The North American electric grid faces intensifying reliability risks over the next decade as demand growth driven by data centers and artificial intelligence threatens to outpace resource additions, according to the 2025 Long-Term Reliability Assessment (LTRA) released Jan. 29 by the North American Electric Reliability Corporation (NERC).

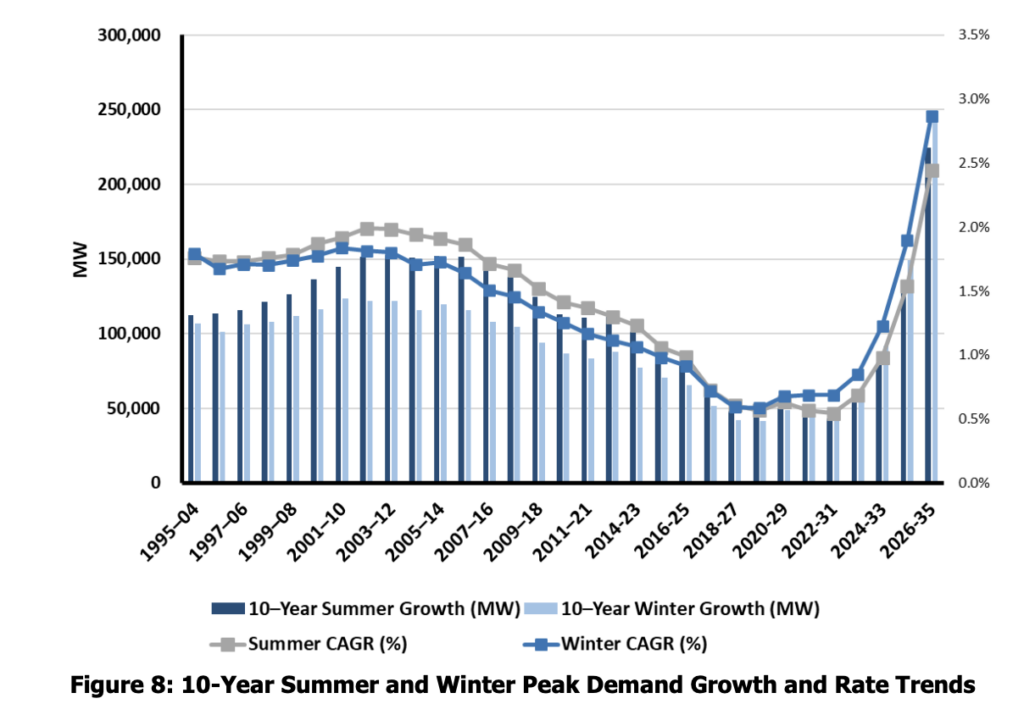

The annual 10-year reliability assessment from North America’s Electric Reliability Organization (ERO), which serves as a snapshot of adequacy for 2026–2035 based on industry projections compiled in mid-2025, projects that summer peak demand could surge by 224 GW—69% more than the 132 GW projected in the previous LTRA 2024 (released in 2025). Winter demand could surge even more, by 245 GW, a 65% increase from last year’s 149 GW growth projection. “Compound annual growth rates (CAGR) for summer and winter peak demand are the highest since NERC’s tracking started in 1995,” the report notes.

Artificial intelligence data centers and the digital economy account for most of the projected load growth, but the report also identifies large industrial facilities, electrified transportation, cryptomining, heat pump deployment, and demographic trends as “primary demand drivers.”

However, the report cautions that demand projections rely on load forecasts from utilities and system planners based on information from the interconnection process and agreements between utilities and owners of connecting loads. “To be counted in load forecasting, data center projects have advanced from speculative and exploratory stages into development commitments,” the report notes. “Consequently, data center and large load growth forecasts in the LTRA are likely to be more conservative than predictions from the technology industry or from economic, research, academic, and policy organizations,” NERC warns.

“We see real load growth,” John Moura, NERC director of Reliability Assessment and Performance Analysis, told reporters during a briefing on Thursday. “We’re not counting every prospective data center, prospective demand, load center out there. We’re taking quite a bit of a haircut and looking at what’s reasonably expected to come in.” Even so, he added, “that uncertainty and kind of what we know—the magnitude of load growth—is increasingly uncertain and its impact on planning—is going to have a significant risk.”

