Data center power demand is accelerating, pushing the grid to its limits and prompting tech giants to bet on next-generation nuclear reactors. But given steep costs, regulatory hurdles, and uncertain scalability, is nuclear the future of data center energy—or just another high-stakes gamble?

At the end of January, Chinese artificial intelligence (AI) startup DeepSeek unveiled two large language models (LLMs)—DeepSeek-R1 and DeepSeek-R1-zero. Unlike previous generations of AI models, DeepSeek’s breakthrough reduced the compute cost of AI inference by a factor of 10, allowing it to achieve OpenAI GPT-4.5-level performance while consuming only a fraction of the power. The news upended future electricity demand assumptions, rattling both the energy and tech sectors. Investment markets reacted swiftly, driving down expectations—and share prices—for power generation, small modular reactor (SMR) developers, uranium suppliers, gas companies, and major tech firms.

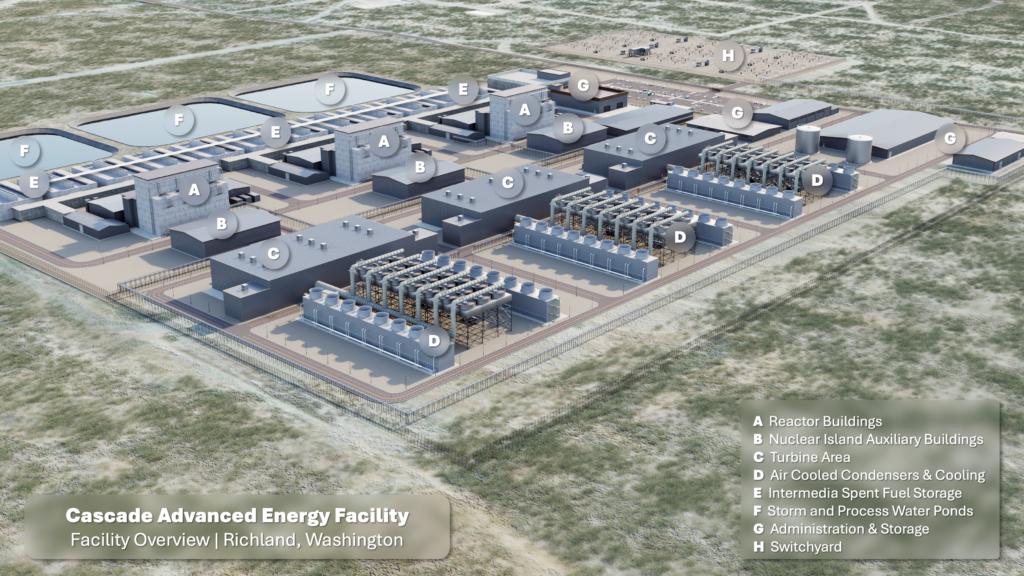

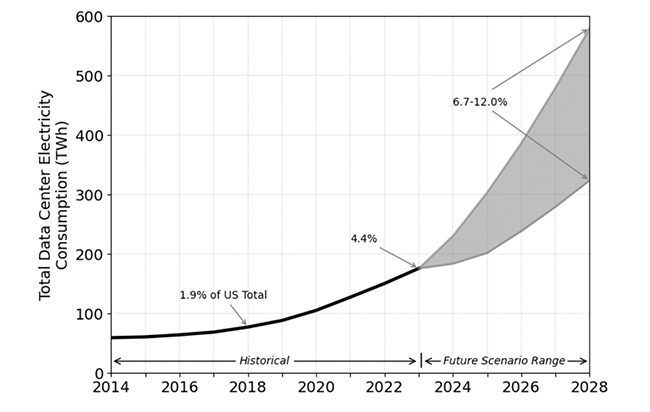

Yet, amid the chaos, optimism abounded. Analysts pointed to Jevons paradox, the economic principle that efficiency gains can increase consumption, rather than reduce it. “Our model shows a ~90% drop in the unit cost of compute over a six-year period, and our recent survey of corporate AI adoption suggests increases in the magnitude of AI use cases,” said Morgan Stanley Research. The U.S. remains the dominant market for AI-driven data center expansion, with 40 GW of new projects under development, aligning with a projected 57 GW of AI-related compute demand by 2028. Already, that load is transforming the energy landscape. A recent POWER analysis shows that U.S. data center electricity consumption could reach between 214 TWh and 675 TWh annually by 2030, up from 176 TWh in 2023 (Figure 1).

