The Trump administration has extended a potential lifeline to coal-fired power plants with its Affordable Clean Energy (ACE) rule. Now the debate is about how much the plan will actually help coal generation.

Energy analysts and other industry experts who spoke with POWER on August 28 say the new rule, which would give individual states the power to determine how to regulate power plant emissions—or whether to regulate them at all—may not make a difference when it comes to the market for coal-based power.

Economic forces, which have increasingly favored natural gas and also renewable energy sources in recent years, have contributed to the fall of coal. And while Trump said the ACE rule is a replacement for the Obama-era Clean Power Plan (CPP), the CPP has never been implemented due to protracted legal challenges, including a continuing stay of the rule by the U.S. Supreme Court.

Other regulations dealing with power plant emissions, including the Clean Air Act (CAA) and the Cross-State Air Pollution Rule (CSAPR), along with the Mercury and Air Toxics Standards (MATS) rule, remain in force and continue to impact power plant operators. The 2009 Endangerment Finding by the Environmental Protection Agency (EPA) also obligates the agency to regulate GHG emissions.

Coal plants already retired are not likely to restart. Several utilities have said their plans to shutter existing plants won’t change.

“Regulated utilities have to plan 20 years in advance for coal plant retirements. I would say that most electric utilities have already made accommodations for plants that will be retiring in the next years and the Clean Power Plan removal won’t make that much difference,” Stephanie Bell, an energy industry consultant and former executive with the Kentucky Public Service Commission, told POWER. “These plans just can’t stop on a dime. At the end of the day it’s all about the cost. Gas is still much cheaper than coal.”

Business as Usual

Utilities that still rely on at least some coal-fired generation have been reluctant to go on the record with comments about the ACE proposal, which POWER reviewed after it was announced by Mandy Gunasekara, principal deputy assistant administrator for the EPA’s Office of Air and Radiation, at the MEGA Symposium in Baltimore, Maryland, on August 21. Several generators have issued statements saying they intend to move forward in a “business as usual” manner, saying they will continue ongoing efforts to reduce power plant emissions and utilize renewable energy resources when it makes sense for their customers.

“I doubt this will cause a significant shift in focus and investment from gas and renewables back to coal,” Raoul Nowitz, managing director with Orlando, Florida-based SOLIC Capital Advisors, told POWER. “This new program could potentially provide longevity to coal plants by allowing upgrades to coal facilities resulting in them running longer versus expected retirements, but comes at the risk of higher emissions that would otherwise be avoided by running natural gas or renewables plants.”

The National Conference of State Legislatures (NCSL) says 29 states, along with Washington, D.C., and three U.S. territories, already have renewable portfolio standards that set targets for renewable generation at various percentages over the next several years. Another eight states have voluntary standards. Just 13 states have no standard or target, with the majority of those in the Southeast.

Southern Co., which serves customers in several states in the southeastern U.S., has already cut its use of coal-fired power from about 70% of its portfolio a decade ago to less than 30% today. Thomas Fanning, Southern’s CEO, earlier this year said the company’s generation fleet would be “low to no-carbon” by 2050, with a focus on renewables, nuclear power—including its long-delayed Vogtle plant in Georgia—energy storage, and natural gas-fired generation with carbon capture technology.