The point of the LTRA, he noted, is to “evaluate where the system could face stress if conditions unfold as they’re currently planned,” he said. “It shows that risk trajectory—not certainties, and just as important, it shows that there is still time to act, and the results shouldn’t be taken as an indictment of those areas.”

The challenge, he predicted, “is not a lack of effort challenge. It’s really a pace and scale of the system transformation occurring at the same time as demand growth accelerates.”

Five Regions to Face ‘High’ Risk by 2030

As Mark Olson, NERC’s manager of Reliability Assessments, explained, another key finding of the report is that “resource adequacy concerns are mounting”—meaning, essentially, that despite surging demand expectations, projected supply growth is not keeping pace.

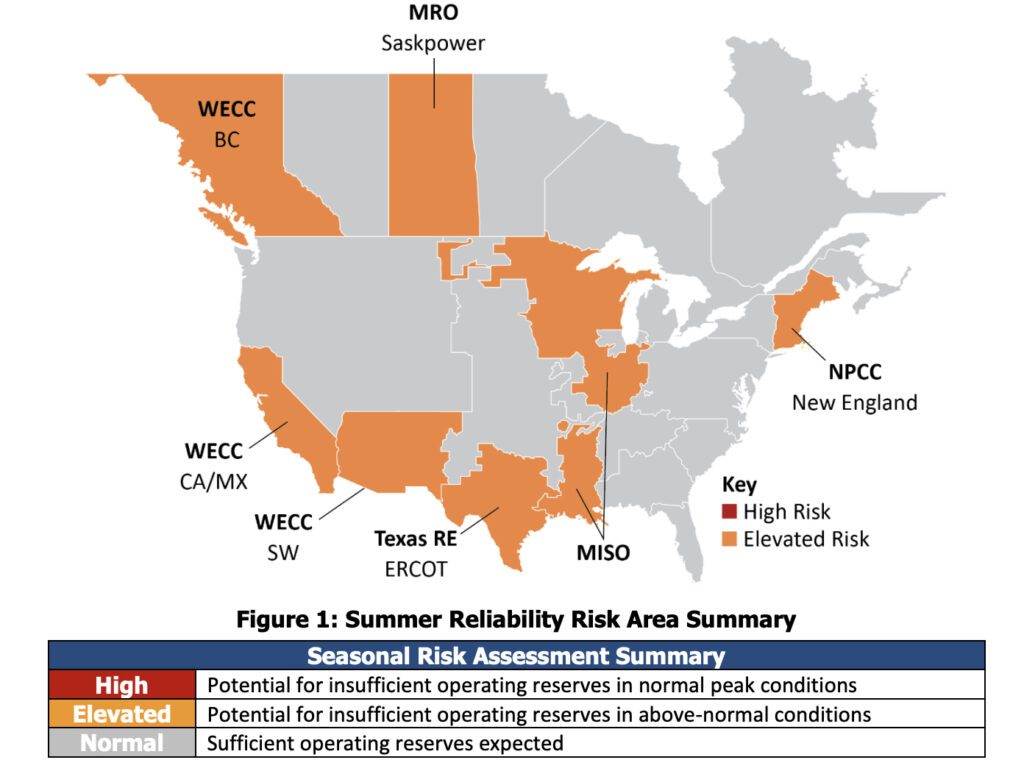

According to NERC’s capacity and energy risk assessment—which identifies potential future electricity supply shortfalls under normal and extreme weather conditions based on bulk power system (BPS) planning forecasts—13 of 23 assessment areas will face resource adequacy challenges over the next five years. By 2030, at least five regions could face “high risk”: the Midcontinent Independent System Operator (MISO), PJM Interconnection (PJM), the Electric Reliability Council of Texas (ERCOT), and the Western Electricity Coordinating Council’s (WECC’s) Basin and Northwest subregions.