|

|

1. U.S. data center electricity consumption began rising steadily in 2017, driven by an expanding server installed base and the growing adoption of graphics processing unit (GPU)-accelerated servers for artificial intelligence (AI). AI inference workloads and hyperscale data center expansions are expected to increase electricity demand sharply in coming years. Source: Lawrence Berkeley National Laboratory (LBNL 2024 United States Data Center Energy Usage Report) |

That has dramatically raised the stakes, igniting a desperate frenzy across both the power industry—which must generate and deliver reliable electricity for a variety of emerging large load consumers—and the data center industry, which is scrambling to procure firm scalable energy to sustain its explosive growth, now and well into the future. The stakes are fueled by real fear. In November, research firm Gartner projected that power required for AI data centers could reach 500 TWh per year by 2027, a 2.6x increase from 2023 levels. It warned that power shortages could restrict 40% of AI data centers by 2027 and drive up energy costs.

The upfront cost of power is no longer the deciding factor for data centers, speakers at the Sustainable Data Centers Summit in Dallas, Texas, suggested in early February. “It’s crazy because we look at like the state of Oregon is about 6 GW, and you have these large hyperscalers [asking] ‘Can I get 6 GW too?’ ” said Mohammed Hassan, senior technical program manager for Amazon Web Services (AWS) Sustainability. Hassan suggested the industry has had to rethink how it approaches energy planning and procurement completely to align with incentives, address regulatory hurdles, and secure long-term reliability. “Solar and wind has taken off in the lead. But if you look at the needs of 2045, in trying to meet the Paris Agreement, solar and wind won’t be enough, so you have to look at what’s the next step.”

At the conference, speakers pointed to potential alternatives that could perform over the short term: natural gas as a “bridge fuel,” carbon capture as a potential future solution, energy storage solutions for flexibility and to promote grid resilience, and renewable diesel as a cleaner backup power option. But to meet long-term goals, the industry is willing to bet on nuclear power for its many benefits—despite the significant challenges that remain.

|

|

2. Advanced nuclear firm Last Energy is pursuing a business model that relies on long-term power purchase agreements (PPAs) to finance, build, and operate its fleet of small modular reactors (SMRs). The company in February announced it would build 30 microreactors at a site in Haskell County, Texas, to power data centers across the state.Courtesy: Last Energy |

Advanced nuclear developers are overwhelmingly on board. “The overwhelming sentiment nuclear has received from the data center industry is gravitation, not reluctance,” Matt Fossen, vice president of Communications at Last Energy (Figure 2), told POWER. Data center developers recognize that nuclear is uniquely well-positioned to provide the kind of clean energy abundance and 24/7 reliability they need to meet demand. And, in particular, they’re gravitating toward solutions like microreactors because they enable fast delivery, on-site installation, and efficient scalability to meet demand today and tomorrow.”

Why Data Centers Are Turning to Advanced Nuclear

Progress to cement supply to data centers has been fluid over the past year, ushering in a wave of mega-deals, with many more still in development. While many have involved power purchase agreements (PPAs) to procure power from renewables and natural gas power plants, several have focused on existing nuclear plants.

In September, Microsoft and Constellation Energy committed $1.6 billion to restart Three Mile Island Unit 1, now rebranded as the Crane Clean Energy Center, with a targeted 2028 reopening. Other deals are under discussion by Vistra for Comanche Peak in Texas; Public Service Enterprise Group, possibly for Salem and Hope Creek in New Jersey; and Constellation Energy, possibly for Calvert Cliffs in Maryland. Meanwhile, though AWS has sought to expand the Cumulus data center’s load, co-located with Talen Energy’s Susquehanna nuclear station in Pennsylvania, to 480 MW, the proposal was blocked by the Federal Energy Regulatory Commission (FERC), which cited concerns about grid cost allocation and reliability impacts, and the dispute has moved to the U.S. Fifth Circuit Court of Appeals. So far, according to trade group the Nuclear Energy Institute (NEI), 45% of the 95 existing units in the U.S. have expressed interest or planning in data centers, with at least 25 sites looking to fulfil power requirements ranging from 400 MW to 1,920 MW.

