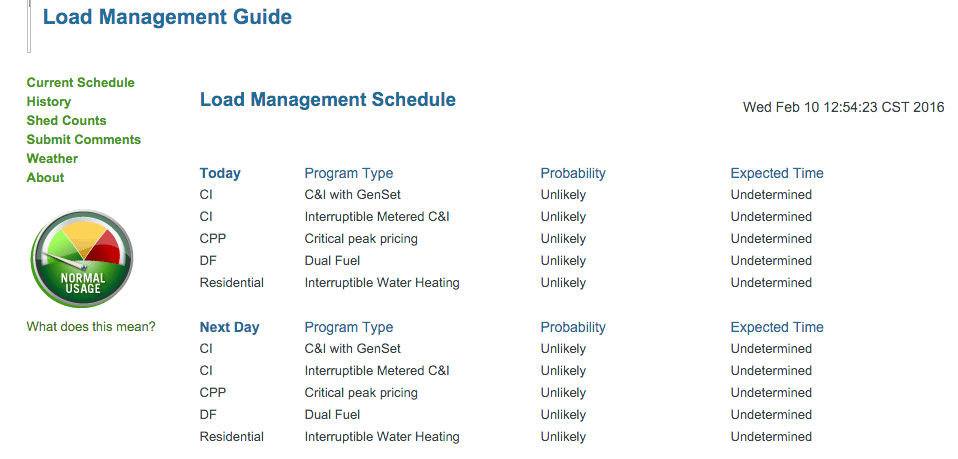

Innovations from the SUNDA project include community solar programs, partnerships with military installations, and combined solar and energy storage projects, including controllable water heaters.

Before SUNDA’s launch, a survey showed that some co-ops were reluctant to pursue a solar program owing to two primary concerns: the cost of solar and their lack of familiarity with PV technology. “Electric co-ops also pointed to caps on ‘self-supply generation’ in long-term wholesale power contracts with their power suppliers as a potential challenge,” NRECA said.

But co-ops are committed to serving members (as opposed to investors), and changes were driven by consumer-member demand, the dramatic declines in the cost of solar, economies of scale, and collaboration. These helped improve the economics of solar. “The first system deployed by a SUNDA co-op tested equipment and designs at a cost of $4.50 per peak watt DC. The last SUNDA deployment benefiting from the lessons learned and declining costs came in at $1.30 per peak watt DC,” NRECA noted.

Business models were also transformed to align with these factors. The community solar model, for example, aligns well with the co-op business model because like the co-ops themselves, they have open membership, they are local, and they are consumer-owned. Community solar among co-ops has today gone “viral,” NRECA noted. As of December 2017, cooperatives had or were planning 196 community solar projects.

SUNDA also transformed financing to reduce risks. Before the project began, few financing options were available to co-ops. “For several years, the Treasury Department offered one solution for tax-exempt entities in their Clean Renewable Energy Bonds, which were available to help finance solar programs at an advantageous rate. Tax-equity-flip financing, in which a for-profit entity partners with the not-for-profit entity in order to collectively take advantage of incentives, was well-known from large wind-power installations,” NRECA noted. “However, it was often too expensive for projects of an appropriate size for a local distribution cooperative (typically under 2 MW). These limited options added to the complexity and cost for co-ops interested in solar.”

In 2018, traditional co-op financing partners now have many more options, including direct financing, available from cooperative lenders such as National Rural Utilities Cooperative Finance Corp. (CFC) or CoBank, federal financing, leasing (arranged through the CFC or CoBank Farm Credit Leasing), and tax-equity financing (organized by third-party vendors or cooperative network organizations).

A financial screening tool created by NRECA, meanwhile, allowed co-ops to compare costs for small and large systems. “During the same period, co-ops’ traditional lenders standardized their solar financing options, making it faster and easier to finance solar projects,” it said.

That was especially important because cooperatives are not-for-profit entities that provide at-cost service in regions of the country where incomes are mostly below the national average. “[C]ooperatives are particularly sensitive to imposing additional costs on their consumer-members,” NRECA said. “As member expectations changed and costs came down, co-ops’ assessment of benefits and risks of solar programs also changed.”

Under the SUNDA project, co-ops also have access to a number of other helpful resources, including a “quick-start guide,” a “communicator’s toolkit,” and PV field manuals, NRECA said.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)