“There’s normal, elevated, and high risk,” explained Olson. “The normal risk areas shown in gray are all meeting their resource adequacy targets, and the all-hours probabilistic analysis generally indicates little or no unserved energy or load loss—even under a variety of conditions. More extreme conditions are baked into that analysis as well.”

“The areas in orange are elevated risk,” Olson continued. “These areas are meeting their adequacy targets and generally meet the one-day-in-10-year load loss criteria, but in our probabilistic and all-hours studies, some unserved energy and load loss begin to emerge. That generally indicates that more extreme conditions—like extreme cold or above-normal temperatures—are more likely to result in load loss given the current resource and load projections.”

“For the areas marked as high risk,” he added, “these are either falling short of a reserve margin target established by a regulatory authority or exceeding the criteria for unserved energy and load loss used in this report—criteria that generally align with a one-day-in-10-year threshold for load loss sometime in the next five years.”

“What we’re seeing this year,” Olson said, “is that many regions move into elevated or high risk later in the decade as demand rises and planned generation fails to keep pace.”

The regions facing the highest risk are contending with steep load growth that consistently outpaces planned resource additions, particularly as thermal retirements mount and solar-heavy additions introduce variability, the report shows. In ERCOT and PJM, notably, demand from data centers could erode resource margins below targets later in the decade despite efforts to expedite new capacity. And in parts of the Western Interconnection, growing reliance on variable renewables could contribute to year-round adequacy concerns. Elevated-risk areas—including portions of MRO, NPCC, and SERC—could grapple with other specific vulnerabilities such as low-hydro conditions, fuel constraints, peaker retirements, and seasonal maintenance gaps that heighten the risk of energy shortfalls, particularly under extreme weather, the report says.

| Assessment area | Peak demand outlook | Primary drivers | Key challenge | Risk period | Mitigation actions |

|---|---|---|---|---|---|

| MISO | Summer demand rises from 127 GW (2026) to 143.7 GW by 2035. | Data center additions totaling 18 GW by 2035. | 8.8 GW decline in accredited thermal capacity; solar additions insufficient to offset retirements. | Normal (2026); elevated (2027); high beginning winter 2028. | ERAS process targets more than 20 GW of accelerated capacity additions by 2030. |

| PJM | +56 GW summer peak and +62 GW winter peak by the mid-2030s. | Data centers, electrification, and manufacturing growth. | Dispatchable generation retiring faster than replacement; limited transfer capability. | Elevated (2026–2028); high beginning 2029. | Reliability Resource Initiative and expanded surplus interconnection. |

| Texas RE-ERCOT | Summer peak grows from 94.7 GW (2026) to 154.1 GW by 2035. | Large industrial load growth, including 23 GW of data centers. | Evening solar ramp-off and rising winter adequacy risk. | Elevated (2026–2028); high beginning 2029. | 765-kV transmission expansion, large-load curtailment authority, ELCC reforms. |

| WECC-Basin | Summer demand increases 1.7 GW (17%) over 10 years. | General demand growth. | 2.3 GW decline in thermal capacity; solar additions insufficient. | Elevated (2026–2028); high beginning 2029. | Reliance on transfers; no specific mitigation identified. |

| WECC-Northwest | Peak load increases 6.6 GW (19%). | Data center influx into the Pacific Northwest. | Winter peak exposure and variable resource dependence. | Normal (2026–2028); high beginning 2029. | More than 10 GW of new wind, solar, and battery projects in development. |

