Duke Energy has kicked off an effort to renew the operating licenses of all its 11 nuclear reactors for 20 more years, starting with Oconee Nuclear Station, its largest nuclear plant.

The utility on June 21 filed an application with the U.S. Nuclear Regulatory Commission (NRC) for a subsequent license renewal (SLR) for the three-unit 2.5-GW Oconee plant. Located on Lake Keowee in Seneca, South Carolina, Oconee’s current operating licenses are slated to expire in the early 2030s. An NRC-approved SLR would extend their licenses to up to 80 years and potentially allow the plant to operate to as late as 2054.

Duke Energy’s application was submitted as the company grapples with the rejection of its subsidiaries’ integrated resource plans (IRPs) by South Carolina regulators last week. Last month, meanwhile, a major investor floated a bold strategic review to break up the company, increase local management, and ramp up Duke Energy’s investments in renewables and related critical infrastructure.

Nuclear and SMRs A Big Part of Duke Energy’s Net-Zero Strategy

Duke Energy said it has been planning to seek license renewals for its 11 reactors, which are sited at six nuclear plants, since 2019. Last October, company executives described nuclear power as an essential part of multiple potential pathways that the U.S. generator is willing to take to achieve its net-zero carbon goals by 2050. To meet that ambitious goal, the fossil fuel–heavy company is currently targeting a carbon emissions reduction of at least 50% compared to 2005 levels by 2030.

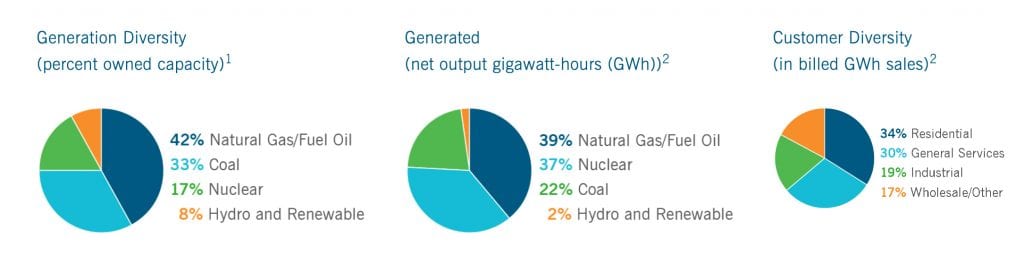

In 2020, Duke Energy’s nuclear fleet provided 83% of the company’s carbon-free generation. The bulk of its net output last year from its 50.8-GW owned fleet, however, was fired with natural gas or fuel oil. Notably, while its nuclear capacity made up only a 17% share of installed capacity, the fleet produced 37% of its net output. “To say that fleet is reliable is really an understatement. The capacity factor of the fleet, a measure of reliability, has been over 90% for the past 21 years,” Dhiaa Jamil, executive vice president and chief operating officer, noted last year.

Oconee Nuclear Station, a plant that has won three POWER Top Plant awards—in 2009, 2012, and in 2018—has three pressurized water reactors (PWRs). Unit 1 began operating in 1973, while Units 2 and 3 came online in 1974. “Renewing these operating licenses is a significant step toward achieving Duke Energy’s aggressive carbon reduction goals, which cannot be achieved without nuclear power,” Duke Energy spokesperson Ryan Mosier told POWER on June 22.

However, Mosier noted the development, commercialization, and deployment of a new generation of nuclear reactors, including small modular reactors (SMRs) and advanced nuclear reactors, are “also critically important” to the company’s goal. “Duke Energy is leaning in on this work because we believe that the enormous potential such technologies will have in the future,” he said. “SMRs represent a promising technology that we believe could potentially help Duke Energy make deep cuts in carbon emissions, while providing reliable energy for our customers.”

Asked what concrete steps the utility has taken to make SMRs a feasible step of its portfolio so far, Mosier noted Duke Energy is currently a member of the Nuclear Energy Institute, including the trade group’s Advanced Reactor Working Group and SMR Start, which is working on SMR technologies.

The company is also “actively involved” with the TerraPower and GE Hitachi Natrium advanced reactor project, along with PacifiCorp, Bechtel, Energy Northwest, North Carolina State University, Rocky Mountain Power, Orano, Centrus Energy Corp, Argonne National Lab, and Idaho National Lab.

“We are supporting this project in an advisory role by providing operational expertise in different areas, including siting and licensing, plant operating experience, project management, operator training and simulator experience. This work will be beneficial for our company as we look at advanced nuclear to complement variable renewables in the future,” Mosier said.

NRC Has So Far Approved Six SLRs

The NRC has so far approved SLRs for six nuclear reactors, clearing them to operate for 60 to 80 years. In December of 2019, Florida Power & Light’s (FPL’s) Turkey Point Units 3 and 4 became the first units to receive SLRs, allowing them to operate until July 2052 and April 2053, respectively. In March 2020, Exelon’s Peach Bottom Atomic Power Station was the second site to receive second license renewals for its two units, which are now licensed to operate until August 2053 and July 2054. And in May 2021, the NRC approved renewals for Dominion Energy’s Surry Power Station Units 1 and 2 in Virginia, clearing them to operate until May 2052 and January 2053.

NRC staff approved the license renewals after concluding each of these reactors had managed the effects of aging and met standards for a renewal issuance. On Wednesday, Duke Energy suggested investments it has made through improvements and regular maintenance would support Oconee’s SLR application.

