Once you synthesize all the elements of the Golden State’s clean energy strategy and extrapolate current trends, it’s easy to see that an impending break with the traditional power generation paradigm is coming, intended or not.

Imagine that you’ve spent several years digging into California’s multi-faceted clean energy policies. All the pieces of the puzzle are in place. Suddenly, you realize the finished puzzle looks a little different than the one on the cover of the box.

When you sift through all the policy papers, presentations, and regulations, it’s clear that California is pursuing what is arguably the most ambitious clean energy strategy in the country, perhaps the world. When you read between the lines, it’s also clear that the state is embracing a distributed power paradigm—something quite different from the familiar central station generating paradigm. Perhaps the scariest thing of all is that no one entity is in charge of implementing the strategy. According to a California Energy Commission (CEC) presentation this past summer, “multiple agencies have independent authority to act on portions of the puzzle, but not the entirety of it.”

If you’re thinking this has nothing to do with you, think again. It is striking to compare California’s energy aspirations and the energy strategy pursued by the Obama administration, at least until the super majority in the Senate got erased and the party in power was humbled with a big loss in the House of Representatives after the midterm elections in 2010. In 2009 a national renewable portfolio standard (RPS) was a real possibility, carbon cap and trade had even won the backing of major utility executives and passage in the Senate, a preference for working the demand side rather than the supply side permeated the stimulus funding and Department of Energy (DOE) programs, and the gauntlet around coal was being tightened. These are, coincidentally, all elements of the California strategy.

It may seem like ancient history, but it was less than three years ago. Today, with a Democratic Party super-majority in both houses of the California legislature supporting Democratic Governor Jerry Brown, impeding the ambitious clean energy agenda is far less likely. And to be fair, many of the programs and policies were also advanced under Republican governors as well.

Chiseling at the Paradigm

First, a little history is in order. Since the dawn of modern day electricity supply and delivery, the prevailing paradigm has been “big iron,” economies of scale from larger and larger power stations, longer and longer transmission lines, a diversity of energy sources, and in effect socializing the costs among all ratepayers in a service territory under a regulated rate of return business model. The Public Utility Regulatory Policies Act (PURPA) of 1978 was the first crack in that paradigm. However, it did not break open the “big iron” paradigm as much as it broke open the regulated and vertically integrated electric utility business model.

Over the past decade and a half, there has been a drive to lower the industry’s carbon footprint, displace coal with natural gas, add renewable energy, and get more out of the existing nuclear fleet. But once again, solar and wind energy facilities and gas-fired plants got bigger and more centralized, not smaller and more distributed. In the past five years, thanks to massive government expenditures, intelligent grid technologies have been deployed as a propellant to make conservation, energy efficiency, and demand side management the equal of supply side options.

Since the 1970s, the industry has seen small waves of distributed energy systems: total energy systems (that is, cogeneration, in the early 1970s), packaged cogeneration units (early 1980s), microturbine generators (late 1990s), and fuel cell units and rooftop solar photovoltaic systems (the past decade). With the exception of rooftop solar, whose wave is still advancing, these waves hit shore and quietly receded.

Ultimately, the centralized “big iron” paradigm prevailed.

California Is Different

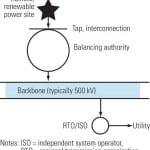

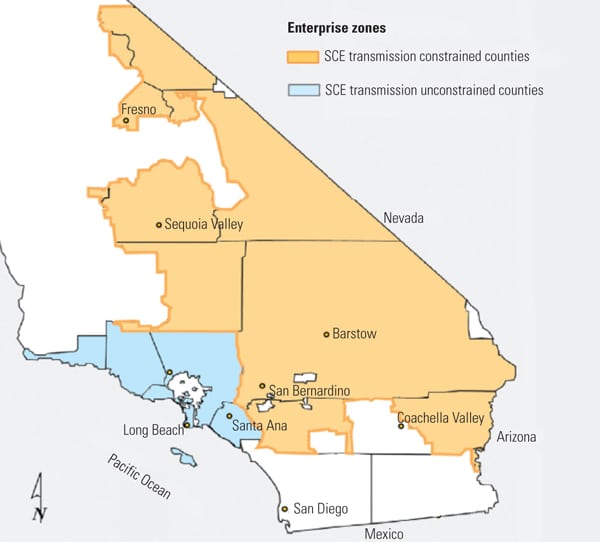

A key element of California’s clean energy strategy is a target of 12,000 MW of distributed generation (DG)—localized generation close to consumer loads (Figure 1)—as part of a 20,000-MW renewable energy buildout included in the state’s 33% RPS law. Approximately 3,000 MW of DG already exist in California, and an additional 6,000 MW are under development or authorized. The obvious regulatory preference for DG is indicated by the fact that it is 60% of the total new renewable capacity expected to be added.

|

| 1. Ambitious planning. Distributed generation is planned for deployment based on, among other things, unemployment characteristics and where low- to moderate-income households are located. Source: California Energy Commission |

Interestingly, California includes individual system size up to 20 MW in its DG planning. Supporting the solar portion of DG are the incentives provided in Senate Bill (SB) 1 and the feed-in tariffs in SB 32. Projects based on gas-fired small turbines and engines need not apply for those perks.