Resource Mix Transformation Poised to Accelerate

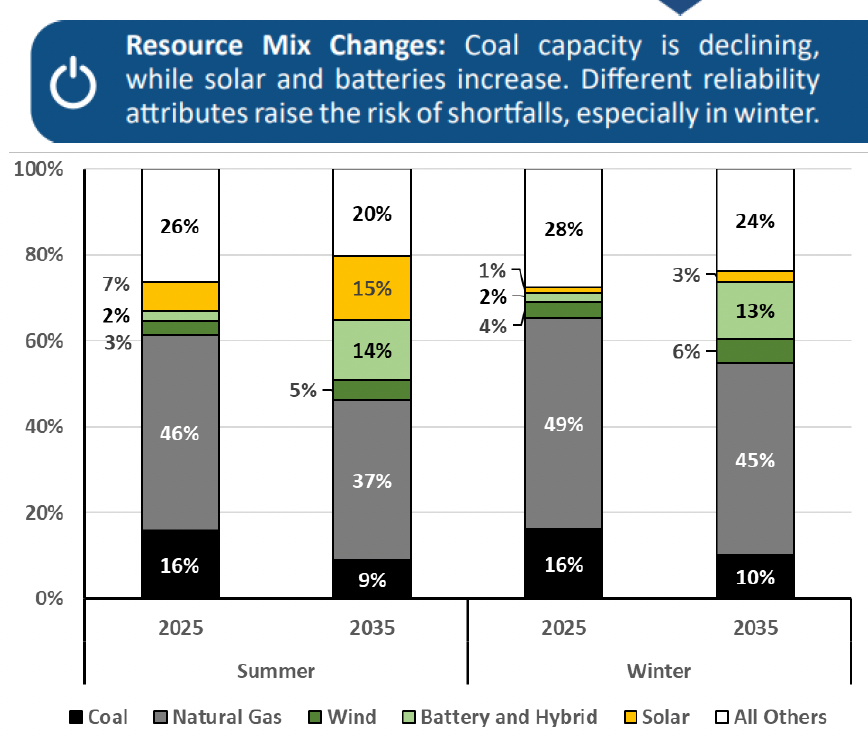

A glaring issue, according to NERC officials, is that the grid’s resource composition is shifting dramatically toward weather‑dependent technologies.

Over the past year alone, fossil capacity dropped by 21 GW while battery, wind, and solar capacity increased by 23 GW, NERC said. The share of variable energy resources (VERs) on the BPS during peak hours grew from 9.5% to 10.2%. While the 2025 LTRA concludes that today’s mix can still meet frequency response requirements through 2027, NERC warns that many inverter‑based resources (IBRs) do not inherently provide essential reliability services like synchronous inertia.

“Looking at a snapshot of resources in development, battery projections have really flooded into the queue,” Olson noted. “More battery projects [are] in the queue than in the past, to the point that now both solar PV and batteries together are about equal in the interconnection process, and they account for two‑thirds of the total capacity that’s in development.”

That composition could raise a critical seasonal vulnerability. “There’s a lot of solar and batteries in the resource mix,” Olson said. “Those provide good capability for meeting summer peak demand, but the capability of resources in the winter is very different.”

Moura noted that solar output is “virtually zero during winter peak,” typically around 6 a.m. and 6 p.m., and that 4‑hour batteries “are unable to fully charge for the next day” during multi‑day cold snaps. “The Germans have a word for this. You might have heard it — the dunkelflaute,” he said. The German term (“dunkel,” meaning dark, and “flaute,” meaning lull) describes a weather phenomenon that happens in winter, partly due to shorter daylight and fewer sunshine hours. “This is an extreme condition that’s always happened, but now we’ve built a lot more wind in certain parts, and so when that wind—or the lack of wind—happens, it now becomes much more susceptible,” he said.

Gas Is Becoming a Solid Reliability Hinge

To cover those gaps, system planners are increasingly turning to natural gas. Thirteen of 23 assessment areas are planning gas‑fired additions—and about 53 GW of new winter‑rated gas capacity is in the queue. But the prospect could introduce a critical problem: the grid’s growing reliance on gas‑fired generation raises fuel‑assurance challenges. The assessment notes significant uncertainty around generators securing firm fuel supply and transportation, particularly during extreme cold when residential heating demand surges.

“Our reliance on gas‑fired generation is increasing, and it’s really important that as generation is being added, the natural gas infrastructure needs to account for that increasing reliance on gas‑fired generation for electric reliability,” Olson noted.

One concern, according to Moura, is lack of visibility and coordination between the electric and gas sectors. “The whole electric system is now underpinned by the… reliability of the gas system and getting gas to where it goes,” he said during the briefing. “But there’s no reliability regime over the gas industry. There’s contracts, there’s arrangements that occur, but there’s not a lot of visibility as to which generators have firm [rights], which are getting from marketers, or getting from neighbors, or maybe grouped in a package. There’s a lot of uncertainty as to where gas is coming from, and then who actually holds firm rights to that.”

