A newly introduced Senate bill aims to make federal loan guarantees available for new high-efficiency, low-emissions (HELE) coal power plants in the U.S. Although it spearheads considerable research and development initiatives to advance coal technology, the nation’s pipeline of coal builds remains virtually vacant, and it now lags painfully behind Asia and Europe in demonstration and utilization of new coal technology.

S.3653, “Reinvigorating American Energy Infrastructure Act,”introduced by Sen. Todd Young (R-Indiana) on November 19, proposes to amend the Energy Policy Act of 2005 to make units larger than 350 MW and modular units smaller than 350 MW eligible for federal loan guarantees.

Eligible large HELE units should use at least 65% of their annual net energy output to generate power and derive at least 65% of their annual heat input from coal or one or more coal-derived fuels. Small-scale HELE units that are eligible under the bill should employ a modular design that maximizes “the benefits of high-quality low-cost shop fabrication to minimize construction costs and project cycle time.” These units must also have a load-following capability down to 25% of maximum continuous rating and be capable of achieving high ramp rates of at least 4% of the maximum continuous rating per minute of the unit.

The bill also stipulates that all eligible HELE units must be designed to achieve an efficiency of at least 40%, be capable of accommodating carbon capture and storage (CCS) technology in the future, and minimize water consumption.

According to the American Coalition for Clean Coal Electricity (ACCCE), a partnership of industries involved in coal power production, the bill “is an important step toward deploying the next generation of advanced coal plants” to replace the massive coal plant retirements the nation faces over the next two decades. The ACCCE estimates that 40% of the U.S. coal fleet has either retired or announced plans to retire. “This new generation will meet strict environmental standards and result in CO2emissions 25% to 40% lower than the coal fleet today,” said Michelle Bloodworth, president and CEO of ACCCE, in a statement on November 19.

The Status of HELE Worldwide

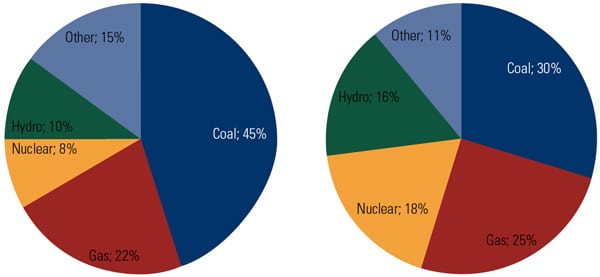

Because HELE technologies offer dramatically improved efficiency and lower carbon and non-carbon emissions compared to subcritical plants, they are increasingly being used around the world—though efforts remain centered in Asia and Europe.

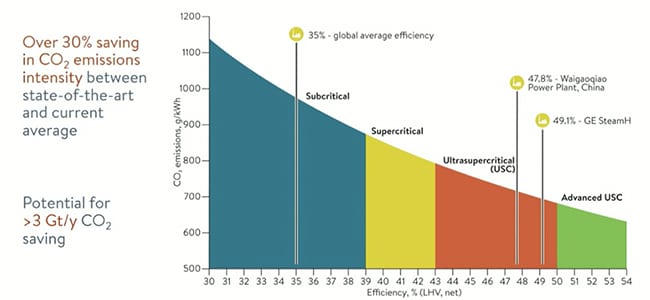

As Dr. Andrew Minchener, general manager of the International Energy Agency’s (IEA’s) Clean Coal Centre, explained in a November 14 webinar: “The efficiency increases result from increasing the steam temperatures from subcritical process—where the maximum steam temperature would be 540C—to a supercritical system—where we’d be looking at right about 580C maximum—to ultrasupercritical, which is the state-of-the-art at present, where we’d be looking at 620C, maybe towards 640C; and then advanced systems, which are still at the development and demonstration stage, where we are looking at steam temperatures of about 700C or higher in some cases.” The global average efficiency of coal power plants is about 35%, Minchener noted.

An ultrasupercritical coal power plant offers several advantages because it uses less coal. Compared to alternative coal power options, the technology could lower specific capital costs, operating costs, and carbon emissions intensity, Minchener said. “There’s also scope to minimize the non-greenhouse gas emissions—particulates, SOx, and NOx—down to levels that you would get from a gas-fired turbine plant, and you can do that with commercially available state-of-the-art technology.”

Currently, according to the IEA, about 250 GW of ultrasupercritical capacity is online—but 90% (224 GW) is in Asia (where another 88.2 GW is under construction, mostly in China and Japan). Most of the remaining 10% is in Europe (19.2 GW), where about 5 GW is under construction. No HELE projects are under construction elsewhere, including in Eurasia, where a 300 MW plant exists, or in the U.S., which has only one ultrasupercritical coal plant: American Electric Power’s (AEP’s) 600-MW John W. Turk Jr. Power Plant, which opened in December 2012 (and was POWER’s 2013 Plant of the Year).

A notable example of a modern ultrasupercritical power plant that Minchener pointed to is the Waigaoqiao No. 3 in Shanghai, China, which comprises two 1,000-MW units. “By a series of innovative efficiency improvements,” the plant’s owners increased its original efficiency from 43% to more than 47%, “which is a tremendous achievement,” Minchener said. (The project was a 2015 POWER Top Plant, when its efficiency stood at 44.5%.)