Deals have also abounded for advanced nuclear, including SMRs and microreactors, even though their commercial viability hasn’t yet been demonstrated. In September, Oracle announced plans to build a gigawatt-scale data center powered by three SMRs, securing building permits as part of a push to expand its cloud infrastructure. In October, Google signed a pioneering Master Plant Development Agreement with Kairos Power to develop a 500-MW fleet of molten salt reactors by 2035. That same week, Amazon unveiled plans to back 5 GW of new X-energy SMR projects, starting with a four-unit, 320-MWe Xe-100 project in Washington with Energy Northwest, alongside a Dominion Energy partnership to explore a 300-MW SMR near Virginia’s North Anna Power Station. In December, Oklo partnered with Switch, a Las Vegas-based data center designer, builder, and operator, to deploy 12 GW of Aurora powerhouses through 2044 in a historic deal hailed as “one of the largest corporate clean power agreements ever signed.”

“When it comes to producing electricity, I wouldn’t say there’s any one advanced reactor technology that jumps out as being optimized solely for data center applications,” said Patrick White, research director of think-tank Nuclear Innovation Alliance (NIA). “But what we’re seeing is that these reactors have the potential to provide the kind of high-reliability, cost-stable, and emissions-free power that data centers are increasingly seeking.”

The key reason SMRs are gaining traction over larger gigawatt-scale nuclear plants relates to siting flexibility, he explained. Industry is looking at deploying “tens or hundreds of megawatts at a time, which can make it a lot simpler in terms of siting it with whatever demand, wherever the electricity demand actually is,” he noted. But, in addition, he said many of these advanced designs will be engineered to have “a reduced water demand for cooling water or to eliminate the need for cooling water entirely, by looking at things like direct air cooling.” That also opens up a wider range of potential siting options, including the possibility of co-locating nuclear power plants directly with data centers, he noted.

The more concerning question surrounding the integration of advanced nuclear with data centers is whether nuclear can scale fast enough to meet the industry’s growing power demands. The first SMRs from companies like GE Hitachi and X-energy aren’t expected to be operational until 2029–2030, and while microreactors might arrive sooner—around 2027–2028—the scalability of the smaller units remains uncertain.

“The question is not whether nuclear can power data centers—it’s whether data centers are willing to wait for nuclear,” White noted. “Data centers could be nuclear’s first customers, pulling tech to commercialization—but will they commit for the long haul?”

The Data Center Dilemma: Weighing the Nuclear BetFor Google, Amazon, Microsoft, and other data center developers, owners, and operators, recent nuclear deals or agreements signal clear interest to bolster the burgeoning advanced nuclear market. But they go well beyond reliability, as sources told POWER on the sidelines at the Sustainable Data Centers Summit in February. “It’s not just about doing a PPA and calling it a day,” explained Mohammed Hassan, senior technical program manager for Amazon Web Services (AWS) Sustainability during a fireside chat. “We’re willing to put our money where our mouth is and invest in the development of these technologies because we know they’re going to be critical to meeting our sustainability targets.” Sources outlined a long list of key attributes that make nuclear an attractive option for data centers, but they also highlighted critical concerns that could hinder adoption. Why Nuclear Is Drawing InterestDecarbonization Goals. Nuclear energy provides a carbon-free alternative to fossil fuels and could help data centers meet aggressive sustainability targets and corporate sustainability targets. Energy Density. AI-driven workloads demand unprecedented power levels, and nuclear’s high energy density makes it an attractive option for scaling capacity without requiring vast land footprints. Grid Stability. The surge in AI workloads is creating volatile demand spikes, putting significant strain on grids. Nuclear’s steady 24/7 baseload power is seen as a potential solution to grid congestion and reliability issues. One industry expert emphasized, “You have to look at a source that can handle the [power needs], and where we need to go, and nuclear is the most sustainable.” Long-term Energy Strategy. Nuclear power is seen as a potential solution to meet future energy demands. What’s Holding Nuclear Back?Public Perception. Historical concerns over safety, spent nuclear fuel management, and cost overruns continue shaping public resistance to nuclear development and could pose risks or affect siting and permitting for colocated data centers. Regulatory Hurdles. Advanced reactors face lengthy approval processes that conflict with the data center industry’s rapid growth timelines. Long Development Timelines. Nuclear projects often face delays and extended construction periods, which may not align with the rapid deployment needs of data centers “You’re looking at 15 to 20 years before you can actually get a nuclear plant up and running,” said one expert. Technology Readiness. While SMRs show promise, they are not yet widely deployed. Financial Risks. High upfront capital costs and first-of-a-kind deployment risks make the economics of SMRs uncertain. That has raised concerns about whether nuclear will be cost-competitive in time to meet AI-driven demand. Grid Integration. As data centers expand, states are reworking utility policies to shift transmission costs onto large-load customers. Some regulatory structures do not yet accommodate nuclear-backed behind-the-meter solutions, adding complexity to grid planning. Competing Clean Energy Options. Data centers are also exploring other clean energy sources. One expert told POWER: “Most companies are moving towards natural gas because of the flexibility that it offers.” Skills Gap. The nuclear industry faces a shortage of skilled workers, which could affect the operation and maintenance of nuclear facilities for data centers. Geopolitical Considerations. Nuclear power involves sensitive technologies and materials, which can complicate international data center operations and expansions. |