Moura contrasted U.S. arrangements with Canadian practices. “If you look at an area like Canada, 97% of electric generation has firm, firm, firm rights to gas,” he said. “It’s unheard of to have so much interruptible gas, especially when it underpins some of our national strategies around electricity dominance and AI dominance.”

Florida’s natural gas fleet, meanwhile, demonstrates a successful U.S. model, he suggested. There, pipelines were built specifically for electric generators with firm, high‑pressure service, and mandates for dual‑fuel oil tanks provide an additional backstop. The core lesson, Moura argued, is that more transparency and better price signals are needed on the fuel side. More visibility is needed so that planners know what gas will actually be available, and that only comes “when you get the right signals in the markets,” he said. “Generators are incentivized to procure those contracts through mechanisms that are aligned with the electricity market and the gas market.”

Coal and nuclear, officials suggested, remain important pillars in the near term but are unlikely to expand substantially under current conditions. On coal, Moura said the fleet is both essential and increasingly fragile. “Coal, like every other resource, has its limitations,” he said, noting that the units are aging and show higher forced‑outage rates in winter, even though “when you look in your backyard at a coal plant, you can see, you know, one‑month, two‑month, three‑month coal supply” that can be “very resilient to things like coal delivery strikes or failures.” The problem, he said, is that “those coal piles freeze. We know how to deal with them through a variety of measures, but in the state in which these units are at, we do see higher forced‑outage rates in these units, and they do fail during winter conditions, just like other resources.”

On nuclear, Olson emphasized that most of what materially affects the LTRA horizon is happening in Canada, not the U.S. “Most of the nuclear development that’s really affecting the LTRA is in Canada, in Ontario, where projects are taking place to upgrade and refurbish nuclear resources,” he said. “Most new nuclear… they’re in the much later years,” and small modular reactors are “really, 2030 and later,” so they do not yet move the near‑term adequacy picture in a significant way. Moura highlighted the uncertainty with timeframes, estimating new nuclear is still “10 to 15 years out.” He added that at “$32 billion a pop,” new large nuclear plants may remain a difficult, “expensive” proposition for many utilities without a more coordinated, longer‑range national strategy that bolsters a build-out at scale.

Transmission Expansion Races Against Time; Industry Responds with Expedited Programs

Transmission development is accelerating but struggling to keep pace with demand. While a record 41,000 miles of new transmission projects above 100 kV are under construction or in planning stages for the next decade—substantially higher than last year’s 28,275-mile projection—only a fraction has begun construction, and nearly 400 of the roughly 900 identified projects have already been delayed from originally expected in-service dates.

“In terms of all the projects that are in planning, the miles of the transmission projects that are under construction have not increased substantially yet,” Olson noted. “So there’s a lag there, but definitely a need for more transmission development to help connect new resources and also improve transfer capability and the ability for neighbors to share energy.”

Several major Planning Coordinators, including Hydro-Québec, ERCOT, SPP, MISO, PJM, BC Hydro, and Ontario’s Independent Electricity System Operator, have approved or are considering expansive extra-high-voltage overlays to address the bottleneck. However, permitting issues, supply chain constraints, and planning challenges continue to hamper development. Notably, interregional transmission projects supporting energy transfers between neighboring systems represent just 4% of total projects—down from 6% in last year’s assessment—despite their importance during extreme weather events.

To address mounting adequacy concerns, grid operators and regulators have accelerated efforts through multiple mechanisms. The Federal Energy Regulatory Commission approved expedited resource programs in late summer 2025 for MISO, PJM, and Southwest Power Pool that prioritize resources addressing identified reliability risks, though most additions from these programs were not included in the 2025 assessment. “The programs are stimulating resource development,” Olson said. “There’s clearly a need for these programs to meet the shortfalls that we’re projecting.”

Beyond expedited procurement, market mechanisms including capacity accreditation are more precisely highlighting loss-of-load risks from generation mixes with increasing variable resources, making market procurements more effective. Generator retirement projections have also moderated as utilities extend service lives for existing units through updated integrated resource plans.

