Europe’s continuing drive toward sustainable energy does not rule out a new generation of coal power plants to replace those scheduled to close by 2015.

In Europe right now, coal-fired power generation poses a paradox.

The years up to 2020 are forecast to see many new coal power plants being built in Europe, even as coal’s share of the generating mix continues to shrink and its perception as a dirty fuel becomes more firmly fixed in the minds of the public. Anti-coal protests are loudest in Germany, where the need for new coal capacity is arguably the greatest.

And though these new plants will boast high thermal efficiencies, they will not include carbon capture and storage (CCS). This seems odd in view of the European Union’s (EU’s) commitment to rapid and deep cuts in carbon emissions, but not even Europe’s political determination and high energy prices seem able to push CCS to full-scale projects. In several other EU countries, the push is toward multipurpose plants that can supply electricity and district heat while burning combinations of fuels (Figure 1).

|

| 1. Multifuel cogen plant. The Avedøre power plant south of Copenhagen, Denmark, is operated by the state-owned company DONG Energy. It has a generating capacity of 810 MWe plus 915 MWt for district heating, which is widely used in Denmark. The coal-fired Avedøre Unit 1 was built in 1990 and generates only power. Unit 2, which dates from 2001, can use a wide variety of fuels—gas, oil, straw, and wood pellets—for power and district heating. Unit 2 has an electrical efficiency of 49% and an overall efficiency of 94%. Courtesy: DONG Energy A/S and Jasper Carlberg |

In short, Europe’s citizens do not like coal, but for the moment they cannot do without it. Does that sound familiar?

Coal Capacity Closing

Europe needs new coal-fired capacity because many aging coal and nuclear plants will be closing in short order. Economics, poor planning, and air pollution all play a part in the shutdowns. In Germany, the political winds changed direction a year ago, forcing eight of the country’s 17 reactors into immediate retirement and scheduling the remainder for closure by 2022, regardless of age or condition.

For more than 20 years the European Commission’s Large Combustion Plant Directive (LCPD) has required furnaces and boilers above 50 MWt (the thermal input expressed in equivalent megawatts) to limit their emissions of sulfur and nitrogen oxides. Equipment for flue gas desulfurization and NOx control has been installed as a matter of course on new coal-fired power plants and has been retrofitted to many existing ones.

The operators of some old coal plants, however, decided that adding SOx and NOx control was not economically justified. In these cases the LCPD allows plants to run for an additional 20,000 hours or until the end of 2015, whichever comes soonest.

In 2009, Reuters reported that in terms of capacity, Britain topped the LCPD opt-out league. Poland opted out 37 plants, representing 32% of that country’s total generating capacity. Romania opted out 22% of its capacity and Spain 10%. Even nuclear-dominated France will lose 5% of its capacity by the 2015 deadline. In total, 17 of the EU’s 27 member states opted out a total of 205 facilities, though not all are power plants.

New Coal Rush Forecast

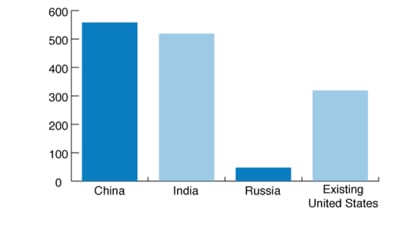

A new study by German energy consultancy ecoprog GmbH forecasts that coal’s share of electricity generation across Europe will decrease slightly over the next decade. But, says ecoprog, loss of existing nuclear and coal capacity, falling subsidies for renewables, and volatile gas prices will trigger a large amount of new coal capacity in the next few years.