Large-scale renewable facilities represent the other 8,000 MW in the RPS that is supposed to be met by 2020. Geographic and permitting realities in the state suggest that the large-scale facilities must be accompanied by relatively long transmission lines if the renewable-based electricity is going to find customers. Thus, 13 critical transmission projects are contemplated along with the wind and solar installations.

Taking reality into account, though, how likely is it that the necessary transmission will be built by 2020? Even in an infrastructure-friendly state, transmission lines can take up to 10 years to permit and build.

By state, California is one of the largest importers of electricity in the country. Importing renewable energy from the hydro- and wind-rich Pacific Northwest and solar-rich Nevada and Arizona seems at first blush a smart way to meet the RPS. If you could get the transmission built, Colorado and Wyoming also could send California plenty of wind energy. Indeed, there are plans to build massive wind energy facilities in those states to serve the California market.

The recent Federal Energy Regulatory Commission (FERC) Order 1000 supports regional transmission planning and socializing the costs among ratepayers in the region. Part, if not most, of the inspiration for FERC 1000 was to get renewable energy to markets. The Department of the Interior, DOE, and other federal agencies are also supporting the development of big renewable energy zones in the western states through expedited reviews and permitting.

Unfortunately, California’s RPS policy is designed to discourage out-of-state renewable energy flows, although the restrictions take effect in the latter years of the mandate. As measured by energy (not capacity), 75% of the mandated flows must be “in-state bundled transactions” which caps the out-of-state opportunity. Also, SB 2X (the formal name of the RPS law) ensnares public utilities for the first time in the RPS program.

Even if California did encourage out-of-state flows, the regional strategy is questionable for other reasons. FERC 1000 could be challenged in the courts, and the means tests for socializing the costs, which requires valuing the benefits for specific classes of ratepayers, might be too arduous. The problem with regional development is that there is no regional government. Finally, multi-state transmission lines are more difficult to permit than in-state ones.

Supply Destruction

It would be one thing if California were simply adding renewable energy and DG capacity to meet future load growth. But that’s not the case. You may have heard the term “demand destruction“—what happens when an economy tanks and demand for goods and services is “destroyed.” Well, California is practicing a version of supply destruction.

The state consumes very little coal for electricity production, although the Los Angeles Department of Water & Power (LADWP) gets electricity from the large coal-fired Intermountain power station in Utah and the Navajo station in Arizona. However, several oil/gas-fired steam plants still operate along the coast, primarily in southern California. They depend on once-through cooling (Figure 2), a practice that could be outlawed by the pending Assembly Bill (AB) 1318. This bill, restricting thermal discharges, along with a new carbon emissions performance standard (1,100 pounds CO2/MWh), the strictest NOx emissions in the country, and other collars on fossil fuel in AB 32 (The Global Warming Solutions Act), are all likely to force the retirement of 15,000 MW of fossil-fired generation.

|

| 2. Water rules challenge power producers. Many of California’s fossil power stations rely on once-through cooling, now under threat by a bill pending in the California assembly. Source: California Independent System Operator |

Do the math: 15,000 MW of fossil-fuel capacity is to be replaced with 20,000 MW of renewable energy, 12,000 of which is DG. This suggests that DG is no longer something that is eating away at the edges. It’s critical to the supply side of the equation in California. When you superimpose a map of where the thermal plants are being retired, where the population centers are, and where transmission is constrained, it becomes pretty clear that DG will be replacing the existing supply, not supplementing it (see sidebar).