Still, according to Olson, “the overall 10-year outlook for generator retirement still remains very high.” Compared to last year’s assessment, some planned retirements are being delayed, he noted. “There are adjustments taking place to delay retirements, either through utility action or Integrated Resource Plan being adjusted so that retiring generators that had the expected retirement date are, in several cases, shifting to the right, and resources are staying around and available to meet these growing demands.” In ERCOT, demand response is expanding through new regulatory mechanisms. Grid operators now have authority to curtail large loads like data centers during grid emergencies. “That’s a form of demand response,” he said.

NERC Issues Recommendations for Industry, Regulators

NERC’s recommendations call for integrated resource planners, market operators, and regulators to expedite new resources and carefully manage generator deactivations through enhanced mechanisms and early retirement identification. The assessment urges regulators and policymakers to streamline siting and permitting processes, noting these issues rank among the most common causes for delayed transmission projects.

The reliability organization also called for continued collaboration between the electric and natural gas industries on interconnected system planning and operations, while urging stakeholders to implement solutions urgently. Regional transmission organizations, independent system operators, and FERC should continue ensuring essential reliability services are maintained as the resource mix transforms, the ERO said.

“We must accelerate the right resources, not just the megawatts,” Moura said. “We have to look at the energy components to the resources that we’re building. We must treat large loads as part of system planning, not just demand forecasts. We must move beyond margin-only thinking to thinking about probabilistic and energy risk analysis, removing siting and permitting bottlenecks, and ensuring essential reliability services are maintained.”

A System Under Stress: Policy, Emergency Orders, and the Pace of Change

NERC’s release of its annual LTRA comes as North America assesses the aftermath of Winter Storm Fern, which swept across much of the continent, producing widespread heavy snow and wind from the southern Appalachians across the Carolina and southern Virginia. Moura said it is “still a little early to tell” how the system performed overall, but preliminary data show the grid and gas infrastructure “holding up” with no major electricity outages, albeit with “tight margins as usual” and some unexpected curtailments and forced generator outages that NERC will analyze in detail.

As mainly a precautionary measure, between January 24 and January 26, the DOE issued eight emergency orders under Section 202 (c) of the Federal Power Act to ERCOT, ERCOT, PJM, ISO New England, NYISO, and Duke Energy. The orders authorized operators to run generating units at maximum output regardless of air quality limits, activate backup generation at data centers as a last-resort measure before declaring Energy Emergency Alert Level 3 conditions, and in some cases, override fuel shortage constraints.

The emergency orders come amid broader DOE intervention in generator retirements. Since May 2025, the Trump administration has issued 27 Section 202(c) emergency orders under Section 202(c) of the Federal Power Act, directing grid operators and utilities to compel the continued operation of generation and transmission assets deemed critical to grid reliability. Orders have repeatedly required utilities, independent system operators, and balancing authorities to override planned retirements, environmental operating limits, and market-based outcomes by mandating unit availability, extended run-hours, and coordinated operating measures to address projected supply shortfalls. Most of the January orders are narrowly time-bounded, expiring within two to seven days, and were issued in response to applications from grid operators or utilities citing near-term reliability concerns tied to winter conditions and elevated demand.

However, as POWER has reported, some orders over the past year have been contentious, particularly, the DOE’s December 2025 directives that froze more than 2 GW of coal retirements in Indiana, Washington, and Colorado. Michigan Attorney General Dana Nessel and environmental groups, including the Sierra Club and Earthjustice, last month filed the first-ever judicial challenges to DOE’s use of Section 202(c) authority, arguing the orders unlawfully override state regulatory decisions and utility resource plans while imposing costs that have exceeded $80 million at a single facility.

NERC, for its part, recognizes that energy policy remains an integral consideration that poses new risks to grid reliability—a profile it first formally identified in August 2023 as an overarching risk factor that has “broad implications across the risk profiles as it catalyzes changes and has the potential to amplify their effects.” In that biennial risk assessment, the reliability organization warned that “policy can affect BPS reliability and resilience and could present risks to its reliable operation,” particularly when policy-driven transitions don’t adequately account for energy sufficiency requirements—ensuring resources can produce enough energy to meet demand at any given time, not just meet peak capacity targets.

