COMMENTARY

From both a regulatory and development perspective, 2018 was a significant year for the expansion of energy storage resources (ESRs). From a significant ruling of the Federal Energy Regulatory Commission (FERC), to the presentation and implementation of aggressive state initiatives, rapid ESR deployment continues unabated while ESR technology costs continue to decline precipitously.

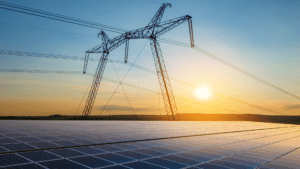

Undeniably, ESRs have arrived as a credible, useful component of a resilient and efficient grid. This article explores common ESRs and how they contribute to grid stability, the FERC’s impact on the development of markets to compensate ESRs, and how states are playing a pivotal role in advancing the development of ESRs.

ESRs and the Grid

An electric storage resource is defined by FERC as “a resource capable of receiving electric energy from the grid and storing it for later injection of electricity back to the grid regardless of where the resource is located on the electrical system.” Common examples of ESRs include batteries, pumped storage facilities, and compressed air energy storage.

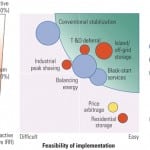

Because ESRs have the flexibility to consume or inject electricity, they can be used by grid operators and market administrators to balance supply and demand efficiently. Generally, grid operators identify the ability of ESRs to shift load as a consumer when load is low and as a supplier when load is high. ESRs can help manage peak demand, manage the integration of intermittent resources (such as solar and wind facilities), and defer distribution and transmission upgrades.

Because of their ability to store energy for later deployment, ESRs have the capability to mitigate demand during peak consumption periods. Additionally, because certain ESRs have the ability to ramp up and down rapidly in response to grid requirements, they are particularly useful in assisting grid operators in integrating increasing levels of intermittent, renewable sources of power.

Resources such as solar and wind do not have defined production patterns, and often they need to be curtailed for economic reasons. ESRs have the capability to flatten the production curve for such resources, thereby enhancing grid reliability.

Finally, ESRs can help operators manage transmission congestion. Grid operators are often confronted by congestion in areas of the grid that lack sufficient transmission infrastructure, particularly during peak periods. During such periods, lower-cost resources may not be able to be dispatched to serve load. ESRs strategically located on the uncongested side of that constrained transmission interface can ameliorate reliability issues.

FERC and the States

Technological and implementation success have been greatly assisted by regulatory intervention and state initiatives. Earlier in 2018, FERC issued Order No. 841. Under that order, Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs) were largely assigned the task of formulating appropriate participation models for ESRs. FERC directed them to make changes such that an electric storage provider can fully participate in all capacity, energy, and ancillary services markets; ensure that ESRs can be dispatched and that an electric storage provider can set the wholesale market clearing price as both a wholesale seller and buyer; account for the physical and operational characteristics of ESRs through bidding parameters or other means; and set a minimum size requirement for participation in wholesale markets that does not exceed 110 kW. In Order No. 841, FERC took a bold step by attempting to remove impediments to ESR development embodied in RTO/ISO rules more properly geared toward conventional generation resources.

FERC was not alone in removing impediments to ESR deployment and recognizing the unique grid enhancement qualities of ESRs. Several states have also instituted aggressive initiatives to spur ESR development. In New York, for example, state agencies issued an “Energy Storage Roadmap” calling for the installation of 1,500 MW of ESRs by 2025. California adopted the nation’s first directive aimed at investor-owned utilities (IOUs) and required the IOUs to have 1,325 MW of storage procured by 2020 and implemented by 2024.

Implications and Next Steps

The regulatory stage has been set to create a true market dynamic for ESRs, and electric market participants from grid operators to IOUs have recognized the real and potential reliability benefits of ESRs. To facilitate further ESR market development, it will be critical to establish wholesale market rules that permit ESRs to participate with a fair and compensatory recognition of their capabilities and services.

It will also be extremely important for state agencies, RTOs/ISOs, and IOUs to develop streamlined, clear interconnection rules. Both participation and interconnection clarity will enhance the investment community’s ability to understand the revenue and operational capabilities of ESRs, thereby leading to further financing opportunities for ESR development. ■

—Nicholas A. Giannasca is a partner in the energy practice of Davis Wright Tremaine (DWT) LLP. The views expressed in this article are his alone and do not reflect the views of the firm or of any particular client of the firm. The author would like to thank Jesse Jacobe and Julia Burke of DWT for their invaluable assistance in locating resources, checking citations and providing very helpful editorial changes to this article.