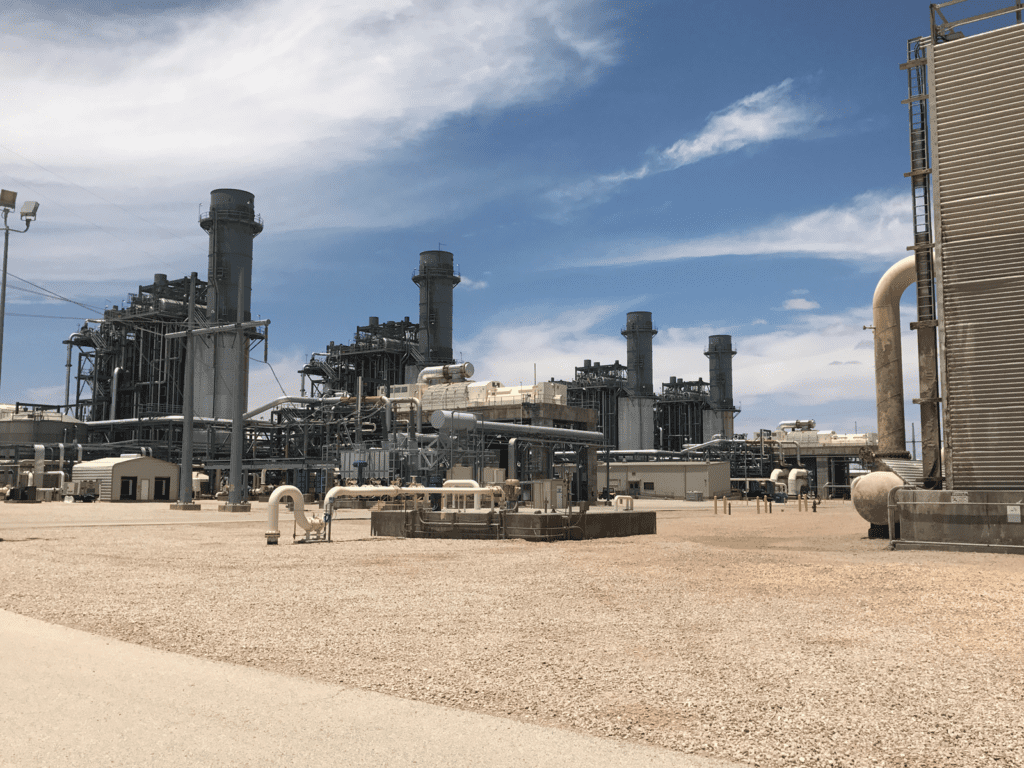

Florida, which like Georgia has no standards for renewable generation, has all but phased out coal-fired power. Florida Power & Light closed one of its two remaining coal plants in the state in January and plans to close its last coal plant by year-end 2019. Only a handful of coal-fired units remain in operation in the state, which relies heavily on natural gas and increasingly on solar for its generation. The largest coal plant still operating is TECO Energy’s Big Bend Power Station at the south end of Tampa Bay. TECO earlier this year said it would convert the plant to combined cycle natural gas technology over the next few years, with a plan to eliminate coal as a fuel source by the middle of the next decade.

Susan Tierney, a senior advisor with Analysis Group, a national economic, financial, and strategy consulting firm, told POWER: “I think that the ACE is likely to do little to help financially distressed coal-fired power generators that are close to retirement [or operating infrequently], for several reasons. First, the principal source of pressure on marginal coal-fired power plants is the low price of natural gas and the relative efficiency of gas-fired generators. Second, renewable projects also dispatch ahead of coal. Third, flat demand means that with more gas-fired and renewable generation, the squeeze is on output at coal plants. Most of the coal plants that have retired or have announced retirements are unlikely to find much help in the ACE. Ironically, the recent trends in the electric industry—that have already reduced greenhouse gas emissions (GHG) from the U.S. power sector by 28% since 2005 and that have reduced coal’s share of electricity from 50% a decade ago to 30% at present—are already producing affordable and clean energy.”

The Edison Electric Institute (EEI), the association that represents U.S. investor-owned power companies, last week touted that the nation’s generators have “made tremendous progress to transition to a cleaner generating fleet,” noting that GHG reductions are, as Tierney noted, in line with the CPP’s goal of a 32% reduction from 2005 levels by 2030.

Market Forces

Dozens of coal-fired power plants have been mothballed in recent years due to government emissions regulations, and also due to market forces that have increased the use of lower-cost natural gas-fired generation, along with a continuing decline in the cost of renewable energy. Richard Glick, a commissioner with the Federal Energy Regulatory Commission (FERC), earlier this year told Bloomberg: “Certainly I think right now utilities are considering going forward with retirement plans as is. It’s pure economics. Gas prices are way down, renewable projects are getting much less expensive and they are beating other older technologies out in the markets.” Glick and the other FERC commissioners have said the federal government should not intervene in energy markets.

Utilities even in the immediate aftermath of last week’s ACE announcement said closed coal plants would remain shuttered, and plans for other closures were unlikely to change. Logansport Municipal Utilities in Indiana, which shut its coal-fired power plant in early 2016 after determining it could not afford updates that would be needed under Obama-era emissions regulations, including the CSAPR, last week said it would not restart the plant even with relaxed rules on GHG.