Addressing the Timing Gap

How advanced nuclear scales up ultimately depends on market risks and scalability challenges, experts told POWER. The most prominent among them, predictably, involves regulatory bottlenecks. While the Nuclear Regulatory Commission (NRC) is shifting toward a more “performance-based and risk-informed” approach, developers remain frustrated by lengthy approval timelines and evolving safety requirements. While high regulatory costs are another considerable consideration, relief may be on the horizon. The NRC recently proposed a dramatic reduction in service fees—slashing them by more than 50%—for advanced nuclear reactor applicants and pre-applicants. The move, designed to incentivize innovation and accelerate next-generation nuclear deployment, proposes a two-tiered hourly rate system, is set to take effect in late 2025.

“The barriers for advanced reactor projects aimed at supporting data center capacity are similar to barriers to advanced reactor development and commercialization more broadly,” Elina Teplinsky, leader of the energy practice at Pillsbury Law, told POWER. “However, there is the added factor of timelines—data center operators need the power today, while it takes a number of years to license, develop, and deploy an advanced reactor, or any nuclear facility.”

So far, the NRC has begun adapting its framework to accommodate smaller, more flexible reactor designs. The approval of NuScale’s site-boundary emergency planning zone (EPZ)—which eliminated the traditional 10-mile evacuation zone requirement—marked a landmark decision that will allow nuclear plants to be located much closer to industrial facilities, including data centers, several experts pointed out.

“NRC already validated a risk-informed methodology for NuScale that allows that developer to adopt an EPZ limited to the site boundary,” Teplinsky explained. “This paves the way for other developers to use methodologies to demonstrate that smaller EPZs will provide the same level of protection to the public as the 10-mile EPZs currently mandated by the NRC for existing plants. This would allow the siting of advanced reactors closer to population centers, including data centers.”

In addition to the NRC licensing issues, regulatory concerns span “contending with the interconnecting utility and state regulations for behind-the-meter generation or the [independent system operators] and interconnection queues if connecting to the grid,” said Baker Botts partner Elaine Walsh. “Some regions are friendlier to these developments than others. Then they may have local water issues to deal with.”

Meanwhile, policy remains a risk. “It’s not clear that policymakers have fully appreciated the challenges with meeting this new expected demand growth, and policy often trails market trends,” noted Eli Hinckley, a partner at Baker Botts. “Uncertainty is a massive hurdle for infrastructure investors—long lives and relatively low yields need certainty as it relates to off-take and policy. An unstable policy position undermines actual investment,” he said.

Permitting is also still evolving—and recently suffered a setback when FERC rejected an interconnection service agreement between PJM Interconnection and Susquehanna Nuclear that would have increased the load sent from the Susquehanna nuclear plant to AWS’s Cumulus data center co-located with the plant. “FERC’s position on interconnection service agreements that allow for direct power sales from nuclear power plants to data centers will be a key permitting issue in the potential co-location of data centers with advanced reactors,” Teplinsky noted. Meanwhile, states like Ohio and Georgia have introduced new policies requiring data centers to cover infrastructure costs upfront. Tha may signal another broad shift in how utilities and regulators plan to manage the financial burden of rapid energy demand growth.