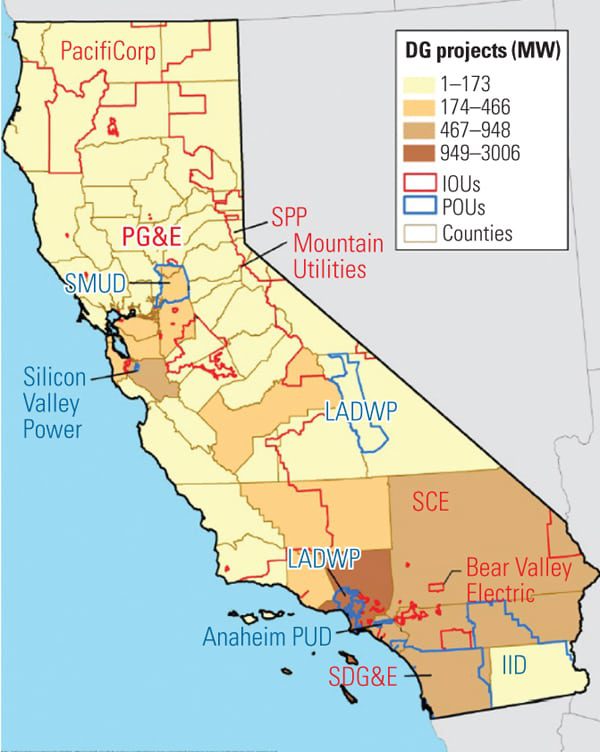

A map showing transmission constraints in Southern California Edison’s territory also tells an interesting story (Figure 3). The power plants (not shown) are mostly along the coast, and the planned centralized renewable capacity is in the southwestern part of the state. According to the utility, “the transmission constrained areas have little or no operational margin to handle any redistribution of network power flows without potentially adverse grid reliability impacts.” What this means is that even small changes to the network flow patterns, such as from developing more renewable energy, may not be possible without significant transmission upgrades.

|

| 3. Moving power problems. Getting power from the southwestern part of the state is constrained by transmission because so many power stations are located along the coast, stations whose operation is threatened because of pending once-through cooling prohibitions. Source: Southern California Edison |

According to the LADWP, the myriad clean energy mandates require the public utility to change 70% of its power system in a relatively short period of time.

If power supply inside population areas is being shut down and renewable power to the west inside or outside the state can’t get in, it seems certain that new DG facilities have to replace the older power station capacity.

Jobs, Jobs, Jobs

DG is also an important part of the state’s economic development plan. A big motivation for the state’s clean energy strategy is to have it serve as an engine for jobs creation and as an export base for advanced electricity infrastructure and electric vehicle systems (another element of the California strategy).

Interestingly, the location of DG systems is being allocated on the basis of electricity consumption (weighted 40%), low- to moderate-income households (20%), unemployed workers (20%), and distribution system capacity (20%). So, not only will the manufacturing of DG systems create jobs, installing them where the unemployed live also will help put people to work, so the theory goes. Estimates of the cumulative number of jobs (2011–2020) that will be created through the state’s clean energy strategy show that demand-side activities will be responsible for three to five times as many jobs as activities in renewable energy and five to 15 times as many jobs as activities in transmission.

It’s pretty clear where the state believes the job creation engine lies.

Not surprisingly, while the rest of the country latches onto the shale gas revolution, the West Coast has seen the largest reduction in natural gas production of any region in the country. Production has declined 33% there while, for example, production more than doubled in the eastern U.S., according to data from the Energy Information Administration.

It’s truly a fascinating dichotomy. California is driving its economy by reducing energy consumption, while one of the only “jobs engines” in the eastern part of the U.S. during the recession and prolonged weak recovery has been the boom in oil and gas extraction from shale plays.