Detroit, Michigan-based DTE Energy on August 21—the same day the ACE rule was announced—said it would move forward with plans to build a new $1 billion natural gas-fired plant to replace three of its coal-fired plants. DTE Energy CEO Gerry Anderson, along with Patti Poppe of Jackson, Michigan-based Consumers Energy, together have committed to a goal of 25% renewable energy generation by 2030, and both said their companies would not burn coal after 2040. DTE and Consumers are the two largest utilities in Michigan; the companies have announced closure plans for more than 20 coal-fired power plants over the next 12 years regardless of federal government regulations.

The Colorado Public Utilities Commission (PUC) on August 27 gave its support to Xcel Energy’s Colorado Energy Plan (CEP), which includes the early closure of two coal-fired units at the Comanche Generating Station in Pueblo. Xcel, Colorado’s largest utility, said it will replace the generation with a $2.5 billion investment, mostly in renewable energy and battery storage.

Vistra Energy and its Luminant subsidiary this year have shut three large coal-fired plants in Texas, saying the plants are “economically challenged.” Coal has long been the dominant energy source in Texas, but wind power generation capacity is taking the top spot.

Easier to Upgrade Coal Plants

The ACE rule if adopted—which would likely not happen until 2019 at the earliest—would provide mechanisms for coal-fired power plants to upgrade their systems more quickly than at present. The rule promises to relax the mandates of New Source Review (NSR), a program under the CAA meant to ensure that when coal plants expand or retrofit, they install the latest and best pollution controls. The new rule would allow plants to make upgrades to increase the efficiency of their operation without undergoing expensive environmental reviews.

EPA spokesman Michael Abboud in a statement said the ACE rule is designed “to further encourage efficiency improvements at existing power plants.” According to the EPA, about 30% of the nation’s operating coal fleet does not have scrubbers, which are designed to pull sulfur out of a plant’s exhaust, and about 22% of coal-fired plants do not have advanced controls to reduce nitrogen oxide (NOx). Updated pollution controls can cost millions of dollars.

Plants could be upgraded and become more efficient by upgrading steam turbines and other components, such as boiler feed pumps, at less cost than the advanced pollution controls. That would allow some older coal plants to continue operating without having to comply with stricter emissions standards.

Elizabeth Knauer, a principal with Sive, Paget & Riesel, a New York City law firm that specializes in environmental law, told POWER that changes to the NSR may be the most important aspect of the ACE rule: “Whereas existing regulations require permitting for modifications that significantly increase the facility’s annual emissions, EPA’s latest proposal would allow overall emissions to increase without triggering NSR requirements as long as a facility’s maximum hourly emissions rate remained the same. This is the element of the plan most likely to benefit existing generators. Most if not all market analysts seem to believe that the relaxation of CPP emissions reduction requirements probably will not encourage new coal plant development because of the relative prices of coal and natural gas/renewables.”

A Duke University analysis of the EPA’s enforcement of the NSR rule said that in the past 20 years, U.S. utilities have been ordered to make more than $18.5 billion in improvements to air pollution control systems at 112 power plants, and pay more than $100 million in fines, due to alleged violations of the NSR.

But even with lower costs to upgrade a plant, experts say coal still faces headwinds due to other pollution regulations and the financial challenge of competing against low-cost natural gas and mandates for renewable energy.

“The question further becomes, even in the event that the ACE rule survives, what is the ultimate long-term economic viability of coal plants and the motivation for extending the lives of these assets?” said Nowitz. “Monies will remain required to address ongoing regulatory requirements and these plants are expected to remain sub-economical relative to natural gas and renewable plants from a go-forward perspective. Many, including I, believe that the outlook for natural gas pricing will continue to remain attractive as drilling and shale technologies continue to drive high domestic volumes for the foreseeable future, as well as adding renewable technology increasingly coming online, overall resulting in questionable economics from running, investing in, and extending the lives of sub-optimal coal assets.”

—Darrell Proctor is a POWER associate editor (@DarrellProctor1, @POWERmagazine).