Along with producing power from 99 turbines, the 309-MW Hornsdale Wind Farm in South Australia has helped trial new technologies that could ramp up power system security and reliability.

At first glance, the Hornsdale Wind Farm, a 99-turbine, 309-MW wind energy facility located in the mid-north region of South Australia near Jamestown, appears to be a run-of-the-mill facility. The project developed by French renewable energy company Neoen in conjunction with international infrastructure investor John Laing comprises three stages, HWF1, HWF2, and HWF3. All use Siemens 3.2-MW SWT-3.2-113 direct-drive wind turbine generators.

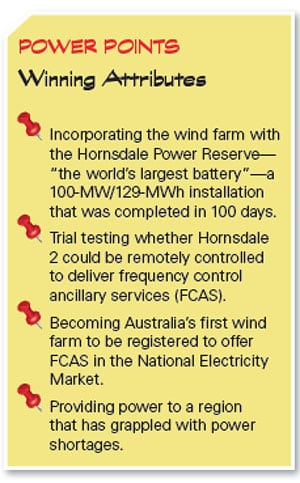

But since the first 32-turbine phase officially began operations in July 2016, the growing wind farm has incorporated two major projects that revolutionize management of wind power’s intermittency: It integrates the Hornsdale Power Reserve, a 100-MW/129-MWh Tesla Powerpack battery energy storage system, and it is the site of the first in-market technical demonstration of a wind or solar farm providing frequency control ancillary services (FCAS) in Australia’s National Electricity Market (NEM).

Building a Wind Giant

According to Neoen, a 2008-founded independent power producer that today develops, finances, builds, and operates renewable power projects across the world, the wind farm garnered development approval in July 2012, but the project officially got its start in 2014, when the company and local partner Megawatt Capital Investments won a 20-year feed-in-tariff for the first 100-MW phase, following the Australian Capital Territory (ACT) wind auction. At the time, Neoen touted the project’s contribution in helping the ACT achieve its 90% renewable energy target. In 2015, the second 100-MW stage of the project succeeded in the ACT’s second wind auction, and in 2016, the ACT government awarded feed-in-tariffs to the third 109-MW stage of Hornsdale. The third stage reached financial close in March 2017, covered by a highly competitive fixed 20-year rate of A$73/MWh.

While the project integrated some of the most highly efficient wind turbine models on the market at the time (Figure 1), in April 2017, Neoen went a step further to cut costs and boost efficiency by installing QOS Energy’s Qantum operations and maintenance (O&M) management platform. The platform monitors the operational and financial performance of the project, gathering and analyzing data generated by each turbine using a secure virtual private network (VPN) connection.

But the project’s importance grew even more dramatically after a chronic power shortage in South Australia surfaced in the latter half of 2016, after the state shut down its last coal-fired power plant. The aging Northern power station in Port Augusta had been rendered uneconomical by an oversupply of generation, owing partly to a surge in renewables that was encouraged by the state. Though reeled by a series of blackouts—including during the summer of 2017—the state stuck doggedly to an energy plan introduced in March 2017 that sought to cut its reliance on the Heywood Interconnector—an electricity interconnector with eastern Australia that feeds it coal power, stressing it wanted to produce its own power from wind, solar, and natural gas. (The state’s gamble has paid off according to a June audit from the Australia Institute, which notes that South Australia recently became a net electricity exporter.)

Development of the Hornsdale Reserve

Days after South Australia announced its energy plan, Tesla CEO Elon Musk tweeted to Australian billionaire Mike Cannon-Brookes, CEO of software company Atlassian, that Tesla could get a massive 100-MW/129-MWh energy storage system installed and working in 100 days as a solution to help the state mitigate debilitating shortages.