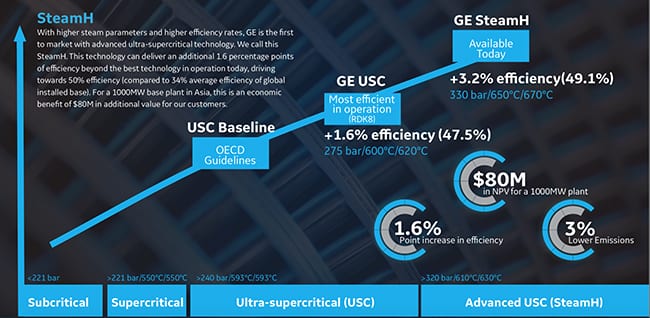

Meanwhile, “a lot of innovation” is coming through as it concerns technology advancement beyond ultrasupercritical systems, he noted. Testing is underway on nickel superalloys that could help achieve the 700C steam target in advanced ultrasupercritical (AUSC) systems—and boost efficiency to beyond 50%—in the U.S., Europe, Japan, and China. GE’s new SteamH technology, for example, uses nickel superalloys, including HR6W and Inconel.The company commercially offers the 650-670C system, which it says is capable of a 49.1% (net) efficiency. At least two companies that are pioneering AUSC projects have so far selected GE’s SteamH offerings: Yildirim for its 2 x 800-MW Karaburun Imported Coal Project in Turkey and Huaibei Shenergy Power Generation Co. for its Pinghsan II plant.

Large component test facilities are already operational in China and Japan, and one is scheduled to open in the U.S. later this year. India, meanwhile, has committed “significant funding” to AUSC technology, “making the basis to develop its first commercial-scale units.” Japan has made notable headway in demonstrating the technology by the early 2020s, and China appears to be following a similar timescale, Minchener said. At the same time, advances continue in supercritical carbon dioxide turbine cycle technology, as well as in integrated gasification fuel cell (IGFC) technologies. Japan’s 166-MW IGFC demonstration at the Osaki CoolGen Project, for example, is slated to begin operations in 2019.

Minchener, however, noted that while several countries have identified a role for HELE in their Paris agreement commitments, challenges have stalled their potential development. Along with a general shift away from coal, owing to climate change concerns, HELE plants often require government commitment and public acceptance, as well as clearance of regulatory, policy, economic, and environmental requirements.

The Curse of Uncertainty

According to the National Coal Council, an industry coalition that advises the U.S. Secretary of Energy, coal plant efficiency “has proven to be one of the most vexing topics over the last decade,” because the topic is both “diverse and complex.” Efficiency improvements at existing coal plants are hampered by a variety of factors, each one dependent upon plant technology, vintage, operational duties, environmental compliance equipment, and coal sources. Regulatory uncertainty, especially as it applies to New Source Review (NSR), have also limited plant owners from aggressively pursuing energy efficiency improvement opportunities. The Environmental Protection Agency’s (EPA’s) August 2018–issued Affordable Clean Energy (ACE) rule—a proposal to replace the 2015 Clean Power Plan—includes NSR reforms, however.

Construction of new coal plants in the U.S., meanwhile, is hampered by several other factors, foremost among them environmental and economic pressures, which have created considerable uncertainty in financial decision-making. Responding to investor pressure, a spate ofmajor power companies—including AEP and Southern Co.—have announced drastic cuts to their generating fleet carbon emissions over the long term.

The Trump administration has responded to mass coal plant retirements by pursuing aggressive solutions to keep coal afloat, including through market intervention by declaring coal power (and other baseload sources) necessary for “fuel security and resilience.” It has directed the Department of Energy to find a “lasting” solution that “meets the needs of both national security and the efficient operation of energy markets.”

At the DOE, a flurry of research and development continues. The DOE has spent $2.66 billion on advanced fossil energy technologies since 2010, but nearly half was committed to the development of carbon capture and storage solutions. More recently, it has unveiled a diverse set of initiatives including exploring whether small-scale modular coal power is feasible. Last week, it launched the Coal FIRST (Flexible, Innovative, Resilient, Small, Transformative) program, which will advance research and development of coal plants “capable of flexible operations to meet the needs of the grid; use innovative and cutting-edge components that improve efficiency and reduce emissions; provide resilient power to Americans; are small compared to today’s conventional utility-scale coal [units]; and will transform how coal technologies are designed and manufactured.”

To date, the DOE has also issued three solicitations for advanced fossil energy loan guarantees—in 2006, for up to $2 billion; in 2008, for up to $8 billion; and most recently in 2014, for $8 billion—but no loans have actually been guaranteed. Recent analysis from the Government Accountability Office suggests that the solicitations failed in part because “natural gas prices fell, causing a shift in the market, which led to such coal-related projects no longer being economically competitive.”

On Monday, as he introduced the incentive measure for new HELE plants, Sen. Young suggested that the DOE loan program has not been heavily utilized due to impracticality of loan-eligible projects. “By widening the eligibility criteria for the DOE loan program, this legislation aims to open up this program to utilization by coal entities,” he said.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)