With retirements outpacing new entrants and data centers driving unprecedented demand for electricity, the power generation sector faces a critical inflection point in workforce development.

The U.S. power industry is confronting a workforce challenge unlike any it has faced in decades. An aging workforce is accelerating toward retirement, taking with it irreplaceable institutional knowledge and specialized skills. At the same time, surging electricity demand—driven by data centers, manufacturing reshoring, and grid modernization—is creating unprecedented need for skilled workers. The question facing the industry is no longer whether a labor shortage exists, but how severe it will become and what can be done to address it.

According to the U.S. Department of Energy’s 2025 U.S. Energy and Employment Report (USEER), the energy sector employed 8.5 million workers in 2024, accounting for 5.4% of all U.S. jobs. Electric power generation alone employed nearly 933,800 workers with a median wage of $65,430. Yet, these numbers mask a troubling reality: the industry is struggling to find workers with the specialized skills needed to keep the lights on.

The International Energy Agency’s (IEA’s) World Energy Outlook 2025 (WEO) puts this challenge in global perspective. Energy employment worldwide expanded by 2.2%—1.7 million jobs—in 2024, outpacing the economy-wide employment growth rate of 1.3%. The power sector consolidated its position as the largest employer in the global energy industry with 22.6 million jobs. The IEA noted, however, that skilled labor shortages “are already constraining energy operations,” with half of the more than 600 companies surveyed reporting “critical hiring bottlenecks” that result in “project delays, longer lead times, and cost overruns.”

To better understand how these macro trends are playing out on the ground, POWER spoke with executives at American Professional Staffing Solutions (APS Solutions), a Sedalia, Missouri–based staffing firm that specializes in placing workers at power generation facilities across the country. Their insights reveal an industry at a crossroads—one where traditional fossil generation is experiencing renewed demand even as the skilled workforce capable of operating these plants continues to shrink.

The Talent Shortage Is Real

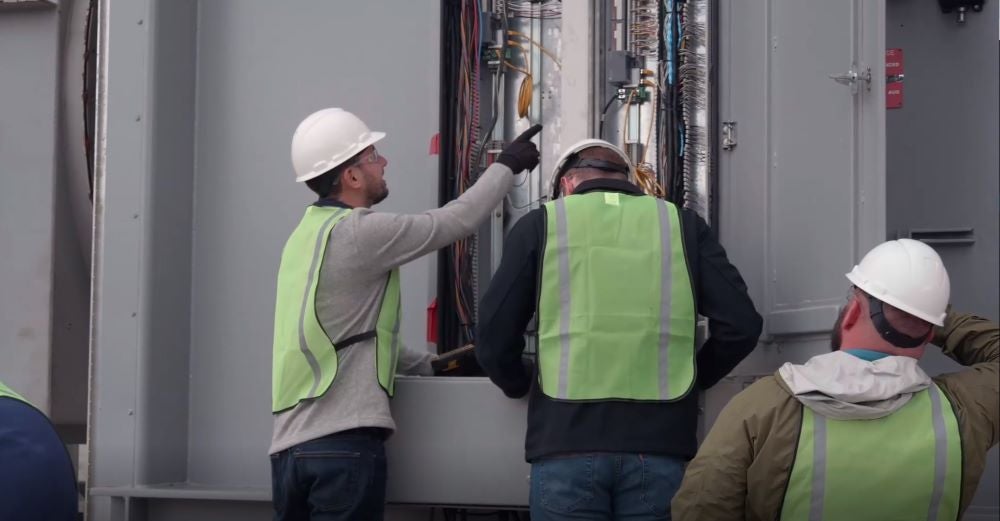

Al Simon, President and CEO of APS Solutions, offered a blunt assessment. “Today’s labor pool is challenging,” he said, noting that the issue extends beyond technical qualifications to include lack of awareness and knowledge with some younger workers. On the skills side, Simon emphasized that while there may be “plenty of video game developers and people who know how to code,” the same cannot be said for highly specialized trades (Figure 1). “There are very few people left who know how to ‘buddy’ weld or mirror weld, get skinny to fit in tight places while a back draft is killing your arc. There, a huge skill shortage exists. Angle welding, pipefitting, heavy-lift pickers—those skills are becoming harder to replace.”