Along with Oconee’s three reactors, four other nuclear reactors are currently in the NRC’s review pipeline for SLRs: NextEra Energy’s Point Beach 1 and 2, and Dominion’s North Anna 1 and 2. FPL this March also notified the NRC it would seek SLRs for St. Lucie 1 and 2 in the third quarter. St. Lucie 2, notably, is already currently licensed to operate until April 2043, and FPL indicated that it would seek an exemption from an NRC requirement that an SLR application not be submitted earlier than 20 years before its current license expires.

Regulatory and Investor Pressure

Duke Energy’s SLR applications for Oconee were announced amid some tumult concerning the companies future plans. On June 17, the South Carolina Public Service Commission (PSC) rejected a motion to approve IRPs submitted by Duke Energy Carolinas and Duke Energy Progress in a 2–4 vote. Instead, in a 4–2 vote, commissioners adopted a second motion that said the companies did not prove that their 2020 IRPs “are the most reasonable and prudent means of meeting their energy and capacity needs at the time of review.”

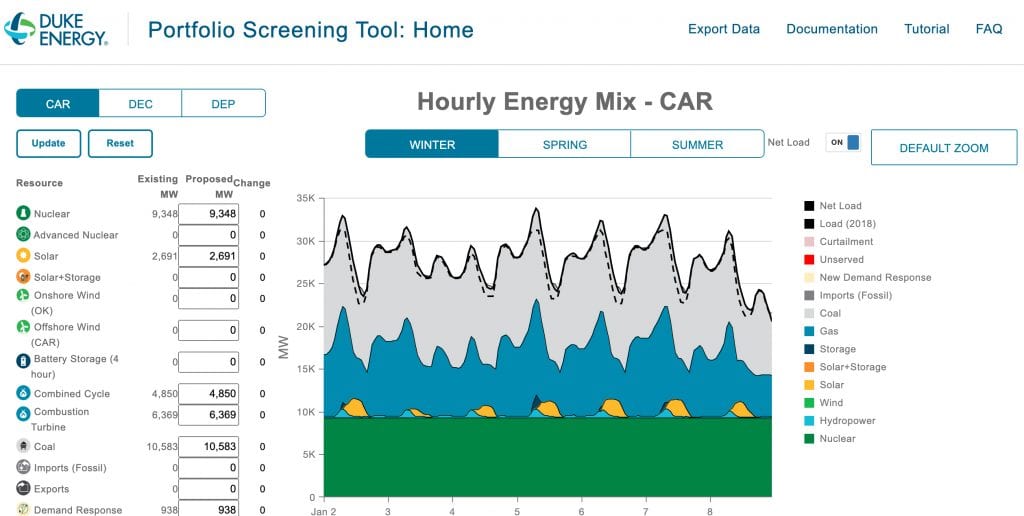

As part of that second motion, the commission ordered Duke Energy to identify a “preferred portfolio” from six plans presented in their IRPs. It also stipulated a long list of changes Duke Energy must make in its IRP, requiring the company to adjust its modeling to account for the December 2020 investment tax credit extension by Congress for solar development and demanding that it use the National Renewable Energy Laboratory’s Annual Technology Baseline (NREL ATB) “low figures” for battery storage costs.

All IRP updates must also include additional load forecast scenarios, “such as high and low scenarios that account for economic and other types of uncertainty or risks,” and Duke Energy must also “develop more sophisticated methods for estimating the potential impact of future extreme winter weather on load.” Finally, the PSC ordered a “comprehensive coal retirement analysis” to inform development of Duke Energy’s 2022 IRP.

The regulator’s action echoes a similar move in December 2020, when commissioners ordered Dominion Energy South Carolina to modify and refile its 2020 IRP. In response, Dominion this February filed a modified IRP, highlighting one resource plan of the 14 it evaluated as the “most reasonable and prudent” plan “to pursue at this time.” The plan suggests the utility would retire two large coal plants—Wateree and Williams stations—and convert another, Cope Station, to natural gas before the end of the decade. It would replace the lost coal capacity with high-efficiency combined cycle gas generation, up to 2 GW of solar, and up to 900 MW of battery storage between 2026 and 2048.

Duke Energy, which has said its 2020 IRPs support a diverse energy mix, is now awaiting more input from South Carolina regulators. “We are currently evaluating the Public Service Commission of South Carolina’s decision concerning our integrated resource plans. We’ll better understand the implications of the decision after we receive the commission’s order on the matter in the coming weeks and undertake the analysis spelled out by the order,” Duke Energy’s Mosier told POWER.

At least one major investor in the company, Elliott Investment Management, has meanwhile publicly pushed for more significant corporate changes. In a public letter on May 17, the hedge fund firm called on the board to begin a strategic review to break up the company into three regionally focused entities. The separation “will enable greater operational focus resulting in improved execution, better system reliability, lower costs and increased investment in critical infrastructure, including renewables,” it said.

But while Duke Energy last month responded that its board will review the proposal, it noted Elliot’s move is just “the latest in a series of proposals” Elliot has offered to Duke Energy since July 2020. Breaking up the company as part of a “shrink-the-company” strategy “underlies all of Elliott’s proposals,” but it “runs counter to the strategic direction of the entire industry at a time when scale is needed to efficiently finance the company’s unprecedented capital investment and growth opportunities,” Duke Energy said. The strategy also “ignores the obvious capital structure and credit issues, material equity issuance requirement, dis-synergies, dividend sustainability risk, regulatory issues and overall execution risks,” it said.

Duke Energy is already performing at a “high level by executing its clean energy strategy, delivering strong, sustainable value for shareholders, customers, communities and its employees, and outlining a clear vision for future growth, grounded in the largest clean energy transition in the country,” the company said. Duke Energy is poised to deploy over $125 billion of capital over the next decade and deliver 5% to 7% annual earnings growth along the way, it noted.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).