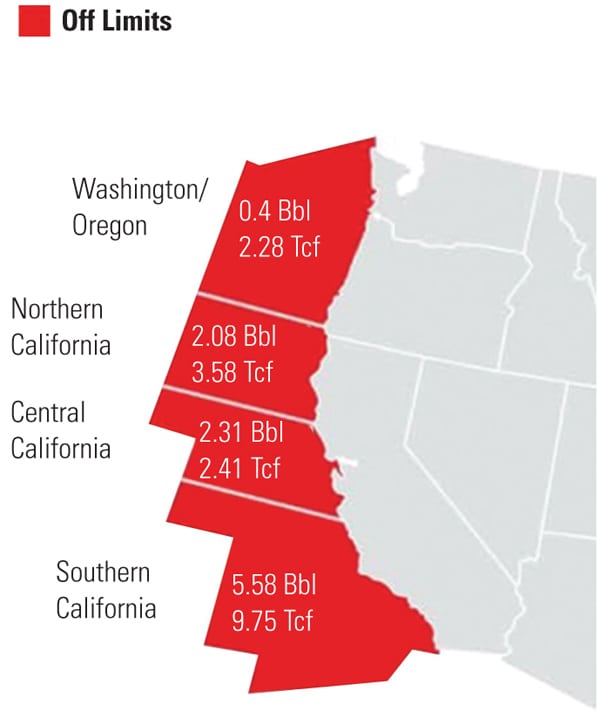

No Coastal Supply

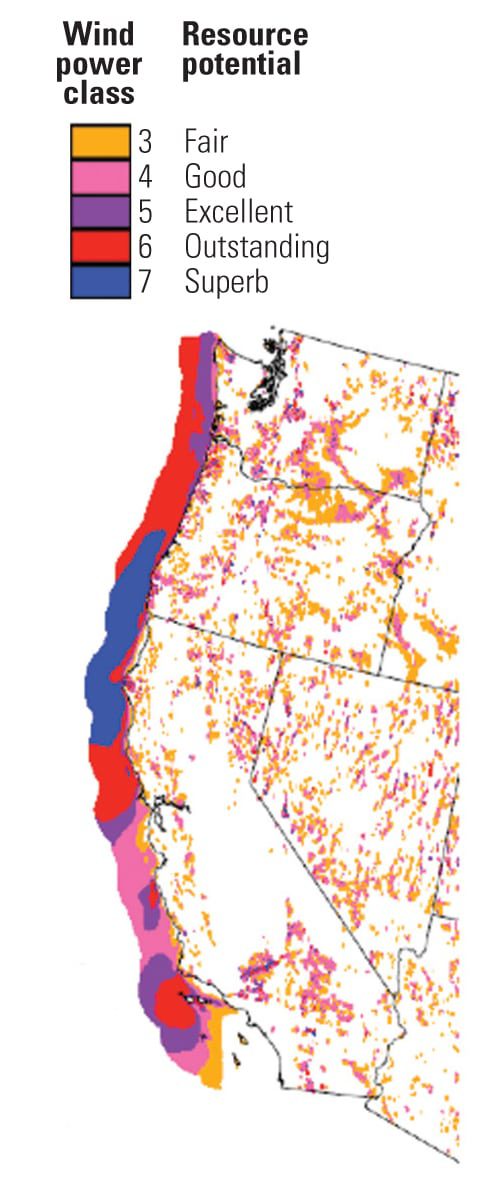

One thing’s for sure: California isn’t looking offshore for any of its energy needs. As states along the Eastern Seaboard and the Gulf Coast eye offshore wind enthusiastically, the resource isn’t even mentioned in California planning activities. Yet Northern California has some of the best offshore wind resources (Figure 4) in the country, and the offshore West Coast as a whole has some of the best oil/gas resources (Figure 5) outside of the Gulf of Mexico.

|

| 4. Snubbing offshore wind. Offshore wind is excellent in Northern California, but no one talks about developing it. This map shows the annual average wind power estimates at a height of 50 meters and ignores environmentally sensitive areas. Source: National Renewable Energy Laboratory |

|

| 5. Ignoring other offshore resources. Offshore oil and gas resources that could be leased from the federal government are also not part of any California energy plan. This map shows offshore undiscovered technically recoverable oil and natural gas reserves. Source: Minerals Management Service, Department of the Interior |

Distributed Storage

California has been active in developing energy storage technologies for many years; it’s one of only two states with an active research, development, and deployment program (New York being the other). It is also the only state considering, through AB 2541, setting targets for how much energy storage utilities should procure.

The California Public Utilities Commission (CPUC) is scheduled to make its recommendation by October 2013 for a first energy storage procurement target to be achieved by affected load-serving entities by December 31, 2015. The recommendation, however, can also be that no target should be set. The CPUC is currently developing “use cases” to determine commercial readiness of technologies, operational viability, benefit streams, policy options, and deployment barriers.

Storage has also become a key element in the state’s Integrated Energy Resource Plan. However, relevant agencies’ (CPUC, CEC, and the California Independent System Operator) planning and policy documents and presentations almost exclusively focus on distributed storage.

Bulk storage solutions, like pumped hydro storage (PHS) and compressed air energy storage (CAES), are hardly mentioned, even though at least a dozen PHS projects are in active development in the state, and several others in neighboring states could serve the California market. Three CAES projects are also being contemplated by utilities in the state; two received stimulus funding. However, the CAES projects are proceeding slowly, if at all.

Storage systems and natural gas–fired plants, in fact, now are considered mostly as support for filling in around intermittently available renewable energy. Quoting from the latest version of the CEC Integrated Energy Policy Report (IEPR), “Integrating [intermittent resources] will require a combination of complementary resources like energy storage, demand response, smart grid technologies, and flexible natural gas plants.” In fact, every mention of energy storage in the IEPR, except one, discusses storage in connection with distributed resources.

— Jason Makansi (jmakansi@pearlstreetinc.com) is president of Pearl Street Inc., a technology deployment services firm. This article is based on material taken from a PGS Energy Training Seminar developed and presented by the author in Sacramento, April 2012, and Portland, Ore., October 2012: “California Clean Energy and the Rest of the West.”