Overall, regulatory complexity will remain a major challenge, several sources suggested. “Developers face technical, political, and regulatory hurdles, including NIMBYism and complicated processes for securing state and federal permits to build new nuclear facilities,” law firm Vinson & Elkins told POWER. The law firm, however, noted that critical issues are partially addressed in the bipartisan ADVANCE Act, passed in 2024, which directs the NRC to streamline licensing, cap fees for advanced reactor applicants, and accelerate approvals for coal-to-nuclear conversions. The law also expands funding for workforce development, strengthens domestic nuclear supply chains, and mandates a faster permitting framework. And, as notably, it introduces prizes to incentivize first-of-a-kind reactor licensing. Those measures, designed to ease financial burdens and spur deployment, are slated to cover NRC fees for the first advanced reactor to secure regulatory approval for flexible operations, nonelectric applications, or the use of spent nuclear fuel.

Behind-the-Meter Nuclear: A Direct Power Solution?A much-explored approach gaining traction as hyperscalers seek dedicated, reliable, and carbon-free power to meet AI-driven energy demand involves behind-the-meter (BTM) configurations—the so-called “colocation” option in which load co-colates with a generator that is interconnected to the grid, but is situated behind the generator’s meter. Compared to traditional power purchase agreements (PPAs), where electricity flows through transmission and distribution networks, a BTM setup connects the data center and power plant on site. In the case of nuclear power, this means a data center could draw electricity exclusively from a co-located nuclear plant, rather than purchasing power from the broader transmission system. A key advantage cited by data centers is that BTM integration offers cost efficiency, generally because they eliminate transmission and distribution charges, but also because they could potentially bypass wholesale power markets, and offer more energy security by shielding data centers from grid congestion, price volatility, and curtailment risks associated with renewable-heavy grids. In addition, proponents argue that co-locating data centers with advanced nuclear could allow faster deployment, given that facilities can be built closer to the load center without lengthy transmission upgrades. However, this comes with a risk: if the nuclear plant goes offline, the data center must rely on on-site backup power, as grid service may not be immediately available. For now, BTM arrangements remain under considerable regulatory scrutiny. Maryland’s Senate Bill 1 (SB1) is actively assessing how colocated projects at the Calvert Cliffs Nuclear Plant would impact ratepayers and grid stability, while Texas, through Senate Bill 6 (SB 6, filed on Feb. 12), is exploring the costs and planning required for integrating massive loads like data centers. If passed, SB6 could impose new requirements on large BTM loads after December 2025, including mandatory transmission charges, financial commitments, and potential deployment of on-site backup generation, and observers suggest it could make BTM arrangements with advanced nuclear more expensive and administratively complex. At the federal level, the Federal Energy Regulatory Commission (FERC) is moving swiftly to define how co-location fits within wholesale electricity markets, particularly in the PJM region. On Feb. 20, FERC initiated a show cause proceeding directing PJM and its transmission-owning utilities to propose tariff changes that govern the rates, terms, and conditions for co-location arrangements. While PJM has projected a dire need for more than 30 GW of additional peak load over the next five years, FERC’s intervention seeks to address critical questions around jurisdiction, cost causation, reliability, and capacity market participation. If FERC imposes new transmission or market requirements, it could alter the economics of BTM nuclear projects, potentially affecting financing models and deployment timelines. From a grid perspective, PJM has flagged concerns over planning and reliability risks. While traditional network loads are integrated into long-term planning, BTM configurations can create blind spots, as they aren’t accounted for in regional capacity planning, it says. According to a February 2025 paper from Duke University’s Nicholas Institute for Energy, Environment, and Sustainability, additional considerations must be weighed when evaluating BTM nuclear projects. One key factor is load flexibility —large colocated loads, such as AI data centers, could be required to provide grid services, such as demand-side response, to help maintain system reliability. The paper also highlights grid utilization impacts, noting that while some BTM loads may avoid grid transmission charges, they may still impose costs on system planning and resource adequacy. Additionally, it warns, market pricing structures may shift, potentially forcing BTM users to contribute to shared grid infrastructure costs. Uncertainties also extend to technical and operational aspects, given that SMRs and microreactors remain untested at scale for continuous high-demand applications. Hybrid models—where BTM nuclear remains partially grid-connected for redundancy—could require new regulatory frameworks to establish pricing, reliability obligations, and backup provisions, it notes. |

Emerging Business Challenges

Still, beyond regulations, the actual business of running co-located nuclear plants remains uncertain. While recent discussions highlight tech companies as potential investors in advanced nuclear facilities, data center sources confirmed most aren’t attracted to the prospect of owning and operating nuclear plants.