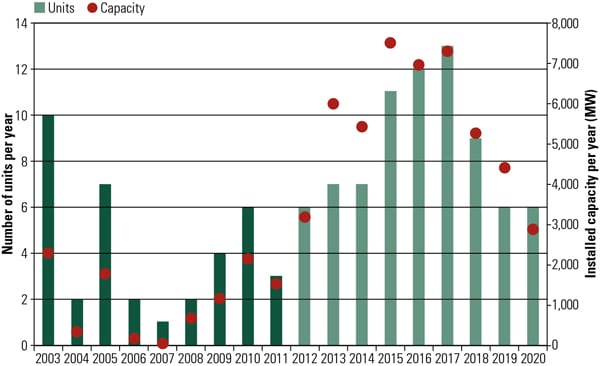

In late 2011, according to ecoprog, Europe had about 330 coal-fired power plants with a combined capacity of 200 GW from almost 950 units. Between 2012 and 2020, the firm says, approximately 80 new coal units will be built, with a capacity of about 50 GW (Figure 2). From 2003 to 2011, by comparison, only 40 units totaling 10 GW were built.

|

| 2. Coal rush begins. Coal-fired power plant construction in Europe is forecast to rise sharply in the years up to 2017 following the closure of old coal plants and nuclear plants, notably in Germany. Source: ecoprog GmbH |

An important driver for this new capacity is the need to replace old equipment, ecoprog says. The average age of Europe’s coal power plants is 34 years, and by 2020 around 55 GW to 60 GW of coal capacity will have reached the end of its operating life. The LCPD alone will account for the loss of 35 GW by 2016. The loss of nuclear power plants in Germany and Switzerland, oil-fired plants in Italy, and gas plants in the UK will further add to the pressure.

Germany’s Transformation

Germany faces considerable challenges in abandoning nuclear power (the Atomausstieg) and moves its energy production to sustainable sources (the Energiewende). With indigenous lignite (brown coal) and hard coal already fueling one-third of Germany’s 155 GW generating capacity, coal could be seen as an obvious choice to fill the 20-GW hole left by the nuclear exit.

Despite much media talk of money earmarked for climate protection being diverted to build new coal plants, a 2011 report for the German federal ministry of economics and technology suggests that this is an oversimplification. Yes, Germany is likely to build several new coal plants in the near future, but the country’s share of coal-fired generation will decline rapidly—with or without an exit from nuclear power.

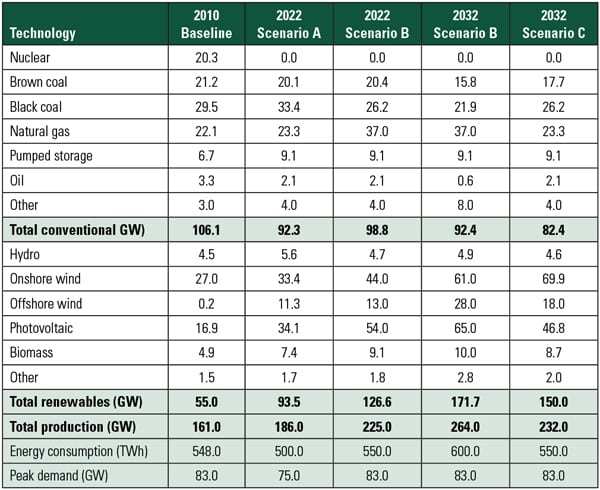

The report was prepared by two research organizations in Germany and one in Switzerland: the Institute of Energy Economics (EWI) at the University of Köln, the Society for Structural Economic Research (GWS) in Osnabrück, and Prognos AG of Basel. As far as coal and lignite are concerned, it suggests that generating capacity will fall from 55 GW now to 20 GW by 2030, even if the Atomausstieg decision were somehow to be reversed. Instead, the gap created by growing demand and loss of coal and nuclear capacity will be made up by gas, offshore wind, and especially solar photovoltaics. Similar predictions have been prepared by BNerzA, Germany’s Federal Network Agency (Table 1).