“The talent shortage has become an increasing issue over time as folks reach retirement and leave the industry without nearly as many entering the industry as there used to be,” said Bob Coggin, Staffing Manager at APS Solutions. “This has led to an unfortunate experience gap as well that creates challenges in the transference of tacit knowledge and industry wisdom to younger generations.”

The Bureau of Labor Statistics (BLS) data supports these observations. While overall employment of power plant operators, distributors, and dispatchers is projected to decline 10% from 2024 to 2034 due to technological advances and greater efficiency, the agency still projects about 3,800 openings annually—all expected to result from workers transferring to other occupations or exiting the labor force to retire. The median annual wage for these positions was $103,600 in May 2024, reflecting the premium employers must pay for experienced talent.

Where the Gaps Are Most Acute

Not all skill categories are equally affected. According to APS Solutions executives, certain disciplines have suffered greater shortages than others. “Electrical commissioning personnel, for example, have become increasingly harder to find,” Coggin noted. “Specialty skill sets such as technical advisors, protective relay technicians, and even power plant experienced civil/structural folks are becoming more of a rarity.”

Chris Cooley, Chief Operations Officer at APS Solutions, expanded on this theme: “The most common skill gaps we see are in experienced craft trades and technically trained field roles, particularly among professionals with advanced safety certifications, specialized equipment experience, and strong industrial maintenance backgrounds. Lead field positions such as foremen, supervisors, and project coordinators who blend technical expertise with leadership are also in high demand.”

Simon specifically highlighted operations and maintenance workers for older technology, especially vintage coal plants, as a critical gap. “Skilled crafts—tube welders, boiler makers—under certain administrations there was a focus on shutting down these types of plants, so naturally younger talent is shying away from this type of work,” he explained. “The question now is, are these plants and older technology going away any time soon?”

The IEA’s analysis reinforces these concerns at a global level. The agency found that six out of 10 occupations in the energy sector where shortages are most acute are in skilled trades—including electricians, grid line workers, solar photovoltaic (PV) installers, pipefitters, welders, and heating, ventilation, and air conditioning (HVAC) installers. Notably, the latest liquefied natural gas (LNG) investment cycle has been particularly marked by shortages of welders, pipefitters, and electricians, driving up costs industry-wide, the agency said.

The Aging Workforce Challenge

The aging workforce problem is perhaps the most frequently cited concern in the industry, and for good reason. Britt Smith, Sales Manager at APS Solutions, described the situation starkly: “The aging workforce in power generation is creating a critical gap between retirements and operational expertise, forcing customers and utilities—especially those operating legacy and coal assets—to rely on APS Solutions to develop a flexible, experienced contract staffing plan to maintain reliability and compliance.”

Coggin called it “a very acute and very real challenge,” noting that “many industry veterans are at, or have already reached, retirement age and thus are taking many years of collective wisdom, insight, and industry knowledge with them when they leave.”

The data is sobering. According to IEA analysis, in advanced economies, retirements are outpacing new entrants across the energy sector (Figure 2). Nearly 30% of union electricians in the U.S. may retire within a decade, the WEO says. Notably, for every young person joining the grid sector, there are 1.4 workers nearing retirement—well above the economy-wide average. Meanwhile, Canada expects retirements of 700,000 trade workers by 2028, the report notes.

A September 2025–issued report from the Center for Strategic and International Studies (CSIS) examining the labor demands of artificial intelligence (AI) infrastructure development notes that nearly one-fifth of construction workers are 55 or older, with a median age of 42. Many retire in their late 50s due to the physical demands of their work—meaning the retirement wave will hit just as AI infrastructure projects peak.

However, there is a silver lining. “Many contractors in the industry choose to continue working well past retirement age, and that is helping bridge this gap somewhat as long as there are sufficient mentorship initiatives in place,” Coggin observed. Simon echoed this point, noting that APS Solutions has built relationships with utility workers nearing retirement. “When they retire, they come and join our team at APS Solutions as a W-2 contract employee. It is really a great opportunity for them, and a win-win-win for them, us, and our end customers, who get the talent they need.”