“Data center operators are not in the business of running power plants,” said Walsh. “They want reliability and cost certainty, but they don’t want to deal with regulatory oversight, fuel procurement, or reactor maintenance.”

For now, long-term PPAs look like the preferred model. “Looking across all fuel and technology types, we’re seeing a variety of structures to accommodate data center load, including PPAs and retail energy supply agreements, as well as data centers, hyperscalers, and real estate developers actually taking equity in these projects,” she added. “I would expect fewer data center and real estate developers will be holding equity in nuclear assets.”

Teplinsky, however, noted that along with recent tech giant investments in nuclear development, some companies are exploring partial ownership stakes to secure guaranteed energy supply. “Deals with hyperscalers also present an opportunity to secure some equity investment into these projects,” she said. “The demand from data centers is less a barrier than an opportunity—it allows developers to secure firm and bankable offtake for these projects—potentially at a premium.”

From an operational standpoint, co-located facilities can pose new risks, as Nina Sadighi, professional engineer and founder of Eradeh Power Consulting told POWER. “Who’s going to insure these plants?” she asked. “That’s a huge unknown. Right now, insurance providers are hesitant because of the regulatory and operational complexity. The traditional nuclear liability structures are built around large reactors with established operational histories, and when you introduce something novel like SMRs or microreactors, you’re dealing with a very different risk profile.”

Sadighi, though generally optimistic about nuclear’s suitability for data centers, also pointed to potential workforce-related challenges that hinge on timely deployment. “If we train nuclear workers now, but deployment gets delayed, those workers won’t wait around,” she said. “The nuclear workforce pipeline is not like a tech workforce, where people can pivot between roles quickly. These are specialized skills that require years of training, and if there’s uncertainty about job stability, we risk losing them to other industries entirely,” she said. Sadighi also raised concerns about the stringent operational protocols that add to labor inefficiencies.

Finally, while the data center industry isn’t solely bent on economics—and told POWER sustainability with a long-term vision is a bigger priority—scaling up will require significant investment. That has sparked all kinds of debate. Lux Research estimates first-of-a-kind (FOAK) SMRs could cost nearly three times more than natural gas ($331/MWh versus $124/MWh) and more than 10 times more when factoring in cost overruns and delays. The firm projects SMRs won’t be cost-competitive before 2035. “Cheap nuclear just isn’t in the cards in the next two decades,” it says.

However, a recent Idaho National Laboratory study suggests costs could decline as SMRs move to Nth-of-a-Kind (NOAK) production. It suggests modular construction, factory fabrication, and standardized deployment could drive efficiencies, potentially reducing costs as more units are built. Notably, the study describes an “economies-of-scale penalty crossover point” where SMRs achieve cost parity with large reactors if enough units are deployed. Deploying four 300-MW SMRs could drop costs by 20% compared to a single 1,200-MW reactor, it suggests. For now, the first real-world test of this cost curve will be Ontario Power Generation’s BWRX-300 SMR fleet, which is expected to start operating by 2029.

The fundamental debate is rooted in several uncertainties—which is not uncommon for emerging sectors, experts also generally pointed out. “Tax credits—especially the clean electricity production tax credits and investment tax credits—will be vital to the commercial viability of these projects, especially considering the FOAK risk,” said Teplinsky. “DOE [U.S. Department of Energy] loan guarantees and direct financing from the Federal Financing Bank at low rates are also essential to companies’ ability to secure debt and reduce cost of capital. Grant funding to support commercial demonstrations and high-assay low-enriched uranium support are also key.”

However, Teplinsky cautioned that these incentives were in place before AI-driven data demand soared. “[T]hey will need to remain in place in order for data center-driven advanced reactor projects to be viable,” she said. “In fact, these incentives need to expand and address some of the key issues still inhibiting large-scale advanced reactor deployment despite data center demand, such as FOAK deployment and cost overrun concerns.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).