|

| Table 1. Nuclear exit strategy. Germany is considering several approaches to fulfilling energy demand in the absence of nuclear power. Shown are three suggested scenarios for Germany’s energy future developed by BNetzA, Germany’s Federal Network Agency. Scenario A assumes all of the German government’s priorities for climate and energy policy will be implemented and includes a moderate rise in coal-fired energy production. Scenario B starts with the assumptions for Scenario A but assumes a larger portion of renewable power, as well as more natural gas–fired energy production. This would make the system more flexible and reliable, due to a diversified mix of energy sources. Scenario C, the least realistic scenario, assumes Germany will have explosive growth in renewable energy, nearly tripling such resources between 2010 and 2022. It assumes that Germany will not continue to build new fossil fuel–fired power plants through 2022. Source: BNetzA |

Other work by the Prognos/EWI/GWS consortium suggests that ecoprog’s forecast coal boom may be overstated. A scenario study published by the consortium in August 2010 showed around 14 GW of new coal capacity planned or under construction. In another study published a year later, however, the researchers lowered this estimate to less than 11 GW and suggested that no investment in new coal capacity was likely before 2020.

Acting against investment in new German coal capacity is public opinion in favor of the Energiewende, backed by the country’s strong coalition of politicians—including conservatives—and environmental activists. BUND (Friends of the Earth Germany) sets up highly organized protests against new coal plants and claims to have halted 11 coal power projects in the past three years.

British Indecision

Britain is similar to Germany in its dependence on coal, which accounts for around one-third of current generating capacity.

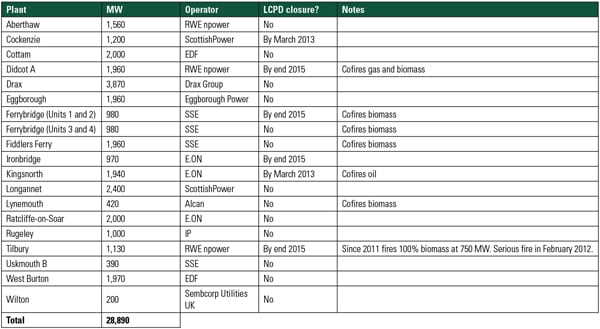

Operators in the UK chose six coal-fired and three oil-fired power plants to opt out from the LCPD. With a total capacity of around 11.5 GW, these nine plants accounted for around 15% of UK generating capacity at the time of the decision in 2001 (Table 2).

|

| Table 2. Coal plants closing in the UK. At 29 GW, total coal-fired capacity in the UK is almost one-third of total UK generating capacity, around 89 GW. LCPD refers to the EU’s Large Combustion Plant Directive, under which 7 GW of coal capacity will close by the end of 2015. Source: Department of Energy and Climate Change |

Because the 20,000 hours allowed by the LCPD opt-out represent less than three years’ continuous operation over the eight years from 2008 to 2015, operators have been managing their old coal plants carefully, but the end is now in sight.

In the UK, an exceptionally cold winter in 2010–11 put coal plants under heavy load. In March, operators E.ON and ScottishPower announced that two UK opt-out plants will close in March 2013, and it is not clear that all of the remaining four plants will stay operational until the December 2015 deadline (Figure 3). One of the original coal plants (Tilbury) has since converted to 100% biomass, though it is still due to close as a result of the LCPD.

|

| 3. Moving to gas. The 1,960-MW Didcot coal-fired power plant in the UK dates from the late 1960s. Now converted to cofire gas and a small amount of biomass, it operates infrequently because of the limit on operating hours imposed by the Large Combustion Plant Directive. Operator RWE npower is due to close the plant by the end of 2015. A 1,360-MW gas-fired combined cycle plant on the same site will continue to operate. Source: Nufkin/Flickr |

On top of this loss of coal capacity, the closure of nuclear and gas-fired plants will put Britain’s energy security at risk, many experts believe.

Government reluctance to plan for replacement of the UK’s aging nuclear fleet will mean the loss of seven plants by 2020. A new reactor at the existing Hinkley Point site is now being discussed, but it is unlikely to be online before 2020, and the degree of public opposition suggests that overall nuclear capacity will fall.