A Shifting Energy Landscape

The mix of staffing needs has shifted notably in recent years, reflecting broader changes in the energy landscape. While renewable energy jobs have seen significant growth, APS Solutions executives report that their clients are experiencing a resurgence in demand for traditional generation expertise.

“In recent years, energy staffing leaned heavily on renewable energy roles like solar, wind, and storage,” Cooley explained. “Today, while renewables remain necessary, their intermittent nature—combined with the rapid growth of data centers and the resulting need for consistent, reliable power—is driving a renewed increase in demand for traditional energy sectors such as natural gas, nuclear, and other fossil fuel operations.”

Gabe Norman, Director of Staffing and Recruiting at APS Solutions, was more direct: “We are seeing the demand for renewable energy expertise diminish and the demand grow for traditional fossil fuel, and specifically temporary power operations. The temporary power market is in huge demand right now due to fracking and data center growth.”

The DOE’s employment data as reported in recent USEERs paints a more nuanced picture, however. While natural gas power generation employment did grow a robust 3.8% in 2024—the largest percentage gain among electric power generation subsectors—clean energy technologies still accounted for roughly four out of five net new energy jobs overall, with solar adding more than 6,000 positions. The apparent contradiction may reflect the difference between aggregate hiring trends and specific skill demands: construction roles drove 86% of net new energy employment in 2024 (Figure 3), potentially masking tighter labor markets for operations and maintenance personnel in traditional generation. Both realities can coexist—and likely will, as utilities and independent power producers work to balance grid reliability with long-term capacity expansion.

Data Centers: A New Driver of Demand

The explosive growth of data centers—driven largely by AI applications—is emerging as one of the most significant factors in energy workforce planning. While the core skill requirements haven’t changed dramatically, the scale and pace of construction are creating new challenges.

“Owners, contractors, and operators all agree that they will need a certain portion of their workforce to be skilled contractors,” Simon explained. “Most of these plants are not built near where the technical and skilled talent lives. New construction of a simple cycle baseload LM6000 facility takes about 120 to 150 days. You will need a construction/commissioning manager, mechanical, electrical, I&C. Our customers have some of this talent in house, but finding the rest local will be a challenge.”

The CSIS report projects between 63,000 and 140,000 additional skilled workers will be needed beyond baseline growth to meet demand. That includes electricians, HVAC pipefitters, heavy-equipment operators, construction laborers (Figure 4), and welders. “These figures matter because skilled trades are not easily fungible,” the report says. “Electricians cannot be trained overnight, HVAC technicians cannot be repurposed from other sectors, and welders or equipment operators require years of preparation. Labor needs of this magnitude cannot be met by reallocating the existing workforce; they require an expansion of the pipeline itself.”

Norman noted that the varied generation mix at data center facilities creates its own staffing challenges. “Understanding that due to unit availability these facilities are oftentimes using a mix of different methods of generation, being able to leverage contract employees that have varied experience is key. They may be operating frame units, trailer-mounted temporary power, etc. Sometimes these are locally controlled vs. a standardized control room, and having seasoned operators that can support these projects is key,” he said.

Nuclear’s Workforce Implications

The growing interest in nuclear power—both for existing fleet support and new builds, particularly small modular reactors (SMRs)—represents another dimension of the workforce challenge. However, most APS Solutions executives say the immediate impact on hiring remains limited.

“This remains to be seen,” Coggin said. “SMR technology will likely take the lead on new nuclear construction and operation as utilities tend to shy away from the cost and public scrutiny of building new baseload capacity nuclear power plants. However, even SMR reactors have yet to be implemented into the industry on a wide enough scale to significantly impact staffing needs. I expect that will change in the very near future.”

Cooley offered a similar assessment. “At this time, we’re not seeing a major impact on the construction and commissioning workforce demand from nuclear, largely because nuclear projects have long development cycles before approvals and construction begin,” he reported. “That said, we are seeing more independent power producers, utilities, and developers planning nuclear additions, particularly around SMRs. So, while the immediate effect is limited, the talent demand is coming, and it will be important for the industry to prepare for it in the near future.”

The nuclear sector faces particularly acute demographic challenges. The IEA found that nuclear has one of the most severe ratios of retiring workers to new entrants, with 1.7 workers nearing retirement for every young person joining the sector.

