Macquarie Capital and a handful of other development sponsors announced they have successfully closed financing for the C$1.5 billion ($1.2 billion U.S.) Cascade Power Project, a 900-MW combined cycle natural gas-fired generating plant near Edson, Alberta.

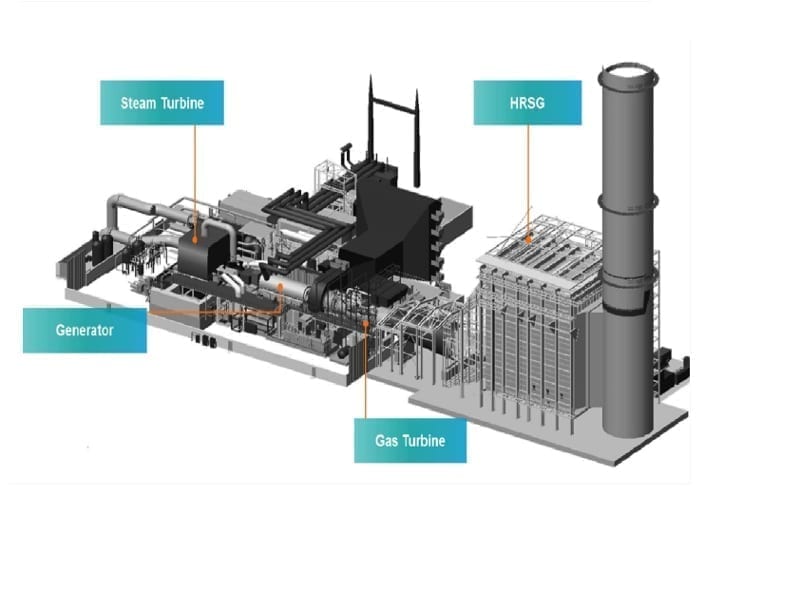

The new facility (Figure 1), expected to meet more than 8% of the province’s average demand for power, will feature two single-shaft Siemens SCC6-8000H power trains (Figure 2), the developers said in announcing details of the project on August 28. The SCC6-8000H is designed to have a combined-cycle efficiency rating greater than 60%, along with high operational flexibility. Siemens also will provide maintenance support under a long-term service agreement.

Alberta-based developer Kineticor Resource Corp. is part of the development group, along with Macquarie and Ontario-based pension fund OPTrust, which also serves as a project sponsor. Other sponsors include Axium Infrastructure, with offices in Montreal, Toronto, and New York City, and DIF Capital Partners, a global investment firm.

Axium Infrastructure is part of the group that recently closed financing for the new Three Rivers Energy Center project, Competitive Power Ventures’ planned 1,250-MW gas-fired power plant in Illinois.

“This project will sustainably deliver clean energy to a significant portion of Alberta and represents a massive emissions reduction opportunity for the province,” said Nicholas Gole, senior managing director at Macquarie Capital, told POWER. “Cascade is emblematic of the value that Macquarie Capital can bring to energy and infrastructure projects as both an early stage development investor, where we apply our deep industry and financial expertise to help drive development, and as financial advisor providing advice to help the project raise the optimal capital to facilitate construction. We are pleased that the project has reached financial close and is now under construction.

“Macquarie Capital is a leader, both in North America and globally, in project development, financing, and providing advice to a variety of energy projects,” Gole said. “Cascade fits alongside Norte III in Mexico, another large combined cycle gas turbine, that Macquarie Capital supported in multiple ways in its development and financing. Macquarie Capital is both currently supporting and actively looking to expand the number of power generation projects and natural gas infrastructure projects in which we can apply our unique blend of technical and financial expertise to create new, sustainable energy and facilitate the continued transition to lower carbon forms of power generation that serve communities well.”

BPC Will Serve as EPC

BPC, a joint venture between affiliates of PCL Construction and Overland Contracting Canada, a Black & Veatch company, will serve as the Cascade project’s engineering, procurement, and construction (EPC) contractor. Kineticor will act as construction and asset manager.

Construction of the power plant is expected to create about 600 jobs during peak construction, with 25 full-time jobs expected at the facility once it is operational.

“Cascade was initially conceived by a group of individuals looking to make a difference as Alberta begins to transition away from coal-fired power generation in the province,” said Andrew Plaunt, CEO of Kineticor, in a statement. “Today represents the culmination of several years of close collaboration with our development partners at OPTrust and Macquarie, along with consultants, engineers, vendors, gas suppliers and local stakeholders.

“With the financial support from Axium and DIF, along with our project financing partners, achieving this significant milestone of a successful financing will allow us to make Cascade a reality,” said Plaunt. “We at Kineticor are extremely excited and proud to be a part of a project that will provide enormous benefits to the environment, the local economy of Edson and Alberta.”

High-voltage transmission lines are already in place to serve the plant, which is located in an area with significant natural gas production. Cascade will be built in proximity to the NGTL System, the natural gas gathering and transportation system for the Western Canadian Sedimentary Basin (WCSB). The system connects most of the natural gas production in Western Canada to domestic and export markets.

The NGTL System is currently undertaking a $9.1 billion multi-year infrastructure expansion program designed to increase transportation capacity for Western Canada producers and provide downstream markets, including power plants, better access to natural gas.

Commercial Operation Set for 2023

The companies on Friday said construction will begin immediately, with the plant expected to enter commercial operation in 2023. Cascade’s power output already is contracted, and the project benefits from long-term gas netback agreements, which the developers said will provide cash flow stability and downside protection once the project is commissioned.

Cascade is among the projects being undertaken in Alberta to support the province’s transition away from coal-fired power. Government data shows Alberta contributes more than half of Canada’s greenhouse gas emissions from electricity generation. The Cascade project is seen as one of the largest emissions reduction opportunities in the country’s electricity sector.

Calgary-based Kineticor is a developer and manager of power projects across Canada. The company focuses on projects “that have an environmental and economic advantage versus the current marketplace.”

OPTrust, a firm with assets of about $22 billion, invests and manages one of Canada’s largest pension funds. DIF Capital Partners is a leading global independent infrastructure fund manager, with €7.5 billion ($8.9 billion U.S.) of assets under management across nine closed-end infrastructure funds and several co-investment vehicles. DIF Capital Partners invests in greenfield and operational infrastructure assets located primarily in Europe, the Americas, and the area known as Australasia, which includes Australia, New Zealand, New Guinea, and neighboring islands in the Pacific.

—Darrell Proctor is associate editor for POWER (@DarrellProctor1, @POWERmagazine).