Even gas-fired generation is struggling in the UK. In March, energy company Centrica announced that it will close combined cycle gas turbine plants at King’s Lynn and Barry because they are not profitable. Even the new London Array offshore wind farm, with its record 1 GW installed capacity, will barely offset the loss of the 325-MW King’s Lynn plant.

Sam Laidlaw, chief executive of Centrica, told the Daily Telegraph newspaper in February: “It is vital that the Government provides the clarity and assurance that will be needed if the industry is to step up and deliver the massive investment—an estimated £200 billion in total by 2020—that the country requires.”

Consultancy Frost & Sullivan is less pessimistic about a UK energy gap. In a study published in March, the firm’s Jonathan Robinson pointed out that UK electricity demand fell by 3.4% in 2011 and that industrial demand fell by 4.1%. The firm suggests that while light industry has seen modest recovery from the recession, energy-intensive industries such as chemicals and steel are continuing to suffer from UK power prices that are high compared with those in many other European countries.

This fall in demand is one reason why Frost & Sullivan believes a UK capacity crunch in 2015–16 is unlikely. Around 1.5 GW of gas capacity was added in 2011, an additional 5.5 GW is under construction, the firm says, and 7 GW of new wind capacity will be online by 2015.

Also acting to damp down prospects for new UK coal plants is their lack of popularity with green-minded British citizens. A prime example is the ill-fated Kingsnorth site in the county of Kent, where operator E.ON proposed to build a 1,600-MW supercritical plant—the UK’s first new coal generation in three decades—to replace the existing plant, which will close by 2015.

Despite the fact that the new Kingsnorth plant was to feature demonstration-scale CCS, the site was the focus of sustained protests by environmentalists. In October 2010, E.ON announced it was abandoning the project.

Not unreasonably, the green movement fears that after permits have been awarded to new coal plants, any requirements to include CCS will later be dropped on grounds of cost. The only other UK demonstration-scale CCS project at the time, at Longannet in Scotland, collapsed a year later.

Beyond Ultrasupercritical

If Europe’s short-term coal boom does materialize, as ecoprog has forecast, what kind of plants will it produce?

Next year is scheduled to see the opening of the Trianel coal power plant in Lünen, Germany. With a forecast 46% efficiency, the €1.4 billion (US$1.9 billion) project will be one of the world’s most advanced conventional coal plants.

But European power companies and technology suppliers are aiming higher, with several research and development projects shooting for 50% efficiency through steam conditions of 700C and 350 bar.

At its headquarters in Mülheim an der Ruhr, Germany, the fossil power generation division of Siemens aims for a 700C steam turbine by 2015. The nickel alloys required are expensive, and experience gained with high-temperature gas turbines is largely irrelevant. Nonetheless, as far back as 2008 the company said it was confident of achieving a 200,000-hour lifetime at 700C (Figure 4).

|

| 4. Pushing the limits. Siemens of Germany is at the forefront of research and development to build a 700C, 350 bar steam turbine. The company is aiming for 50% efficiency from a non–integrated gasification combined cycle coal plant by 2015. Courtesy: Siemens AG and Rupert Oberhaeuser |

Industry consortia focused on 700C technology include the EU-supported COMTES700 component test facility, based at E.ON’s Scholven coal-fired power plant in Gelsenkirchen, Germany, and the North Rhine-Westphalia 700C Power Plant (NRWPP700) pre-engineering study by 10 European energy suppliers.

E.ON plans to start up a 500-MW 700C coal-fired plant in 2014. The “Kraftwerk 50plus” project is located at the German port of Wilhelmshaven, where seawater cooling and combustion air preheating will help to achieve the planned 50% efficiency. Average European coal plant efficiency is 36%, E.ON says.

According to Siemens, the €1 billion (US$1.3 billion) 50plus project will cost around 18% more than a conventional coal plant of the same size. Series production could reduce the cost premium to 10% to 15%, which might be acceptable if prices for coal and CO2 rise.

— Charles Butcher (charles@thiswritingbusiness.com) is a UK freelance writer specializing in the energy and chemical industries and a POWER contributing editor.