Compensation Trends

How are wage expectations and compensation packages evolving in response to these pressures? There’s clearly money flowing into certain skill categories and positions, but it’s not always the more educated workers who are cashing in.

“Wages and benefits are evolving to where they should be,” Simon said. “Very talented carbon steel or dissimilar-metal welders are making more money than degreed engineers these days.” He noted power producers are having to pay more to attract talented skilled craftsmen and high-level project managers, while compensation for plant engineers has stayed relatively flat.

Coggin mentioned that from the traveling contractor’s perspective, expectations have remained relatively stable. “Traveling contractors have always expected to ‘live on the road’ and are mostly willing to work anywhere as long as the pay and package is right,” he said. Notably, however, he has observed that clients are beginning to evaluate overall costs differently, with some seeking talent from local markets to reduce living and travel expense reimbursement.

Cooley emphasized the strategic advantage of geographic flexibility: “The wider the geographic area a company is willing to draw talent from, the greater the pool of skilled, qualified candidates available—and that’s a major advantage in today’s competitive labor market.”

Cross-functional skills command a premium. “As the talent pool tightens, cross-functional workers are becoming increasingly valuable and in demand,” Cooley noted. “However, that versatility comes at a premium, and employers need to be willing to pay more for professionals who can wear multiple hats and add value across functions.”

Contract Staffing: From Stopgap to Strategy

Perhaps one of the most significant shifts in the industry is the evolving role of contract and temporary staffing. Once viewed primarily as a stopgap measure, supplemental staffing is increasingly becoming a permanent structural feature of workforce planning.

“In the heavy industrial markets we serve—power, energy, process, oil and gas, and renewables—workforce needs are inherently project-based and cyclical,” Cooley explained. “What’s changing is that more companies are recognizing they don’t have the internal infrastructure to effectively manage contract labor at scale, even if they believe they do. As a result, partnering with supplemental staffing firms, such as APS Solutions, is becoming a permanent structural solution.”

Simon characterized APS Solutions’ role as helping customers “hyperscale,” which he called “incredibly important in the fast-paced projects to support infrastructure for artificial intelligence campuses.” He noted that while APS Solutions employees remain APS Solutions employees and the company is not a temp-to-hire organization, they have several customers that rely on APS Solutions to handle all field hiring. “They decided they didn’t want to carry that overhead, risk, and workload,” he said.

Norman pointed to the practical advantages for clients. “With the fluctuating labor demands for existing plants or new construction projects, I feel that supplemental staffing is becoming a more feasible option for clients to build into their long-term plans,” he said. “It is much easier to lean on a company like APS Solutions that can provide temporary short-term or long-term solutions with qualified individuals, rather than putting the burden on a company’s internal HR [human resources department] and hiring teams.”

Retention and Development Strategies

Amid the challenges, some strategies are proving effective for workforce development and retention. “The most effective strategies we’re seeing focus on retention through stability, engagement, and clear career paths,” Cooley observed. “Clients who invest in consistent work schedules, competitive compensation, and strong safety cultures tend to keep talent longer. We’re also seeing success where companies partner closely with staffing providers to create longer-term, project-based assignments rather than short-term fills, which gives workers more certainty and loyalty.”

The IEA emphasizes the critical role of vocational education and training (VET) systems in meeting future energy workforce needs (Figure 5). The agency calls for coordinated policies to expand and modernize VET systems, with priorities including expanding certification capacity, modernizing training to match emerging technologies, strengthening provider-employer partnerships, improving the perception of vocational degrees, and broadening access to VET programs.

Cooley highlighted active engagement with educational institutions. “One of the root causes [of the talent shortage] is a long-term shift in education away from promoting the skilled trades in favor of technical and white-collar paths, which are important but shouldn’t come at the expense of the trades,” he said. “That’s why APS Solutions actively works with local high schools, technical schools, and colleges to raise awareness and help rebuild the pipeline of qualified craft and technical professionals our industry depends on.”

Major technology companies are also stepping up. One example is Google’s support for an effort to train 100,000 electrical workers and 30,000 new apprentices in the U.S. With funding from Google.org to the electrical training ALLIANCE (etA), an organization created by the International Brotherhood of Electrical Workers (IBEW) and the National Electrical Contractors Association (NECA), etA will integrate AI tools into its curriculum and boost the number of apprentices nationally.