By July 6, 2017, after a competitive bidding process, South Australia’s former premier, Jay Weatherhill, announced an agreement between the state government and California-based Tesla to install 640 Powerpacks, roughly the amount of battery power used in 1,300 Tesla Model S P100Ds. The system was paired with the second-stage 100-MW Hornsdale Wind Farm. By September 2017, when the contract was officially signed, Tesla was already halfway through construction. By November 2017, the Hornsdale Power Reserve battery energy storage system had been completed, becoming one of the largest grid-scale battery installations in the world.

The Hornsdale Power Reserve, whose capacity represents about 75 minutes at full discharge, shares the same 275-kV network connection point as the 309-MW Hornsdale Wind Farm. The system provides a range of services under commercial agreements between the South Australian government, Tesla, and Neoen. These include providing 30 MW of the battery’s discharge capacity under normal conditions to Neoen for commercial operation in the NEM. The remaining 70 MW is reserved for power system reliability purposes (though it had not been dispatched as of April 2018). The system is also part of a new control plan—the System Integrity Protection Scheme (SIPS)—which is designed to reduce the likelihood of separation of South Australia’s power system from the rest of NEM following a sudden increase in flow on the Heywood Interconnector (as occurred and resulted in a blackout in September 2016). About 10 MWh of the power reserve’s total energy storage capacity is reserved for the control scheme.

According to the Australian Energy Market Operator (AEMO), operation of the power reserve to date suggests it can provide “a range of valuable power system services, including rapid, accurate frequency response and control.” These include changing how frequency response is assessed and paid for, which is important because current methods for assessing and commodifying frequency response involve performance assessment against a slow-moving change in frequency, and do not reward the more rapid response capabilities of batteries or other inverter-based technologies.

An Australian-First Frequency Control Services Trial

Paired with the lithium-ion battery system, Hornsdale’s potential garnered so much interest that in March 2017, just as the third stage of Hornsdale reached financial close, AEMO and the Australian Renewable Energy Agency (ARENA) announced it would collaborate with Neoen and Siemens-Gamesa Australia to assess whether HWF2 could provide grid-stabilizing services to the NEM in reaction to rapid changes in supply and demand, and other system conditions that could affect the stability of the South Australian grid.

The trial, which was conducted between August 2017 and February 2018, was implemented in three stages. But without any major grid outages during the trial, the potential for the wind farm to deliver full FCAS contingencies could not be evaluated. While the trial showed that Hornsdale could provide six of eight FCAS products, the 100-MW phase “was not able to register for fast raise and lower contingency FCAS, after preliminary modelling suggested wind turbines were likely be in ‘fault-ride-through’ mode providing voltage support in the first few seconds following a frequency event,” the AEMO said in a July report. That’s an important consideration because obligations in NEM Generator Performance Standards for wind farms to support system voltage and prioritize provision of reactive power over active power following a fault may prevent delivery of active power within six seconds of the frequency event. AEMO is now investigating whether another wind farm, the 168-MW Musselroe Wind Farm in Tasmania—can provide fast FCAS and interactions between ride-through and frequency control capability.

Still, the Hornsdale FCAS trial is critical because almost all wind farm projects built in Australia have been financed based on a business model relying on revenue from large-scale generation certificates (LGCs) and sale of power in the wholesale market. Frequency control services in the NEM before the trial were only provided by thermal and hydropower plants, AEMO noted. Hornsdale, which is the first Australian wind farm to be registered to offer FCAS, along with the Hornsdale Power Reserve, lowered FCAS prices from the historically observed A$9,000/MWh to just A$248/MWh—and that likely reduced the cost of the five-hour local South Australian FCAS requirement by approximately $3.5 million, it said.

Ultimately, it shows that wind providers could broaden the pool of available FCAS providers, and that delivers value to NEM customers by “improving market outcomes and increasing supply of system security services,” the operator said. The trial at Musselroe will more-fully examine the potential commercial and economic value available to a wind farm from participating in the FCAS market, the AEMO said.

For demonstrating these technologies and highlighting new business models that could make wind power more economic and reliable, Hornsdale is a worthy winner of a POWER 2018 Renewable Top Plant award.

—Sonal Patel is a POWER associate editor.