Markets

-

Legal & Regulatory

Perry Hammered on FERC Order During House Subcommittee Hearing

Criticism for Secretary of Energy Rick Perry’s recent notification of proposed rulemaking (NOPR) directing the Federal Energy Regulatory Commission to show favor to coal and nuclear plants was in no short supply during an October 12 hearing of the House Subcommittee on Energy. The hearing, which focused on the Department of Energy’s (DOE) missions and […]

-

Renewables

The Netherlands to Quit Coal Power; UK and Canada Champion Global Transition Away from Coal

The Netherlands, a country that recently commissioned three state-of-the-art coal plants and has been reluctant to close them, on October 10 moved to phase out coal power by 2030. Meanwhile, the UK and Canada this week jointly urged other nations to drop coal from their power profiles. The countries are part of a growing list […]

Tagged in: -

Legal & Regulatory

How Power Sector Deregulation Is Affecting Mexico [PODCAST]

Mexico’s energy reform began in 2013. It has opened up key parts of the country’s electricity sector to new market participants, foreign investors, and innovative technology. Prior to the reform, Mexico operated under a traditional, vertically integrated model with the state-owned Federal Electricity Commission (CFE) responsible for all power supply functions from generation to distribution. […]

Tagged in: -

Renewables

Monticello Goes Under, More Coal and Nuclear Imperiled in Texas (Updated)

A week after the Department of Energy (DOE) proposed a rule to bolster uneconomic coal and nuclear generators in competitive power markets, Luminant announced that an “unprecedented low power price environment” will force it to retire a 1.9-GW coal-fired power plant operating in the Texas market. The plant’s economic woes suggest a larger swath of […]

-

Renewables

Power Groups Unite to Block DOE Grid Resiliency Rule; FERC Sets Tight Window for Comment

The Federal Energy Regulatory Commission (FERC) set a three-week window for comment on the proposed Department of Energy (DOE) grid resiliency rule that 11 power trade groups—representing natural gas, wind, solar, public power, and power consumers—worry could have serious ramifications for competitive markets because it favors coal and nuclear. The groups filed a joint motion on […]

Tagged in: -

Environmental

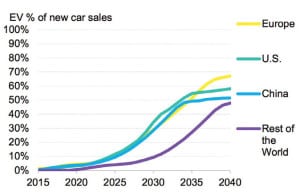

Reports: Electric Vehicles Are Poised to Reshape Global Power Consumption

The rapid adoption of electric vehicles (EVs)—both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs)—is expected to transform global electricity consumption through 2040, three

-

Coal

POWER Digest (October 2017)

Construction Scheduled for Hydrogen Fuel Cell Plant in South Korea. Hanwha Energy on August 25 approved formation of a subsidiary, Daesan Green Energy , to build a 50-MW hydrogen fuel cell plant in the

-

Legal & Regulatory

[UPDATED] DOE to FERC: Force Competitive Markets to Value Coal and Nuclear Resiliency, Reliability Attributes

A rule proposed by the U.S. Department of Energy (DOE) on September 29 directs the Federal Energy Regulatory Commission (FERC) to mandate that competitive power markets develop and implement market rules to “accurately price” what it calls “fuel-secure” generation. The DOE’s “Grid Resiliency Pricing Rule” directs FERC—an independent regulatory government agency that is officially organized as […]

-

Renewables

CAISO Expansion, 100% Zero-Carbon Bids Flatline, But Bills for Energy Storage, DERs Thrive

California’s legislature last week wrapped up its 2017 session without authorizing the broad expansion of the California Independent System Operator (CAISO) into other Western states or passing a zero-carbon bill, which would have put the state on a path to 100% clean energy by 2045. It did, however, succeed in passing bills to encourage development […]

-

Commentary

Power Market Deregulation Transforms Mexico

Mexico’s energy reform, which began in 2013, has opened up key parts of the country’s electricity sector to new market participants, foreign investors, and innovative technology. Prior to the reform