Asked whether policy-driven reliability risk has increased, decreased, or become more nuanced relative to other drivers like data center load growth, retirements, and transmission delays, NERC told POWER: “Energy policy certainly continues to shape the risk profile, affecting demand projections and resource additions and retirements. That is why the LTRA recommends that policymakers manage the pace of retirements, streamline regulatory processes to bring needed generation online, and continue to improve gas/electric coordination.”

Industry Reactions Propose Diverging Solutions to Mounting Risk

On Thursday, the NERC assessment, however, prompted swift reactions from energy industry groups. Stakeholders offered sharply different perspectives and potential solutions to the report’s reliability concerns.

Michelle Bloodworth, president and CEO of America’s Power, a coalition of coal-producing utilities, warned that premature coal retirements are driving the crisis. “For the first time, families and businesses in half the U.S. face a high risk of blackouts,” she said. “One of the primary reasons for this dangerous situation is the premature retirement of coal power plants. Another is the rapid growth of energy-intensive data centers.”

Utilities have announced plans to retire more than one-fourth of the nation’s coal fleet over the next five years, with most retiring plants located in high-risk regions identified by NERC, Bloodworth noted. “Unless these retirement plans are reversed, the grid will lose an energy-secure, affordable, and reliable source of baseload power,” she said. “Coal power plants have been critical to keeping the lights on during Winter Storm Fern, just as they have during past winter storms. According to the U.S. Energy Information Administration, coal power plants increased their electricity production during Fern more than any other source of electricity.”

Caitlin Marquis, a managing director at Advanced Energy United, which represents solar, storage, and demand-side technology providers, countered that deployment barriers—as opposed to resource type—are the core problem. “With demand rising quickly, the power grid could become less reliable if barriers to advanced energy deployment are not addressed,” she said. “State leaders and grid operators need to remove the red tape blocking deployment of the most cost-effective and fastest-to-build resources, including solar, energy storage, and demand-side resources.”

Marquis cited NERC’s own prior findings that “gas-fired generation accounted for 70% of unplanned outages in PJM during Winter Storm Elliott in 2022.” She argued that “rather than double down on resources that already dominate the supply stack, adding more affordable, reliable advanced energy technologies like storage paired with renewable energy and demand-side solutions will increase resource diversity and support affordability by minimizing fuel-based price spikes. Advanced energy technologies are also the fastest to deploy if regulatory barriers are addressed—and as NERC’s report highlights, some regions face heightened risk starting as soon as this year.”

The Electric Power Supply Association (EPSA), which represents competitive power generators, honed in on market design and regulatory barriers. “NERC’s LTRA highlights the importance of retaining existing capacity, as well as the outcome of policies that distort market signals and delay timely investment in essential power generation resources,” said EPSA President and CEO Todd Snitchler.

“Reliability is best served by competitive electricity markets that send clear, durable development signals—not by policy interventions that create misalignment between supply and demand,” Snitchler said. “In order to address the warnings NERC’s LTRA sets out, it will require getting market signals right while addressing permitting and siting delays, supply chain bottlenecks, and other barriers to development.”

Snitchler noted that competitive power markets are already responding to price signals, and that EPSA member companies have announced more than 12,000 MW of new generation, uprates, and restarts in PJM Interconnection alone since 2024, along with tens of thousands of megawatts cleared for interconnection across multiple RTOs. “Now the priority is building them. That requires regulatory certainty, predictable permitting at the local, state, and federal levels, and policies that will add these resources in a timely fashion to ensure long-term system reliability,” he said.

EPSA also called for improved load forecasting practices, arguing that forecasts should “distinguish between committed load and speculative projects, reflect realistic development timelines, and be updated regularly to avoid over- or under-building” to protect consumers while maintaining reliability. The trade group stressed that “competitive power markets shield consumers from the risks associated with uncertainty and shifting demand estimates as the data center industry evolves.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).