In a Reuters article published in April 2025, Kenneth Cooper, president of the IBEW, said, “This initiative with Google and our partners at NECA and the electrical training ALLIANCE will bring more than 100,000 sorely needed electricians into the trade to meet the demands of an AI-driven surge in data centers and power generation.”

On the Ground: Real-World Solutions

The APS Solutions executives shared several examples of how their staffing solutions have addressed real workforce challenges at power facilities.

Smith described a scenario involving a large utility that had announced the planned shutdown of several baseload plants: “Once the closures were made public, a significant portion of the full-time workforce left to secure long-term employment elsewhere, even though the utility was still required to operate the plants through their official closure dates. APS Solutions worked closely with the client to develop a project-based staffing plan, supplying experienced contract professionals ranging from plant management to maintenance craft roles. This approach allowed the utility to maintain safe, reliable operations with minimal disruption until each facility reached its scheduled shutdown.”

Simon described a similar situation where employees at a utility in the southern U.S. were “put between a rock and hard place” as they faced a choice between staying at plants scheduled for closure or accepting longer-term positions elsewhere. “Everyone would do what is best for their families. There is no blame,” he said. “APS Solutions provided temporary operations support to backfill these key positions. Our employees are still out there today—everyone is happy!”

Crisis situations are common. Smith recalled a scenario involving a coal facility. “A customer operating a highly critical coal facility experienced a sudden departure of several key team members including CROs [control room operators], AOs [auxiliary operators], and maintenance personnel who left for opportunities at a nearby data center,” Smith explained. “APS Solutions immediately developed and executed a staffing plan, rapidly mobilizing experienced personnel to fill the critical roles and stabilize operations.”

Simon described another rapid-response situation. “A customer was in a jam. Independent power producer—peaking combined cycle facility and had to ramp up to baseload for eight months,” he described. “We mobilized an operations strike team to embed with their current staff and management to round out 24/7 operations support. Customer met their eight-month schedule—and we redeployed our employees to other projects.”

The Path Forward

The power industry’s workforce challenges are not going away anytime soon. The IEA projects that energy-related employment will expand in the medium and long term across all scenarios, but it says the pace of growth depends on the availability of specialized workers (Figure 6). Weldingworkforcedata.com, a website endorsed by the American Welding Society (AWS), estiimates that 320,500 new welding professionals will be needed in the U.S. by 2029. That’s significant, considering there are reported to be about 771,000 welding professionals working in the U.S. today with more than 157,000 approaching retirement.

Norman offered a note of optimism about the younger generation. “In recent years, there has been a shift in the younger generations pursuing trade schools and/or apprenticeships,” he said. “That will still lead to an overall skills gap in the industry that will take some time to cover, but there will be an incoming generation that will be eager to take advantage of that and rise to the occasion. The opportunities in front of them will be great!”

For plant managers struggling to maintain adequate staffing levels, Simon’s advice was straightforward. “Find a great staffing partner and build a great relationship with them. They can really help support you and take some of the staffing worry off your plates,” he said.

Cooley elaborated, “First, take a hard look at your compensation strategy and be willing to adjust where needed. For urgent gaps, consider partnering with a firm like APS Solutions to supplement staffing through contract/temporary labor while you work through longer-term hiring. Using experienced contract talent allows plants to maintain performance and avoid penalties while taking the time to hire and properly onboard the right full-time employee—often with that contract professional helping train their replacement once hired.”

When asked what differentiates successful client relationships, Simon pointed to APS Solutions’ fundamental philosophy. “We believe in three strong pillars at APS Solutions: Employee Care, Employee Redeployment, and Customer Service. We believe if you take care of the first two—the last one takes care of itself,” he said.

The power industry has weathered numerous challenges over the decades—fuel crises, regulatory upheavals, and technological disruptions. The current workforce crisis may prove to be among the most consequential. How the industry responds—through training partnerships, competitive compensation, flexible staffing models, and renewed investment in vocational education—will determine not just its ability to keep the lights on, but its capacity to meet the electrification demands of an increasingly digital economy.

Learn more about APS Solutions at exploraps.com